What is Compound Finance, Governance, Current State and Tokenomics Explained

Understanding Compound Finance

Compound Finance operates as one of the oldest DeFi lending protocols on Ethereum. Founded in 2017 by Robert Leshner and Geoffrey Hayes, this decentralized platform enables users to lend and borrow cryptocurrency without intermediaries. The protocol launched on mainnet in September 2018.

Today, Compound maintains approximately $2.7 billion in total value locked according to January 2025 data from DefiLlama. The platform supports multiple blockchains including Ethereum, Base, Arbitrum, Polygon, and Optimism. Users supply crypto assets to earn interest or borrow against collateral.

The protocol pioneered liquidity mining in DeFi. When Compound distributed COMP governance tokens in June 2020, it sparked the DeFi Summer phenomenon. This approach transformed how protocols incentivize user participation and distribute ownership.

Compound differs from traditional banks by using smart contracts to automate lending. Interest rates adjust algorithmically based on supply and demand for each asset. Lenders can withdraw assets anytime, and borrowers pay variable interest without fixed loan terms.

How Compound Finance Works

Users interact with Compound through two primary roles: suppliers and borrowers. Suppliers deposit supported cryptocurrencies into lending pools to earn interest. The platform issues cTokens that represent the deposit plus accrued interest over time.

Borrowers must deposit collateral before taking loans. The protocol requires overcollateralization, typically between 60-75% loan-to-value ratio depending on the asset. If collateral value drops below maintenance thresholds, liquidators can purchase it at a discount.

Compound V3 introduced a base asset model in August 2022. Unlike V2 where users could borrow any supported asset, V3 markets only allow borrowing one base asset per market. The USDC market on Ethereum accepts ETH, WBTC, UNI, LINK, and COMP as collateral.

Interest rates update automatically per Ethereum block, approximately every 15 seconds. Higher demand for an asset increases both lending and borrowing rates. This encourages more lending and reduces excessive borrowing to maintain market equilibrium.

The protocol operates without customer support or manual approvals. Smart contracts handle all transactions, making the system permissionless and accessible globally. Users need only a crypto wallet and supported assets to participate.

Compound Finance Total Value Locked Over Time

Data: Historical TVL metrics from DeFi analytics platforms

Current State and Recent Developments

As of December 2024, Compound holds $2.7 billion in TVL across multiple chains. The protocol ranks among the top lending platforms in DeFi, though Aave leads with approximately $17.8 billion TVL. Compound's market position reflects both its maturity and competitive pressures.

The COMP token trades around $24-37 with a market capitalization near $244-364 million. The token peaked at $848 in May 2021 during the bull market. Circulating supply stands at 9.96 million COMP out of a maximum 10 million tokens.

In July 2024, Compound faced a governance attack when whale "Humpy" and the Golden Boys group passed Proposal 289. This allocated 499,000 COMP tokens worth $24 million to a yield protocol they controlled. After community outcry, the proposal was cancelled.

The incident led to a compromise. Compound developed a staking product distributing 30% of market reserves annually to COMP holders. This addressed longstanding concerns that COMP provided only governance rights without financial rewards for holders.

Recent platform expansions include adding Ethena's USDe and Mantle's mETH in January 2025. Compound also listed Treehouse's tETH as collateral on Arbitrum in November 2025. These integrations expand utility and attract new capital to the protocol.

Compound Finance Versus Competing DeFi Lenders

| Protocol | TVL (Jan 2025) | Founded | Flash Loans | Market Cap |

|---|---|---|---|---|

| Aave | $17.8 billion | 2017 | Yes | $2.0 billion |

| Compound | $2.7 billion | 2017 | No | $350 million |

| JustLend | $5.2 billion | 2020 | No | N/A |

| Morpho | $3.1 billion | 2021 | No | N/A |

Data: DefiLlama, CoinMarketCap - January 2025

Compound Finance Governance Structure

COMP token holders control the protocol through on-chain governance. The token launched in June 2020, transferring decision-making power from Compound Labs to the community. This decentralization represents a core principle of DeFi.

Creating a proposal requires 100,000 COMP tokens or delegated voting power. After submission, the community has three days to vote. Proposals need minimum 400,000 votes to pass, with majority support required. Approved changes implement after a two-day timelock.

Governance covers asset listings, collateral factors, interest rate models, treasury management, and protocol upgrades. Recent proposals addressed risk management partnerships with Gauntlet, cross-chain deployments, and the staking mechanism introduction.

The July 2024 governance attack exposed vulnerabilities in this system. A small group acquired enough COMP on the open market to pass proposals despite widespread opposition. This prompted discussions about improving governance security through vote delegation requirements and participation thresholds.

Token holders can delegate voting rights to any address without transferring ownership. This enables specialized governance participants to vote on behalf of passive holders. Major delegates include Wintermute Governance, institutional investors, and active community members.

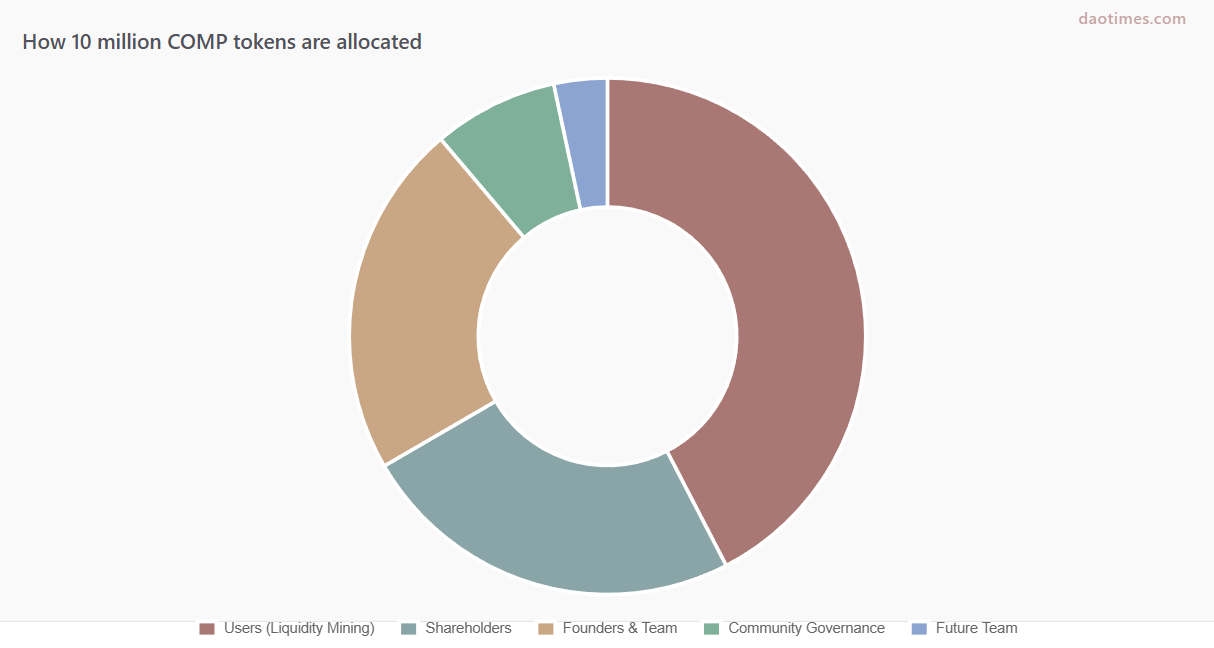

Compound COMP Token Distribution Breakdown

Data: Compound token economics documentation

Compound Finance Token Economics Explained

The COMP token serves as both governance mechanism and user incentive. Total supply caps at 10 million tokens with approximately 9.96 million currently circulating. The initial distribution allocated 4.2 million COMP to users over four years through liquidity mining.

Shareholders of Compound Labs received 2.4 million COMP. Founders and team members got 2.2 million tokens with four-year vesting schedules. Community governance incentives reserved 775,000 COMP, while 332,000 tokens went to future team members.

Originally, users earned COMP by supplying or borrowing assets on the protocol. Distribution occurred every Ethereum block based on dollar value of assets in each market. This liquidity mining made Compound more attractive than competitors but didn't provide direct yield on COMP itself.

The new staking mechanism changes this dynamic. Starting in 2024, staked COMP holders receive 30% of protocol reserves annually. This creates real yield for token holders beyond governance participation. The staking product undergoes security audits and remains controlled by the DAO.

Market valuation concerns persist. In April 2025, COMP's market cap represented about 16% of protocol TVL compared to 8% for competitors JustLend and Morpho. Analysts suggest this indicates relatively high valuation despite declining usage metrics.

Security Track Record and Incidents

Compound underwent multiple security audits from leading firms including OpenZeppelin, ChainSecurity, Trail of Bits, and Certora. These audits examine smart contract code for vulnerabilities before deployment. The protocol's seven-year operational history provides extensive real-world testing.

In September 2021, a bug in Compound V2 caused approximately $90 million in excess COMP distribution. A governance proposal inadvertently changed the reward distribution mechanism. The error allowed some users to claim more COMP tokens than intended before the issue was corrected.

A front-end phishing attack occurred in July 2024. Attackers compromised the Compound website to display malicious links. Users who connected wallets to the fake interface risked asset theft. The team quickly resolved the incident and warned users to verify URLs.

The July 2024 governance attack represented a different threat category. While not a technical vulnerability, it showed how token concentration enables hostile takeovers of protocol governance. Compound now works with Gauntlet to improve risk parameters and governance safeguards.

Liquidation mechanisms in V3 reduce protocol risk compared to V2. Instead of partial liquidations by external actors, V3 absorbs underwater positions entirely. The protocol then sells seized collateral at a discount, eliminating cascading liquidation risks.

Compound Finance Key Performance Indicators

Data: DeFi analytics platforms Q1 2023 - Q3 2024

Historical Development and Milestones

Robert Leshner and Geoffrey Hayes founded Compound in 2017 after working together at Postmates. Both brought experience from traditional finance and technology sectors. Leshner holds a degree in Economics from University of Pennsylvania and previously founded Safe Shepherd.

The protocol launched on Ethereum mainnet in September 2018 as Compound V1. This initial version used a monolithic contract structure where all tokens and accounting existed in one contract. Compound deprecated V1 in June 2019 after launching the improved V2.

Compound V2 introduced individual contracts for each asset, distributed accounting, and improved risk management. The upgrade enabled greater capital efficiency and reduced protocol-wide risk from single asset failures. V2 became the foundation for numerous DeFi lending forks.

The platform raised $33.2 million across funding rounds from investors including Andreessen Horowitz, Bain Capital Ventures, and Polychain Capital. This venture backing provided resources for development while maintaining the team's vision for decentralization.

June 2020 marked a turning point when Compound distributed COMP governance tokens to users. This sparked DeFi Summer as other protocols copied the liquidity mining model. TVL surged from under $500 million to over $12 billion by May 2021.

Compound V3 (Comet) launched in August 2022 with a streamlined architecture. The new version separated into isolated markets with single borrowable base assets. This design improved capital efficiency and risk isolation compared to V2's pooled model.

Multichain expansion accelerated from 2023-2025. Compound deployed to Polygon, Arbitrum, Base, and Optimism. Each deployment creates new markets with locally relevant base assets and collateral options. The protocol targets 50 total deployments across EVM and non-EVM chains.

Future Plans and Development Roadmap

Compound aims to double its Comet deployments from 25 to 50 markets by 2026. This expansion covers additional Layer 2 networks and alternative Layer 1 blockchains. Each deployment requires careful parameter setting and risk assessment from Gauntlet.

The protocol develops autonomous lending markets that adjust parameters automatically based on on-chain data. This reduces reliance on manual governance decisions while maintaining decentralization. Early code commits show progress on modular cross-chain architecture.

Real-world asset integration represents another growth vector. The renewed Gauntlet partnership includes RWA collateral support. This could enable borrowing against tokenized securities, real estate, or other traditional assets within Compound markets.

Compound Growth Program prioritizes increasing TVL and user adoption. The program funds grants for integrations, developer tools, and educational content. Recent initiatives include partnerships with exchanges and wallet providers to simplify access.

The community debates whether Compound should add flash loans to compete with Aave. Critics argue this adds complexity and risk. Supporters believe it would attract more sophisticated users and increase protocol utility. No formal proposal exists yet.

Compound Finance Supported Assets and Markets

| Chain | Base Asset | Collateral Assets | Total Supplied |

|---|---|---|---|

| Ethereum | USDC | ETH, WBTC, UNI, LINK, COMP | $1.02B |

| Ethereum | ETH | wstETH, rETH, cbETH | $86.78M |

| Arbitrum | USDC | ETH, ARB, GMX, WBTC, tETH | $420M |

| Base | USDC | ETH, cbETH, wstETH | $285M |

| Polygon | USDC | WETH, WBTC, MATIC | $158M |

Data: Compound V3 market statistics as of Q4 2024

Advantages and Limitations

Strengths

Compound pioneered DeFi lending with seven years of operational history. This longevity provides confidence in the protocol's reliability and security. Multiple audits from top firms reduce smart contract risk compared to newer platforms.

The protocol charges no trading or withdrawal fees. Users pay only Ethereum gas fees for transactions. This cost structure makes Compound accessible for both large and small positions, though gas can be expensive during network congestion.

No minimum requirements exist for lending or borrowing. Users can start with any amount of supported assets. This contrasts with traditional finance where minimums often exclude smaller participants. The permissionless nature enables global access without identity verification.

Compound's influence on DeFi extends beyond its own platform. Many protocols forked Compound's codebase or copied its liquidity mining model. This includes Venus, Cream Finance, and numerous others. The protocol established design patterns that became industry standards.

Weaknesses

Limited asset support compared to competitors restricts user options. Compound V3 supports fewer than 10 tokens per market. Aave offers dozens of assets including niche tokens. Users needing specific collateral types may find better options elsewhere.

The governance attack vulnerability exposes risks from token concentration. While resolved through compromise, it demonstrated how wealthy actors can manipulate decentralized governance. Improving these protections requires balancing accessibility with security.

Declining market share presents challenges. Compound's TVL dropped from $12 billion in 2021 to $2.7 billion today. Aave and newer competitors capture more growth. Revenue metrics show three consecutive years of decline from 2022-2024 before the 2024 rebound.

Interface complexity may deter newcomers. Understanding collateral factors, liquidation thresholds, and cToken mechanics requires learning. Competitors like Aave invested more in user experience improvements. Compound prioritizes technical robustness over ease of use.

Understanding Compound Finance Interest Rates

Interest rates on Compound adjust algorithmically every Ethereum block based on utilization. Utilization equals borrowed assets divided by total supplied assets in a market. Higher utilization means more demand relative to supply, which increases rates.

The V3 model decouples supply and borrow rates. Supply rates depend on utilization but can be set independently from borrow rates. This gives governance more control over protocol economics compared to V2's coupled model.

Typical supply rates range from 2-8% APY depending on the asset and market conditions. Borrowing rates usually sit 3-6% higher than supply rates. The spread represents protocol revenue and incentives for maintaining healthy liquidity levels.

Rates can spike during high utilization periods. If 90% of supplied USDC gets borrowed, rates increase sharply to incentivize more lending and discourage more borrowing. This mechanism maintains liquidity for lenders who want to withdraw.

Compound V2 and V3 use different rate models. V2 applied the same model across all assets with parameter variations. V3 allows completely custom rate curves per market, enabling optimization for each asset's characteristics and risk profile.

Frequently Asked Questions

Sources and References

DefiLlama - Compound Finance TVL and Protocol Metrics

CoinMarketCap - COMP Token Price and Market Capitalization

The Block - Compound Governance Attack and Settlement Coverage

Cointelegraph - Compound Finance Proposals and Community Updates

Messari - Compound Protocol Analysis and Historical Data

Compound Community Forum - Governance Proposals and Discussions

Cryptonews - Compound Finance Platform Review and Features

Exponential DeFi - Compound V3 Technical Documentation

Gate.io - Compound vs Aave Competitive Analysis

Ledn Blog - DeFi Lending Platform Comparison