What is Arbitrum Foundation DAO, Governance, Current State and Tokenomics Explained

Arbitrum Foundation operates as the steward organization behind Arbitrum, the largest Ethereum Layer 2 network by total value secured. The foundation manages the development and governance of Arbitrum technology while supporting ecosystem growth. As of December 2025, Arbitrum One has processed over 2.1 billion lifetime transactions and maintains $20 billion in total value secured.

The foundation launched the ARB governance token in March 2023. This token enabled the Arbitrum DAO to control protocol decisions, treasury allocations, and chain management. Token holders now govern two main chains: Arbitrum One and Arbitrum Nova. The DAO treasury currently holds approximately $150 million in non-native assets including stablecoins and ETH.

The organization differs from traditional corporate structures through its decentralized governance model. Rather than a board of directors making closed decisions, ARB token holders vote on proposals through an on-chain process. This structure aims to align network development with community interests. The foundation itself functions primarily as an administrative body that executes DAO decisions.

How Does Arbitrum DAO Governance Actually Work

Governance operates through Arbitrum Improvement Proposals submitted to the community forum. Proposals first undergo temperature checks via Snapshot polling to gauge community interest. If support exists, proposals move to on-chain voting through Tally. The process typically requires five weeks minimum but often extends longer when consensus proves difficult.

Two proposal types exist: constitutional and non-constitutional. Constitutional AIPs change governance frameworks, core protocols, or chain management. These require votes from at least 5% of all votable tokens and more than 50% support. Non-constitutional AIPs handle treasury allocations, grants, and community initiatives, needing only 3% quorum plus majority approval.

As of March 2025, the DAO had passed 57 AIPs through on-chain voting. Less than one quarter addressed constitutional matters. The remainder focused on treasury management and ecosystem development. Treasury-related proposals consistently attract the highest scrutiny and debate among participants.

Delegation plays a central role in the system. Token holders can assign voting power to active delegates who vote on their behalf. Approximately 240,000 delegates currently control 320 million ARB in voting power. This concentration has grown since launch, with the Gini coefficient rising from 0.75 to above 0.90 between early 2023 and mid-2025.

To qualify as an active delegate, participants need at least 200,000 ARB in voting power. The DAO recently approved a $1.5 million annual incentive program to reward delegates who maintain consistent participation and publicly explain their voting rationale. Qualified delegates must vote on at least 75% of monthly proposals.

What Are the Key Components of ARB Tokenomics

The ARB token maintains a fixed supply of 10 billion tokens with a 2% annual inflation cap that began in March 2024. The initial distribution allocated 42.78% to the DAO treasury, 26.94% to Offchain Labs team and advisors, 17.53% to investors, 11.62% to user airdrops, and 1.13% to ecosystem DAOs.

As of December 2025, approximately 5.7 billion ARB tokens circulate publicly, representing 57% of total supply. The remaining tokens follow a vesting schedule that releases 92.63 million ARB monthly through March 2027. This continuous supply increase creates downward price pressure that the ecosystem must absorb through organic demand growth.

ARB functions purely as a governance token. Unlike many blockchain tokens, it does not pay transaction fees. Users pay gas costs in ETH or other ERC-20 tokens when using Arbitrum services. This design separates governance rights from network utility, which some view as a weakness for token value accrual.

The token trades at approximately $0.19 as of late December 2025. This represents an 82% decline from its peak and 56% drop year-to-date despite strong network fundamentals. The disconnect between growing TVL and falling token price reflects the challenge of monthly unlocks outpacing demand.

Treasury management has become a major focus. The DAO holds over $150 million in diversified assets through programs like STEP. This initiative allocates funds to tokenized US Treasuries from Franklin Templeton, Spiko, and WisdomTree. The treasury also generates revenue from sequencer operations and the Timeboost feature, which produced $5 million in its first seven months.

How Does Arbitrum Compare Against Other Layer 2 DAOs

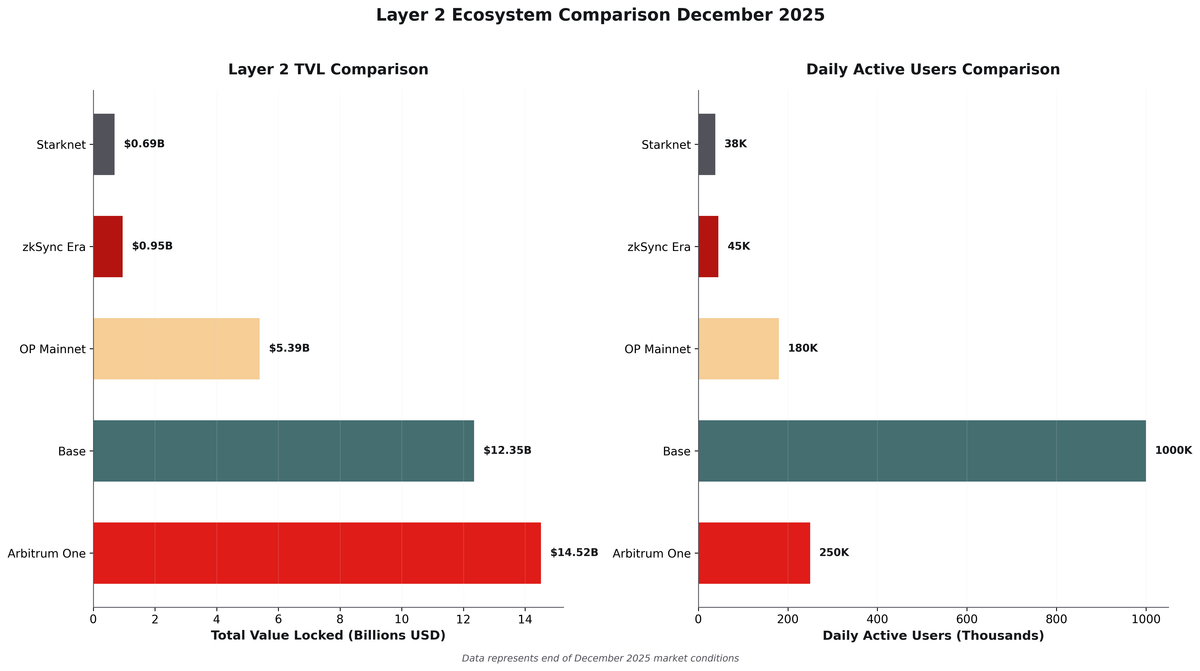

Base emerged as Arbitrum's primary competitor in 2025. Built by Coinbase on the OP Stack, Base crossed $12.35 billion in TVL by late 2025 compared to Arbitrum's $14.52 billion. Base grew faster through retail adoption, social applications, and Coinbase's distribution network. Daily active users on Base reached 1 million versus 250,000 on Arbitrum.

Optimism maintains $5.39 billion in TVL through its Superchain strategy. The OP Stack allows anyone to deploy their own Layer 2 chain, creating a network of 34 interconnected chains. This modular approach attracts teams wanting scalability without building infrastructure from scratch. Optimism's Retroactive Public Goods Funding distributed over $500 million to ecosystem builders.

zkSync Era operates differently with zero-knowledge rollup technology instead of optimistic rollups. This provides instant finality compared to Arbitrum's fraud-proof dispute windows. However, zkSync holds only $1.1 billion in TVL, well behind the optimistic rollup leaders. The technology remains more expensive despite recent improvements.

Arbitrum leads in DeFi liquidity and developer activity. Major protocols like Uniswap and Aave maintain their largest deployments outside Ethereum on Arbitrum. Active loans grew 109% to $1.5 billion in 2025. The network hosts over 1,000 projects and maintains the most mature tooling ecosystem among Layer 2 solutions.

The ecosystem expanded significantly in real-world assets during 2025. RWA tokenization on Arbitrum reached $1.1 billion in October, representing an 18-fold increase from 2024. Over $240 million in RWAs sits on Arbitrum-based platforms. Major institutions including BlackRock and Franklin Templeton now interact directly with the DAO through governance forums.

What Is the Current Financial State of Arbitrum DAO

The DAO projects to end Q4 2025 with approximately $6.5 million in gross profit, representing a $26 million annual run rate. This reflects over 50% period-on-period growth. Revenue streams now include four sources, up from two last year: sequencer fees, Timeboost auction revenue, stablecoin program yields, and treasury management returns.

Gross margins exceed 90% across all revenue streams. The Timeboost feature alone generated $5 million in its first seven months of operation. Network fees produced over $600 million in ecosystem GDP during 2025, marking a 30% year-over-year increase. These economics position Arbitrum uniquely among Layer 2 networks for sustainable self-funding.

The treasury diversification strategy addresses idle capital problems. The DAO deployed more than $45 million across eight issuers through STEP. Another 8,500 ETH recently transferred to treasury management strategies. These moves aim to generate yield while maintaining liquidity for operational needs and ecosystem investments.

Stablecoin liquidity grew dramatically in 2025. The DRIP program helped fuel 229% growth in stablecoin holdings since its September launch. The network now supports $6.6 billion in stablecoin TVL, making it a preferred venue for dollar-denominated DeFi activity. This liquidity deepens the moat against competing Layer 2 networks.

The Gaming Catalyst Program represents a $215 million bet on blockchain gaming. Multiple Layer 3 Orbit chains launched for gaming applications, leveraging Arbitrum's low fees and high throughput. Over 100 chains now operate or develop using Arbitrum technology. Each new chain extends the ecosystem while potentially generating future revenue for the DAO.

What Are the Main Risks and Opportunities for Users

Centralization concerns persist despite governance token distribution. The sequencer remains operated by a centralized entity rather than a decentralized network. This created a 78-minute outage in December 2023 when the sequencer stalled during high traffic. Validators who can challenge fraud proofs remain on an allowlist controlled by the Security Council.

The Security Council itself represents both strength and risk. These elected entities can bypass normal voting to address emergencies quickly. While necessary for security, this mechanism concentrates power among a small group. Elections occur every six months, providing regular opportunities to refresh membership based on community trust.

Token dilution will continue through March 2027. Monthly unlocks of 92.63 million ARB keep selling pressure constant. Early investors and team members holding vested tokens may liquidate positions gradually. Even responsible selling from aligned stakeholders impacts price unless demand grows proportionally. Price performance has not matched network growth in 2025.

Competition intensifies across multiple dimensions. Base captured market share through superior user experience and Coinbase distribution. zkSync advances zero-knowledge technology that may prove superior long-term. Ethereum itself continues improving with upgrades like EIP-4844 that reduce Layer 2 costs. Maintaining dominance requires continuous innovation beyond current achievements.

The opportunity lies in becoming the settlement layer for institutions bringing traditional finance on-chain. Arbitrum positioned itself at the convergence of crypto and TradFi better than competitors. Robinhood deployed 500 tokenized stock contracts on Arbitrum in December 2025. These enterprise partnerships compound into network effects that prove difficult for competitors to replicate.

Developers benefit from mature infrastructure that competitors lack. Years of production operation created extensive documentation, libraries, and community support. Projects can migrate from Ethereum with minimal code changes. The large DeFi ecosystem provides composability that enables complex financial products. Understanding how to leverage these tools through resources like comprehensive DAO tooling guides helps builders maximize their impact.

Active governance participants gain influence over a multi-billion dollar treasury. The incentive program now pays delegates for informed participation. This creates opportunities for community members to earn while shaping protocol direction. Those researching governance models across different organizations can explore comprehensive DAO lists to compare approaches and identify best practices.

Sources

- Arbitrum Foundation Blog - "Arbitrum in 2025: The Year of Everywhere"

- Arbitrum Foundation Official Website - Grants and Governance Pages

- Arbitrum DAO Governance Documentation

- The Block - "2026 Layer 2 Outlook" and RWA Coverage

- CoinMarketCap - ARB Price Data and Tokenomics

- Dune Analytics - "Arbitrum DAO: The Evolution of Decentralized Governance"

- L2Beat - Layer 2 Comparison Data

- Tally - Arbitrum DAO Voting Records

- CoinLaw - Optimism Statistics 2025

- TheStandard.io - Arbitrum Deep Due Diligence Report 2025

- Tokenomist.ai - ARB Vesting Schedule Data

- CoinGecko - Arbitrum Market Data

- The Defiant - DAO Incentive Program Coverage

- Arbitrum Governance Forum - Proposal Archives