What is Lido DAO, Governance, Current State and Tokenomics Explained

Lido DAO operates the largest liquid staking protocol in decentralized finance. Users stake Ethereum and receive stETH tokens representing their deposit plus rewards. The protocol controls $25.7 billion in total value locked as of January 2026.

Unlike traditional staking that locks assets for months, Lido provides immediate liquidity. Users can trade stETH or deploy it across DeFi platforms while earning staking rewards. This design attracts both retail investors and institutions seeking flexibility without sacrificing returns.

The DAO governs protocol decisions through LDO token holders who vote on fees, node operators, and treasury management. Founded in December 2020, Lido now faces increased competition and regulatory scrutiny. Its market share has declined from 75% in early 2023 to 24.4% in late 2025.

How Does Lido Actually Work for Users

Users deposit ETH into Lido smart contracts and receive stETH tokens on a one-to-one basis. The protocol distributes deposits across 200 node operators selected by the DAO. Node operators run validators that secure the Ethereum network and earn rewards.

Staking rewards automatically accrue to stETH balances without requiring manual claims. Users maintain full control and can withdraw anytime through Lido's withdrawal queue. The process typically completes within 1-5 days depending on network conditions.

No minimum deposit requirement exists, unlike solo staking which requires 32 ETH. Users pay a 10% fee on staking rewards, split between node operators (5%) and the DAO treasury (5%). Current annual returns hover around 3% after fees.

The stETH token integrates with over 200 DeFi protocols. Users can provide liquidity on Curve, borrow against stETH on Aave, or use it as collateral across lending platforms. This composability distinguishes Lido from centralized exchange staking.

What Governance Powers Do LDO Token Holders Control

LDO holders vote on all protocol parameters including fee structures, node operator additions, and treasury allocations. Each token equals one vote. Proposals require 5% of total supply and simple majority to pass.

The DAO implemented dual governance in June 2025, giving stETH holders veto power. If 1% of staked ETH opposes a proposal, it delays 5 days. Opposition exceeding 10% triggers a full pause until resolution. This protects stakers from governance attacks.

Easy Track handles routine operations like adjusting staking limits or funding grants. These motions pass automatically after 72 hours unless 0.5% of LDO supply objects. This reduces voter fatigue on minor decisions.

Snapshot captures off-chain sentiment before on-chain votes via Aragon. Monthly voting cadence allows the community to review multiple proposals simultaneously. Delegation enables passive holders to assign voting power while retaining token custody.

Critical governance decisions include the $60 million 2026 budget proposal (GOOSE-3) and V3 upgrade activation. These votes shape Lido's transition from pure staking protocol to multi-product DeFi platform. The DAO also controls $118.7 million in treasury assets.

Why Has Lido Market Dominance Declined Since 2023

Lido held 75% of Ethereum's liquid staking market in early 2023. By December 2025, this dropped to 24.4%. The decline stems from deliberate diversification efforts and competitive pressure.

The Ethereum community raised concerns when Lido approached 33% of total staked ETH. This threshold could theoretically enable censorship or network attacks. Users and developers pushed for greater decentralization.

Rocket Pool gained market share by offering permissionless node operation. Users can run validators with just 16 ETH versus Lido's curated operator set. This appeals to decentralization advocates despite lower TVL.

Centralized exchanges expanded staking services aggressively. Binance holds 9% market share, Coinbase controls 6.8%. These platforms offer simpler user experiences for retail investors unfamiliar with DeFi mechanics.

New protocols like ether.fi (5.3% share) and Figment (4.5% share) target institutional clients. They provide dedicated validator infrastructure and compliance features that Lido historically lacked. Lido's V3 upgrade aims to recapture this segment.

The liquid restaking category emerged through platforms like EigenLayer. These protocols enable "double yield" by reusing staked assets to secure additional networks. This diverts capital from traditional liquid staking.

What Are the 2026 Strategic Priorities and V3 Upgrade

Lido transitions from single-product staking protocol to multi-product ecosystem in 2026. The GOOSE-3 proposal allocates $60 million for product development and market expansion. Core staking remains profitable but growth requires diversification.

The V3 upgrade introduces stVaults—modular smart contracts enabling customized staking strategies. Institutions can deploy dedicated validators while maintaining stETH liquidity. The phased rollout begins with 3% TVL cap for pilot programs.

stVaults support over-collateralized positions that absorb slashing penalties. Users maintain exposure to stETH price movements while implementing custom risk parameters. This architecture targets ETF providers, DAOs, and corporate treasuries.

Lido Earn launches as yield optimization layer on top of staking rewards. The product combines stETH with DeFi lending protocols and restaking opportunities. Target returns range from 4-6% APR versus 3% for basic staking.

Node operator compensation shifts to performance-based routing in Staking Router v3. Better uptime and lower slashing rates attract more deposits. This market mechanism aims to improve validator quality without centralized oversight.

The protocol explores institutional custody integrations and compliance-ready vaults. Traditional finance firms require regulatory clarity and audit trails. Lido's institutional segment currently represents 2% of a 25% market opportunity.

Automated LDO buybacks activate when ETH exceeds $3,000. The protocol pairs purchased LDO with wstETH in liquidity pools rather than burning tokens. This preserves treasury flexibility while supporting token price during favorable cycles.

How Does LDO Tokenomics Compare to Competitors

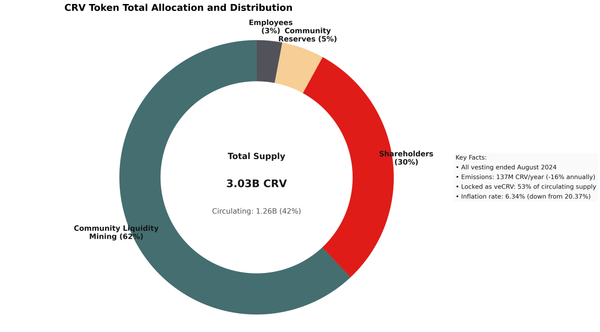

LDO launched with 1 billion fixed supply. Current circulation stands at 846.6 million tokens. The remaining 153.4 million sits in DAO treasury awaiting governance decisions on distribution.

Founding members received 64% of initial supply, locked for one year then vested over 12 months. This schedule completed in 2022. DAO treasury holds 36%, used for ecosystem grants and protocol development.

LDO provides governance rights but no direct revenue share. The protocol generates $8.1 million annual surplus from staking fees. This contrasts with Rocket Pool's RPL token which captures node operator bond requirements.

Token price sits around $0.60 in January 2026 with $512 million market cap. This represents 50% decline from 2025 highs near $3.30. The TVL to market cap ratio of 50:1 appears undervalued versus Aave's 3:1.

Critics note LDO lacks utility beyond voting. The 2026 roadmap addresses this through buyback mechanisms and potential staking functionality. Proposals suggest allowing LDO staking for enhanced governance weight.

Governance centralization remains contentious. Five wallets controlled 85% of one major vote in 2022. Dual governance mitigates this by empowering stETH holders as check on LDO whale influence.

The protocol competes against governance-minimized alternatives like Coinbase's cbETH. Some users prefer institutional backing over DAO governance complexity. Others value Lido's permissionless validator participation through Community Staking Module.

Lido maintains strongest DeFi integration network. Over 200 protocols accept stETH as collateral versus limited support for competing LSTs. This network effect provides moat despite market share decline.

Looking forward, success depends on executing V3 rollout without security incidents. The protocol must balance innovation with risk management. Institutional adoption could reverse market share losses if regulatory environment improves.

Explore other DAOs and compare governance models through comprehensive DAO directories. Understanding different approaches helps evaluate Lido's competitive position in the evolving decentralized staking landscape.

Lido represents the largest experiment in decentralized staking infrastructure. The coming year tests whether DAOs can adapt to institutional demands while preserving decentralization values. Market dynamics favor specialization over pure scale.

The protocol's technical infrastructure remains robust with 474 total slashing events across all Ethereum validators. Lido maintains 99.9% uptime. Security audits from multiple firms validate smart contract safety.

Users seeking staking solutions should weigh Lido's liquidity advantages against emerging competition. Tools for DAO participation and governance become increasingly important as protocols mature beyond simple staking products.

Sources

- Lido Finance official website and documentation (lido.fi)

- DefiLlama protocol data and analytics (defillama.com)

- The Defiant: "Lido Outlines $60M Plan to Expand Beyond Liquid Staking" (December 2025)

- Blockworks: "Lido V3 brings modular staking and opt-in restaking" (February 2025)

- The Block: "Lido unveils V3, introducing customizable stVaults" (February 2025)

- CoinDesk: "Ethereum Staking Shake-Up: Lido's Share Falls as Figment Posts Month's Biggest Gain" (August 2025)

- AMBCrypto: "Analyzing Ethereum's liquid staking growth: Lido vs competitors market share update" (November 2025)

- ainvest.com: "Lido's 2026 Transition: From Staking Infrastructure to DeFi Platform" (November 2025)

- CoinMarketCap: Lido DAO latest updates and governance news (2025-2026)

- Messari: "Governor Note: Lido DAO's LDO and stETH Dual Governance" (August 2022)

- Lido Blog: "Poolside Recap: Tokenholder Update, November 2025"

- Lido Blog: "Lido's Roadmap to Pectra: Delivering Validator Consolidations in the Protocol" (July 2025)

- Gate.com: "Best Staking Protocols in 2025: Comparing Lido, Rocket Pool, and Beyond"

- Trust Wallet: "Liquid Staking in 2025: ETH, SOL, and Beyond" (November 2025)

- Solo Stakers: "Understanding Lido: The Gateway to Ethereum Liquid Staking" (August 2025)

- Governance Lab Newsletter #121: Lido V3 governance analysis (December 2025)

- Intel Market Research: "Liquid Staking Market Outlook 2026-2032"

- Dune Analytics: Ethereum staking dashboard (hildobby)

- Coinlaw.io: "ETH Staking Statistics 2025: Security, Distribution, Forecast" (September 2025)