Wyoming Blockchain Nonprofit Framework in 2025

What Changed in 2025

Wyoming's DUNA law, active since July 1, 2024, saw its first major adoption in 2025. Uniswap Foundation proposed transitioning to DUNA structure in August 2025 with $75,000 budget for legal and operational costs. This marks the first major DeFi protocol considering the framework.

The broader regulatory environment shifted favorably. Trump administration's January 2025 executive order supporting blockchain technology reduced federal regulatory uncertainty. However, the DUNA framework itself remained unchanged since its 2024 enactment. No amendments passed Wyoming legislature in 2025.

Nouns DAO continues operating under DUNA since early 2024. The organization submitted improvement recommendations to Wyoming lawmakers in May 2025. Proposed changes include optional registration system, administrator duty clarification, and AI agent governance recognition. These remain under legislative consideration.

Legal service providers standardized DUNA formation processes. Full-service formation costs settled around $23,000 including governance design and first-year compliance. DIY formation remains possible but requires navigating Corporate Transparency Act reporting requirements introduced in 2024.

Core Requirements for DUNA Status

Minimum Member Threshold

Organizations must maintain 100 members minimum to qualify as DUNAs. This requirement separates genuine decentralized communities from founder-controlled entities. Membership drops below 100 trigger automatic conversion to standard Wyoming Unincorporated Nonprofit Association, losing DUNA-specific benefits.

Members join through mutual consent for common nonprofit purpose. Governing principles define membership criteria. Without explicit principles, purchasing membership interest or property conferring voting rights creates membership. Token ownership typically satisfies this requirement if tokens grant governance rights.

Blockchain Technology Integration

DUNAs must utilize distributed ledger technology for governance and operations. Smart contracts can constitute entire governing principles without traditional written agreements. The statute explicitly recognizes consensus formation algorithms and on-chain governance as legally binding organizational rules.

Wyoming law treats smart contract code as equivalent to traditional corporate bylaws. This eliminates friction between blockchain-native operations and legal requirements. Organizations need not translate on-chain governance into separate legal documents. The code itself serves as the governing document.

Nonprofit Purpose Mandate

DUNAs operate for nonprofit purposes only. This doesn't prohibit revenue generation. Organizations can engage in profit-making activities if proceeds advance nonprofit mission. Protocol fees, transaction revenues, and similar income remain permissible when supporting network development.

The statute prohibits dividend distributions to members. Surplus funds must reinvest into organizational mission. However, reasonable compensation for services rendered faces no such restriction. Payment to developers, validators, node operators, and other contributors remains explicitly allowed.

Formation Process and Timeline

Data: Legal service providers and Wyoming Secretary of State, November 2025

Preparation Phase

Formation begins with governance design. Organizations define voting mechanisms, membership criteria, treasury management rules, and operational procedures. These principles may exist entirely on-chain or combine smart contracts with supplementary documentation. The design phase typically spans 2-4 weeks depending on governance complexity.

Teams must identify beneficial owners for Corporate Transparency Act compliance. FinCEN requires reporting individuals exercising substantial control over the DUNA. This includes founders, key contributors, and major token holders meeting ownership thresholds. Initial reports due within 30 days of formation, with updates required within 30 days of changes.

Filing and Registration

DUNAs form through adoption of governing principles rather than state filing. No articles of incorporation or similar documents submit to Wyoming Secretary of State. This paperless formation aligns with decentralized ethos but creates documentation challenges for third parties.

Organizations appoint Wyoming registered agent for service of process. This requirement enables legal system to locate and serve the DUNA with documents. Registered agent services cost $100-300 annually. Agent maintains physical Wyoming address and forwards legal notices to DUNA administrators.

Complete formation takes 20-30 days from governance finalization through agent appointment and beneficial ownership reporting. Professional legal services charge $23,000 for full-service formation including governance design, compliance setup, and ongoing advisory.

Legal Protections and Entity Status

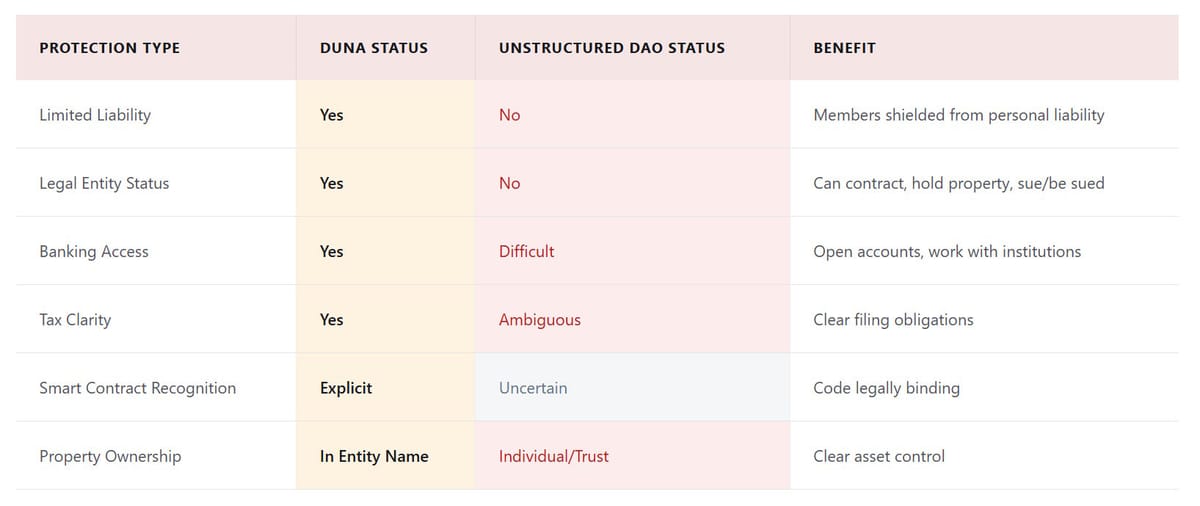

| Protection Type | DUNA Status | Unstructured DAO Status | Benefit |

|---|---|---|---|

| Limited Liability | Yes | No | Members shielded from personal liability |

| Legal Entity Status | Yes | No | Can contract, hold property, sue/be sued |

| Banking Access | Yes | Difficult | Open accounts, work with institutions |

| Tax Clarity | Yes | Ambiguous | Clear filing obligations |

| Smart Contract Recognition | Explicit | Uncertain | Code legally binding |

| Property Ownership | In Entity Name | Individual/Trust | Clear asset control |

Data: Wyoming DUNA Act statutory provisions and legal analysis

Member Liability Shield

Individual DUNA members face no personal liability for organizational debts, obligations, or other members' actions. Courts cannot pierce this protection based solely on membership status. This mirrors corporate shareholder protections while maintaining nonprofit structure.

The shield extends to administrators appointed by the DUNA. These individuals handle operational tasks without personal liability exposure for decisions made in good faith advancing organizational purposes. The statute permits indemnification for expenses incurred defending claims arising from DUNA service.

Separate Legal Personality

DUNAs exist as distinct legal entities separate from members. This enables contracting with third parties, property ownership, and participation in legal proceedings using the organization's name. Treasury funds belong to the DUNA itself rather than members collectively.

Entity status solves practical operational problems. DUNAs open bank accounts, sign employment agreements, license intellectual property, and enter commercial relationships directly. Without entity status, these activities require trusts, foundation companies, or individual signatories creating liability and control issues.

Real World Implementation Cases

Data: Public governance proposals and legal filings through November 2025

Nouns DAO Pioneer Implementation

Nouns DAO ratified DUNA adoption through on-chain vote in early 2024. The protocol maintains 100% on-chain governance with daily NFT auctions funding the treasury. DUNA structure provided legal wrapper without changing smart contract architecture or voting mechanisms.

Implementation preserved complete decentralization. No foundation company or corporate entity manages operations. The DUNA exists purely through governing principles encoded in smart contracts. This approach demonstrates maximum alignment between legal structure and technical reality.

Nouns identified practical improvement areas through operation experience. May 2025 recommendations to Wyoming legislators proposed optional registration system providing public formation records. This would help defendants dismiss improper claims against individual members by proving DUNA entity status quickly.

Uniswap Foundation Proposal

Uniswap Foundation announced August 2025 proposal transitioning to DUNA framework. The $75,000 budget covers legal structuring and operational changes. Cowrie advisory group, co-founded by David Kerr who helped draft DUNA statute, assists the transition.

The proposal maintains existing governance structure. Foundation serves as Ministerial Agent handling administrative functions without governing authority. This preserves decentralized control while meeting legal entity requirements. Community discussions began August 12, 2025 with governance calls for delegate feedback.

If approved, Uniswap becomes the first major DeFi protocol operating under DUNA. The precedent could influence other protocols considering legal structures. Uniswap's $6 billion treasury and extensive regulatory scrutiny make this a significant test case.

a16z Crypto Portfolio Strategy

Andreessen Horowitz mandated DUNA consideration for applicable portfolio investments. General Counsel Miles Jennings published analysis positioning DUNA as likely U.S. standard. The firm testified before Wyoming legislature during bill consideration, incorporating preferred provisions into final statute.

Portfolio guidance focuses on protocol-layer governance rather than application companies. DeFi protocols, Layer 1 networks, and infrastructure projects receive strongest DUNA recommendations. Application-layer companies typically use traditional corporate structures with token-based governance overlay.

Comparison With Wyoming DAO LLC

Data: Wyoming Statutes Title 17 analysis

Wyoming enacted DAO LLC framework in 2021, amended 2022. This allows DAOs organizing as limited liability companies with blockchain governance features. The structure served as Wyoming's first DAO approach before DUNA creation.

Key differences affect suitability for different use cases. DAO LLCs operate as for-profit entities distributing profits to members. DUNAs function as nonprofits reinvesting surplus into mission. DAO LLCs require articles of organization filing with Wyoming Secretary of State. DUNAs form through governing principles without state filing.

Member requirements differ substantially. DAO LLCs allow single-member formation suitable for early-stage projects. DUNAs require 100 members minimum ensuring genuine decentralization. This threshold prevents DUNA use for small teams but strengthens decentralization arguments for established protocols.

Smart contract recognition improved from DAO LLC to DUNA. DAO LLC statute permits smart contracts as operating agreements but maintains traditional corporate hierarchy with articles of organization taking precedence. DUNA statute treats smart contracts as primary governing documents without separate articles requirement.

Both structures provide limited liability protection and legal entity status. Choice depends on profit distribution intent, team size, and desired governance formality level. For-profit protocols with venture funding typically use DAO LLCs. Nonprofit protocols with community treasuries fit DUNA better.

Practical Considerations and Limitations

Reasonable Compensation Standards

DUNAs pay reasonable compensation for services rendered. Wyoming courts will ultimately interpret reasonableness through case law development. No DUNA compensation disputes reached court as of November 2025, leaving standards undefined.

Blockchain networks present unique reasonableness arguments. Users choosing to pay protocol fees implicitly endorse compensation levels. If fees or rewards seemed unreasonable, users would fork to alternative networks with lower costs. This market-based validation differs from traditional nonprofit analysis.

Wyoming Nonprofit Network data shows sector average compensation around $38,000 annually per employee based on 2021 figures. Courts may reference these benchmarks while acknowledging blockchain industry differences. Technical complexity, security responsibilities, and market rates factor into reasonable compensation analysis.

Securities Law Interaction

DUNA adoption doesn't guarantee securities law exemption. SEC maintains independent authority analyzing token distributions under federal securities regulations. The structure strengthens arguments against securities classification but provides no immunity.

The Howey test examines investment contracts through three prongs: investment of money, common enterprise, expectation of profit from others' managerial efforts. DUNA addresses the third prong by eliminating traditional management structure. No directors or officers exist with centralized control.

Nonprofit status reduces profit expectation arguments. Members receive no dividends or equity-style distributions. Service compensation differs from profit-sharing. However, token price appreciation might still create profit expectations requiring careful legal analysis.

Banking and Treasury Access

Legal entity status enables traditional banking relationships. Financial institutions require entity documentation for account opening under Bank Secrecy Act and anti-money laundering regulations. DUNA registration provides necessary legal personality.

Most major banks remain hesitant serving crypto-native organizations despite legal structures. Specialized crypto-friendly banks and credit unions show greater willingness. Wyoming created Special Purpose Depository Institution charter for digital asset banking but adoption remained limited through 2025.

Treasury management combines traditional and crypto-native approaches. DUNAs maintain bank accounts for fiat operations while keeping most assets in multi-signature wallets or smart contract treasuries. This hybrid approach balances regulatory compliance with decentralization preservation.

Existing Entity Conversion Restrictions

Organizations already incorporated under other laws cannot adopt DUNA status. The statute requires formation specifically as DUNA, preventing existing offshore foundations or companies from converting. This creates path dependency problems for established protocols.

Conversion requires dissolving existing entity and reforming under Wyoming DUNA statute. This process triggers tax implications, requires creditor notification, and may complicate existing contracts referencing the prior entity. Legal and operational costs make conversion expensive for established organizations.

Standard Wyoming UNAs with under 100 members can convert to DUNAs when membership grows above threshold. The statute provides clear conversion procedures for this pathway. However, foreign entities lack similar conversion mechanism and must start fresh.

Tax Treatment and Compliance

| Tax Aspect | DUNA Treatment | Requirement |

|---|---|---|

| Entity-Level Tax | None on mission-aligned income | Informational returns required |

| Member Compensation | Ordinary income to recipient | Form 1099 reporting if over $600 |

| Token Distributions | No tax if mission-advancing | Must document nonprofit purpose |

| Treasury Gains | No tax if used for mission | Track use of proceeds |

| 501(c) Status | Theoretically available | Requires IRS application (untested) |

| State Income Tax | None (Wyoming has no state income tax) | N/A |

Data: IRS nonprofit guidelines and Wyoming tax code

DUNAs file informational tax returns reporting activities and finances. Unlike for-profit entities, no corporate income tax applies to properly mission-aligned revenues. This nonprofit treatment reduces tax burden compared to DAO LLC structure.

Federal 501(c) tax-exempt status remains theoretically possible but untested for DUNAs. No DUNA applied for IRS recognition through 2025. The process requires demonstrating charitable, educational, or similar exempt purposes under federal tax code. Blockchain protocol governance may not fit traditional exempt categories easily.

Member compensation creates standard income tax obligations. Recipients report compensation as ordinary income on personal returns. DUNAs must issue Forms 1099 for payments exceeding $600 annually to contractors and service providers. This reporting helps members maintain tax compliance.

Frequently Asked Questions

What costs apply to DUNA formation?

Full-service legal formation costs around $23,000 including governance design, compliance setup, and first-year support per DAObox pricing. This covers beneficial ownership reporting, registered agent fees, and advisory services. DIY formation possible but requires legal expertise navigating DUNA statute and Corporate Transparency Act requirements.

How long does DUNA formation take?

Formation spans 20-30 days from governance design finalization through registered agent appointment and beneficial ownership reporting. Timeline varies based on governance complexity and stakeholder coordination speed. Simple governance structures complete faster than complex multi-token voting systems.

Can DAOs under 100 members use DUNA?

No, 100 members minimum required. Smaller DAOs use standard Wyoming Unincorporated Nonprofit Association until reaching threshold. UNAs provide limited liability and entity status without 100-member requirement. Conversion to DUNA possible when membership grows above 100.

Do DUNAs file with Wyoming Secretary of State?

No state filing required. DUNAs form through adoption of governing principles without submitting articles or similar documents. This paperless approach aligns with decentralized structure but creates documentation challenges when proving entity existence to third parties.

What happens if membership drops below 100?

Automatic conversion to standard Wyoming Unincorporated Nonprofit Association occurs. The organization loses DUNA-specific benefits like explicit smart contract governance recognition but maintains nonprofit status and limited liability. Reconversion to DUNA possible when membership exceeds 100 again.

Can existing offshore foundations convert to DUNA?

No direct conversion available. Organizations incorporated elsewhere must dissolve and reform under Wyoming DUNA statute. This creates tax implications, creditor notification requirements, and contract complications. Conversion costs often exceed initial formation expenses for established entities.

Does DUNA protect against SEC enforcement?

No guarantee of protection exists. DUNA strengthens decentralization arguments under securities law but doesn't create immunity. SEC maintains independent authority analyzing tokens under federal regulations. The structure provides better defensive position than unstructured associations without guaranteeing enforcement protection.

What beneficial ownership reporting applies?

Corporate Transparency Act requires reporting individuals with substantial control to FinCEN. Initial reports due within 30 days of formation. Updates required within 30 days of beneficial owner changes. This includes founders, key contributors, and major token holders meeting ownership thresholds.

Can DUNAs pay dividends to members?

No, dividend distributions prohibited. Surplus funds must reinvest into nonprofit mission. However, reasonable compensation for services rendered faces no such restriction. Payment to contributors advancing organizational purposes remains explicitly permitted under statute.

How does DUNA compare to offshore foundations?

DUNAs offer U.S. legal recognition and banking access with lower formation costs. Offshore foundations provide tax neutrality and enhanced privacy but require higher expenses and complex compliance. Choice depends on tax priorities, privacy needs, and desired jurisdictional alignment. Wyoming formation costs $23,000 versus $15,000-40,000 for Cayman or Liechtenstein foundations.

Looking Forward

DUNA framework faces its first real-world tests in late 2025 and 2026. Uniswap Foundation's transition proposal, if approved, will demonstrate DUNA viability for major DeFi protocols. Regulatory response to this high-profile adoption will shape other projects' decisions.

Nouns DAO's proposed improvements may drive legislative amendments. Optional registration, administrator clarity, and AI agent recognition address practical operational issues discovered through actual DUNA usage. Wyoming lawmakers typically remain receptive to blockchain industry feedback based on past amendment history.

The 100-member threshold may warrant reconsideration. This requirement prevents early-stage adoption, forcing small DAOs to use alternative structures until reaching scale. Graduated thresholds or provisional DUNA status for growing organizations could expand framework accessibility.

Federal regulatory clarity from the Trump administration's 2025 Working Group recommendations may increase DUNA attractiveness. If federal policy provides safe harbor for certain token structures, combining federal compliance with DUNA entity benefits could become standard approach. The interaction between state entity law and federal securities regulation remains key uncertainty.

Other states show limited interest replicating Wyoming's approach through November 2025. First-mover advantage and established service provider ecosystem give Wyoming compounding benefits. Network effects around legal precedents, practitioner expertise, and the DAO tooling ecosystem create barriers for other jurisdictions attempting similar frameworks.

International harmonization remains distant. European Union's MiCA regulations and Switzerland's foundation structures offer alternatives without DUNA-style blockchain governance recognition. The global landscape of DAOs will likely use mixed structures based on specific needs rather than converging on single standard.

Sources

Wyoming State Legislature: Senate File 50, Decentralized Unincorporated Nonprofit Association Act (2024)

a16z crypto: The DUNA, An Oasis For DAOs (March 2024)

Preston Byrne: The Wyoming Decentralized Unincorporated Nonprofit Association Act, Section-by-Section (March 2024)

Latham & Watkins: Wyoming Adopts New Legal Structure for DAOs (December 2024)

Nouns DAO: Letter to Wyoming Select Committee on Blockchain (May 2025)

DAObox: DUNA as a DAO Legal Wrapper (2025)

XT: Uniswap Foundation Proposes 2025 Legal Framework Under Wyoming's DUNA Law (August 2025)

Falcon Rappaport & Berkman: The Wyoming DUNA and Future of DAO Legal Frameworks (June 2025)

Aurum Law: Wyoming's DUNA Act, A New Dawn for DAOs

National Crowdfunding & Fintech Association: Wyoming Passes the DUNA Act (March 2024)