Wormhole DAO Tool Report For 2025

What Wormhole Is and How It Works

Wormhole operates as a cross-chain interoperability protocol connecting 40+ blockchain networks. The platform launched in 2020 as the first Ethereum-Solana bridge. Today it processes asset transfers and data messages across multiple chains.

The protocol uses a Guardian Network consisting of 19 validator nodes. These validators include Google Cloud and other reputable entities. Each Guardian runs full nodes and observes events on every connected blockchain.

When users bridge assets, Wormhole creates Verifiable Action Approvals (VAAs). These VAAs require signatures from 13 of 19 Guardians to confirm transactions. The system uses lock-and-mint mechanics for token transfers.

Portal Bridge serves as the main user interface for asset transfers. Users can move tokens between networks with fees often under $0.01. The bridge has processed over $60 billion in total volume since launch.

Wormhole 2025 Current State and Metrics

Wormhole Trading Volume and Cross-Chain Messages in 2025

Data: Wormhole official statistics and CoinMarketCap, January 2025

Wormhole has facilitated over $60 billion in cross-chain volume by December 2025. The platform processed more than 1.09 billion messages. Volume increased from $7 billion to over $60 billion between 2023 and 2025.

The W token launched April 3, 2024, with a total supply of 10 billion tokens. Currently 5 billion W tokens circulate in the market. The token trades around $0.04 with a market cap near $200 million.

Multichain tokenized assets under management reached $3.5 billion in May 2025. BlackRock's BUIDL fund ($1.9 billion) uses Wormhole for cross-chain functionality. Apollo's ACRED fund ($1.3 billion) also relies on Wormhole infrastructure.

Major Changes in 2025

Wormhole Token Economics Transformation

September 2025 brought the W 2.0 tokenomics upgrade. The update changed annual token unlocks to bi-weekly releases starting October 3, 2025. This spreads distribution over 4.5 years instead of cliff releases.

A Wormhole Reserve now accumulates protocol revenues in W tokens. The reserve captures fees from Portal transfers and ecosystem applications. Stakers earn a 4% base yield for participating in governance.

Extended lock schedules keep investors aligned until October 2028. Core contributors receive tokens bi-weekly while maintaining original annual agreements. The changes reduce concentrated market pressure.

Wormhole Institutional Expansion

May 2025 saw the opening of Wormhole's Global Ecosystem Hub in New York City. The Flatiron District location positions the protocol at the center of traditional finance. Partners include BlackRock, Apollo, VanEck, and Hamilton Lane.

Securitize selected Wormhole as its exclusive interoperability provider. The partnership enables multichain capabilities for institutional-grade tokenized funds. BlackRock's BUIDL expanded beyond Ethereum using Wormhole's Native Token Transfer framework.

March 2025 featured the Tokenize.NYC conference organized by Wormhole and Securitize. Attendees included JP Morgan, Goldman Sachs, and Morgan Stanley. The event focused on real-world asset tokenization and institutional adoption.

New Features Launched in 2025

Wormhole MultiGov Platform for Cross-Chain Governance

MultiGov launched as the first multichain governance system. DAOs can create and vote on proposals across Ethereum, EVM Layer-2s, and Solana. Built with Tally and Scopelift, MultiGov allows W holders to participate from any supported chain.

Users stake W tokens to receive voting power. Delegates can vote on protocol upgrades, fee models, and new chain integrations. The system eliminates the need to bridge tokens between networks for governance.

Wormhole Settlement and Portal Earn Programs

February 2025 introduced Wormhole Settlement for fast multichain transfers. The intents-based protocol handles institutional-scale volume. Developers can integrate cross-chain swaps without managing complex infrastructure.

Portal Earn rewards users who stake W tokens for boosted yields. The program incentivizes multichain activities like transfers and liquidity provision. Participants earn points redeemable for additional W tokens.

Wormhole Zero-Knowledge Security Layer

August 2025 integrated zero-knowledge proofs via Boundless zkVM. Developers can choose ZK-verified routes for high-stakes transactions. The layer supports Ethereum, Base, Optimism, and Avalanche.

Solana compatibility arrived in the implementation roadmap. The optional cryptographic verification adds trust-minimized security. Institutions use ZK routes for real-world asset transfers.

Security History and 2025 Status

Wormhole February 2022 Exploit Analysis

February 2, 2022, saw an attacker exploit Wormhole for 120,000 wETH worth $320 million. The hacker bypassed signature verification using a deprecated function. The vulnerability allowed minting tokens without proper collateral backing.

Jump Trading replaced stolen funds within 24 hours to maintain 1:1 backing. The company committed resources to make users whole. Wormhole offered a $10 million bounty for returning funds.

The attacker converted stolen ETH to staked ETH in January 2023. They used borrowed capital to leverage positions across protocols. The exploit demonstrated risks inherent to cross-chain bridge infrastructure.

Wormhole Post-Exploit Security Improvements

After 2022, Wormhole launched two $2.5 million bug bounty programs. CertiK, PeckShield, and Trail of Bits conducted multiple audits. The Guardian network expanded from 7 to 19 validators.

Google Cloud joined as a validator in 2024. AMD partnered for hardware acceleration in security operations. Uniswap's Bridge Assessment Committee approved Wormhole as the most secure cross-chain option.

The committee cited validator quality, decentralization, and architecture improvements. LayerZero was denied approval due to security concerns. No major exploits occurred in 2023, 2024, or 2025.

Wormhole 2025 Security Incidents

November 2025 saw a DIMO bridge incident involving approximately 30 million DIMO tokens. An attacker accessed a developer key for a bridge under development. The exploit targeted transfers between Ethereum, Base, Solana, and Polygon.

The DIMO team confirmed the incident isolated to the bridge's deployer key. User data and the main DIMO network remained secure. Wormhole's core protocol was not compromised in this incident.

Wormhole Compared to Competing Bridges

Wormhole vs. LayerZero vs. Stargate Performance Metrics

| Bridge Protocol | Chains Supported | Total Volume | Messages Processed | Transfer Fees | Validation Model |

|---|---|---|---|---|---|

| Wormhole | 40+ | $60B+ | 1.09B+ | < $0.01 | 19 Guardians |

| Stargate/LayerZero | 50 | $45B | N/A | 0.06% | Validator-Oracle |

| Symbiosis | 45 | N/A | N/A | Variable | MPC Relayers |

| Synapse | 20 | N/A | N/A | Variable | Multi-Sig |

| THORChain | 16 | N/A | N/A | Variable | Node Network |

Data: Bridge protocol statistics, August-December 2025

Wormhole leads in total cross-chain volume with over $60 billion processed. The platform handles more blockchains than most competitors. Transfer costs remain lower than percentage-based fee models.

Stargate processes high volumes but charges flat 0.06% fees per transaction. LayerZero uses a validator-oracle model requiring fewer nodes. Symbiosis supports more chains but lacks Wormhole's institutional partnerships.

August 2025 brought competition when LayerZero proposed acquiring Stargate for $110 million. Wormhole countered with a higher bid citing Stargate's $345 million TVL. The bidding war continues as of December 2025.

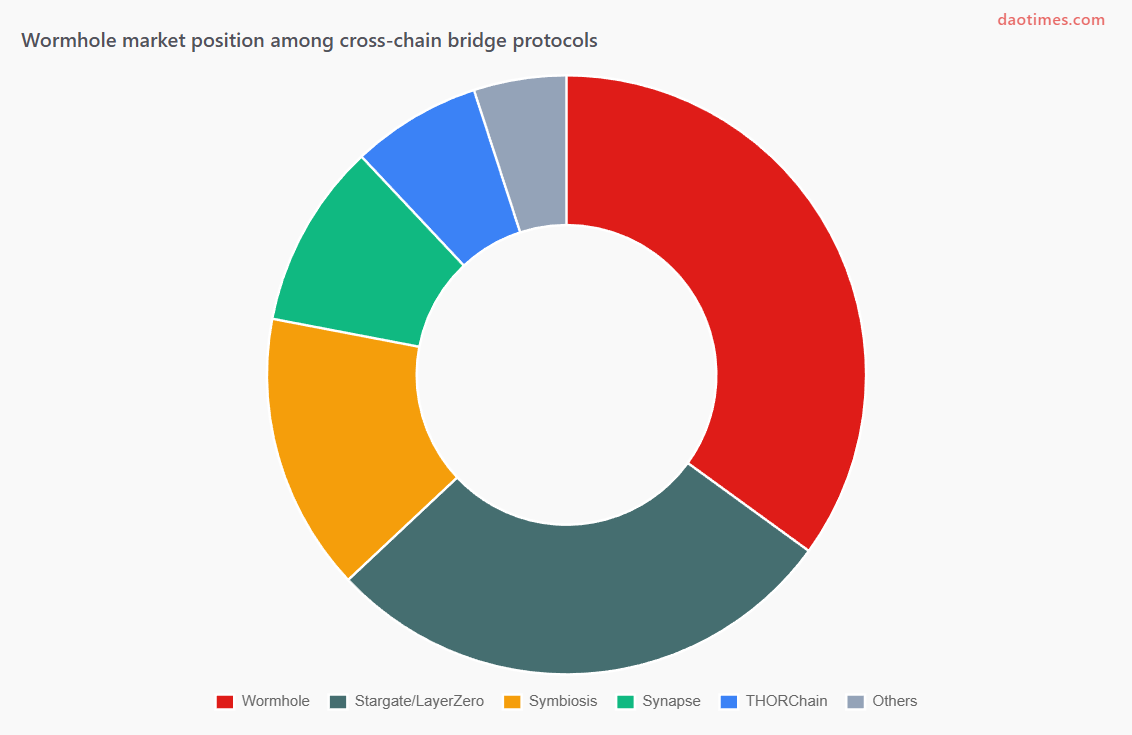

Wormhole Bridge Market Position Analysis

Wormhole Cross-Chain Bridge Market Share Distribution

Data: DeFi bridge statistics Q4 2025

Wormhole captures the largest share of institutional cross-chain transfers. BlackRock, Apollo, and VanEck rely exclusively on Wormhole infrastructure. No other bridge has secured comparable traditional finance partnerships.

The protocol ranks first in message passing with 1.09 billion processed. Stargate leads in native asset transfers for retail users. Symbiosis offers the widest token pair support across chains.

Understanding different use cases helps users select appropriate bridges. Tools like the comprehensive DAO tooling guide provide comparison frameworks. Each protocol optimizes for specific transfer types and user needs.

Wormhole Institutional Partnerships Detail

Wormhole Tokenized Asset Volume by Partner Institution

Data: Securitize and Wormhole partnership announcements, May 2025

BlackRock's BUIDL fund represents $1.9 billion in tokenized treasuries. The fund uses Wormhole NTT for multichain deployment. Apollo's ACRED provides $1.3 billion in diversified credit access.

VanEck's tokenized products utilize Wormhole for cross-chain liquidity. Hamilton Lane's SCOPE fund launched on multiple networks through Wormhole. Mercado Bitcoin integrated for Latin American market access.

Combined institutional assets exceed $3.5 billion managed through Wormhole. Traditional finance increasingly chooses blockchain interoperability solutions. The trend mirrors broader adoption of tokenized real-world assets.

Wormhole Ecosystem and DAO Landscape

Wormhole governance launched through W token staking on Tally. Token holders delegate voting power to themselves or representatives. Proposals cover protocol upgrades, fee structures, and chain integrations.

Current staking shows $45 million in W tokens locked. Over 485 million W participated in governance votes. Dan Reecer holds 25.1% of voting power as co-founder.

The protocol connects to broader DAO infrastructure across supported chains. Users can explore various governance models through resources like the comprehensive list of DAOs. Cross-chain governance remains experimental but shows promise.

Wormhole Roadmap and Future Development

Wormhole Era4 Product Development Timeline

Data: Wormhole official roadmap and announcements

Era4 focuses on decentralization through multichain governance tools. Portal brand refresh targets improved user experience. Wormhole Settlement unifies intents protocols under one system.

BLS signature aggregation arrives Q3 2025 to reduce gas costs. Native Layer-2 integration for Optimism, Arbitrum, and zkSync launches Q4 2025. Cross-chain liquid staking comes in 2026.

Monad mainnet integration provides day-one cross-chain support. The protocol continues expanding institutional partnerships. Hardware acceleration with AMD enhances validator performance.

How to Use Wormhole for Token Transfers

Visit portalbridge.com to access the main user interface. Connect a Web3 wallet like MetaMask, Phantom, or Coinbase Wallet. Select source and destination chains from 40+ options.

Choose the token type and amount to transfer. Review estimated fees (typically under $0.01 for most transfers). Confirm the transaction in your connected wallet.

Guardian validators process the cross-chain message within 20-30 seconds. Wrapped tokens appear in the destination wallet after confirmation. Users can redeem wrapped tokens back to native assets.

Advanced users access Wormhole SDK for custom integrations. Developers build cross-chain applications using Wormhole Connect. The platform supports NFT transfers alongside fungible tokens.

Wormhole Advantages and Limitations

Strengths

Wormhole connects more blockchains than most competing bridges. Transfer fees remain among the lowest in the industry. Institutional partnerships provide credibility and adoption momentum.

The protocol leads in total volume and messages processed. Security improved after the 2022 exploit through extensive audits. Google Cloud validator participation adds enterprise trust.

Native Token Transfer framework solves fragmented liquidity issues. Multichain governance enables participation from any supported network. The platform handles both retail and institutional scale.

Weaknesses

The February 2022 hack damaged trust despite full fund recovery. Lock-and-mint model creates wrapped tokens instead of native assets. This differs from protocols offering direct native swaps.

W token price declined 72% from all-time highs in 2024. Market cap remains small compared to protocol volume. Competition intensifies as LayerZero and others improve offerings.

Centralization concerns exist with 19 Guardian validators. Users must trust validator honesty for transaction verification. The system differs from trustless zero-knowledge proof bridges.

Frequently Asked Questions

What makes Wormhole different from other cross-chain bridges?

Wormhole supports 40+ blockchains including non-EVM networks like Solana, Aptos, and Sui. The Guardian Network uses 19 validators including Google Cloud. Transfer fees often cost under $0.01, lower than percentage-based competitors.

Is Wormhole safe to use after the 2022 hack?

Post-2022 security upgrades include multiple audits from CertiK, PeckShield, and Trail of Bits. Uniswap's Bridge Assessment Committee approved Wormhole as the most secure option. Bug bounties totaling $5 million incentivize vulnerability disclosure. No major exploits occurred in 2023-2025.

How does Wormhole W token work?

W serves as the native multichain governance token. Holders stake W to participate in protocol decisions. A 4% base yield rewards stakers participating in governance. W exists natively on Solana, Ethereum, Arbitrum, Optimism, and Base.

What institutions use Wormhole?

BlackRock uses Wormhole for its $1.9 billion BUIDL tokenized treasury fund. Apollo's $1.3 billion ACRED fund relies on Wormhole infrastructure. VanEck, Hamilton Lane, Circle (USDC), Uniswap, and Lido also use the protocol.

Can I transfer NFTs through Wormhole?

Yes, Portal Bridge supports NFT transfers across supported chains. Users can move NFTs between Ethereum, Solana, and other networks. The same lock-and-mint mechanics apply to non-fungible tokens.

How long do Wormhole transfers take?

Most transfers complete within 20-30 seconds after Guardian validation. Users need to wait for blockchain confirmations on both source and destination chains. Finality times vary by network congestion levels.

Does Wormhole require KYC verification?

Portal Bridge does not require KYC for retail users. Institutional products through Securitize require accredited investor verification. Compliance standards apply to tokenized real-world assets.

What happened in the Wormhole vs. LayerZero Stargate bidding war?

August 2025 saw LayerZero offer $110 million to acquire Stargate. Wormhole countered, claiming the bid undervalued Stargate's $345 million TVL. The voting process paused to allow competitive bidding. Final outcome remains pending as of December 2025.

How does Wormhole generate revenue?

Protocol fees come from cross-chain transfers through Portal. Ecosystem applications built on Wormhole contribute revenue. The W 2.0 Reserve accumulates these fees in W tokens. Revenue supports network expansion and staker rewards.

What chains will Wormhole add next?

Monad mainnet integration arrives Q4 2025 with day-one support. Native Layer-2 connections for Optimism, Arbitrum, and zkSync launch late 2025. Additional chains join based on governance votes and market demand.

Sources

Official Sources:

Wormhole Official Website and Blog

Wormhole W Token 2.0 Tokenomics Announcement

Wormhole Platform Roadmap Documentation

Portal Bridge Official Statistics

Market Data:

CoinMarketCap Wormhole Price and Statistics

CoinGecko Wormhole Market Data

Messari Wormhole Research and Updates

Tokenomist Wormhole Supply Analysis

Security and Analysis:

Chainalysis Wormhole Hack Analysis Report

CertiK Wormhole Bridge Exploit Incident Analysis

Halborn Wormhole Hack Explanation

Uniswap Bridge Assessment Committee Report

Industry Coverage:

Cointelegraph Wormhole Coverage

The Block Cross-Chain Bridge Analysis

Symbiosis Finance Best Crypto Bridges 2025 Report

BSC News Wormhole Tokenomics Update