What is Optimism DAO, Governance, Current State and Tokenomics Explained

Understanding Optimism DAO

Optimism stands as a Layer 2 scaling solution for Ethereum, launched in January 2021. The network uses optimistic rollup technology to process transactions off-chain before batching them to Ethereum's mainnet. This approach reduces gas fees by up to 98% while maintaining Ethereum's security guarantees.

Founded by Jinglan Wang and Karl Floersch in 2019, Optimism has grown into a governance powerhouse. The DAO operates through the Optimism Collective, which controls the network's development and treasury allocation. As of December 2025, the network secures $5.6 billion in total value locked across 75+ DeFi protocols.

The comprehensive DAO tooling ecosystem enables Optimism to manage governance efficiently. The network processes an average of 1.2 million daily transactions, demonstrating real-world adoption beyond speculation.

What sets Optimism apart is its two-house governance system. The Token House handles protocol upgrades and treasury decisions, while the Citizens' House focuses on public goods funding. This bicameral structure prevents power concentration and ensures diverse stakeholder representation.

Optimism DAO Token Price and Market Performance in 2025

Data: CoinMarketCap and price tracking platforms, December 2025

The OP token trades at $0.27 as of December 22, 2025. Market capitalization sits at $525 million, ranking OP at position 78 among all cryptocurrencies. Trading volume reached $47.2 million in the past 24 hours, down 3.6% from the previous day.

The year 2025 proved challenging for OP holders. The token peaked at $2.18 in January 2025 but declined steadily throughout the year. By February, OP dropped to $0.84, losing 61% of its January value. The downward trend continued through summer, with prices hitting $0.74 in September.

Despite price struggles, on-chain metrics tell a different story. Active addresses increased throughout 2025, with Base (built on OP Stack) driving significant transaction volume. The network's resilience comes from memecoin launches and AI applications rather than DeFi speculation.

Whales accumulated OP during the November crash, when prices fell 27%. This buying pressure suggests long-term confidence, even as technical indicators remain bearish. The Ethereum Fusaka upgrade in December 2025 could reduce L2 fees by 40%, potentially improving OP's value proposition.

Optimism DAO Governance Structure and Token House Operations

The Token House comprises OP holders and their delegates. Currently, over 1,000 delegates participate in governance decisions. The top delegate holds 6.4 million OP in voting power, representing delegated tokens from 352 individual holders.

Season 8 launched in August 2025, introducing four distinct voting groups: tokenholders, end-users, apps, and chains. This subdivision ensures balanced representation across all ecosystem participants. Each group can veto proposals that unfairly disadvantage their constituency.

| Governance Metric | Value | Change from Season 7 | Status |

|---|---|---|---|

| Active Delegates | 310 | +8% | Growing |

| Voting Cycle | Cycle #46 | Ongoing | Active |

| Quorum Threshold | 30% | Unchanged | Standard |

| Top 10 Delegate Power | 48% | -11% | Decentralizing |

| Proposals Passed | 87 | +15 | Active |

| Average Vote Duration | 7 days | Unchanged | Standard |

Data: Optimism Agora and Curia governance dashboards, December 2025

Voting power concentration decreased in 2025. The top 10 delegates now control 48% of voting power, down from 59% in 2022. This redistribution signals healthier decentralization, though the Gini coefficient remains at 0.998, indicating room for improvement.

The Developer Advisory Board handles protocol upgrades based on technical merit. This board acts on behalf of both houses, streamlining technical decisions. Any of the four stakeholder groups can veto board approvals if proposals harm their interests.

Optimism DAO Superchain Ecosystem Growth

Data: L2Beat and DeFiLlama, December 2025

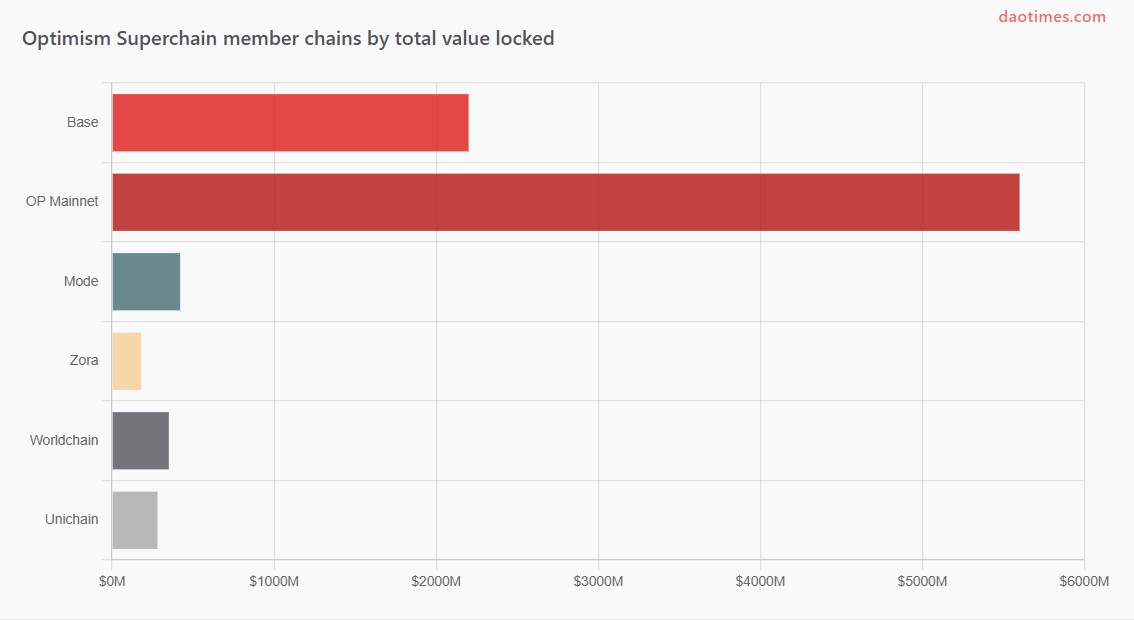

The OP Stack powers a network of interoperable Layer 2 chains called the Superchain. Major chains include Base (Coinbase), Mode, Zora, Worldchain, and Unichain. These networks share security infrastructure, communication protocols, and development standards.

Base emerged as the Superchain's flagship success. Launched in 2023, Base now processes more transactions than OP Mainnet itself. The chain attracted Coinbase's 98 million users, creating a massive on-ramp for DeFi. However, Base lacks a native token, limiting direct value capture for OP holders.

The Fusaka upgrade went live December 3, 2025, raising gas limits from 200 million to 500 million. This change enables more complex smart contracts and improves transaction throughput. The upgrade also introduced interop-ready contracts, preparing for the Interop Layer launch in early 2026.

OKX migrated its XLayer network to the OP Stack in December 2025. This adoption by a major exchange validates OP Stack's technical superiority. Over 200 millisecond block times and sub-cent fees deliver instant user experiences at scale.

Revenue sharing agreements with Superchain members fund public goods. Each chain commits a portion of transaction fees to the Optimism treasury. This model creates sustainable funding for infrastructure development without relying solely on token sales.

Optimism DAO Retroactive Public Goods Funding Program

RetroPGF (Retroactive Public Goods Funding) represents Optimism's most innovative contribution to crypto governance. The program has distributed over $100 million across seven rounds since 2021. An additional $850 million OP remains allocated for future distributions.

Data: Optimism Foundation and RetroPGF documentation, 2025

Round 7 started January 2025, transitioning from annual rounds to continuous impact evaluation. The program now rewards builders throughout the year based on measurable contributions. Developer tooling and on-chain builders receive priority in the first half of 2025.

The Citizens' House votes on RetroPGF allocations using a one-person-one-vote model. Badgeholders evaluate projects across categories including OP Stack development, governance infrastructure, and developer ecosystem tools. Round 6 allocated 5 million OP to 88 governance projects.

The Impact Chain maps contribution dependencies across the Superchain. This framework ensures all builders receive fair compensation based on their actual impact. Projects with ongoing value creation earn perpetually from future RetroPGF rounds.

Critics note that visibility often outweighs long-term impact in voting. Insights and data science work received higher funding than infrastructure projects in Round 6. The Foundation continues iterating on voting mechanisms to address this imbalance.

Optimism DAO Tokenomics and Supply Distribution

Data: Tokenomist and Optimism documentation, December 2025

The total OP supply caps at 4.29 billion tokens. Currently, 1.94 billion tokens (45.26%) circulate in the market. The next unlock occurs December 31, 2025, releasing tokens to investors and core contributors.

Allocation breaks down as follows: 20% for Retroactive Public Goods Funding, 19% for user airdrops, 19% for core contributors, 17% for investors, 8.8% unallocated ecosystem fund, and 5.4% each for partner fund, seed fund, and governance fund.

The protocol maintains 2% annual inflation after Year 1. Token holders vote annually to determine the Foundation's distribution budget. This democratic control prevents unchecked supply expansion while funding ongoing development.

Vesting schedules extend through 2029 using cliff mechanisms. Tokens release all at once after waiting periods, creating predictable supply events. Historical data shows high volatility seven days after major unlocks, though price impact depends on market conditions.

| Allocation Category | Percentage | Amount (Millions) | Vesting Status |

|---|---|---|---|

| RetroPGF | 20% | 859 | Ongoing |

| User Airdrops | 19% | 816 | Partial |

| Core Contributors | 19% | 816 | Vesting |

| Investors | 17% | 730 | Vesting |

| Ecosystem Fund | 8.8% | 378 | Allocated |

| Partner Fund | 5.4% | 232 | Active |

Data: Optimism Foundation token allocation, 2025

Optimism DAO Recent Developments and Protocol Upgrades

Upgrade 17 (Jovian Hardfork) passed November 19, 2025, with less than 1% opposition. The proposal prepared Optimism for Fusaka readiness, implementing Stage 1 security requirements. Only 17% against votes were needed to defeat the measure, demonstrating strong community support.

The Governor Upgrade Proposal introduced onchain controls MVP in November 2025. This change allows smart contracts to execute governance decisions automatically. The measure passed with just 0.39% opposition, far below the 17% veto threshold.

CCTP V2 went live on mainnet June 13, 2025. Circle's Cross-Chain Transfer Protocol enables 1:1 USDC transfers across chains without bridge risk. This integration strengthens Optimism's DeFi infrastructure and reduces friction for stablecoin users.

The Superchain Protocol Security Expansion launched June 20, 2025. The program extended the $2 million bug bounty to cover pre-production upgrades. Over $2.6 million has been paid to security researchers since 2022, with Optimism ranking second only to Polygon in bounty payouts.

Ripple's RLUSD stablecoin expanded to Optimism in partnership with Wormhole. This integration adds regulatory-compliant stablecoin options beyond USDC and USDT. The move positions Optimism for institutional adoption while maintaining grassroots appeal.

Optimism DAO Security and Risk Assessment

Optimism maintained a clean security record through 2024 and 2025. No major exploits or hacks targeted OP Mainnet during this period. The network's optimistic rollup architecture proved resilient against common attack vectors that plagued other L2s.

The platform inherits Ethereum's security through its fraud-proof system. When invalid transactions are detected, validators can challenge them during a seven-day dispute window. This mechanism prevents malicious activity without requiring expensive zk-proof generation.

Withdrawal times take one week due to the challenge period. Users must wait before moving assets from Optimism to Ethereum mainnet. Fast-exit services exist but introduce counterparty risk and fees. This tradeoff prioritizes security over convenience.

The protocol uses a permissioned sequencer controlled by the Foundation. This centralization point enables rapid transaction processing but creates a single point of failure. Plans exist to decentralize sequencing through the Superchain shared sequencer in 2026.

Smart contract risks remain across DeFi protocols built on Optimism. While the base layer stays secure, individual applications face vulnerabilities. Users should verify protocol audits and track records before depositing funds.

Optimism DAO Compared to Other Layer 2 Solutions

| Layer 2 Network | TVL (Billions) | Daily Transactions | Avg Gas Fee | Technology |

|---|---|---|---|---|

| Arbitrum | $10.4 | 2.5M | $0.008 | Optimistic Rollup |

| Optimism | $5.6 | 1.2M | $0.005 | Optimistic Rollup |

| Base | $2.2 | 1.8M | $0.004 | OP Stack |

| Polygon | $6.1 | 3.1M | $0.012 | Plasma/PoS |

| zkSync Era | $1.1 | 0.8M | $0.015 | ZK Rollup |

Data: L2Beat and DeFiLlama, December 2025

Arbitrum leads Layer 2 networks with $10.4 billion TVL, doubling Optimism's holdings. However, Optimism's broader ecosystem strategy through the Superchain creates different value capture mechanisms. The network trades direct TVL for ecosystem growth.

Transaction fees on Optimism average $0.005, cheaper than Arbitrum and Polygon. Base undercuts all competitors at $0.004, benefiting from OP Stack optimizations. These low costs make microtransactions and high-frequency trading viable.

ZK-rollups like zkSync offer instant finality but face higher computational costs. Optimistic rollups sacrifice instant finality for lower fees and better EVM compatibility. This tradeoff suits different use cases, with neither approach clearly superior.

Frequently Asked Questions

How does Optimism reduce Ethereum gas fees?

Optimism processes transactions off-chain and batches them to Ethereum. This method reduces fees by up to 98% while maintaining Ethereum security. Users pay around $0.005 per transaction compared to $5-50 on Ethereum mainnet.

What makes the Superchain different from other multichain ecosystems?

Superchain chains share the same OP Stack technology and security infrastructure. They communicate natively without bridge risks. Revenue sharing funds public goods development, creating aligned incentives across all member networks.

How can I participate in Optimism governance?

Hold OP tokens and delegate voting power to yourself or another delegate. You can vote on proposals through Optimism Agora. Citizens' House membership requires earning citizenship through community contributions and RetroPGF participation.

When will the next OP token unlock occur?

The next scheduled unlock happens December 31, 2025. These releases follow predetermined vesting schedules for investors and core contributors. Token unlocks typically create short-term price volatility but follow a predictable timeline through 2029.

What is RetroPGF and how does it work?

RetroPGF rewards projects based on proven impact rather than future promises. The Citizens' House votes to allocate OP tokens to builders who contributed value. Over $100 million has been distributed, with $850 million reserved for future rounds.

Is Optimism safe from hacks and exploits?

Optimism maintained a clean security record through 2025 with no major exploits. The network inherits Ethereum security and runs a $2 million bug bounty program. Individual DeFi protocols carry their own risks independent of base layer security.

How does Optimism compare to Arbitrum?

Both use optimistic rollup technology with similar security guarantees. Arbitrum holds more TVL ($10.4B vs $5.6B), but Optimism focuses on ecosystem growth through the Superchain. Transaction fees are comparable, with Optimism slightly cheaper at $0.005 versus $0.008.

What chains are built on the OP Stack?

Major OP Stack chains include Base (Coinbase), Mode, Zora, Worldchain, Unichain, and OP Mainnet. OKX's XLayer migrated to OP Stack in December 2025. These chains form the Superchain, sharing infrastructure and security standards.

Can I bridge assets instantly between Optimism and Ethereum?

Withdrawals from Optimism to Ethereum take seven days due to the fraud-proof challenge period. Third-party fast-exit services exist but charge fees and introduce counterparty risk. Deposits from Ethereum to Optimism complete in minutes.

What is the long-term vision for Optimism?

Optimism aims to create a network of interoperable chains that scale Ethereum to billions of users. The Collective funds public goods through RetroPGF, aligning profit with positive impact. Success means treating multiple chains as a single unified platform rather than fragmented networks.

Sources

CoinMarketCap - Optimism price and market data

L2Beat - Layer 2 network analytics and governance metrics

DeFiLlama - Total value locked and DeFi protocol data

Optimism Foundation - Official documentation and governance proposals

Tokenomist - Token unlock schedules and vesting data

Chainalysis - Cryptocurrency security and hack statistics

Optimism Agora - Governance dashboard and voting records

Curia Hub - Delegate analytics and participation metrics

Messari - Governance analysis and DAO research

The Block - Blockchain industry news and data

Superchain Eco - Ecosystem insights and project tracking