Guide For Investment DAOs

What Investment DAOs Are

Investment DAOs are decentralized organizations that pool member capital to invest in startups, protocols, and assets. Members hold governance tokens that grant voting rights on investment decisions. No single authority controls allocations.

These organizations differ from protocol governance DAOs. Uniswap and Aave govern existing protocols. Investment DAOs actively deploy capital into external projects for returns.

Thirty-one specialized investment DAOs operate globally according to Tracxn July 2025 data. Eighteen received external funding, with four reaching Series A or later stages. The United States hosts ten organizations, Switzerland has four, and Panama has two.

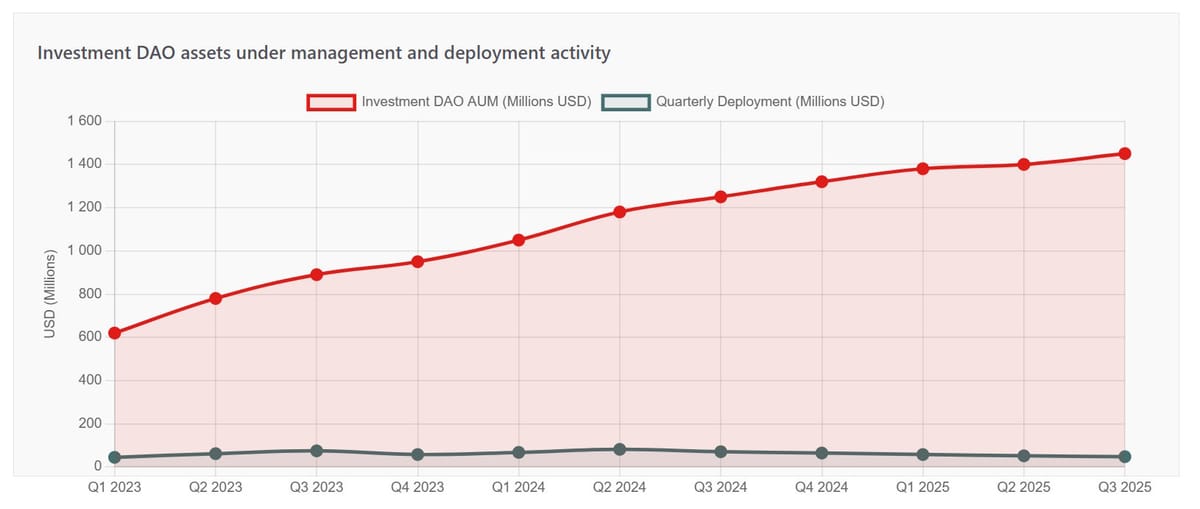

Investment DAOs collectively manage $1.4 billion in diversified assets across DeFi, NFTs, gaming, real estate, and longevity research according to CoinLaw data from August 2025. This represents dedicated investment vehicles, not protocol treasuries.

Traditional venture capital requires $250,000 minimum investments and accredited investor status. Investment DAOs lower barriers to $100-$5,000 through fractional token ownership. Anyone with a crypto wallet can participate in funding decisions.

Categories of Investment DAOs

Investment Focus Distribution Among Active Investment DAOs

Data: Alchemy, Tracxn, and DAO project analysis 2025

Investment DAOs specialize by sector and stage. Four primary categories exist based on investment approach and target assets.

Venture DAOs

Venture DAOs fund early-stage crypto and Web3 companies. They provide equity or token investments to startups building decentralized applications, infrastructure, and protocols.

Orange DAO raised $80 million in Series C funding from Algorand in August 2022. The organization restricts membership to Y Combinator alumni, creating a network of 1,400 experienced founders. Orange DAO completed 47 portfolio investments by 2025 according to Tracxn data.

Alliance DAO operates a 12-week accelerator program providing mentorship, funding, and networking for early-stage crypto startups. The organization combines traditional accelerator methods with decentralized governance.

MetaCartel DAO focuses on supporting teams building Web3 applications. Members vote on funding proposals ranging from $1,000 grants to larger equity investments.

Sector-Specific DAOs

These organizations concentrate on particular industries or technologies.

VitaDAO funds longevity and biomedical research. The organization raised $4.6 million across three rounds with backing from Pfizer, L1 Digital, and Shine Capital according to Crunchbase. VitaDAO supported over 20 research projects by 2025 at institutions including the University of Copenhagen.

The DAO uses IP-NFTs to tokenize research outcomes. Members holding $VITA tokens vote on funding proposals. In July 2025, Gero (a VitaDAO-backed company) secured a $1 billion partnership with Roche's Chugai division for AI-driven drug discovery.

Perion DAO specializes in Web3 gaming investments. The organization backs gaming studios and play-to-earn protocols. Gaming DAOs collectively manage $520 million in digital and in-game assets according to CoinLaw research.

Collector DAOs

Collector DAOs purchase and manage NFT art, rare digital assets, and cultural artifacts.

PleasrDAO operates as a collective of art enthusiasts investing in NFT artwork and digital collectibles. The DAO experiments with fractional ownership, giving members shares in a growing collection of high-value NFTs.

The organization made headlines purchasing rare pieces including the original Doge NFT and unreleased Wu-Tang Clan albums. Members govern acquisition decisions and potential sales through token-weighted voting.

Syndicate and Sub-DAO Models

Syndicate DAO enables users to create investment clubs with legal entity structures. These sub-DAOs invest in crypto assets and startup equity off-chain.

The LAO operates as a "DAO of DAOs" with limited liability entity status in the United States. Up to 99 members can participate, each purchasing 1% membership blocks for 375 ETH (approximately $1.1 million at current prices). The LAO pools capital for investments in early-stage Web3 projects.

Major Investment DAOs Performance and Activity

| Investment DAO | Founded | Capital Raised | Members | Portfolio/Projects | Specialization |

|---|---|---|---|---|---|

| Orange DAO | 2021 | $80M | 1,400 YC alumni | 47 investments | Early-stage crypto |

| BitDAO/Mantle | 2021 | $2.4B treasury | N/A | Web3 ecosystem | Infrastructure investment |

| VitaDAO | 2021 | $4.6M | 64.3M VITA supply | 20+ research projects | Longevity science |

| Alliance DAO | 2021 | Undisclosed | Multiple cohorts | Accelerator program | Web3 startups |

| The LAO | 2020 | Up to 99 members | 375 ETH per 1% | Early Web3 portfolio | Accredited investors |

| Syndicate DAO | 2020 | N/A | Sub-DAO model | Varied by club | Investment clubs |

| PleasrDAO | 2021 | N/A | Fractional model | NFT collection | Digital art/culture |

| MetaCartel DAO | 2019 | N/A | Active builders | dApp funding | Application layer |

| SeedClub DAO | 2020 | N/A | Community focus | Multiple communities | Community building |

| Global Coin Research | 2019 | N/A | Community-first | Research + invest | Community research |

Data: Tracxn, Crunchbase, Alchemy, project websites July-November 2025

Investment DAO Capital Deployment 2023-2025

Data: CoinLaw and Tracxn investment DAO analysis

BitDAO and Mantle Network

BitDAO operated as one of the largest investment DAOs before merging with Mantle Network in May 2023. The combined treasury held $2.5 billion including $300 million in USDC/USDT and 270,000 ETH.

The organization manages a $200 million EcoFund supporting Web3 infrastructure projects. Mantle's investment strategy focuses on Layer-2 scaling solutions and decentralized applications.

The Mantle Index Fund (MI4) launched in April 2025 targeting $1 billion in assets under management. This represents a bridge between traditional index investing and crypto asset allocation.

Recent Portfolio Developments

VitaDAO's portfolio company Gero announced a $1 billion partnership with pharmaceutical giant Roche in July 2025. The deal validates the DAO's investment thesis around AI-driven drug discovery.

In August 2025, VitaDAO proposed a $30,000 Phase 2 clinical trial feasibility assessment in the UAE for autophagy-enhancing compounds. This demonstrates progression from research funding to clinical development.

Orange DAO portfolio companies received follow-on funding from major VCs including Andreessen Horowitz and Paradigm. This shows traditional capital recognizes DAO-vetted deals.

How Investment DAOs Operate

Membership and Token Acquisition

Investment DAOs require purchasing governance tokens for participation. Token prices range from $0.50 to $50 per unit. Most DAOs set minimum holdings for proposal creation rights.

Orange DAO restricts membership to Y Combinator alumni. Applicants submit credentials proving accelerator participation. This creates a vetted community of experienced founders.

The LAO limits membership to 99 accredited investors. Each member purchases 1% blocks for 375 ETH. This structure complies with U.S. securities regulations while maintaining decentralized governance.

Other DAOs like Syndicate allow anyone to purchase tokens without restrictions. Entry costs start at $100-$500 depending on token price and minimum voting requirements.

Investment Decision Process

Members or dedicated sourcing teams identify investment opportunities. Deal flow comes from founder networks, accelerator programs, and community referrals.

Proposals include company overview, team backgrounds, market analysis, investment terms, and exit strategy. Most DAOs require 5-20 page investment memos following traditional VC formats.

Discussion occurs on Discord, Discourse, or Telegram for 7-14 days. Members ask questions, request additional information, and debate thesis merits.

Voting takes place on Snapshot or custom governance platforms. Token holdings at proposal creation determine voting power. Quorum requirements range from 4-20% of total supply.

Passed proposals execute through smart contracts or multi-sig wallets. Funds transfer to portfolio companies directly or into escrow pending milestone completion.

Token Distribution and Voting Power

Data: CoinLaw DAO governance analysis 2025

Less than 0.1% of token holders control 90% of voting power in major DAOs according to CoinLaw research. This concentration creates governance risks where whale decisions override community preferences.

Some investment DAOs implement quadratic voting to reduce whale influence. Each additional vote costs more tokens, making it expensive to dominate decisions single-handedly.

Delegation mechanisms allow passive holders to assign voting power to active participants. This increases participation rates while maintaining decentralized control distribution.

Portfolio Management and Returns

Investment DAOs track portfolio performance through custom dashboards and reporting tools. Members access real-time valuation data for liquid holdings.

Returns distribute through several mechanisms. Token buyback programs use exit proceeds to purchase and burn governance tokens, increasing remaining holder value.

Some DAOs distribute profits proportionally to token holders in stablecoins or ETH. Others reinvest returns into new opportunities, compounding treasury growth.

VitaDAO's IP-NFT model allows members to share in research commercialization proceeds. When funded discoveries become therapies, IP-NFT holders receive royalty payments.

Comparing Investment DAOs to Traditional VC

| Factor | Investment DAOs | Traditional VC Funds |

|---|---|---|

| Minimum Investment | $100-$5,000 typical | $250,000-$5,000,000 typical |

| Investor Requirements | Open to public (most DAOs) | Accredited investors only |

| Decision Authority | Token-weighted member voting | General partners decide |

| Transparency | All votes and transactions public | Quarterly reports to LPs |

| Liquidity | Tokens trade on exchanges | 10+ year lockup standard |

| Management Fees | 0-2% annual (varies) | 2% annual + 20% carry standard |

| Geographic Reach | Global, internet-native | Regional focus typical |

| Portfolio Support | Community networks, variable | Dedicated operating partners |

| Investment Focus | Primarily crypto/Web3 | All sectors |

| Legal Structure | LLC, DAO, or unincorporated | Limited partnership |

Comparative analysis based on investment DAO operational data and VC industry standards

Investment DAOs excel at accessibility and transparency. Anyone with internet access participates regardless of net worth or location. On-chain records provide real-time visibility into all portfolio holdings and transactions.

Traditional VCs provide deeper operational support. Established funds have decades of relationships with later-stage investors, acquirers, and executives. They offer portfolio companies recruiting assistance, strategic advice, and market access.

Token liquidity provides exit flexibility traditional VC lacks. Members sell tokens on secondary markets rather than waiting years for distributions. However, token prices often disconnect from underlying portfolio value.

Investment DAOs typically focus on crypto-native projects where community expertise is strong. Traditional VCs invest across all sectors including biotech, cleantech, and consumer goods where DAOs have limited domain knowledge.

Evaluating Investment DAOs Before Joining

Review Investment Track Record

Request portfolio performance data for the past 12-24 months. Calculate realized returns on exited investments. Ask about unrealized gains and losses on current holdings.

Examine investment thesis consistency. Does the DAO stick to stated focus areas or chase trending sectors? Consistent strategy indicates disciplined decision-making.

Check deal velocity. How many investments does the DAO complete quarterly? Low activity suggests difficulty sourcing quality deals or governance paralysis.

Assess Governance Structure

Review token distribution on block explorers. If 10 wallets control 80% of supply, practical decentralization is limited. Whale preferences override community consensus.

Examine voting participation rates using Snapshot or Tally. Healthy DAOs see 5-15% of holders voting on major proposals. Consistently low turnout indicates apathy or concentration.

Check proposal passage rates. Do most pass unanimously or face genuine debate? One-sided voting suggests insufficient diversity of opinion or rubber-stamping.

Evaluate Team Quality

Research core contributors and investment committee members. Check LinkedIn profiles, previous exits, and Web3 experience. Look for investment analysis expertise and sector knowledge.

Assess community engagement quality. Active Discord or Telegram channels with substantive deal discussions indicate healthy participation. Silent channels or complaint-dominated conversations raise concerns.

Review advisor involvement. Reputable advisors with successful track records add legitimacy. Be skeptical of name-heavy advisor lists without evidence of active participation.

Understand Legal and Tax Implications

Verify the DAO's legal structure. Unincorporated associations expose members to unlimited liability for DAO obligations. LLC or foundation structures provide protection.

Understand your tax obligations. U.S. members may face ordinary income or capital gains taxes on distributions and token sales. Some DAOs issue K-1 forms treating members as partners.

Consult legal and tax professionals before committing capital. Investment DAO participation creates complex reporting requirements varying by jurisdiction.

Match Investment Strategy to Your Goals

Does the DAO's focus align with your interests and expertise? Sector-specific DAOs like VitaDAO work best when you understand longevity science. Generalist DAOs suit those wanting broad Web3 exposure.

Consider time horizon expectations. Early-stage venture investments take 5-10 years to mature. DeFi protocol investments may generate immediate yields but face higher volatility.

Evaluate risk tolerance. Crypto-native investments face regulatory uncertainty and market volatility. Ensure you can afford complete capital loss.

Investment DAO Landscape Changes in 2025

Regulatory Developments

The SEC created a cryptocurrency task force in January 2025 led by Commissioner Hester Peirce. The task force develops crypto asset regulations with "realistic paths to registration" rather than enforcement-first approaches.

Switzerland and Singapore established clear legal frameworks for DAO operations. The European Union's Markets in Crypto-Assets (MiCA) regulation addresses investment DAO activities and investor protection.

Most U.S. investment DAOs organize as Delaware LLCs to provide limited liability while maintaining decentralized governance. Wyoming offers alternative DAO LLC structures with explicit blockchain-based governance provisions.

Regulatory clarity increased institutional comfort with DAO participation. Some family offices and wealth managers began allocating to established investment DAOs in 2025.

DAO Tooling Improvements

The DAO-as-a-Service market reached $123.6 million in 2023 and projects growth to $680.6 million by 2033 at an 18.6% CAGR according to Market.us research.

Platforms like Aragon, DAOstack, and Syndicate provide treasury management, voting, and member communication tools. Template-based deployment allows launching investment DAOs in days rather than months.

Integration with traditional finance infrastructure improved. Some DAOs now accept wire transfers alongside crypto deposits. Fiat on-ramps simplified onboarding for non-crypto-native investors.

Hybrid Models Emerging

Traditional VC firms launched Service Venture DAOs. Bessemer Ventures created BessemerDAO offering Web3 community access alongside traditional fund operations.

These hybrid structures combine professional investment management with community participation. General partners make final decisions but consult DAO members for deal sourcing and due diligence.

Some investment DAOs hired full-time portfolio managers and analysts. This professionalized operations while maintaining token-based governance for major decisions.

Cross-Border Collaboration

Investment DAOs increasingly coordinate across geographic regions. Global Coin Research operates community chapters in North America, Europe, and Asia for local deal flow.

Multi-chain investment strategies expanded. DAOs deploy capital across Ethereum, Polygon, Arbitrum, and other networks to access different ecosystems and opportunities.

For comprehensive tooling resources supporting investment DAO operations, see the Dashboard of DAO tools. To explore specific investment-focused organizations and their strategies, review the List of DAOs.

Frequently Asked Questions

Sources and References

Tracxn - Top Companies in Investment DAOs (July 2025)

CoinLaw - Decentralized Autonomous Organizations Statistics 2025 (August 2025)

Crunchbase - VitaDAO and Orange DAO Company Profiles and Funding Data (2025)

Alchemy - List of Venture DAOs (2025)

Market.us - DAO-as-a-Service Market Size Report (November 2024)

Messari - Mantle Network Research and News (2025)

VitaDAO - Official website and project updates

Orange DAO - Organization website and member information

University of Chicago Business Law Review - Startup Investing and Venture DAOs

OSL Academy - What are investment DAOs and why are they important for investors (February 2025)