What is Uniswap DAO, Governance, Current State and Tokenomics Explained

Understanding Uniswap DAO

Uniswap operates as a decentralized exchange protocol governed by UNI token holders through a DAO structure. The protocol enables direct cryptocurrency swaps without intermediaries using automated market makers.

Founded by Hayden Adams in 2018, Uniswap launched on Ethereum mainnet in November of that year. The protocol revolutionized decentralized trading by introducing an AMM model that replaced traditional order books.

The DAO controls protocol parameters and treasury allocations. Token holders vote on upgrades, fee structures, and funding proposals. Governance happens through a three-phase process requiring minimum vote thresholds at each stage.

As of December 2025, Uniswap holds the largest DAO treasury at $5.4 billion. The protocol has processed approximately $4 trillion in total trading volume since launch. The ecosystem supports 356,900 UNI token holders with 35,600 lifetime governance participants.

Current State and Metrics for Uniswap DAO

UNI trades at $6.21 as of December 22, 2025, with a market capitalization of $3.9 billion. The token ranks 39th among all cryptocurrencies. Daily trading volume averages between $400 million and $550 million across exchanges.

Total value locked in Uniswap protocols stands at $4.5 billion across multiple networks. Ethereum mainnet holds the majority of TVL, while layer 2 networks process 67.5% of daily trading volume. Average daily volume ranges from $1 billion to $2 billion depending on market conditions.

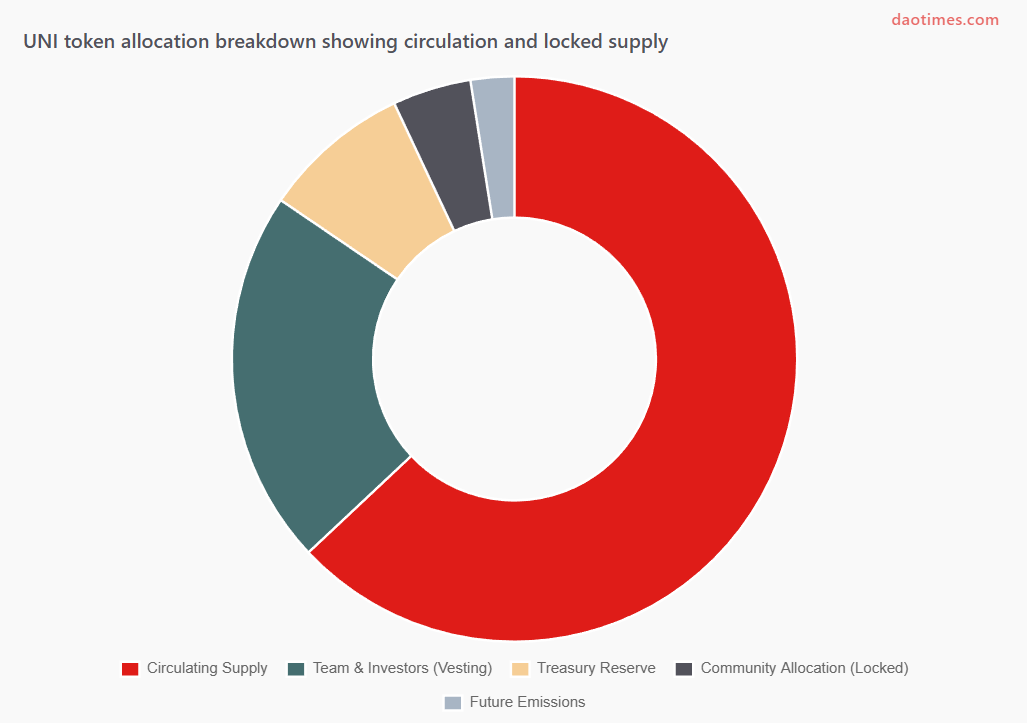

The circulating supply reached 630 million UNI tokens out of a maximum 1 billion. Monthly trading volume hit $1.2 trillion over the past year according to Token Terminal data. PancakeSwap generated slightly higher volume during the same period at approximately $1.2 trillion.

Uniswap V4 achieved $1 billion in TVL within 177 days of its January 2025 launch. The protocol created over 2,500 custom liquidity pools using the new hooks system. Base network drives 50% of protocol revenue given current activity levels.

Uniswap DAO Monthly Volume and TVL Growth

Data: Token Terminal, DefiLlama, Uniswap Analytics (2023-2025)

How Uniswap DAO Governance Functions

Proposals move through three stages before implementation. The process begins with temperature checks requiring 25,000 yes votes. Consensus checks follow, needing 50,000 yes votes. Final governance votes require 40 million yes votes for adoption.

Delegates play a key role in the voting process. Token holders can assign voting power to delegates who participate actively. The top 20 delegates control substantial voting weight. One delegate wielded 455,000 UNI tokens before departing in May 2025.

The Uniswap Foundation and Uniswap Labs maintain distinct legal entities. The Foundation operates as a nonprofit supporting ecosystem growth. Labs functions as a for-profit company developing protocol versions. In 2025, governance discussions centered on clarifying these relationships.

A delegate named Pepo withdrew from governance participation in May 2025. The departure highlighted tensions around Foundation influence over DAO decisions. Executive Director Devin Walsh responded by reaffirming the importance of delegate participation.

The DAO established formal principles in 2025. These include maintaining decentralization, preventing cartel formation, and requiring conflict disclosure. Delegates must conduct professional reviews of proposals. Transparency remains mandatory through public communication.

Recent Changes and the UNIfication Proposal

Voting on the UNIfication proposal runs from December 19-25, 2025. The proposal activates protocol fees and implements UNI token burns. Early vote counts show strong support with over 62 million votes in favor.

The proposal burns 100 million UNI tokens from the treasury worth approximately $525 million. This retroactive burn compensates for years without active protocol fees. Uniswap processed $4 trillion in volume without capturing fees for UNI holders.

Protocol fees activate on V2 and V3 pools covering 80-95% of liquidity provider fees on Ethereum mainnet. V2 reduces LP fees from 0.3% to 0.25%, with 0.05% going to protocol. V3 pools set protocol fees between one-fourth and one-sixth of LP fees.

Unichain sequencer fees direct to the burn mechanism after covering costs. The layer 2 network processes $100 billion in annualized DEX volume. Annual sequencer fees reach $7.5 million after L1 data costs and Optimism's 15% share.

Uniswap Labs shifts focus from interface monetization to protocol development. Labs removes fees on its interface, wallet, and API. The company receives a 20 million UNI annual growth budget starting January 2026. Foundation teams transfer to Labs under this restructuring.

Uniswap DAO Token Distribution and Circulation

Data: Uniswap tokenomics, Etherscan on-chain data (December 2025)

Uniswap V4 Features and Innovation

Version 4 launched in January 2025 after missing its Q3 2024 target. The upgrade introduces hooks allowing developers to customize pool behavior. Over 150 hooks were developed before mainnet launch. The system enables dynamic fees, limit orders, and automated liquidity management.

The singleton contract model replaces individual pool contracts. All pools exist within one smart contract, reducing gas costs by 99% for pool creation. Flash accounting settles only net balances instead of transferring assets after each swap.

Native ETH support eliminates wrapped ether requirements. Direct ETH trading reduces gas fees by approximately 15% compared to WETH operations. The change simplifies transactions and lowers costs for traders.

Protocol Fee Discount Auctions internalize MEV that typically goes to searchers. The mechanism auctions fee-free swap rights for short windows. Winning bids burn UNI tokens. Early analysis shows PFDA could increase LP returns by $0.06-$0.26 per $10,000 traded.

Aggregator hooks source liquidity from other protocols while burning UNI. V4 functions as an on-chain aggregator that anyone can integrate. Labs integrates these hooks into its frontend and API for broader liquidity access.

Several protocols built on V4 architecture. Bunni offers concentrated liquidity management. Silo Finance provides isolated lending markets. EulerSwap combines AMM functionality with lending vault infrastructure. However, Bunni suffered an $8.4 million exploit in September 2025.

Uniswap DAO Governance Participation Metrics

Data: Uniswap Governance Forum, Tally voting records (2024-2025)

Competitive Landscape Comparison

| DEX Platform | TVL | Daily Volume | Primary Network | Key Feature |

|---|---|---|---|---|

| Uniswap | $4.5B | $1-2B | Ethereum + L2s | Hooks system, concentrated liquidity |

| PancakeSwap | $1.8B | $1.5-3B | BNB Chain | Low fees, yield farming |

| Curve Finance | $3.2B | $400-800M | Ethereum + L2s | Stablecoin swaps, low slippage |

| SushiSwap | $102M | $50-150M | Multi-chain | Multi-chain support, fee sharing |

| Balancer | $850M | $100-200M | Ethereum + L2s | Weighted pools, custom ratios |

Data: DefiLlama, Token Terminal (December 2025 averages)

PancakeSwap captured significant market share in 2025. The platform recorded $16.3 billion in daily swaps on June 30, 2025. BNB Chain's lower fees and faster transactions drove adoption. Meme coin launches on Four.meme platform amplified PancakeSwap volume.

SushiSwap experienced decline from its 2022 peak. TVL dropped 99% from $8 billion to $102 million. CEO Jared Grey resigned after SEC scrutiny. Synthesis Capital acquired 10 million SUSHI tokens for $3.34 million to take control.

Curve Finance specializes in stablecoin swaps. The platform offers superior efficiency for similar-asset pairs. Liquidity providers earn returns through low-slippage trading. Curve maintains relevance despite broader DEX competition.

1inch operates as a DEX aggregator rather than direct competitor. The platform routes trades across multiple protocols including Uniswap. Aggregators optimize execution prices by splitting orders. This model complements rather than replaces individual DEXes.

Security Track Record

Uniswap core protocol avoided major exploits since launch. The architecture underwent extensive audits by Trail of Bits and other firms. V4 launched with a $15.5 million bug bounty program, the largest in DeFi history.

A wallet vulnerability emerged in January 2025. Security firm ScaleBit flagged the issue affecting Web3 wallets. Attackers with physical device access could retrieve mnemonic phrases in under three minutes. The vulnerability persisted in the latest app version at the time.

Bunni DEX, built on V4 hooks, suffered an $8.4 million exploit in September 2025. Hackers manipulated the Liquidity Distribution Function through carefully calculated trade sizes. The attack drained $2.4 million from Ethereum and $6 million from Unichain.

Phishing attacks targeted users in July 2022 and May 2024. These exploited user behavior through fake websites rather than protocol vulnerabilities. Security experts recommend verifying URLs and protecting seed phrases.

The broader DeFi ecosystem faced increased security challenges in 2025. First half losses exceeded $2.17 billion according to Chainalysis. Wallet compromises accounted for $1.71 billion of total losses. Off-chain attacks represented 80.5% of stolen funds in 2024.

Uniswap DAO Competitor Analysis by Trading Volume

Data: DefiLlama DEX rankings, Token Terminal (November 2025)

Historical Development Timeline

November 2018 marked Uniswap V1 launch on Ethereum mainnet. The protocol introduced automated market makers to decentralized finance. Liquidity providers could deposit token pairs and earn fees from traders.

Uniswap V2 arrived in November 2020 with ERC-20 pairs and price oracles. Flash swaps enabled complex DeFi strategies. The upgrade improved capital efficiency and expanded use cases.

September 2020 brought the UNI governance token through retroactive airdrop. Early users received 400 UNI tokens for free. The distribution created one of the largest instant token holder bases.

V3 launched in May 2021 featuring concentrated liquidity. Providers could focus capital within specific price ranges. Capital efficiency improved dramatically compared to V2's full-range positions. The token reached an all-time high of $44.92 around the V3 launch.

Governance approved $165 million in funding for the Foundation in March 2025. The Uniswap Unleashed proposals passed with over 80% support. Funds targeted ecosystem growth, V4 development, and governance tools.

Congressional hearings in June 2025 examined Uniswap governance. Representative Sean Casten questioned Foundation control over protocol decisions. Katharine Minarik defended the separation between Labs, Foundation, and DAO entities.

Tokenomics Structure

The total UNI supply caps at 1 billion tokens. Distribution allocated 60% to community members over four years. Team members and investors received 21.51% with four-year vesting. Advisors got 0.69% with the same vesting schedule.

Initial liquidity providers earned 15% through the first four months. This incentivized early participation and bootstrapped protocol liquidity. The distribution ended in November 2020.

UNI enables governance participation and voting rights. Each token represents voting power on protocol decisions. The token lacks built-in fee distribution mechanisms. Value accrues indirectly through protocol usage and ecosystem growth.

The UNIfication proposal introduces deflationary mechanics. Protocol fees burn UNI instead of distributing to holders. Unichain sequencer fees also feed the burn mechanism. The model creates programmatic token value capture.

Treasury holdings reached $5.4 billion as of January 2025. Assets include UNI, ETH, USDC, DAI, and OP tokens. The treasury provides funding for ecosystem development through governance votes.

Annual inflation runs at 2% after the initial four-year distribution period. The UNIfication burn mechanism could offset or reverse inflation. Net deflation depends on protocol usage levels and fee generation.

Frequently Asked Questions

Future Outlook and Development

The UNIfication proposal reshapes Uniswap's economic model. Protocol fees create direct value capture for UNI holders through burns. The deflationary mechanism ties token value to protocol usage for the first time.

Unichain development continues as a DeFi-focused layer 2. The network targets low-cost, high-performance AMM trading. Gas sponsorship makes Uniswap the cheapest trading venue within Labs' interfaces. Strategic positioning attracts liquidity providers and asset issuers.

Institutional adoption remains a key growth driver. Ethereum ETF approval in late 2024 legitimized crypto assets. Regulatory clarity under the new SEC leadership enables institutional participation. DeFi protocols implementing compliance frameworks attract traditional finance integration.

Competition intensifies across the DEX landscape. PancakeSwap dominates BNB Chain volume. Curve maintains stablecoin swap leadership. Aggregators like 1inch optimize execution across protocols. Uniswap's hooks system provides differentiation through customization.

Development focus shifts to Protocol Fee Discount Auctions and aggregator hooks. These features internalize MEV and expand liquidity sources. Labs commits to zero-margin API distribution. The growth budget enables strategic partnerships, grants, and ecosystem expansion.

Governance maturity depends on delegate participation. The DAO must balance Foundation influence with community control. Established principles provide frameworks for decision-making. Transparency requirements and conflict disclosure build trust.

Security remains paramount as protocols grow. V4's modular architecture increases attack surfaces. Regular audits and bounty programs mitigate risks. Users must practice good security hygiene. Wallet protection and URL verification prevent phishing attacks.

The next 12 months determine UNIfication outcomes. Fee activation affects LP migration patterns. Burn rates depend on trading volume levels. Token price reflects market perception of the new model. Competitive responses from other DEXes shape the landscape. Check resources at comprehensive DAO tooling guide and explore more at the comprehensive list of DAOs.

Sources and References

Price and Market Data: CoinGecko, CoinMarketCap, Bybit, OKX, Bitget (December 2025)

Protocol Metrics: DefiLlama, Token Terminal, Uniswap Analytics, Dune Analytics

Governance Information: Uniswap Governance Forum, Tally, Snapshot voting records

Technical Documentation: Uniswap Docs, GitHub repositories, V4 whitepaper

News Sources: CoinDesk, Cryptopolitan, DLNews, Crypto Briefing, AMBCrypto

Security Reports: ScaleBit, Hacken, Halborn, Nominis, CertiK, Chainalysis

Analysis Platforms: Messari, AInvest, OnchainStandard, CoinLaw

Research Articles: DWF Ventures, BingX, WunderTrading analysis reports