Weekly newsletter of DAO highlights | Issue #31

Catch up on the latest happenings within DAO communities and the most relevant news from the DeFi space.

DAO Stats

The total number of decentralized organizations being tracked by the DAO analytics site DeepDAO stood at a whopping 18,999 as of July 17, 2023. This is a sharp spike from last week’s figure of 12,727. It is currently unclear if the data represents new entrants to the DAO industry over the past week or new listings added to DeepDAO.

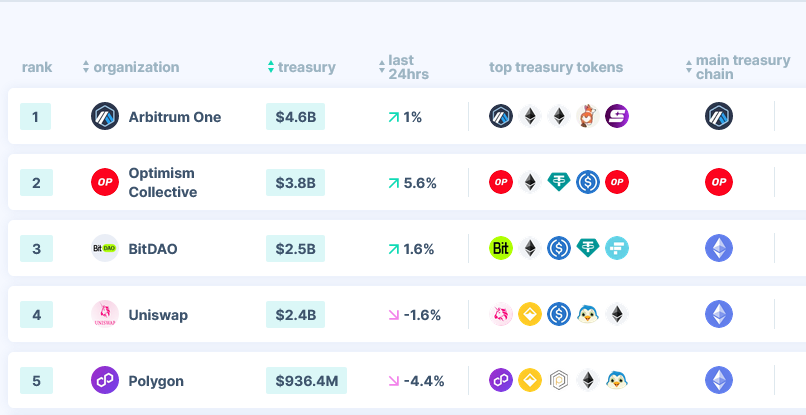

Nevertheless, the general DAO market saw an uptick in a few areas. For instance, the total assets held in DAO treasuries grew from $20.7 billion to $21.7 billion over the past seven days, representing a weekly increase of $1 billion.

Another interesting stat worth highlighting is Optimism Collective’s new title as the second-largest decentralized autonomous organization. The group has $3.8 billion in assets under management, unseating BitDAO whose treasury has slumped to $2.5 billion.

Major DAO Highlights

Mixed Reactions as Aave DAO plans to launch new GHO Stablecoin

On July 15, Aave executed a proposal approving the launch of its new GHO stablecoin on Mainnet. The Aave-native stablecoin is expected to offer more transparency to users and will be minted through a plethora of collateral assets held by users across the Aave ecosystem.

However, some quarters have questioned Aave’s decision to enter the already oversaturated stablecoin market. There are claims that despite the “efficiency” and “transparency” tags, the stablecoin simply “clones existing models like USDC and DAI while adding needless complexity with custodial facilitators.”

ShapeShift DAO to borrow $1M from Fox Foundation

Amid the ongoing Crypto Winter, ShapeShift DAO has approved a $1 million loan request from Fox Foundation. The said loan will be used to extend the DAO’s runway by roughly six months.

Apparently, the DAO’s Treasury Management and Diversification Committee (TMDC) believes that ShapeShift DAO’s ability to achieve “sustainable autonomy and maximal decentralization is at risk” due to the negative market sentiments.

The loan will be fully collateralized by a transfer of FOX tokens from the DAO’s treasury to the FOX Foundation. The DAO will also have about 15 months to repay the 0% interest loan.

Arbitrum DAO to fund Pluralistic Grants Program

Last week, Arbitrum DAO approved a proposal from the Plurality Labs Team requesting 3.971 million ARB (roughly $5.2 million) to form a Pluralistic Grants Program for the DAO.The initial capital will be used to fund the first milestone comprising ecosystem development, Plurality Labs services, grant managers, and project buffer.

According to the proposal, Plurality Labs will “maintain accountability for sourcing, selecting, reporting on, and delivering results of the chosen pluralist grants programs during milestone 1.”

DeFi News

Rodeo Finance hit a second time; attacker steals $1.5M

On July 11, Rodeo Finance became the latest victim of a security breach. The Arbitrum-based DeFi protocol was exploited for $1.53 million after a malicious actor manipulated Rodeo’s price oracle, allowing them to execute trades at a profit.

This is the second time that Rodeo Finance has been exploited in a week. The first exploit occurred on July 5 and resulted in a loss of around $89,000.

DeSantis Promises to Nix CBDCs if Elected President

Ron DeSantis, the governor of Florida and a potential 2024 presidential candidate, has vowed to ban central bank digital currencies (CBDCs) in the United States if he is elected president.

DeSantis made the announcement at the Family Leadership Summit in Iowa on July 14, 2023. He said that CBDCs would give the government too much control over the financial system and would be a "massive transfer of power from consumers to a central authority." While some people supported his stance, others believe that CBDCs could be a valuable tool for economic growth.

Brazilian CBDC's 'Freeze Funds' Feature Sparks Privacy Concerns

A blockchain developer has discovered that the Brazilian Central Bank Digital Currency (CBDC) has a built-in function that allows the government to freeze funds and adjust balances. The developer, Pedro Magalhaes, found the function while reverse-engineering the code for the CBDC, which is still in development.

Magalhaes says that the ability to freeze funds is a "major concern" because it could be used to censor political dissent or target individuals for financial reasons. He also says that the ability to adjust balances could be used to manipulate the value of the CBDC.

The Brazilian Central Bank has not yet commented on Magalhaes's findings. However, the discovery has raised concerns about the potential for government overreach with CBDCs.

DAO Governance Updates

Completed

- Aave DAO is gearing up to introduce the StrategicAssetManager contract to manage the DAO's strategic assets following a temperature check round. For a start, the upgradeable contract will manage the DAO’s veBAL holdings, under the control of Aave governance.

- BitDAO has ratified a proposal seeking to authorize the establishment of the Mantle EcoFund with $100 million from the treasury. The proposal endorses the establishment of the Mantle EcoFund Investment Committee and the first capital call of 10 million USDC from the treasury.

- Magic Internet Money DAO has selected Switzerland as the jurisdiction for its DAO legal framework.

Active Voting Rounds

- ApeCoin DAO is currently voting on a proposal seeking to expand the ApeCoin ecosystem through an animated series pilot and three spin-off comic books featuring characters owned by members of the community. The proposal is asking for $300k in funding.

- There is an ongoing governance round in Arbitrum DAO over leveraging Camelot as an ecosystem hub to support Arbitrum-native builders.

Upcoming Votes

- On July 20, Bankless DAO will begin voting on a proposal to delegate the DAO’s VITA token voting rights to DAOstewards.eth. The move is expected to improve BanklessDAO’s participation in VitaDAO’s governance.