zkSync Layer 2 Ethereum Scaling Solution Achieves 15,000 TPS with 1 Second Finality in 2025

zkSync Layer 2 Solution Overview

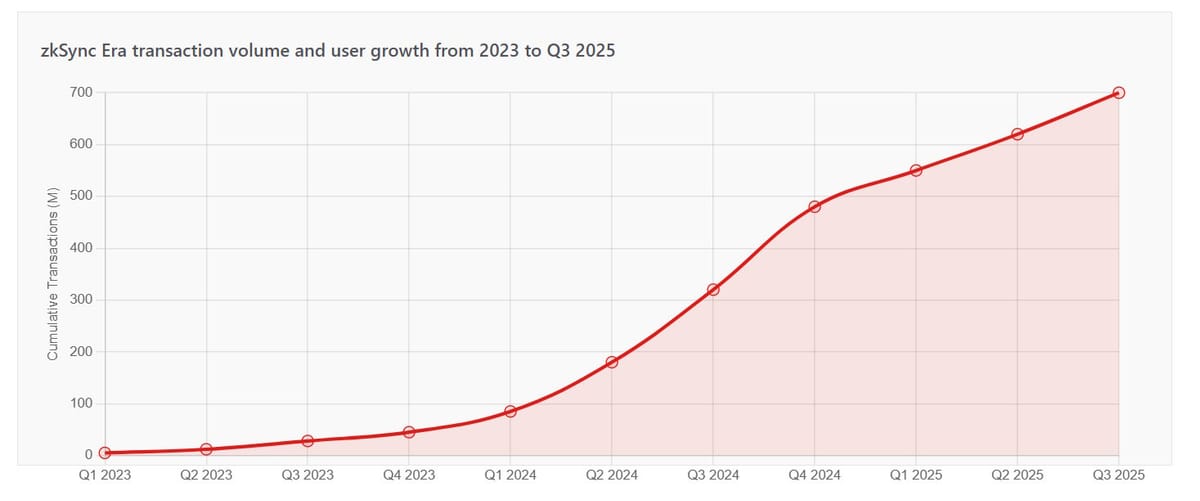

zkSync Era is zero-knowledge rollup that scales Ethereum. It processes transactions off Ethereum mainnet using cryptographic proofs. This reduces gas fees by 95% while maintaining Ethereum's security guarantees. Matter Labs developed the protocol, launching public mainnet in March 2023.

The network has processed over 700 million transactions since launch. As of October 2025, zkSync serves 10,400 daily active users. The platform supports full Ethereum Virtual Machine compatibility. Developers deploy Solidity smart contracts without code modifications.

zkSync differs from optimistic rollups through instant finality. Where Arbitrum and Optimism require seven-day withdrawal periods, zkSync confirms transactions in one second. This enables real-time settlements matching traditional financial systems. The Atlas upgrade in October 2025 brought throughput to 15,000 transactions per second with sub-second confirmation times.

Atlas Upgrade Performance

Data: zkSync announcements, L2Beat, November 2025

Matter Labs shipped Atlas upgrade October 7, 2025. The release rebuilt sequencer architecture from scratch. Production environment now sustains 15,000+ transactions per second. Stress testing showed peaks between 25,000-30,000 TPS.

Airbender proof system generates validity proofs under one second per block. This represents 6x speed improvement over nearest competitor SP1 Turbo. Proving costs dropped to $0.0001 per ERC20 transfer. The system runs on commodity hardware with single H100 GPU.

Direct Ethereum liquidity access eliminates fragmented pools across Layer 2 networks. zkSync chains now settle transactions instantly with mainnet liquidity. This reduces slippage and improves capital efficiency for traders and protocols. Vitalik Buterin endorsed the upgrade November 1, 2025 as "underrated and valuable work."

Layer 2 Competitive Position

| Solution | Technology | Finality Time | TPS Capacity | TVL November 2025 |

|---|---|---|---|---|

| Arbitrum One | Optimistic Rollup | 7 days | 40,000 | $18-19B |

| Optimism | Optimistic Rollup | 7 days | 4,000 | $9B |

| Base | Optimistic Rollup | 7 days | 4,000 | $3-4B |

| zkSync Era | ZK Rollup | 1 second | 15,000+ | $186M DeFi |

| StarkNet | ZK Rollup | Minutes | 100,000+ | $700M |

Data: L2Beat, DefiLlama, November 2025

Arbitrum dominates total value locked with $18-19 billion. Optimism holds $9 billion through Superchain ecosystem. Base leverages Coinbase's user base for retail adoption. zkSync trails competitors in locked capital but leads in transaction finality speed.

The seven-day challenge period in optimistic rollups creates capital inefficiency. Traders and institutions prefer faster settlements. zkSync's one-second finality better matches traditional finance requirements. This advantage attracts enterprises exploring blockchain infrastructure.

zkSync ranks second among blockchains for real-world asset tokenization. The platform hosts $1.9-2.1 billion in tokenized assets across 28 projects. Tradable platform facilitated 38 private credit deals worth $2.1 billion. Deutsche Bank partnered for fund servicing infrastructure.

Institutional Adoption Through Prividium

Data: zkSync Prividium whitepaper, Deloitte workshops, October 2025

Matter Labs introduced Prividium in May 2025. The system enables private permissioned blockchains anchored to Ethereum through zero-knowledge proofs. Over 30 financial institutions participated in capability workshops organized with Deloitte.

Participants include Citibank, Deutsche Bank, Mastercard, Bank of France, and two unnamed central banks. Deutsche Bank deployed first production Prividium chain through Memento partnership. The implementation handles fund servicing, investor onboarding, custody, and KYC-gated access.

Prividium targets 10,000 transactions per second with fees below $0.01. The architecture combines institutional data privacy with public blockchain benefits. Banks maintain regulatory compliance while accessing global liquidity networks. Fireblocks provides custody infrastructure and Chainlink delivers oracle services.

Use cases span cross-border wholesale payments, global payroll systems, tokenized asset issuance, and collateral mobility. The MiCA regulatory framework in Europe accelerates adoption timeline. Financial institutions require both privacy and auditability which zero-knowledge technology enables.

Ecosystem Growth and Developer Tools

Data: zkSync block explorers, project analytics

zkSync Era supports over 124 decentralized applications across DeFi, gaming, and social sectors. Top protocols include SyncSwap with $23.7 million TVL, Venus Protocol with $12.1 million, and Aave with $10.9 million. The Ignite Program allocated $60 million in ZK tokens as liquidity incentives starting January 2025.

Developers access two programming approaches for flexibility. Solidity provides full EVM compatibility for easy Ethereum dApp migration. Zinc offers Rust-like syntax optimized for zero-knowledge circuits. This dual strategy balances accessibility with performance optimization.

Native account abstraction enables smart contract wallets with custom authentication logic. Applications sponsor user gas fees through paymaster patterns. This reduces onboarding friction for mainstream users. Projects implement social recovery, spending limits, and gasless transactions.

ZK Stack framework lets teams launch customized rollups and validiums. Over 150 projects registered for deployment. Lens Chain migrated 650,000 users and 125GB of social data to zkSync infrastructure. The Elastic Network connects chains through Gateway settlement layer with atomic swaps.

Find more blockchain infrastructure tools in our comprehensive DAO tooling guide and explore governance structures in our list of DAOs.

Token Economics and Network Revenue

| Revenue Source | Description | Allocation Use |

|---|---|---|

| Gateway Fees | Cross-chain messaging and transfers across 20+ ZK Stack chains | 40% Buyback/Burn, 35% Staking, 25% Development |

| Prividium Licensing | Enterprise chains for banks and institutions | 35% Buyback/Burn, 40% Staking, 25% Grants |

| Sequencer Operations | Running infrastructure for institutional clients | 30% Buyback/Burn, 35% Staking, 35% Development |

Data: zkSync tokenomics proposal, November 2025

Alex Gluchowski proposed tokenomics overhaul November 4, 2025. The ZK token shifted from pure governance to utility-driven model. All network revenue now funds buybacks, burns, staking rewards, and ecosystem development through community governance.

Market responded immediately with 24% price surge within 24 hours. Weekly gains reached 67% as of November 5. Total supply caps at 21 billion tokens with 49% allocated to ecosystem airdrops, 17.2% to Matter Labs team, 17.3% to investors, and 16.5% to reserves.

First staking program launches Q4 2025 under TPP-12 governance proposal. Token holders will delegate stakes to validators while earning protocol revenue share. Monthly token unlocks of approximately 167 million continue through 2029 under linear vesting schedule.

Network Security and Challenges

zkSync experienced security incidents in 2025 that highlighted operational risks. April 2025 saw $5 million stolen from airdrop contract through compromised administrative key. The attacker returned 90% of funds after accepting 10% bounty within 72-hour safe harbor period. Core protocol and user funds remained secure throughout.

Matter Labs partnered with OpenZeppelin for continuous security audits. Bug bounty program offers up to $1.1 million in rewards. Third-party reviews found zero high-severity issues in Layer 1 smart contracts. However, private key management and backend infrastructure require ongoing attention.

Total value locked remains substantially below leading competitors. zkSync Era DeFi TVL stands at $186 million compared to Arbitrum's $18 billion. Lower liquidity limits composability for complex DeFi protocols. The Ignite Program aims to attract capital through incentives.

Technical complexity affects developer adoption pace. Zero-knowledge proof generation requires specialized knowledge beyond standard Solidity programming. While EVM compatibility helps, circuit optimization demands deeper cryptography understanding. This creates steeper learning curve versus optimistic rollups.

2025 Developments and Roadmap

Data: zkSync official roadmap and announcements

Q4 2025 priorities include ZK token staking launch enabling holders to earn protocol revenue. Elastic Network expansion targets 10+ additional ZK Stack chains by 2026. ADIChain deployment scheduled early 2026 with compliance-focused features for regulated institutions.

Performance improvements continue beyond Atlas. Roadmap targets median gas fees under $0.0001 by year-end 2025. Airbender proof system receives ongoing optimization for faster block generation. Decentralized sequencer implementation addresses centralization concerns.

Regulatory clarity under frameworks like MiCA accelerates institutional adoption in Europe. Prividium success depends on favorable interpretation of existing rules. Clear token classification guidelines needed across jurisdictions for broader financial institution participation.

Frequently Asked Questions

Sources

L2Beat - Layer 2 analytics and security analysis

DefiLlama - DeFi protocol metrics

zkSync Official Blog - Atlas upgrade technical documentation

Matter Labs - Prividium whitepaper and institutional partnerships

Messari - State of zkSync Q4 2024 report

CoinMarketCap - Latest zkSync news and market data

Bitget News - Vitalik Buterin endorsement coverage

RWA.xyz - Real-world asset tokenization data

Comprehensive DAO Tooling Guide - https://daotimes.com/comprehensive-dao-tooling-guide-list-of-dao-tools/

List of DAOs - https://daotimes.com/a-comprehensive-list-of-daos-to-explore/