What is Mantle Network, Governance, Current State and Tokenomics Explained

Understanding Mantle Network

Mantle Network launched as an Ethereum Layer 2 scaling solution in July 2023. The network evolved from BitDAO through a community vote. Token holders converted BIT to MNT at a 1:1 ratio.

The network uses modular architecture. Three layers handle execution, data availability, and settlement. EigenDA manages data storage. Ethereum provides security. This design cuts costs while maintaining speed.

Mantle transitioned to zero-knowledge validity proofs in September 2025. The OP Succinct upgrade reduced finality time to one hour. Withdrawals now complete in twelve hours instead of seven days.

The ecosystem includes multiple products. mETH Protocol handles liquid staking. Function's fBTC bridges Bitcoin to Web3. Mantle Index Four manages institutional assets. UR provides banking infrastructure.

Mantle Network Current Metrics December 2025

Data: DefiLlama, Messari Q4 2024 Report, Mantle 2024 Year Review

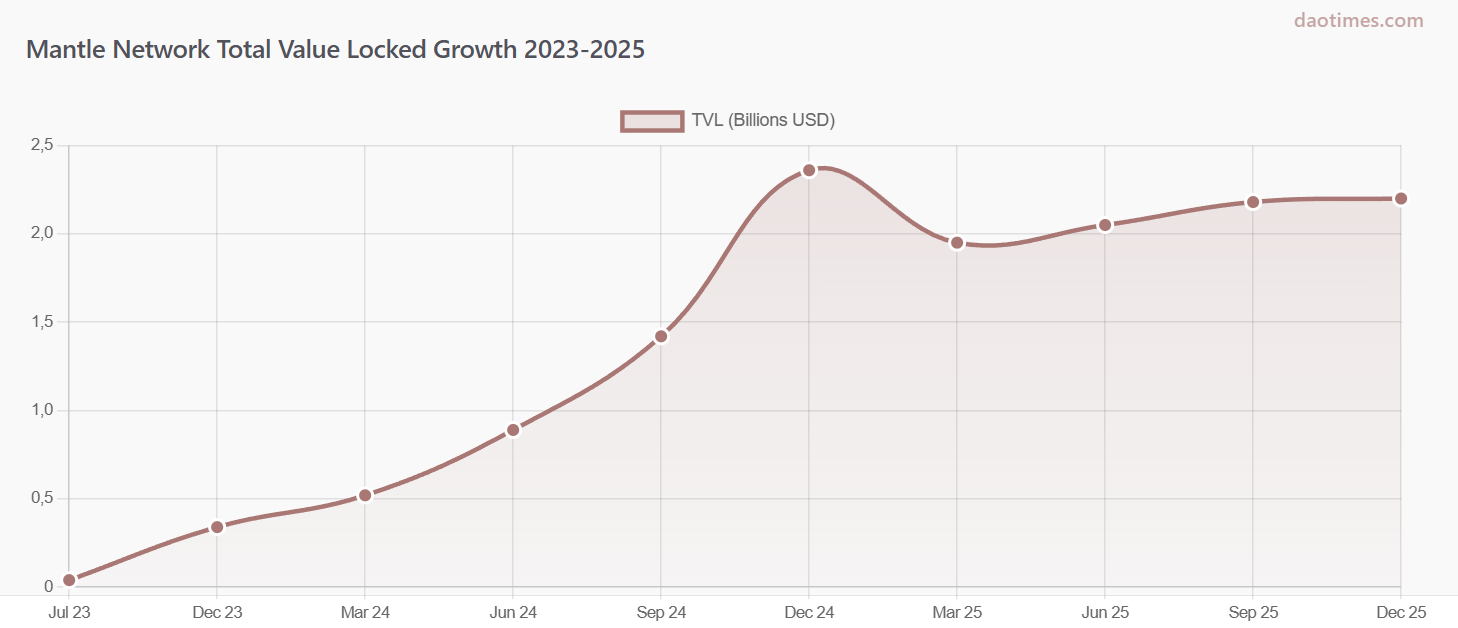

Mantle's total value locked reached $2.2 billion as of December 2025. The network processed over 175 million transactions since launch. Treasury assets exceed $7.9 billion.

Daily active users range from 45,000 to 650,000 depending on activity cycles. The network deployed 1.4 million smart contracts. Monthly active wallets maintain 4.9 million users.

MNT token trades at $1.05 with a market cap of $3.4 billion. Circulating supply stands at 3.25 billion tokens from a total of 6.22 billion. Trading volume averages $50 million daily.

The network achieved peak TVL of $2.36 billion on December 9, 2024. This represents 690% growth from January 2024. In-dApp TVL shows high user activity in DeFi protocols.

Mantle Governance Structure and Token Holder Rights

MNT holders control network decisions through off-chain governance. Snapshot platform hosts all proposals. Discourse forum manages community discussions.

Proposal creation requires 200,000 MNT voting power. The voting period lasts seven days minimum. Quorum needs 200 million MNT to pass proposals.

Token holders delegate voting rights to addresses. Delegation includes L1 Ethereum and L2 Mantle balances. Locked tokens in Rewards Station automatically gain voting power.

Core contributors implement approved proposals. Budget proposals authorize fund transfers. Governance covers treasury allocation, network upgrades, and strategic partnerships.

Recent Governance Milestones

MIP-31 passed in 2024, establishing the second budget cycle. The cycle runs from July 2024 to June 2025. This follows BIP-19 authorization from February 2023.

Mantle EcoFund partnered with 20 venture capital firms. Partners include Polychain Capital and Dragonfly Capital. The fund accessed over 500 deals through these relationships.

Rewards Station attracted 36,438 users who locked $128 million in MNT. The program distributed over $10 million in ecosystem tokens. This drives community participation.

Mantle Network Technology and Recent Upgrades

Data: Mantle Network Technical Documentation, Messari Report December 2025

OP Succinct ZK Rollup Integration

The September 2025 mainnet deployment changed Mantle's architecture. OP Succinct technology enables zero-knowledge proof generation. Succinct's SP1 zkVM verifies state transitions cryptographically.

Transaction costs dropped to $0.002 per proof. Throughput tripled to 10,000 TPS from previous targets. Finality improved 168x, reaching one hour.

The upgrade maintains EVM equivalence through OP Stack. Developers deploy Ethereum contracts without modifications. Cross-rollup interoperability expanded through ZK proofs.

EigenDA Data Availability Layer

Mantle integrates EigenDA for off-chain data storage. This cuts costs over 90% compared to Ethereum mainnet. The system uses Hokulea for blob derivation.

Data availability verification relies on ServiceManager. The sequencer publishes transaction roots on-chain. Full data posts to EigenDA for retrieval.

Prague Hardfork Compatibility

Version 1.3.1 added preemptive support for Ethereum's Prague upgrade. The optimism_safeHeadAtL1Block API aligns L2 headers with Ethereum consensus. Verkle trees and EIP-7251 features prepare for Q4 2025.

Mantle Ecosystem Products and Performance

| Product | TVL | Launch Date | Primary Function | Key Integration |

|---|---|---|---|---|

| mETH Protocol | $1.5B | April 2024 | ETH Liquid Staking | 42 DeFi protocols |

| Function fBTC | $2.06B | August 2024 | Bitcoin Wrapping | 28 BTC-Fi projects |

| Mantle Index Four | $173M | April 2025 | Institutional Index | TradFi onramp |

| UR Banking | N/A | June 2025 | Fiat Management | 50+ countries |

| Merchant Moe | $59M | 2023 | DEX | $308M volume |

| Agni Finance | $36.3M | 2023 | AMM DEX | $169M volume |

Data: Messari Report November 2025, DeFiLlama, Mantle Network

mETH Protocol Performance

mETH became the fourth-largest Ethereum liquid staking token. The protocol crossed $100 million TVL within one week of launch. Peak TVL reached $2.1 billion in 2024.

Exchange rate currently sits at 1 mETH equals 1.08 ETH. Partners include Eigenlayer, Symbiotic, and Karak. The token serves as collateral across CEX platforms and DeFi applications.

Function fBTC Growth

fBTC TVL surged from $100 million to $1.18 billion between August and November 2024. This represents 400% growth in three months. Year-end TVL hit $2.06 billion, marking 600% annual increase.

The product powers ecosystems including Babylon, Solv Protocol, and PumpBTC. It provides the most integrated wrapped BTC asset for DeFi composability.

Mantle Treasury and Financial Performance

Data: Messari Q4 2024 Report, Treasury Monitor

Mantle Treasury holds between $4.3 billion and $7.9 billion in assets. The variance reflects MNT price fluctuations and asset valuations. Treasury value grew 52.56% in Q4 2024.

MNT tokens comprise 88.85% of total treasury holdings. This concentration ties treasury performance to token price. Remaining assets include stablecoins and ecosystem tokens.

Treasury profits exceeded $50 million in 2024. Earnings come from Ethena USDe holdings (~20% of treasury income), staking rewards, and DeFi yields. Asset deployment focuses on sustainable returns.

The treasury funds operations through budget proposals. Monthly expenditures cover workforce, marketing, ecosystem programs, and infrastructure. All spending requires governance approval.

Mantle Rewards Station manages token distribution. The program incentivizes ecosystem participation. Token holders earn yields while maintaining governance rights.

Competitive Analysis Mantle Versus Major L2 Networks

| Network | TVL | Technology | TPS | Finality | Market Share |

|---|---|---|---|---|---|

| Arbitrum | $2.8B | Optimistic Rollup | 4,000 | 7 days | 30.86% |

| Base | $5.6B | OP Stack | 4,000+ | 7 days | 46.58% |

| Optimism | $430M | Optimistic Rollup | 4,000 | 7 days | ~5% |

| Mantle | $2.2B | ZK Validity Rollup | 10,000 | 1 hour | ~8% |

| Polygon zkEVM | $75M | ZK Rollup | 2,000 | Minutes | ~1% |

Data: DefiLlama December 2025, The Block 2026 L2 Outlook, L2BEAT

Advantages Over Competitors

Mantle offers faster finality than optimistic rollups. One-hour exits beat seven-day withdrawal periods. ZK proofs provide cryptographic security without challenge periods.

The largest treasury in Web3 provides financial stability. $7.9 billion enables sustained ecosystem development. Competitors lack equivalent capital reserves.

EigenDA integration cuts data costs over 90%. This creates lower transaction fees than Ethereum calldata solutions. Cost efficiency attracts high-volume applications.

Bybit partnership drives liquidity and distribution. MNT integrates across spot markets and institutional desks. 36% APR staking products comply with MiCA regulations.

Competitive Challenges

Base captures majority L2 growth through Coinbase integration. 46.58% TVL market share reflects mainstream adoption. Mantle needs stronger consumer applications.

Arbitrum maintains developer mindshare and ecosystem maturity. Over 51% of developers choose Arbitrum for new projects. Mantle requires more tooling and documentation.

Ecosystem concentration remains limited. Merchant Moe and Agni represent 66% of DeFi TVL. More protocols need deployment to diversify activity.

The DAO tooling ecosystem needs expansion for better governance participation. Enhanced tools improve token holder engagement and proposal quality.

Mantle Network Recent Developments and Roadmap

Data: Dune Analytics, Mantle Network Statistics

2025 Strategic Initiatives

Mantle Scouts Program Season 2 launched with 40 industry scouts. Participants include Piers Kicks from Delphi Ventures and Guy Young from Ethena Labs. The program supports early-stage crypto projects.

Global RWA Hackathon runs from October 2025 to December 2025. Over 900 developers registered across six tracks. $150,000 in prizes fund RWA, DeFi, AI, and infrastructure projects.

Anchorage Digital partnership enables institutional custody for MNT. The federally chartered bank provides compliant storage solutions. This lowers barriers for regulated entities.

Tokenized equities launched through Bybit and Backed partnership. Users trade stocks like NVDA on-chain with 24/7 access. Real-world asset integration expands use cases.

Technical Roadmap

Sequencer decentralization progresses toward 2026 launch. Multiple operators will share transaction ordering. This reduces censorship risk and improves reliability.

Cross-chain interoperability advances through Chainlink SCALE integration. ERC-7683 support enables standardized bridging. Bungee partnership expands liquidity access.

USDT0 integration strengthens stablecoin liquidity. The native layer provides institutional-grade settlement. This positions Mantle for global finance flows.

Enhanced security through BlockSec collaboration. Protocol audits resolved 15+ vulnerabilities. JWT key handling and nonce overflow issues received fixes.

Ecosystem Growth Metrics

Over 200 ecosystem partners joined in 2025. Projects span DeFi, gaming, and infrastructure verticals. Developer activity increased through hackathons and grants.

Transaction volume hit 30 million in Q1 2025 alone. This represents sustained network usage. Monthly active addresses maintain high retention rates.

DeFi protocols received $200 million through EcoFund allocations. Mirana Ventures expertise guides fund deployment. Access to top-tier deals drives quality projects.

Security and Risk Assessment

Mantle Network maintained a clean security record through December 2025. No major hacks or exploits occurred on the protocol level. This contrasts with $2.17 billion stolen across the crypto industry in H1 2025.

The network implements multiple security layers. ZK proofs verify state transitions cryptographically. Ethereum mainnet provides base layer security. Guardian roles enable emergency interventions.

Known Vulnerabilities and Mitigations

Data availability relies on EigenDA without verification bridges. A malicious sequencer could publish unavailable commitments. This represents the primary trust assumption.

The network can pause withdrawals through Guardian controls. This centralization enables emergency responses but reduces decentralization. Plans call for removing this power post-upgrade.

Smart contract risks exist across ecosystem protocols. Users face exposure to third-party application bugs. Regular audits and bug bounties mitigate these threats.

Operational Security

Multi-signature wallets protect treasury assets. Safe{Core} implementation requires multiple approvals. This prevents single points of failure.

BlockSec partnership provides ongoing monitoring. The collaboration detected and resolved 15+ issues in 2025. Proactive security measures reduce attack surface.

Phishing protection systems alert users to suspicious transactions. The network tracks known malicious addresses. User education programs raise awareness.

Regulatory Compliance

UR banking service operates under SR Sapherstein AG supervision. Multi-currency fiat access spans 50+ countries. Compliance frameworks meet regional requirements.

MiCA-compliant staking products launched through Bybit. The 36% APR offering meets European standards. Regulatory clarity attracts institutional capital.

Anchorage Digital custody provides regulated asset storage. Federal charter ensures compliance for institutional holders. This addresses banking sector requirements.

Tokenomics and Distribution Model

MNT total supply caps at 6.22 billion tokens. Circulating supply reached 3.25 billion (52.3%) as of December 2025. The remaining tokens sit in treasury or vesting schedules.

Initial distribution came from BIT token conversion. BitDAO holders received 1:1 MNT allocation. This migration occurred on July 17, 2023.

Token Utility Functions

MNT serves as the network gas token. Users pay transaction fees in MNT instead of ETH. This creates consistent demand for network operations.

Governance rights attach to each token. One MNT equals one vote after delegation. Token holders control treasury allocation and network parameters.

Staking mechanisms secure the network. Validators require MNT thresholds for participation. Rewards incentivize honest behavior and network support.

Rewards Station locks tokens for ecosystem benefits. Participants earn partner protocol tokens. The system distributed over $10 million in rewards.

Treasury Allocations

Core budget covers operational expenses through June 2025. Categories include workforce, general administration, marketing, ecosystem programs, and infrastructure.

EcoFund received $200 million for ecosystem development. The capital deploys across early-stage projects. Venture partnerships provide deal flow access.

Technology partner incentives totaled 45 million MNT. Ecosystem incentives allocated 100 million MNT. These programs drive adoption and integration.

Price Performance

MNT reached an all-time high of $2.86 in October 2025. Current price sits at $1.05, down 63% from peak. Market cap stands at $3.4 billion.

The token saw 354% TVL growth year-over-year in 2024. Price appreciation followed network adoption. Corrections occurred with broader market downturns.

Trading volume averages $50 million daily across exchanges. Major listings include Bybit, Coinbase, Binance, and OKX. Liquidity pools maintain healthy depth.

Frequently Asked Questions

Getting Started With Mantle Network

New users begin by acquiring MNT tokens from exchanges. Bybit, Coinbase, Binance, and OKX provide trading pairs. Transfer tokens to MetaMask or compatible wallets.

Add Mantle Network to wallet through Chainlist.org. The network RPC connects wallets to Mantle infrastructure. Bridge assets from Ethereum using the official bridge at app.mantle.xyz.

Explore ecosystem applications like Merchant Moe for trading. Agni Finance provides concentrated liquidity options. mETH Protocol enables ETH staking. Track activity through the comprehensive DAO directory.

Participate in governance through forum discussions. Create proposals with sufficient MNT holdings. Vote on active proposals through Snapshot. Delegate tokens if you prefer passive participation.

Monitor treasury operations via treasurymonitor.mantle.xyz. Track budget allocations and spending categories. Rewards Station at rewards.mantle.xyz manages token staking.

Resources for Developers

Documentation lives at docs.mantle.xyz with technical guides. The network maintains EVM compatibility for easy migration. Hackathons provide funding and support for new projects.

Grants program accepts applications through official channels. EcoFund considers early-stage project investments. Technical support available through Discord and Telegram communities.

Developer tools include Hardhat, Truffle, and Remix compatibility. Mantle SDK simplifies integration workflows. Code examples and tutorials guide implementation.

Sources

Messari - Understanding Mantle: A Comprehensive Overview (December 2025)

DefiLlama - Mantle Network TVL and Protocol Data

L2BEAT - Mantle Scaling Solution Analysis

The Block - 2026 Layer 2 Outlook and Market Analysis

CoinMarketCap - Mantle Price and Market Data

Mantle Network - Official Documentation and Blog

Phemex Academy - What is Mantle Network Guide

Crypto News - Mantle TVL Surges 354% YoY Analysis

ABC Money - Mantle MNT OP Succinct Upgrade Report

Gate.com - Mantle's 2025 Financial Blueprint

AInvest - Mantle's Strategic Position in Crypto Ecosystem

The Daily Hodl - Mantle Network Technical Roadmap

Lemma Solutions - The Governance of Mantle Network

Bitfinex Blog - MNT Token Listing Announcement

CoinDesk - Layer 2 Market Analysis

Tangem Blog - Top Layer 2 Projects by Market Cap