DAO Governance Voting Schemes Comparison

No perfect DAO voting scheme exists. Token-based systems give whales power but enable fast decisions. Quadratic voting reduces whale influence but needs identity verification. Conviction voting prevents attacks but slows governance. Multisig offers speed but centralizes control. Choose based on your DAO's priorities: speed, fairness, or security.

Token Based Quorum Voting

Token-based quorum requires minimum participation before proposals pass. Compound demands 400,000 votes minimum. Lido needs 5% of LDO supply voting yes. Uniswap requires 40 million yes votes for approval. The side with most votes wins after reaching quorum.

Research from 2025 shows large voters always vote with greater probability than small voters. Small voters abstain when large holders vote with certainty. Mechanisms designed to mitigate large holder influence show minimal effect on small voter participation.

Used by: Compound, Uniswap, Lido, MakerDAO, Aave. Approximately 60% of DAOs employ token-based quorum as primary mechanism.

Data: Coinlaw.io 2025, SSRN Token-Based Voting Research 2025

Simple Majority Voting

Simple majority requires over 50% of votes cast to approve proposals. No minimum participation threshold exists. One member can pass proposals if others abstain. The straightforward process makes decisions quickly.

MakerDAO uses simple majority for many governance decisions. This allows rapid adaptation to DeFi market conditions. The mechanism works when proposals lack controversy. Contentious changes require different approaches.

Used by: MakerDAO (routine decisions), smaller DAOs prioritizing speed. Works best for non-controversial proposals affecting daily operations rather than fundamental protocol changes.

Supermajority Voting

Supermajority requires 66%, 75%, or higher approval before passing proposals. This higher threshold protects against contentious changes. Used for decisions with major protocol impact.

Best suited for constitutional changes like tokenomics modifications or treasury fund allocation above certain amounts. Snapshot approval rates for critical proposals average 85% compared to 96.8% for routine decisions. The gap shows supermajority requirements function as intended filter.

Used by: Protocol upgrades in major DAOs, treasury decisions above $1M threshold, changes to governance rules themselves. Approximately 15% of all DAO votes require supermajority approval.

Quadratic Voting

Quadratic voting increases cost exponentially for additional votes. First vote costs 1 token. Second costs 4 tokens. Third costs 9 tokens. Fourth costs 16 tokens. This prevents whales from dominating through pure token volume.

Data: Colony.io DAO Mechanisms 2024

Adoption grew 30% in 2025 compared to previous year. Shiba Inu Doggy DAO deployed quadratic voting in August 2025. Proposal creators choose between staking, token, or quadratic methods per proposal. Gitcoin uses quadratic funding for public goods allocation successfully.

The main barrier remains identity verification. Decentralized identity solutions like Soulbound Tokens offer partial answers but lack universal adoption. Over 200 DAOs implement DID systems as of 2025.

Used by: Gitcoin, Shiba Inu DAO, experimental governance frameworks. Approximately 12% of DAOs offer quadratic voting as option in 2025.

| Votes Cast | Token Cost | Cumulative Cost | Marginal Cost |

|---|---|---|---|

| 1 | 1 | 1 | 1 |

| 2 | 4 | 4 | 3 |

| 3 | 9 | 9 | 5 |

| 4 | 16 | 16 | 7 |

| 5 | 25 | 25 | 9 |

| 10 | 100 | 100 | 19 |

Quadratic voting formula: cost = votes²

Conviction Voting

Conviction voting weighs votes by time commitment. Longer a vote remains unchanged, stronger it becomes. Voting power increases gradually toward maximum threshold. Members switch votes anytime but sacrifice accumulated weight.

Used primarily for public goods funding and grant allocation. 1Hive and Commons Stack deploy conviction voting for continuous treasury distribution. The mechanism suits contexts where decisions lack urgency but require genuine community support.

Time-weighted systems create natural filtering. Only proposals with sustained backing receive funding. This reduces spam and frivolous proposals compared to binary voting periods.

Used by: 1Hive, Commons Stack, Gardens framework. Approximately 8% of DAOs implement conviction voting in 2025, primarily for funding decisions rather than protocol governance.

Delegated Voting and Liquid Democracy

Delegation lets token holders assign voting power to trusted representatives. Delegates vote on behalf of assigners. Members revoke delegation anytime. This creates expertise-based governance without sacrificing token holder control.

MakerDAO proxy delegates control 9.16% of voting power individually. Research shows delegation pathways must maintain accountability mechanisms. Top delegates consolidate disproportionate power through opaque networks. This enables governance influence extraction without robust oversight.

ENS, MakerDAO, and Optimism use delegation extensively. Approximately 35% of major DAOs offer delegation as primary or secondary mechanism. SNS DAOs on Internet Computer implement topic-specific delegation allowing expertise matching.

Best practices include: transparent delegate platforms, regular delegate reporting requirements, easy revocation processes, competitive delegate elections, minimum participation requirements for delegates.

Used by: ENS, MakerDAO, Optimism, Compound, SNS DAOs. Most effective when combined with transparent delegate accountability systems. For exploring how various DAOs implement delegation, see this list of DAOs.

Multi Signature Voting

Multi-signature requires predetermined number of authorized signers approving proposals. Example: 6 of 9 signers must approve before execution. Provides balance between decentralization and operational efficiency.

Approximately 45% of DAOs use multi-sig as backup governance layer. Yearn Finance and Safe wallets popularized this approach. Most effective when combined with community voting for non-urgent decisions.

Common implementations: 3 of 5 signers for small treasuries, 5 of 9 for medium protocols, 7 of 12 for major platforms. Signer rotation and transparency reduce centralization concerns. Time-locks provide community override opportunities.

Used by: Yearn Finance, Sushiswap, most DAO treasuries. Serves as emergency governance when speed matters more than broad participation. Best combined with community voting for routine decisions.

Rage Quit Voting

Rage quit allows minority voters to exit DAO with proportional treasury share if they oppose passed proposals. Grace period after voting enables withdrawal before proposal execution. Protects minority rights.

Moloch DAO pioneered rage quit mechanism. Proposal sponsorship combined with grace period creates security. Members reconsider support during grace period. Proposals lacking sustained backing get discarded.

Most effective for investment DAOs where capital allocation creates strong disagreements. Less suitable for protocol governance requiring coordinated upgrades.

Used by: Moloch DAO, DAOhaus framework. Approximately 8% of DAOs implement rage quit in 2025. Primarily investment and grant-focused organizations rather than protocol governance.

Reputation Based Voting

Reputation systems weight votes by contribution history rather than token holdings. Factors include GitHub commits, forum participation, proposal quality, and community engagement. Rewards actual involvement over wealth.

Creating good reputation systems proves challenging in practice. Different DAOs value different contributions. Developers prioritize code commits. Communities value forum engagement. Balancing multiple contribution types requires judgment calls.

Reputation may expire over time to prevent early-mover advantages. However, determining decay rates creates new controversies. Some contributions like code remain valuable indefinitely. Others like forum posts lose relevance quickly.

Used by: BPC DAO, OrangeDAO, some development-focused DAOs. Rare as primary mechanism due to implementation complexity. More common as modifier to token-based systems. For various DAO tools and approaches, explore this comprehensive tooling guide.

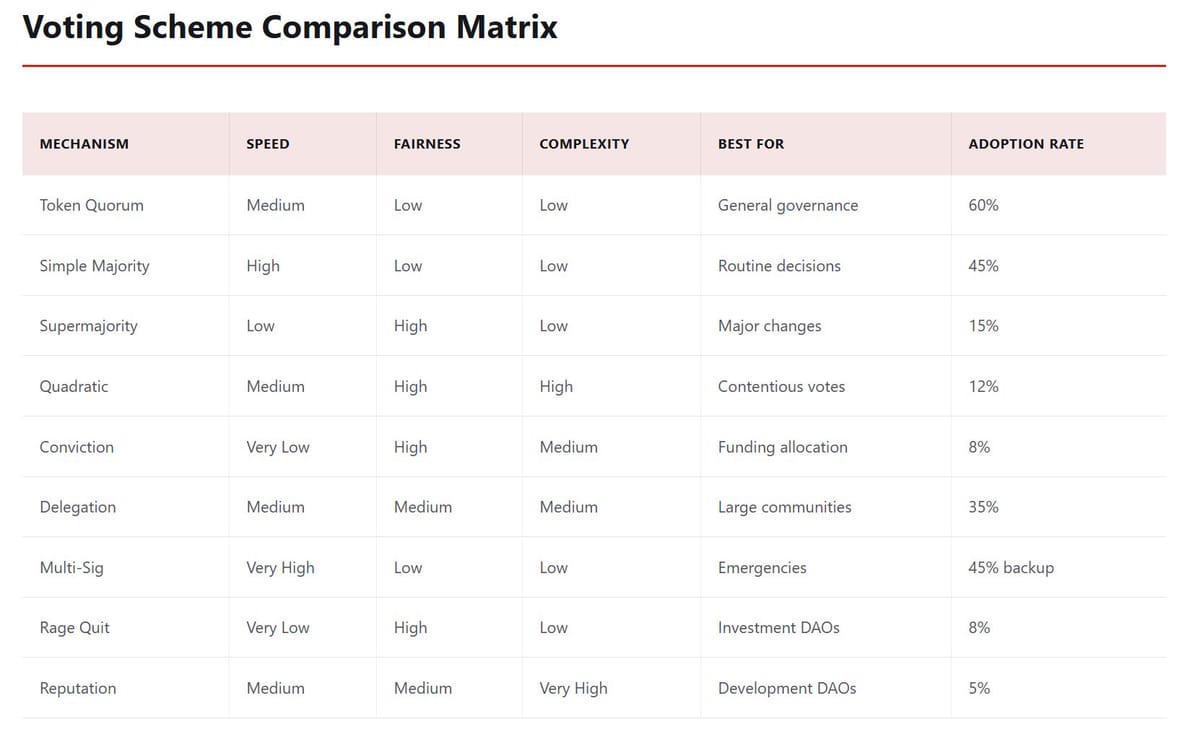

Voting Scheme Comparison Matrix

| Mechanism | Speed | Fairness | Complexity | Best For | Adoption Rate |

|---|---|---|---|---|---|

| Token Quorum | Medium | Low | Low | General governance | 60% |

| Simple Majority | High | Low | Low | Routine decisions | 45% |

| Supermajority | Low | High | Low | Major changes | 15% |

| Quadratic | Medium | High | High | Contentious votes | 12% |

| Conviction | Very Low | High | Medium | Funding allocation | 8% |

| Delegation | Medium | Medium | Medium | Large communities | 35% |

| Multi-Sig | Very High | Low | Low | Emergencies | 45% backup |

| Rage Quit | Very Low | High | Low | Investment DAOs | 8% |

| Reputation | Medium | Medium | Very High | Development DAOs | 5% |

Data: Colony.io 2024, Limechain 2023, Coinlaw.io 2025, Author Analysis

Implementation Considerations

Choosing the Right Scheme

No single voting scheme solves all problems. Each trades off between speed, fairness, and decentralization. DAOs often combine multiple mechanisms for different decision types.

Protocol DAOs like Uniswap use token quorum for major decisions but multi-sig for treasury management. Investment DAOs like Moloch combine proposal sponsorship with rage quit. Public goods DAOs like Gitcoin employ quadratic voting for fund distribution.

Hybrid Approaches

Shiba Inu DAO lets proposal creators choose voting methods per proposal. Routine operational decisions use simple majority. Treasury allocations above thresholds require quadratic voting. Emergency situations activate multi-sig committee.

SNS DAOs implement topic-specific delegation enabling expertise matching. Token holders delegate voting power to different experts for different proposal categories. This balances efficiency with appropriate domain knowledge.

Technical Infrastructure

Off-chain voting through Snapshot eliminates gas fees. 96% of DAOs adopted this approach by 2025. Snapshot X on Starknet brings off-chain voting on-chain using storage proofs. Layer-2 solutions like Arbitrum and Optimism reduce on-chain voting costs by 90%.

Zero-knowledge proofs enable private voting while maintaining verifiability. The S2DV protocol uses Groth16 zk-SNARKs with ElGamal encryption. Voters prove vote validity without revealing choices.

Participation Challenges

Average participation stays at 17% across DAOs in 2025. Leading protocols reach 22-28% for major proposals. Decentraland averages 0.79% with median at 0.16%. Low turnout concentrates power regardless of voting scheme chosen.

Solutions include: gasless voting via Snapshot, mobile-friendly interfaces, proposal summarization tools, delegation options, voting incentives, clear communication of proposal impact. None solve participation problem completely.

Frequently Asked Questions

Sources

Academic Research: SSRN 2025 - Token-Based Voting by Nakaguma & Botelho; ScienceDirect 2025 - Review of DAO Governance; Frontiers in Blockchain 2025 - Delegated Voting in DAOs; Economics Letters 2025 - Distributed Governance and Value Creation

Technical Analysis: Coinlaw.io 2025 - DAO Statistics; Colony.io 2024 - Voting Mechanisms; Limechain 2023 - DAO Voting Guide; Aragon Documentation - Token Voting Implementation

Case Studies: The Shib Daily 2025 - Doggy DAO Governance Expansion; Chainalysis 2024 - DAO Ownership Concentration; Various DAO governance forums and documentation