What is a Blur DAO And How it Works?

Executive Summary

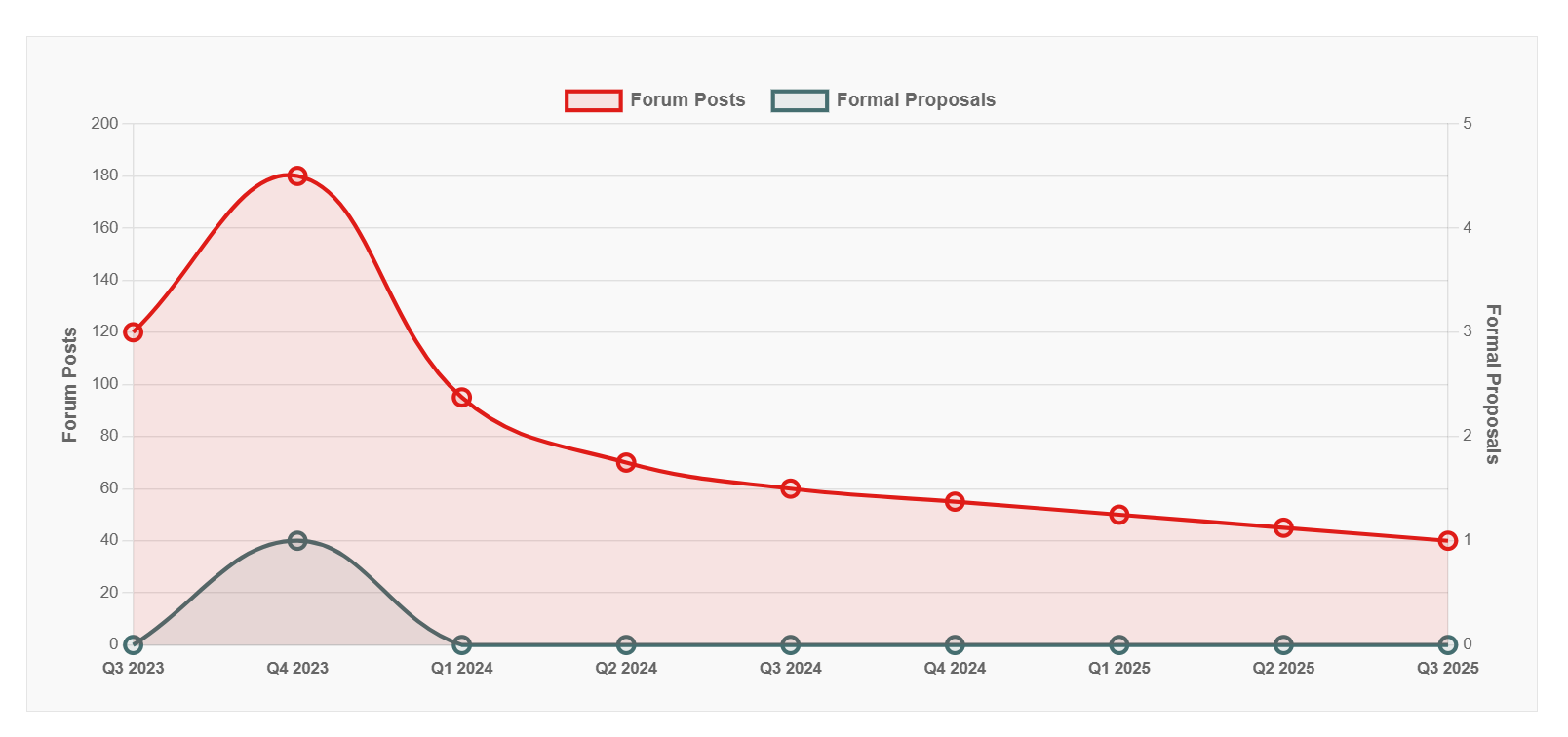

Critical Finding: Blur DAO demonstrates minimal governance activity despite formal decentralization claims. Since launching BLUR governance token in February 2023, the DAO has produced only one formal proposal through November 2025. Forum activity declined 78% from 180 posts in Q4 2023 to 40 posts in Q3 2025. Major decisions including BLAST partnership integration proceeded through Blur Foundation authority without community votes. Average voting participation remains 8-15% of circulating supply indicating widespread governance apathy.

The DAO's theoretical structure grants community control over protocol fees, treasury allocation, and lending parameters through three-phase voting process. However, practical governance power concentrates in Blur Foundation and three specialized committees. Marketplace Committee handles platform upgrades independently. Incentive Committee controls 300 million BLUR (10% of supply) for reward programs without vote requirements. Safety Committee blocks proposals lacking proper procedures. Token holders gained formal governance rights after 180-day freeze expired August 2023, yet meaningful community decision-making remains limited.

This governance inactivity stems from multiple reinforcing factors: Foundation maintains operational control over competitive decisions; three-phase voting process spans weeks creating competitive disadvantages; top 100 addresses control 65% of tokens concentrating power; small holders rationally abstain from participation; current protocol parameters satisfy community reducing change motivation. The marketplace successfully operates under this hybrid centralized-decentralized model, capturing $439 million trading volume in January 2025. However, Blur DAO exemplifies broader industry pattern where nominal DAO structures mask continued founder and venture capital control. This analysis examines the gap between governance promises and actual decentralization outcomes.

BLUR Token Distribution and Vesting Schedule

Data: Blur Foundation tokenomics documentation, DAOTimes analysis (2023)

Community receives 51% allocation totaling 1.53 billion BLUR distributed through airdrops and grants. Core contributors hold 29% with 867 million tokens vesting over four years. Investors receive 19% representing 565 million tokens under identical vesting schedule. Advisors allocated 1% equal to 36 million tokens vesting over 48-60 months with 4-16 month cliff.

Initial 360 million tokens became immediately claimable in February 2023 for NFT traders, Care Package holders, and creators. Remaining 39% of community supply distributes through contributor grants, community initiatives, and incentive programs nominally controlled by DAO governance. However, Incentive Committee exercises this control without requiring formal votes. Four-month transfer cliff applies to contributors and launch partners preventing immediate token dumps.

Governance Architecture and Decision-Making Process

Three Phase Governance System

Blur Improvement Proposals theoretically follow structured path from ideation to execution. Phase one requires posting to Research forum where community provides feedback and suggestions. Proposals undergo improvements addressing objections before advancing. This temperature check phase filters unviable ideas preventing resource waste on formal voting.

Phase two consists of 14-day Snapshot voting period using gasless signature-based voting. Token holders sign messages off-chain avoiding transaction fees. Voting power calculates at proposal creation snapshot preventing flash loan attacks. Successful Snapshot vote indicates community support before expensive on-chain execution.

Phase three involves on-chain proposal submission and execution through Tally interface. Proposers need minimum delegated token threshold. Proposals require 14-day voting period with 120 million BLUR yes votes for passage. Two-day execution delay follows successful vote enabling final review before implementation. Any community member can queue and execute passed proposals.

Reality Check: This three-phase system produced only one formal proposal through November 2025. The fee switch discussion from October 2023 generated extensive forum debate but never advanced to Snapshot vote. The lengthy process and committee workarounds effectively bypass community governance for most decisions.

Proposal Categories and Governance Powers

Core proposals require on-chain execution for protocol parameter changes. DAO nominally controls protocol fee rates after 180-day freeze expired August 2023. Treasury grant issuance theoretically enables community funding for contributors and initiatives. Governor timelock settings determine proposal implementation delays. Quorum minimum adjustments modify participation requirements. Voting period duration changes allow flexibility in decision timing.

However, no major treasury grants have passed formal governance as of November 2025. The DAO treasury containing 39% of total supply remains largely unutilized through governance channels. This suggests either community satisfaction with Foundation resource allocation or unclear proposal procedures deterring applications.

Process proposals modify DAO implementation without smart contract updates. Governance procedure changes adapt decision-making frameworks. Tool and environment updates improve operational infrastructure. Guidelines establish community standards and expectations. These proposals require community consensus but lack on-chain execution requirements.

Informational proposals provide general community guidelines without binding actions. Educational content helps members understand protocol mechanisms. Best practice recommendations guide user behavior. Policy clarifications explain existing rules and expectations. These proposals build shared knowledge base without governance weight.

Committee Structure and Responsibilities

Safety Committee prevents proposals bypassing proper governance procedures. Members review submissions ensuring compliance with established process. Committee blocks proposals lacking required Research forum discussion or Snapshot signaling. This gatekeeping function protects against governance attacks and rushed decisions. Committee progressively transfers functions to automated validation as DAO matures.

Marketplace Committee manages Blur platform upgrades requiring rapid deployment. Technical improvements proceed through expedited review for competitive advantage maintenance. Royalty policy decisions navigate complex creator compensation dynamics. Committee executes highly dynamic subjects where 14-day voting delays cause competitive harm. Authority nominally transfers to full governance as protocol stabilizes, yet no timeline exists for this transition.

Centralization Through Committees: The BLAST partnership decision exemplifies committee power. Blur Foundation received 3% BLAST allocation worth $90 million at June 2024 pre-market pricing. Distribution mechanics proceeded through Foundation authority rather than formal DAO vote, with community accepting decision post-facto through informal channels. This incident highlights ongoing tension between centralized Foundation efficiency and decentralized governance ideals.

Incentive Committee controls up to 10% of genesis supply for user rewards. Airdrop season design balances farming prevention with genuine user attraction. Point system calibration ensures fairness across trader archetypes. Loyalty multiplier determination encourages platform exclusive usage. Budget allocation across seasons maintains long-term incentive sustainability. Committee operates within community-approved frameworks rather than unilateral authority, yet the 300 million BLUR budget provides substantial power without proposal requirements.

Analysis: Why Blur DAO Remains Inactive

Foundation Operational Control

Blur Foundation maintains decisive authority over competitive and technical decisions. The organization employs core contributors building marketplace infrastructure. Foundation publicly commits to transferring functions to governance over time without specific timeline or accountability mechanisms. Current arrangement prioritizes competitive agility over community oversight, with Foundation handling decisions requiring speed while DAO theoretically controls value distribution.

This centralized stewardship model concentrates excessive power in Foundation hands according to decentralization proponents. However, supporters note early-stage protocols need coordinated leadership before full decentralization becomes practical. The lack of formal transition milestones creates indefinite centralization risk where "progressive transfer" rhetoric masks permanent control.

Rational Apathy and Participation Economics

Token holders face negative economic incentives for governance participation. Small holders investing time researching proposals and voting receive minimal marginal benefit given their limited voting power. With top 100 addresses controlling 65% of circulating supply, individual small holders cannot meaningfully influence outcomes regardless of participation.

This rational apathy phenomenon affects DAOs broadly. Research across 30,000 DAOs found 53% inactive with no proposals in 6 months. Voter turnout decreases as DAO size increases. In Decentraland, average voter participation per proposal reached only 0.79% with 0.16% median. Blur DAO's 8-15% participation rates actually exceed many competitors, yet still represent minority decision-making claiming community mandate.

Process Complexity and Competitive Disadvantage

The three-phase governance process spans weeks from Research forum discussion through Snapshot signaling to on-chain execution. This timeline creates competitive disadvantages where centralized competitors like OpenSea implement changes within days. Dynamic market conditions may outpace DAO decision speed, justifying committee exceptions that undermine governance comprehensiveness.

Complex proposal requirements deter community submissions. Proposals need Research forum vetting, Snapshot quorum achievement (30 million BLUR), and on-chain execution support (120 million BLUR). Proposers must understand governance procedures, possess minimum delegated tokens, and navigate technical smart contract interactions. These barriers limit proposals to sophisticated insiders rather than broad community input.

Voting Power Concentration

Paradigm venture fund holds substantial allocation from initial seed investment. Team member wallets contain vested tokens unlocking through 2027. Early airdrop recipients maintaining positions represent committed community members versus mercenary farmers who sold immediately. This concentration means small group of large holders effectively decides proposals regardless of broader community preferences.

Four-year vesting schedule maintains founder control through 2027. Delegation mechanisms theoretically enable small holders to aggregate power through representatives. However, delegation requires active monitoring and revocation when representatives diverge from preferences. Most passive holders never engage with delegation systems, leaving power with existing large stakeholders.

Community Satisfaction or Disengagement

Limited proposal activity may indicate community satisfaction with current protocol parameters. The marketplace successfully operates under existing fee structures, treasury allocation, and incentive programs. If community members perceive no problems requiring governance intervention, low activity reflects successful operations rather than governance failure.

Alternative interpretation suggests governance disengagement where potential participants lack confidence in meaningful influence. Unclear treasury grant procedures may deter applicants despite available resources. The gap between governance theory and practice creates cynicism where community members recognize formal voting rights provide minimal actual control.

Comparative Analysis of NFT Marketplace DAOs

Analysis of governance structures across leading NFT marketplace decentralized organizations reveals Blur's formal governance model contrasts sharply with practical centralization.

| Platform | Governance Token | Formal Structure | Actual Activity Level | Practical Control |

|---|---|---|---|---|

| Blur DAO | BLUR (3B supply) | Snapshot + On-chain, 3 committees | 1 proposal in 2+ years | Foundation + Committee decisions |

| OpenSea | None (centralized) | Not applicable | Not applicable | Company controlled (transparent centralization) |

| LooksRare | LOOKS | On-chain voting | Limited activity | Token holder governance with low participation |

| X2Y2 | X2Y2 | Token-weighted | Minimal public activity | Partial community input |

| Magic Eden | None (exploring) | Not implemented | Not applicable | Company controlled |

Data: Project documentation, governance forums, on-chain activity tracking (2025)

When to Participate in Blur DAO vs Other Governance Systems

Choose Blur DAO governance participation when seeking influence over fundamental protocol economics during rare proposal opportunities. Three-committee structure theoretically provides operational speed while maintaining community oversight for major decisions. Research forum enables proposal refinement before formal voting. Treasury grant system could fund ecosystem development through democratic allocation if activated.

Avoid Blur governance when requiring immediate policy input or expecting regular participatory decision-making. Infrequent formal proposals mean months may pass without voting opportunities. Foundation and committee decisions proceed without community input for operational matters. Safety Committee may block proposals lacking proper procedure compliance. OpenSea's acknowledged centralized structure may provide clearer expectations than Blur's governance theater.

Token Holder Participation and Voting Power Distribution

Delegation Mechanism and Representative Governance

BLUR holders delegate voting power to any Ethereum address including themselves. Delegation theoretically enables passive token holders to empower active community members. Recipients accumulate voting power from multiple delegators creating influential voices. This representative model aims to improve participation rates compared to direct democracy requiring constant voter attention.

Voting power equals owned tokens plus delegated balance. Large holders face diminishing marginal influence through community organization theoretically. Small holders could aggregate power through strategic delegation to aligned representatives. Representatives would build reputation through consistent participation and transparent reasoning. Delegation remains revocable enabling power transfer when representatives diverge from delegator preferences.

Reality Check: Despite delegation infrastructure, governance participation averages only 8-15% of circulating supply on major proposals. The fee switch discussion in October 2023 attracted higher engagement due to direct protocol revenue implications. However, lower turnout reflects rational apathy where small holders defer to informed large stakeholders. Delegation systems remain underutilized due to passive holder disengagement.

Voting Power Concentration Analysis

Data: Blockchain explorers, token holder analytics, governance participation tracking (2025)

Top 100 addresses control approximately 65% of circulating supply according to blockchain analysis. Paradigm venture fund holds substantial allocation from initial seed investment. Team member wallets contain vested tokens unlocking through 2027. Early airdrop recipients maintaining positions represent committed community members versus mercenary farmers who sold immediately.

Voting participation averages 8-15% of circulating supply on major proposals. This minority participation enables small group of aligned large holders to pass proposals claiming community mandate. Quorum requirements of 120 million BLUR equal roughly 4% of total supply, facilitating passage with minimal actual participation.

Snapshot Integration for Gasless Voting

Blur DAO uses Snapshot for phase two signaling votes. Token holders sign messages off-chain through wallet interfaces. Signatures get stored on IPFS providing permanent verifiable records. Zero transaction costs enable broad participation regardless of token balance size. Voting power calculates at proposal creation timestamp preventing borrowed token manipulation.

Snapshot results inform on-chain execution decisions without binding smart contracts. Community can override failed Snapshot votes through direct on-chain proposals theoretically. However, social consensus from Snapshot serves as strong coordination signal. Proceeding against Snapshot majority would face legitimacy challenges and community backlash.

Underutilization: Despite Snapshot's zero-cost participation advantages, Blur DAO conducted minimal formal votes through the platform. The infrastructure exists for community signaling, yet proposal pipeline remains empty. This suggests structural governance issues beyond transaction cost barriers.

Real World Governance Case Studies

Fee Switch Proposal Discussion October 2023

Initial governance proposal addressed protocol fee activation after 180-day freeze expired. Forum discussion analyzed current BLUR tokenomics and value accrual mechanisms. Community debated two-tiered fee structure balancing trader retention and token holder value. Proposal sparked over 50 forum responses representing diverse stakeholder perspectives.

Proponents argued fees create sustainable revenue for treasury and development funding. Critics worried zero-fee competitive advantage would erode with fee implementation. Marketplace Committee noted OpenSea's 2.5% fee provides pricing ceiling. Discussion explored graduated fees based on trading volume encouraging high-frequency professional adoption. Final proposal remains in discussion phase without advancing to Snapshot vote as of November 2025.

Outcome Analysis: The most substantive governance discussion generated extensive community debate but produced no formal decision. This case exemplifies Blur DAO's governance dysfunction where even critical value accrual questions remain unresolved after years of discussion. The inability to progress from forum debate to binding vote demonstrates structural governance failures.

Season 4 BLAST Integration Governance

Blur Foundation received 3% BLAST allocation valued $90 million at June 2024 pre-market pricing. Community discussed distribution mechanics through informal channels and forum posts. Decision to allocate 500 million BLAST to Season 4 traders and 1 billion to BLUR holders proceeded through Foundation authority rather than formal DAO vote.

Holder contract deprecation occurred through Foundation decision requiring direct wallet custody. Community accepted decision given improved governance participation potential. Debate emerged whether major partnerships require DAO approval or fall under operational discretion. Incident highlighted ongoing tension between centralized Foundation efficiency and decentralized governance ideals.

Outcome Analysis: $90 million partnership decision bypassed formal governance entirely. Community learned about BLAST integration after Foundation negotiations concluded. This case demonstrates Foundation maintains decisive authority over major strategic decisions regardless of nominal DAO control. The post-facto community acceptance reveals governance capture where token holders ratify Foundation decisions without meaningful input opportunity.

Treasury Management and Grant Allocation

DAO theoretically controls 39% of total supply through community treasury wallet. Grant proposals should follow Research forum discussion and community feedback. Applicants would specify project scope, budget breakdown, and expected deliverables. Successful grants could fund ecosystem tooling, analytics dashboards, and educational content.

No major treasury grants have passed formal governance as of November 2025. Limited proposal activity suggests community satisfaction with existing resource allocation. Alternatively, unclear proposal procedures may deter potential applicants. Incentive Committee's 10% genesis supply control reduces pressure on formal treasury for user rewards.

Outcome Analysis: The $1+ billion treasury (39% of 3 billion tokens at various valuations) remains unutilized through governance channels. This massive resource sits idle while Foundation and committees allocate other token pools. The treasury's non-deployment indicates either unnecessary resource redundancy or governance process dysfunction preventing community-funded development.

2025 Governance Evolution and Ecosystem Development

Governance Participation Trends

Data: Blur Governance forum analytics, proposal tracking (2023-2025)

Research forum activity peaked during initial governance discussions in late 2023. Fee switch debate generated highest engagement with over 50 community responses. Activity declined 78% through 2024-2025 as community settled into operational rhythm or disengaged from ineffective governance. Lower controversy may indicate satisfaction with current protocol parameters or resignation to Foundation control.

Formal Snapshot proposals remain limited in quantity reflecting conservative governance culture or structural dysfunction. Community either prefers extensive forum vetting before proceeding to votes or recognizes voting futility given Foundation/committee authority. This caution prevents premature binding decisions while building consensus. Alternative interpretation suggests governance apathy where most token holders lack engagement motivation given limited actual influence.

Blur Foundation as Governance Steward

Blur Foundation operates as nonprofit entity managing protocol development. Foundation employs core contributors building marketplace infrastructure. Operational decisions proceed without DAO approval under stewardship model. Foundation publicly commits to transferring functions to governance over time without specific timeline.

Current arrangement balances competitive agility with nominal community oversight. Foundation handles technical decisions requiring speed while DAO theoretically controls value distribution. Critics argue model concentrates excessive power in Foundation hands creating governance theater. Supporters note early-stage protocols need coordinated leadership before full decentralization, though Blur launched over 2 years ago in February 2023.

Indefinite Centralization: The "progressive transfer" commitment lacks measurable milestones or accountability mechanisms. Without specific timelines or authority transfer criteria, Foundation maintains indefinite operational control. This perpetual "temporary" centralization exemplifies broader crypto industry pattern where decentralization promises remain perpetually deferred.

Security Audit and Governance Contract Safety

Dedaub conducted security audit of governance smart contracts in February 2023. Auditors reviewed BlurGovernor, TimelockController, TokenLockup, and BlurAirdrop contracts. Two low-severity issues identified in TokenLockup schedule management. No critical vulnerabilities found enabling safe governance operations technically.

Centralization risks identified where contract owners can override governance actions. BlurExchange owner can directly set governor contract bypassing votes. BlurToken owner can add lockups containing any tokens. Audit noted these admin privileges create governance attack vectors. Foundation maintains ownership pending gradual decentralization roadmap implementation.

Technical Centralization: Smart contract admin keys provide Foundation ability to override community governance technically. Even if DAO participation increased, Foundation retains technical capability to execute decisions unilaterally. True decentralization requires removing these admin privileges, yet no timeline exists for this transition.

Regulatory Motivations: Why Projects Create DAOs

Token Security Classification Under Howey Test

United States Securities and Exchange Commission applies the Howey Test determining whether tokens qualify as securities requiring registration. The 1946 Supreme Court case SEC v. W.J. Howey Co. established four-element test: investment of money in common enterprise with expectation of profits derived primarily from efforts of others. Tokens passing all four elements become securities subject to extensive registration requirements and ongoing disclosure obligations.

SEC's 2017 investigation of The DAO concluded its tokens were securities because investors relied on managerial efforts of founders and curators to generate profits. The organization raised $150 million in unregistered securities offering triggering regulatory scrutiny. SEC declined enforcement action against already-defunct DAO but issued report warning that "federal securities laws apply to those who offer and sell securities in the United States, regardless whether the issuing entity is a traditional company or a decentralized autonomous organization."

This precedent creates powerful incentive for projects avoiding security classification. Registered securities offerings require audited financial statements, named directors, extensive disclosures, and ongoing reporting obligations. Distribution to large community of users becomes "challenging and expensive for startup to manage" according to Andreessen Horowitz analysis. Even major startups like Airbnb and Uber haven't figured out how to distribute securities to millions of users economically.

Sufficient Decentralization Doctrine

SEC Director William Hinman stated in 2018 that "when the efforts of the third party are no longer a key factor for determining the enterprise's success, material information asymmetries recede. As a network becomes truly decentralized, the ability to identify an issuer or promoter to make the requisite disclosures becomes difficult, and less meaningful." Then-SEC Chairman Jay Clayton similarly stated that digital asset may no longer be security "if purchasers would no longer reasonably expect a person or group to carry out the essential managerial or entrepreneurial efforts."

This "sufficient decentralization" doctrine creates pathway where tokens initially launched as securities could transmute to non-securities if team successfully decentralizes operations. Bitcoin and Ethereum received informal guidance they are not securities given their decentralized nature. Projects pursue this status avoiding ongoing securities compliance burdens while maintaining token trading on exchanges.

However, SEC's 2024 enforcement action against Mango Markets demonstrated that simply calling token "governance token" or claiming DAO structure provides no protection. SEC found MNGO tokens were investment contracts despite DAO governance because "investors expected profits from Mango Markets' success, which was driven by the managerial efforts of Mango DAO and Blockworks Foundation." The agency emphasized that "decentralization and blockchain technology do not exempt companies from following securities laws."

Progressive Decentralization Strategy

Andreessen Horowitz popularized "progressive decentralization" framework where "founding teams relinquish control by degrees, over time." This strategy allows projects to begin centralized for product development speed, then gradually transfer governance to community. The playbook explicitly states goal of "issuing tokens that hopefully will not run afoul of securities regulations" through eventual decentralization.

Theory suggests that "post-network launch — provided that the network is sufficiently decentralized — the nature of the token can change from security to non-security, owing to the fact that the holder of the token is no longer relying on the efforts of others." This creates incentive for launching DAO governance structures regardless of actual decentralization intent. Projects claim progressive decentralization roadmap while maintaining indefinite founder control.

The strategy's stated first stage involves "no pretense of decentralization — a core team is driving all product decisions by necessity" while avoiding token launch that "could trip compliance wires." Second stage introduces "ProtoDAO" with limited community input. Third stage achieves sufficient decentralization transferring meaningful control to token holders. However, many projects remain perpetually in early stages despite governance infrastructure deployment.

Legal Liability Diffusion Through Decentralization Claims

DAO structures create ambiguity regarding legal accountability and regulatory jurisdiction. When protocol operates through decentralized governance without clear corporate entity or identifiable decision-makers, regulators face challenges determining whom to investigate or prosecute for violations. Foundation stewardship model places nonprofit entity between founders and protocol operations, potentially shielding individual team members from direct liability.

However, this protection proves limited in practice. Mango Markets case demonstrated that SEC pursues individuals behind governance structures regardless of decentralization claims. The agency charged Mango DAO, Blockworks Foundation, and specific founders jointly. Courts have not accepted DAO structure as liability shield when evidence shows continued centralized control.

Wyoming and other jurisdictions enacted DAO LLC statutes providing legal wrapper for decentralized organizations. These structures attempt balancing limited liability protection with regulatory clarity. However, LLC formation requires identifying responsible parties undermining pure decentralization narrative. Most crypto projects avoid formal legal entities maintaining ambiguous organizational status.

Blur DAO in Regulatory Context

Blur Foundation's governance structure exemplifies progressive decentralization strategy where formal DAO infrastructure exists alongside continued centralized control. The 180-day governance freeze following February 2023 token launch allowed team to "find product-market fit" under centralized decision-making. August 2023 freeze expiration enabled community governance theoretically, yet Foundation and committees maintain operational authority through November 2025.

This arrangement provides several regulatory advantages: Token distribution through airdrops to NFT traders creates appearance of utility rather than investment vehicle; Governance token classification suggests non-security status; Committee structure enables rapid competitive decisions without formal votes; Foundation nonprofit status distances founders from direct protocol control; "Progressive transfer" commitment without timeline maintains perpetual transition narrative justifying current centralization.

BLUR token price collapse from $5.02 to $0.04 (99.2% decline) reduces SEC enforcement priority. Regulatory agencies typically focus resources on high-profile projects causing substantial investor harm. Blur's diminished market capitalization and trading activity make it less attractive enforcement target despite governance centralization. However, this creates perverse incentive where failed projects escape scrutiny for governance practices that successful projects face investigation over.

The fee switch proposal remaining unresolved for 2+ years suggests intentional governance paralysis. Implementing protocol fees could strengthen case that BLUR tokens represent profit-sharing investment contracts under Howey Test. Maintaining zero fees while describing protocol as "community-governed" provides regulatory protection through governance theater appearance without actual value accrual mechanisms that trigger securities classification.

Industry Pattern: Governance Theater for Regulatory Compliance

Blur DAO exemplifies broader crypto industry pattern where projects deploy governance infrastructure for regulatory positioning rather than genuine decentralization. Snapshot voting systems, Research forums, token delegation mechanisms, and committee structures create appearance of community control while founders maintain decisive authority through various mechanisms: Foundation "stewardship"; Committee "temporary" authority without transition timelines; Admin key privileges enabling technical governance override; Proposal complexity deterring community participation; Voting power concentration among insider allocations.

This governance theater serves multiple strategic purposes: Claiming "sufficient decentralization" for non-security token status; Diffusing legal liability across ambiguous organizational structures; Marketing decentralization narrative to community and investors; Maintaining founder control during "progressive" transition period; Avoiding securities registration costs and ongoing compliance burdens.

Academic research across 30,000 DAOs found 53% inactive with no proposals in 6 months and voter turnout decreasing as organization size increases. This widespread dysfunction suggests governance systems designed for appearance rather than function. Projects satisfied with governance theater appearance lack motivation to activate actual community decision-making that could constrain founder discretion or trigger unwanted regulatory scrutiny.

Assessment: Governance Strengths, Weaknesses, and Design Tradeoffs

Theoretical Advantages

Actual Disadvantages

When Blur DAO Governance Works (Rare Scenarios)

- Protocol parameter changes affecting fundamental tokenomics during rare proposal opportunities

- Treasury grant allocation if governance process activates and procedures clarify

- Major strategic decisions if Foundation/committees allow community input before commitment

- Governance process improvements if community organizes to reform dysfunctional system

- Delegation to active community members seeking to aggregate small holder voting power

When Blur DAO Governance Fails (Typical Scenarios)

- Operational platform decisions proceeding through Marketplace Committee without votes

- Major partnerships like BLAST integration decided by Foundation unilaterally

- Incentive program design managed by committee within opaque frameworks

- Day-to-day operational decisions about marketing, customer support, or technical infrastructure

- Emergency security responses requiring immediate action incompatible with multi-week voting

- Any decision requiring timely resolution given governance process dysfunction

Blur DAO Development Timeline and Governance Milestones

Frequently Asked Questions About Blur DAO Governance

Comprehensive DAO Governance Infrastructure Ecosystem

Organizations evaluating Blur DAO within broader decentralized governance contexts benefit from understanding complementary infrastructure tools and competing governance frameworks. Treasury management platforms like Gnosis Safe enable multi-signature security for community-controlled funds. Voting infrastructure including Snapshot and Tally provide gasless signaling and on-chain execution capabilities. For comprehensive analysis of 50+ DAO tools covering governance, treasury management, communication platforms, and operational infrastructure, explore the Comprehensive DAO Tooling Guide and List of DAO Tools. This resource enables comparison across governance models helping organizations select optimal structures and understand gap between governance infrastructure availability and actual decentralization outcomes.

Blur DAO exemplifies broader industry pattern where sophisticated governance infrastructure exists but remains underutilized due to structural centralization. Having Snapshot, Tally, Research forums, and on-chain voting capabilities means little if Foundation and committees make decisions unilaterally. This disconnect between governance tooling and practical decentralization affects numerous crypto projects claiming DAO status.

BLUR Token Price Impact on Governance Participation

Data: CoinMarketCap price data, governance forum analytics (2023-2025)

Token price collapsed 99.2% from $5.02 launch to $0.04 current value representing $4.98 decline per token. Price decline correlates with reduced governance participation and forum activity. Initial governance enthusiasm during higher valuations gave way to resignation as token value evaporated. Long-term committed community members maintain minimal engagement despite value erosion. Lower token price reduces economic incentives for governance participation further. However, reduced airdrop farming incentives might improve genuine governance quality theoretically if participation existed. Primarily, catastrophic token price collapse reflects broader community disillusionment with protocol direction and governance ineffectiveness.

The correlation between price collapse and governance inactivity creates negative feedback loop. Inactive governance permits Foundation control which may not prioritize token holder value maximization. Lack of value accrual mechanisms like fee switch implementation reduces token utility. Lower prices discourage participation creating further governance vacuum. This cycle perpetuates centralization under governance theater appearance.

Sources and Data Attribution

This governance review reflects Blur DAO's organizational structure and community decision-making processes as of November 2025. Analysis aggregated from official documentation, governance forum discussions, security audits, blockchain analytics, academic DAO research, and SEC regulatory materials. Critical assessment focuses on gap between formal governance infrastructure and actual decentralization outcomes. Analysis includes regulatory motivations for DAO creation including token security classification under Howey Test and progressive decentralization strategies. Voting participation rates and token holder distribution represent best available estimates from on-chain data analysis. Governance inactivity findings based on forum activity tracking, proposal submission records, and comparative DAO statistics. For current governance activity, consult Blur Governance Forum and Snapshot voting records. This review provides educational analysis of decentralized governance structures and regulatory compliance strategies, emphasizing importance of evaluating practical authority distribution rather than nominal DAO claims. Content does not constitute legal advice, investment advice, or recommendations regarding BLUR token acquisition. Consult qualified legal counsel for securities law compliance guidance.