What is ENS DAO, Governance, Current State and Tokenomics Explained

Ethereum Name Service DAO transforms complex blockchain addresses into readable names like "alice.eth". The protocol launched in 2017 and became a DAO in November 2021. ENS replaces alphanumeric wallet addresses with human-friendly domain names. This makes crypto transactions safer and easier to execute.

The service operates on Ethereum through smart contracts that maintain registries and resolvers. Users purchase domains for annual fees ranging from five dollars for five-character names. Shorter domains cost more, with three-character names reaching 640 dollars yearly. All revenue flows to the DAO treasury, which currently holds 115 million dollars in assets.

Over 3.5 million domains were registered by late 2025, up from just 50,000 in 2019. The protocol generates approximately 4.92 million dollars in annual revenue through DeFi activities. Major platforms including PayPal, Venmo, Coinbase and Google integrated ENS into their systems. This adoption validates the protocol's utility for mainstream applications.

How Does ENS DAO Governance Structure Work and Who Controls Decisions

ENS operates as a decentralized autonomous organization with 100 million governance tokens. Token holders delegate voting power to representatives who vote on proposals. The system requires 100,000 delegated tokens to create executable proposals. Social proposals need only 10,000 tokens to proceed.

Three working groups manage operations: Meta-Governance, ENS Ecosystem, and Public Goods. Each group has three elected stewards serving one-year terms. Stewards control multisig wallets requiring three of four signatures for transactions. The secretary coordinates activities across all working groups.

A Security Council exists as a four-of-eight multisig with limited veto power. This council can cancel malicious proposals but cannot propose or amend governance actions. The veto authority expires two years after deployment, promoting decentralization over time. Token holder participation averages around 17 percent for major votes.

Governance happens through multiple channels including discuss.ens.domains forums, Snapshot for social votes, and Tally or Agora for executable proposals. Social votes last five days and require no gas fees. Executable proposals run seven days and require gas payments. Quorum requirements vary by proposal type but generally demand one percent of total supply.

Voter concentration remains a problem. Research shows fewer than 10 addresses control over half the voting power. Top delegates accumulate influence through default sorting on platforms. This concentration exists despite mechanisms designed to distribute power. The DAO has not implemented delegate reward programs common in other DAOs.

What Are the Current Financial Metrics and Treasury Management Strategy

The ENS endowment manages 115 million dollars with a 9.8-year operational runway. Treasury assets include ETH, stablecoins and ENS tokens. The endowment achieved 3.54 percent APY through DeFi strategies. Monthly revenue from domain registrations varies based on market conditions and gas prices.

Protocol revenue exceeded 43,800 ETH since launching fee collection in May 2019. Peak revenue months occurred during 2022 when domain speculation surged. September 2022 saw 378,000 new registrations generating approximately 6.8 million dollars. Registration fees account for roughly 80 percent of income, with renewals making up the remainder.

The DAO diversified holdings to reduce ETH exposure following market volatility. Working groups receive funding through biannual windows requiring both social and executable votes. Meta-Governance typically requests the largest budget allocation for tooling and audits. Public Goods and Ecosystem working groups fund grants and ecosystem development.

Net income tightened as operational expenses grew while revenue stabilized. The protocol transferred 16,000 ETH to its endowment in March 2022. This move separated long-term reserves from operational funds. Treasury management follows conservative strategies to ensure sustainability through market cycles.

How Does ENS Token Distribution Compare to Other Major DAOs

Total supply stands at 100 million tokens with 38.2 million currently circulating. The DAO treasury holds 50 percent of supply, with 10 percent unlocked at launch. Linear vesting distributes the remaining 40 percent over four years ending December 2025. The airdrop allocated 25 percent to .eth domain holders before token launch.

Core contributors received 18.96 percent with various vesting schedules. Future contributors, external contributors, and launch advisors split 5.08 percent. Active Discord users and translators received small allocations totaling 0.175 percent. Unclaimed airdrop tokens returned to the DAO treasury.

Token concentration mirrors governance participation issues. Centralized exchanges hold significant portions alongside DAO-affiliated wallets. Top 50 holders remained stable through 2025 with minimal distribution changes. This concentration affects price discovery and governance outcomes.

Compared to competitors, ENS maintains stronger decentralization credentials. Uniswap and Compound show similar voting power concentration. However, ENS avoids the venture capital token allocations common in newer protocols. The airdrop-heavy distribution favored early users over investors. This approach aligned incentives with long-term protocol health.

What Challenges Does ENS Face Compared to Unstoppable Domains and Other Competitors

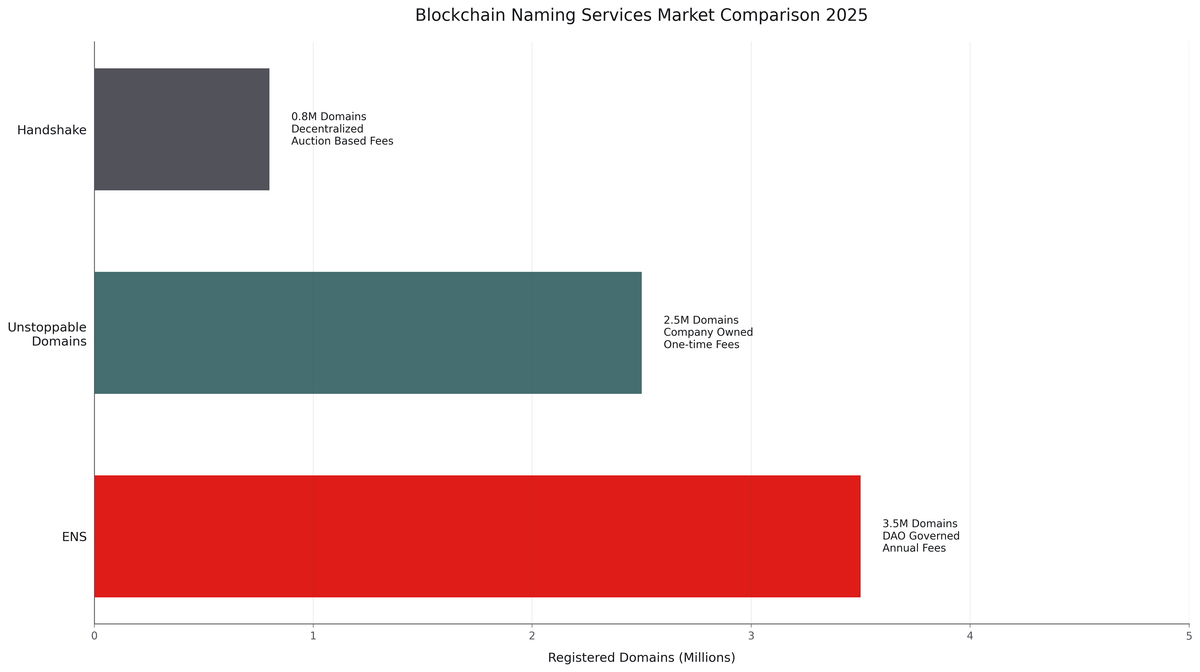

Unstoppable Domains registered 2.5 million domains using one-time payment model. Users pay once and own domains forever without renewal fees. ENS requires annual payments ranging from five to 640 dollars plus gas costs. This creates friction for cost-conscious users.

Unstoppable operates as a centralized company while ENS functions as a DAO. The centralization enables faster decision-making but reduces censorship resistance. Unstoppable supports multiple blockchains including Polygon, reducing transaction costs to near zero. ENS operates primarily on Ethereum mainnet where gas fees fluctuate.

ENS maintains stronger integration within Ethereum ecosystem. Hundreds of wallets and applications support .eth domains natively. The protocol benefits from first-mover advantage and technical credibility. Vitalik Buterin and other Ethereum leaders actively use ENS domains.

Handshake offers different approach allowing users to own top-level domains. Registration occurs through auctions with burns reducing speculation. However, Handshake adoption remains limited compared to ENS or Unstoppable. Browser and application support lags behind both competitors.

The comprehensive DAO tooling landscape shows ENS leads in governance maturity. The protocol developed custom dashboards and voting interfaces. Agora and Tally provide sophisticated delegation tracking. These tools enhance participation despite low engagement rates.

What Does the Namechain Layer Two Launch Mean for ENS Future Growth

ENS Labs plans Namechain launch around December 2025 using zero-knowledge rollup technology. The Layer 2 will reduce transaction costs by 99 percent compared to mainnet. Namechain prioritizes interoperability allowing users to bridge between different L2 networks. This addresses high gas fees that limit mainstream adoption.

ENSv2 represents complete protocol rewrite for Layer 2 compatibility. The upgrade maintains backward compatibility with existing ENS registrations. Users experience no difference in functionality except lower costs. Registration and renewal processes migrate to Namechain while maintaining Ethereum security guarantees.

Linea Association partnered with ENS Labs to build Namechain infrastructure. The collaboration leverages Linea's zkEVM technology for fast finality. Over 400,000 linea.eth subnames demonstrated demand for L2 integration. The partnership advances both projects toward stage two rollup status.

Namechain enables features impractical on mainnet including batch registrations and enhanced resolver logic. The team selected L2 partners but has not disclosed specific names. Launch timing depends on technical audits and compatibility testing. The protocol must ensure smooth migration without disrupting existing users.

Competition from app-specific L2s increases as Uniswap, Kraken and Sony launch networks. ENS focuses on identity rather than total value locked metrics. The protocol already has 3.5 million users eliminating need for user acquisition. This differs from other L2s optimizing for liquidity and trading volume.

Integration with mainstream platforms accelerated through 2025. PayPal and Venmo enabled 270 million users to transfer crypto using ENS addresses. Gemini exchange adopted ENS for wallet recovery through subnames. These partnerships demonstrate real-world utility beyond crypto-native applications.

The broader DAO ecosystem watches ENS governance evolution closely. The protocol pioneered delegate models and working group structures. Other DAOs adopted similar frameworks with modifications. ENS treasury management strategies influenced how organizations balance growth and sustainability.

Long-term success depends on balancing decentralization with execution speed. Current governance participation rates threaten legitimacy of major decisions. Small groups control outcomes despite token distribution to thousands of holders. Namechain must attract users while maintaining security and censorship resistance.

ENS faces technical challenges ensuring cross-chain name resolution. Different L2s use varying finality mechanisms and security models. The protocol must resolve names consistently across all environments. This requires sophisticated bridging infrastructure and resolver logic.

Revenue models may shift as transaction costs decrease. Lower fees could increase volume but reduce per-transaction value. The DAO must evaluate pricing structures for optimal sustainability. Treasury diversification strategies protect against single-asset exposure.

Sources

- ENS DAO Official Documentation (docs.ens.domains)

- ENS DAO Governance Forum (discuss.ens.domains)

- ENS DAO Newsletter via Paragraph

- KPK H1 2025 Review for ENS Endowment

- ENS DAO Term 6 Dashboard and Proposal Bulletin

- CoinGecko ENS Price and Market Data

- CoinMarketCap ENS Statistics

- The Block - ENS Labs Namechain Announcement

- CoinDesk - Ethereum Name Service Layer 2 Launch

- Linea Association Partnership Announcement

- DeepDAO Treasury Holdings Statistics 2025

- Analyzing Voting Power in Decentralized Governance Study (ScienceDirect)

- Fairness in Token Delegation Research Paper (arXiv)

- Messari State of ENS Q3 2022 Report

- Dune Analytics ENS Domain Registration Data

- CCN - ENS Powering Digital Identity in Web3

- Gate.io ENS Domain Investment Guide 2025

- Blockscout ENS Domain Exploration Guide

- Unstoppable Domains vs ENS Comparison Articles

- 3DNS Decentralized DNS Provider Comparison