What Is Aave, Governance, Current State and Tokenomics Explained

What Is Aave and How Does It Work

Aave is a decentralized lending protocol that allows users to lend and borrow cryptocurrencies without intermediaries. Launched in 2017 as ETHlend, the protocol rebranded to Aave in 2020.

The platform operates through smart contracts on multiple blockchain networks. Users deposit crypto assets to earn interest, while borrowers provide collateral to access loans. Interest rates adjust automatically based on supply and demand.

Aave processes transactions across 14+ blockchain networks. The protocol supports over 30 different assets for lending and borrowing. As of December 2025, total value locked stands at approximately $32 billion.

The platform earned $885 million in fees during 2025, capturing 52% of all DeFi lending protocol revenue. Total historical deposits have reached $3.33 trillion since launch, with nearly $1 trillion in loans issued.

Aave Protocol Current Metrics and Market Position

Aave Total Value Locked Evolution by Quarter

Data: DefiLlama, The Defiant, Token Terminal Q1 2023 - Q4 2025

Aave commands 59% of the DeFi lending market by December 2025. The protocol supports 61% of all active loans in decentralized finance. Monthly active users number approximately 99,200 across all networks.

The platform's TVL peaked at $75 billion in 2025 before settling around $32 billion. Market capitalization of AAVE token reached $2.47 billion with 15.3 million tokens circulating. Token price trades at $161.54 as of late December 2025.

Aave holds the 34th position among all cryptocurrencies. The protocol ranks as the largest DeFi lending platform globally. Cumulative deposits exceeded $71 trillion according to September 2025 reports.

Revenue generation doubled when TVL expanded from $12 billion to $24 billion. Protocol generated $71.5 million during this growth phase. Treasury reserves now hold $115 million, up 115% since mid-2024.

Aave Governance Structure and Recent Disputes

The Aave DAO manages protocol decisions through token-weighted voting. AAVE token holders submit and vote on proposals affecting interest rates, risk parameters, and treasury management. Over 500 proposals were submitted in 2025.

Average voter turnout reaches 22% on important votes, higher than the 17% DeFi average. Participation ranges from 500 to 700 voters per proposal. Governance votes determine which assets get listed and set borrowing limits.

Recent disputes emerged between Aave Labs and the DAO in December 2025. Tensions arose over $200,000 weekly swap fees from CoW Protocol integration. Critics claimed Aave Labs diverted revenue from the DAO treasury.

Founder Stani Kulechov purchased $10 million in AAVE tokens, signaling confidence. A contentious proposal sought to transfer Aave Labs' intellectual property to the DAO. The vote proceeded despite founder opposition, causing AAVE price to drop 20% in one week.

The U.S. SEC closed its four-year investigation on December 17, 2025, without enforcement. This removed regulatory uncertainty but governance tensions continued. The alignment proposal aimed to clarify roles between Aave Labs and the DAO.

Aave Governance Participation Rates Compared to Competitors

| Protocol | Voter Turnout | Active Voters | 2025 Proposals | Token Holders |

|---|---|---|---|---|

| Aave | 22% | 500-700 | 500+ | 539,000+ |

| Compound | 18% | 300-500 | 280 | 412,000 |

| MakerDAO | 25% | 600-800 | 420 | 298,000 |

| Uniswap | 15% | 400-600 | 190 | 625,000 |

| DeFi Average | 17% | 350-450 | 220 | 380,000 |

Data: Dune Analytics, CoinLaw, Gate Research 2025

Aave Version 4 Launch and Technical Upgrades

Aave V4 introduces a hub-and-spoke architecture launching Q4 2025. The testnet went live in November 2025 for developer testing. Mainnet deployment depends on audit completion and governance approval.

The new design centralizes liquidity in network-specific hubs. Customizable "spokes" connect to these hubs, each with distinct risk profiles. This solves V3's liquidity fragmentation across isolated markets.

Each spoke draws liquidity from the central hub without trapping capital. Risk parameters adjust dynamically for different asset types. Collateral-aware interest rates replace uniform pricing across all assets.

V4 implements health-targeted liquidations that sell only minimum collateral needed. This protects borrowers better than V3's fixed-percentage liquidations. The Position Manager automates repayments and multi-action transactions.

ERC-4626 tokenization simplifies tax accounting for lenders. A Reinvestment Module deploys idle capital into yield strategies automatically. The architecture supports trillions in assets, targeting institutional adoption.

Aave V4 Architecture Compared to V3 Feature Set

Data: Aave documentation, BGD Labs, Sentora analysis November 2025

The upgrade maintains V3's 62% DeFi lending market share while adding modularity. Cross-chain expansion continues with deployments on 20+ blockchains. Non-EVM support includes Aptos integration using Move language.

Security audits include formal verification of contracts. Multiple blockchain security firms review the codebase. Bug bounty programs offer up to $500,000 for vulnerability discoveries.

Aave Competitors Analysis and Market Share

Aave Market Position Among DeFi Lending Protocols

| Protocol | TVL (USD) | Market Share | Networks | Assets Supported | 2025 Revenue |

|---|---|---|---|---|---|

| Aave | $32.0B | 59% | 14+ | 30+ | $885M |

| JustLend | $5.2B | 9.6% | 1 | 19 | $142M |

| Compound | $3.0B | 5.5% | 6 | 18 | $89M |

| Morpho | $2.8B | 5.2% | 3 | 25 | $67M |

| Venus | $1.9B | 3.5% | 2 | 22 | $54M |

| Others | $9.1B | 17.2% | Various | Various | $278M |

Data: DefiLlama, Token Terminal, Gate Research December 2025

Aave dominates with six times the TVL of its nearest competitor. The protocol processes more loan volume than the next five competitors combined. Revenue capture rate of 52% exceeds all other lending platforms.

Compound launched in 2017 but faces declining metrics. Its TVL dropped from peak levels, with revenue falling for three consecutive years until 2024. Token value declined over 90% from 2021 highs.

JustLend operates exclusively on TRON network with lower fees. The platform offers higher average borrow rates ranging from 0.94% to 18.56%. Limited network support constrains growth compared to multi-chain protocols.

Aave offers both variable and stable interest rate options. Compound provides only variable rates. Aave introduced flash loans enabling instant, uncollateralized borrowing within single transactions.

MakerDAO focuses on DAI stablecoin issuance rather than general lending. Morpho optimizes capital efficiency through peer-to-peer matching. Venus concentrates on Binance Smart Chain ecosystem.

Cross-chain presence gives Aave access to diverse user bases. The protocol maintains over $1 billion TVL on four different networks. Ethereum drives 90% of revenue despite multi-chain expansion.

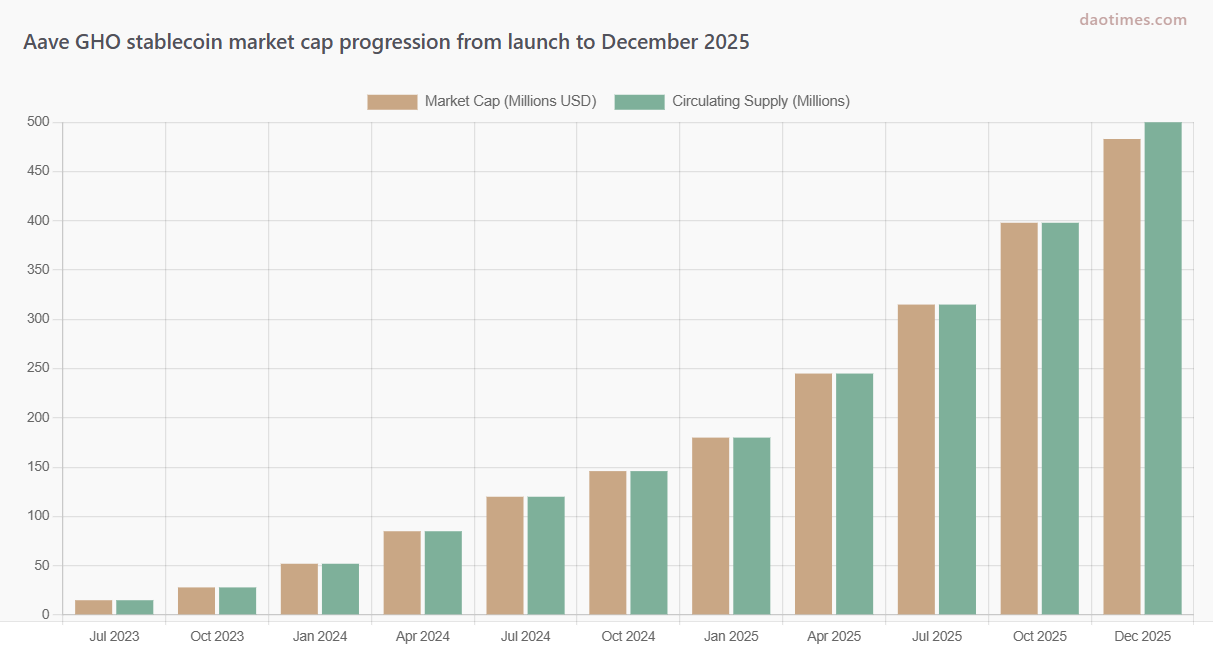

Aave GHO Stablecoin Growth and Performance

GHO launched in July 2023 as Aave's native overcollateralized stablecoin. Users mint GHO by depositing collateral into Aave V3 markets. The stablecoin maintains a 1:1 peg with the U.S. dollar.

Market capitalization reached $483 million by December 2025, up 230% from $146 million in January. The stablecoin ranks 21st among all decentralized finance stablecoins. Circulating supply exceeds 500 million tokens.

Interest from GHO loans flows directly to the Aave DAO treasury, not asset suppliers. This creates sustainable revenue streams for protocol development. One GHO borrowed generates revenue equal to ten USDC, according to Aave Chan Initiative.

The staking module launched January 2024, allowing GHO holders to earn additional yield. The Merit Program began February 2024, distributing rewards to stakers. Current staking yields reach approximately 8.4% APY.

Aave GHO Stablecoin Supply Growth Through 2025

Data: DefiLlama, CoinGecko, OAK Research 2023-2025

GHO expanded to Arbitrum, Avalanche, and Base networks in 2025. Bridging utilizes Chainlink's CCIP for secure cross-chain transfers. Ethereum remains the primary network with 90% of usage.

The anti-GHO mechanism introduced March 2025 rewards AAVE stakers. This non-transferable token offsets GHO debt or converts to staked GHO. Fifty percent of GHO fees generate anti-GHO for distribution.

Lens Chain adopted GHO as its native gas token. The Ethereum Foundation borrowed $2 million in GHO, showcasing institutional use. Partnerships with Circle, Ripple, and Franklin Templeton support adoption.

Competition includes USDC ($28 billion), DAI ($5.3 billion), and newer entrants. GHO trails established stablecoins but grows faster. The protocol targets $300 million circulating supply, which would rank it 15th overall.

Aave Security Track Record and Risk Management

Aave maintains a strong security record with minimal incidents. The protocol underwent six independent security audits for V3. Continuous auditing occurs with each upgrade and feature addition.

A peripheral contract exploit occurred August 28, 2024, resulting in $56,000 loss. The ParaSwapRepayAdapter contract held leftover tokens from swap slippage. The attack spread across Ethereum, Arbitrum, Polygon, Optimism, and Avalanche.

Core protocol funds remained unaffected during this incident. The contract lacked auditing and sat outside main protocol operations. Aave founder described the loss as equivalent to a "tip jar" raid.

No major hacks compromised user deposits in Aave's history. A November 2023 security concern led to temporary pool pausing. Details remained private to protect vulnerable protocol forks.

The Safety Module holds $246 million in backstop funds. AAVE tokens staked here provide insurance against protocol shortfalls. Up to 30% slashing occurs if liquidations fail to cover bad debt.

Aave Security Spending and Audit Coverage Over Time

Data: Aave Security Reports, Halborn Research, DeepStrike 2020-2025

Bug bounty programs reward vulnerability discoveries. The Aptos deployment offered $500,000 for critical bugs. Community members actively report potential issues through designated channels.

DeFi sector losses totaled $2.29 billion in first half 2025. Private key compromises caused 80% of theft, not smart contract bugs. Aave avoided these issues through decentralized architecture.

Dynamic risk parameters adjust automatically based on market conditions. The Edge Risk Oracle enables real-time adjustments of loan-to-value ratios. Chaos Labs handled over 1,100 parameter updates since late 2024.

Drosera partnership launched October 2025 for flash loan attack prevention. Integration with security monitoring tools provides early warning systems. The protocol maintains DDoS protection for user interfaces.

Aave Tokenomics and Distribution Model

AAVE token has a fixed supply of 16 million tokens. Approximately 13 million came from ETHlend migration. Three million tokens sit in ecosystem reserves for incentives and safety modules.

Current circulating supply reaches 15.3 million tokens. Market capitalization stands at $2.47 billion as of December 2025. Token trades at $161.54, down from $300+ levels earlier in the year.

Distribution allocated 30% to ecosystem reserves for liquidity mining. Team and founders received 23% with multi-year vesting periods. Investors obtained 16% across multiple funding rounds.

Safety Module receives 20% for backstop protection. Token stakers earn rewards while providing insurance against protocol deficits. Staking participation reached 30% of total supply.

Aave Token Value Capture Mechanisms Under Aavenomics

| Mechanism | Launch Date | Weekly Amount | Annual Impact | Benefit |

|---|---|---|---|---|

| Token Buybacks | April 2025 | $1M | $52M | Reduces supply |

| Anti-GHO Rewards | March 2025 | 50% of fees | $6.5M estimated | Staker incentive |

| GHO Interest | July 2023 | Varies | $12.9M at 6.45% | DAO revenue |

| Protocol Fees | Ongoing | $17M | $885M (2025) | Treasury growth |

| Safety Module | 2020 | Variable | $246M locked | Risk protection |

Data: Aave Governance, AFC Reports, OAK Research 2025

The Aavenomics update launched mid-2024, introducing new value capture methods. Weekly buyback program uses protocol revenue to purchase AAVE tokens. Initial pilot proved successful, leading to extended allowances.

Founder purchased $9.8 million in AAVE tokens December 2025, showing confidence. The buy-and-distribute program redirects treasury funds to token holders. Aave Finance Committee manages buyback execution.

Utility includes governance voting on protocol parameters. Staked AAVE provides insurance and earns yield from protocol operations. Holders receive discounts on GHO borrowing rates.

Token inflation remains minimal with fixed supply cap. No new tokens mint beyond the 16 million maximum. Deflationary pressure builds through buybacks and burned transaction fees.

Aave 2026 Roadmap and Future Plans

Aave outlined an ambitious 2026 roadmap following SEC investigation closure. Three pillars guide development: V4 infrastructure, Horizon real-world assets, and mobile app expansion.

V4 mainnet launches Q4 2025 or early 2026 after audit completion. The hub-and-spoke model enables management of trillions in assets. New developer tools simplify building custom lending markets on Aave.

Horizon platform currently holds $550 million in real-world asset deposits. The target reaches $1 billion by end of 2026. Partnerships with Franklin Templeton and VanEck bring institutional capital.

Tokenized treasury bills, real estate, and corporate bonds will join as collateral. The platform aims to bridge $500 trillion in traditional assets to blockchain. Banks and asset managers can access DeFi settlement.

Aave Historical TVL and Future Projection Toward 2026 Goals

Data: Aave 2026 Master Plan, DefiLlama, Token Terminal projections

The Aave mobile app launched November 2025 in limited release. Full rollout targets early 2026 with one million user goal. The interface simplifies DeFi access with zero-fee onboarding.

High-yield savings accounts compete with traditional banking. The app integrates seamlessly with existing financial apps. Target market includes the $2 trillion fintech sector.

GHO multichain expansion continues through Q1 2026. Cross-chain deployments utilize Chainlink's CCIP bridge. Additional blockchain integrations planned beyond current 14 networks.

Aptos integration expands in 2026 with more asset listings. Incentive programs drive adoption on non-EVM chains. The protocol becomes chain-agnostic, operating wherever liquidity exists.

Layer-2 optimization focuses on cost reduction. Some underperforming deployments face closure, including zkSync and Metis. The DAO imposed $2 million annual revenue floor for chain deployments.

DeFi sector competition intensifies as traditional finance explores blockchain. Aave positions itself as the infrastructure layer for all on-chain credit. The protocol aims to match top 50 U.S. banks in scale.

How to Use Aave Protocol

Visit app.aave.com and connect a compatible Web3 wallet. Supported wallets include MetaMask, WalletConnect, and Coinbase Wallet. Select your preferred blockchain network from the dropdown menu.

To supply assets, choose "Supply" from the main interface. Select the asset you want to deposit from available options. Enter the amount and approve the transaction in your wallet.

Supplied assets earn interest automatically. Rates adjust based on utilization across the protocol. You receive aTokens representing your deposit plus accrued interest.

Borrowing requires collateral deposited first. Navigate to "Borrow" section after supplying assets. Choose between variable or stable interest rate options.

Variable rates change with market conditions. Stable rates remain fixed for extended periods but typically start higher. You can switch between rate types by paying gas fees.

Health factor displays your position's safety. Values above 1.0 indicate safe collateralization. Falling below 1.0 triggers liquidation to protect lenders.

Flash loans require technical knowledge for execution. These enable borrowing without collateral if repaid in same transaction. Developers use them for arbitrage and collateral swaps.

GHO minting works similarly to borrowing other assets. Deposit collateral to Aave V3 Ethereum market first. Navigate to GHO section and mint desired amount.

Monitor positions regularly through the dashboard. Adjust collateral or repay loans to maintain healthy ratios. Set up notifications through third-party DeFi management tools.

Gas fees vary by network and transaction complexity. Ethereum mainnet costs more than Layer-2 solutions. Choose networks based on your transaction size and urgency.

For comprehensive guides on DAO participation, visit the DAO tooling guide which covers ecosystem tools. Explore other decentralized organizations at the comprehensive DAO list for comparative analysis.

Frequently Asked Questions

What makes Aave different from traditional banks?

Aave operates without intermediaries through smart contracts. Users maintain full custody of their assets. Interest rates adjust algorithmically based on supply and demand, not bank policies.

How safe are funds deposited in Aave?

Aave underwent six independent security audits. The protocol maintains a $246 million safety module as insurance. No major hacks have compromised user deposits since launch.

What happens if my collateral value drops?

Your health factor decreases when collateral loses value. The protocol liquidates positions when health factor falls below 1.0. V4 implements targeted liquidations, selling only minimum collateral needed.

Can I use Aave without cryptocurrencies?

You need crypto assets to participate in Aave. The mobile app launching 2026 simplifies onboarding for newcomers. Fiat on-ramps will integrate directly into the interface.

How does Aave generate revenue?

The protocol collects fees from borrowing interest. Flash loan fees contribute additional revenue. GHO stablecoin interest flows directly to the DAO treasury.

What is the minimum amount to start using Aave?

No protocol-level minimum exists for deposits. Gas fees make small transactions uneconomical on Ethereum mainnet. Layer-2 networks enable smaller position sizes with lower fees.

How does governance work in Aave DAO?

AAVE token holders vote on protocol proposals. Voting weight corresponds to tokens held. Proposals require quorum thresholds to pass.

What are flash loans and who should use them?

Flash loans enable instant, uncollateralized borrowing within single transactions. Developers use them for arbitrage and collateral swaps. Technical knowledge required for safe execution.

How competitive are Aave interest rates?

Rates vary by asset and market conditions. Stablecoin lending typically yields 2-6% annually. Rates exceed traditional bank savings accounts but involve smart contract risk.

What is Aave V4 and when does it launch?

V4 introduces hub-and-spoke architecture for better capital efficiency. Testnet launched November 2025 for developer testing. Mainnet deployment targets Q4 2025 or Q1 2026 pending audits.

Sources and References

Protocol Documentation: Aave Official Documentation, Aave V4 Architecture Overview, GHO Documentation

Analytics Platforms: DefiLlama Protocol Statistics, Token Terminal Metrics, Dune Analytics Governance Data

Market Analysis: CoinMarketCap Latest Updates, CoinGecko Price Data, Messari Research Reports

News Coverage: The Defiant DeFi News, CoinDesk Market Reports, Cointelegraph Protocol Updates

Research Reports: OAK Research GHO Analysis, Sentora V4 Architecture Notes, Gate Community Reports

Governance Forums: Aave Governance Forum, BGD Labs Updates, Aave Chan Initiative Proposals

Security Sources: Aave Security Page, Halborn DeFi Hacks Report, DeepStrike Statistics

Institutional Analysis: BingX Academy Research, LeveX DeFi Comparison, Coin Bureau Analysis