The Dark Side of DAOs Continues in 2025 With Millions Lost to Grant Misuse and Treasury Draining

The Growing Problem in 2025

Decentralized Autonomous Organizations control approximately $24.5 billion as of October 2024, down from a peak of $37 billion in March 2024. This $12.6 billion decline in six months reflects both market volatility and increased scrutiny of treasury management. Over 13,000 DAOs exist globally, with 211 having treasuries exceeding $1 million.

The proposal-based grant system created unintended consequences. Contributors learned to write compelling applications but failed to deliver results. Some projects received funding from multiple DAOs without disclosing overlaps. Others disappeared after receiving grants. The problem became widespread enough that major DAOs launched specific anti-fraud initiatives like Arbitrum's Watchdog Program in May 2025.

Treasury concentration remains extreme. The top five DAOs control significant portions of total value. According to October 2024 data, Optimism holds $3.8 billion, Uniswap $2.9 billion, Mantle $2.7 billion, Arbitrum $2.4 billion, and GnosisDAO $1.7 billion. These large treasuries became targets for sophisticated schemes. Bad actors found ways to manipulate voting, misrepresent projects, and extract funds through legitimate-looking proposals.

The human cost is real. Every dollar diverted from legitimate projects is a dollar not spent on actual development. Communities lost trust in governance processes. Token holders questioned whether their votes mattered when insiders could game the system. The promise of decentralization collided with the reality of human nature.

Treasury Growth and Concentration in 2025

Data: ChainCatcher, Bitcoin.com News (October 2024)

The treasury landscape experienced extreme volatility. In November 2023, combined DAO assets totaled $18 billion. By March 2024, that figure reached $37 billion. Then came a sharp correction: by October 2024, treasuries fell to $24.5 billion, losing $12.6 billion in six months. The number of DAOs with treasuries exceeding $1 million grew from 179 to 211 despite market decline.

This volatility created problems. Larger treasuries attracted more grant seekers, both legitimate and fraudulent. Review committees struggled to evaluate hundreds of proposals. Decision fatigue set in. Some committees approved mediocre proposals just to clear the queue. Others became so cautious that good projects couldn't get funded.

Asset volatility added another layer of complexity. A grant approved when ARB traded at $2 might be worth $0.83 by distribution. Projects budgeted based on grant values that evaporated before they could execute. The Arbitrum Gaming Catalyst Program saw its value drop from $215 million to $190 million before even starting operations. DAOs discovered that denominating grants in volatile tokens created planning nightmares for both sides.

Major Cases of Grant Misuse in 2024-2025

Across Protocol Vote Manipulation ($23 Million)

In June 2025, Glue Network founder Ogle publicly accused the Across Protocol team of manipulating DAO votes to transfer $23 million in ACX tokens. The allegations sent ACX price down 10-12% within 24 hours. The token now trades at $0.13-0.14, down 91% from its December 2024 all-time high of $1.69.

The scheme involved two separate governance proposals. In October 2023, team lead Kevin Chan proposed moving 100 million ACX tokens worth $15 million to Risk Labs, the private entity behind Across. On-chain analysis revealed Chan secretly voted "yes" using multiple wallets while publicly proposing the grant under his known address. The proposal promised tokens wouldn't be sold for two years, but Risk Labs allegedly began selling token option agreements to investors shortly after.

A second proposal in October 2024 secured another 50 million ACX tokens for "retroactive funding." Team members including Reinis FRP voted through several secret wallets controlling millions of ACX tokens. Combined, these proposals transferred 150 million ACX tokens to Risk Labs. The votes only passed because insiders controlled enough tokens to override community opposition.

Co-founder Hart Lambur denied all allegations, stating Risk Labs is a Cayman Islands nonprofit with no shareholders. He claimed the grants were standard DAO practice and tokens were used for protocol development as intended. However, the controversy also sparked insider trading allegations when LayerZero founder Bryan Pellegrino suggested Lambur bought ACX tokens before a surprise Binance listing in December 2024. This case exposed how token-based voting can be manipulated when founders retain large holdings across multiple wallets.

Arbitrum Gaming Catalyst Program ($215 Million)

The program launched with DAO approval in June 2024, allocating 225 million ARB tokens worth $215 million. The goal was positioning Arbitrum as a gaming leader by funding 100 projects over three years. By August 2025, ARB value had collapsed 76% to $0.83, reducing the program's worth to approximately $190 million before any grants were distributed.

The program spent its first six months on infrastructure without funding a single project. Nearly $1.2 million went to legal fees and administrative costs. In January 2025, contributors finally announced readiness to begin grant distribution, claiming 64 projects in the pipeline. But problems persisted: delayed website launch, missing bylaws until February 2025, unclear reporting standards, and team turnover including Treasure DAO leaving Arbitrum for zkSync.

In March 2025, frustrated DAO members proposed clawing back all unused funds. Nathan van der Heyden and others cited mismanagement, opacity, and failure to meet promised milestones. The proposal stated: "The GCP was created in overly optimistic times. With key backers now gone, it's clear the program isn't delivering on its promises." Community member Argonaut simply called it "a failure."

Program defenders including David Bolger from Offchain Labs argued the slow pace reflected proper due diligence rather than negligence. He noted that over 50 deals were reviewed but fewer than 5% reached final stages, demonstrating caution with treasury funds. The program hired Castle Labs as DAO liaison in March 2025 to improve communication. As of November 2025, the program continues operating despite ongoing controversy, but the clawback debate damaged trust in large-scale DAO grant initiatives.

Optimism RetroPGF Controversy ($53 Million)

The third round of Retrospective Public Goods Funding allocated 30 million OP tokens worth approximately $53 million in December 2023. The concept seemed solid: reward past contributions rather than funding future promises. Voting ran from November through early December, with results announced December 7, 2023. Problems emerged during the evaluation period.

On-chain investigator ZachXBT revealed that top-ranked projects weren't actual public goods. Well-funded companies like Alchemy, which raised millions from venture capitalists, competed for grants. Some highly ranked projects hadn't open-sourced their code despite public goods requirements. The community discovered that companies with marketing budgets and professional grant writers outcompeted struggling solo developers building actual infrastructure.

The controversy revealed deeper issues about defining "public goods" in crypto. Determining what qualifies proved subjective. Projects with VC backing argued their open-source contributions provided public value regardless of funding source. Critics countered that public goods funding should go to projects unable to access traditional capital. The program's rules explicitly allowed VC-backed projects based on "impact = profit" principle, but many voters felt this violated the spirit of retroactive public goods funding.

Additional controversies plagued Optimism's grant ecosystem in 2023. Major delegate Griff Green failed to disclose that his company General Magic charged 7-50% commissions on grants they helped secure. Some grantees allegedly misappropriated funds. The doxxing allegations case involving Carlos Melgar raised questions about DAO moderation authority. These repeated issues damaged confidence in Optimism's governance processes and grant distribution mechanisms.

Furucombo and Arbitrum STIP Fraud

The Arbitrum Short-Term Incentive Program discovered fraudulent behavior in 2024. Furucombo failed to file final reports on grant spending. The foundation accused the project of misusing backfund STIP grants. After community voting, Arbitrum DAO banned Furucombo entirely.

Similar cases emerged with Dolomite and Umami. Both falsely applied for funding while pocketing money for personal use. These weren't sophisticated schemes. The projects simply lied on applications and hoped nobody would check. The fact that they got away with it initially revealed weak verification processes.

General Magic Conflict of Interest

Griff Green, a major Optimism delegate, failed to disclose that his company General Magic charged 7-50% commissions on grants they helped teams secure. Green supported client proposals on forums without revealing financial relationships. He held enough voting power to influence outcomes.

The community discovered that grantees padded budgets to cover these undisclosed fees. Optimism paid more because applicants factored in consultancy costs. Green claimed it was an oversight, not intentional deception. The DAO accepted his explanation but the damage to trust persisted. The case established clearer disclosure requirements for delegates with financial interests.

Major Grant Misuse Cases 2024-2025

| Case | DAO | Amount | Type of Abuse | Outcome |

|---|---|---|---|---|

| Across Protocol | Across DAO | $23 million (150M ACX) | Secret wallet voting, insider control | June 2025: Team denies, ACX down 91% |

| Gaming Catalyst Program | Arbitrum DAO | $215M → $190M | Delays, no grants distributed in 6 months | Mar 2025: Clawback proposed, ongoing |

| Furucombo | Arbitrum DAO | STIP grant (amount undisclosed) | No final report, fund misuse | 2024: Banned from DAO |

| ETHTrustFund DAO | ETHTrustFund | $2 million | Treasury withdrawal and laundering | Funds laundered on blockchain |

| General Magic | Optimism DAO | Multiple grants | Undisclosed 7-50% commission fees | Aug 2023: Accepted as oversight |

| BanklessDAO | Optimism/Arbitrum | 70K OP received, 1.82M ARB requested | Poor execution, single-digit views | 2023-2024: Community rejection |

Data: Blockchain analytics, DAO governance forums, investigative reports (2023-2025)

How the Abuse Happens

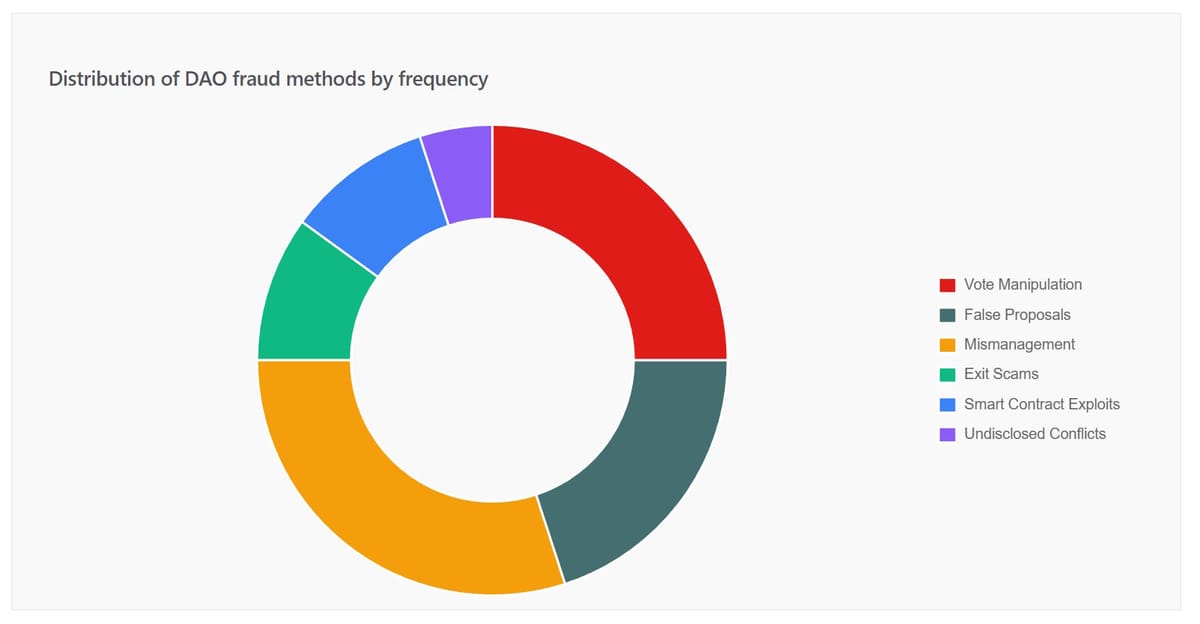

Data: Quantuma crypto fraud analysis, DAO case studies (2024-2025)

Vote Manipulation Through Token Concentration

Token-based voting creates inherent vulnerabilities. Founders and early investors hold disproportionate shares. They can vote through multiple wallets to create false consensus. Some buy votes from passive holders. Others delegate tokens to friendly addresses before proposals.

The Across case demonstrated this perfectly. Team members controlled enough tokens to pass their own grant proposal. They spread votes across wallets to avoid detection. Public addresses proposed while secret addresses voted. The blockchain recorded everything, but most voters never checked.

Professional Grant Farming

Some teams became expert grant writers without building anything. They study successful applications and replicate formats. They promise ambitious roadmaps but deliver minimal products. After receiving funds, they submit new proposals to other DAOs. The same team can collect grants from Optimism, Arbitrum, and smaller DAOs simultaneously.

BanklessDAO exemplified this pattern. After receiving 70,000 OP from Optimism, they delivered posts with single-digit views. Content went through small accounts instead of official channels. When they requested 1.82 million ARB from Arbitrum, the community revolted. Historical data proved they couldn't execute despite professional proposals.

Fake Milestones and Progress Reports

Milestone-based funding requires teams to hit checkpoints before receiving tranches. Bad actors game this by creating fake deliverables. They might deploy nonfunctional contracts to claim technical completion. They generate artificial user metrics through bots. They produce documentation for features that don't work.

Verification is hard. Review committees lack technical depth to evaluate complex projects. They rely on self-reported metrics. Projects submit screenshots and demos that look impressive but lack substance. By the time problems surface, the team received multiple tranches and moved on.

Coordinated Proposal Approval

Delegates sometimes coordinate to approve each other's proposals. A votes for B's request, B votes for A's. Both get funded despite mediocre applications. This creates cliques that drain treasuries while excluding better projects. The Gaming Catalyst Program controversy included allegations of popularity contests rather than merit-based evaluation.

New Solutions Emerging in 2025

Arbitrum Watchdog Program

Launched in May 2025, the Watchdog program pays bounties for reporting grant misuse. Whistleblowers earn $5,000 to $100,000 per confirmed report. A review committee from Entropy Advisors, Arbitrum Foundation, and SeedGov evaluates submissions. Reports go through GlobaLeaks, the same platform governments use for secure whistleblowing.

The program allocated 400,000 ARB tokens for bounties. Severity determines payout. High-severity violations like the Furucombo case earn maximum rewards. Medium-severity issues like missed reporting get smaller amounts. The program aims to create economic incentives for community policing.

Early results show promise. Community members with on-chain analysis skills now hunt for misuse. The program attracted sophisticated investigators who previously focused on private bounties. However, critics worry it might create false accusations or witch hunts against legitimate projects.

Milestone-Based Funding Becomes Standard

Most major DAOs now require milestone-based grants. Arbitrum Foundation, Solana Foundation, and others only release funds after completing predefined checkpoints. Teams must demonstrate progress before receiving the next tranche. This reduces risk but adds administrative overhead.

Implementation varies. Some DAOs require technical milestones like code commits or user metrics. Others want community engagement benchmarks. The best programs combine both. Clear deliverables prevent ambiguity. Teams know what's expected and committees can objectively evaluate progress.

The system isn't perfect. Defining good milestones takes expertise. Too easy and they don't filter bad actors. Too hard and legitimate projects fail. Some programs got stuck reviewing milestone completion instead of making new grants. The Gaming Catalyst Program struggled with this balance.

Improved Transparency and Reporting

DAOs now demand regular public updates. Grantees must post monthly or quarterly reports. Treasury movements are tracked on dashboards like DeepDAO and DAOlytics. Community members can see who received what and when. This social pressure improves accountability.

Some DAOs require final reports before marking grants complete. The report must detail spending, results achieved, and lessons learned. Failure to submit can result in blacklisting. The Furucombo ban came partly from not filing final documentation. Public records help future committees avoid repeat offenders.

Separation of Voting and Execution Power

Optimism pioneered bicameral governance. Token holders vote through Token House. A separate Citizen House uses identity-based voting for public goods funding. This prevents pure token-weight dominance. Identity verification reduces Sybil attacks and multi-wallet manipulation.

Other DAOs experiment with delegation limits. No single delegate can control more than X% of votes. Proposals require approval from multiple independent committees. The goal is preventing concentration of power while maintaining efficiency. Implementation remains challenging. Too many checks slow everything down.

DAO Grant Program Evolution

Data: DAO governance forums, grant program documentation analysis (2023-2025)

Treasury Management Market Growth

Data: DataIntelo DAO Treasury Management Market Research Report (2024-2033)

The DAO treasury management sector reached $1.25 billion in 2024. Projections show growth to $5.38 billion by 2033. This represents a 19.7% compound annual growth rate. The market expansion reflects increasing sophistication in treasury operations.

Demand for professional tools drives growth. DAOs need multi-signature wallets, compliance software, and risk management platforms. Cloud-based solutions captured 65% market share due to scalability and flexibility. Consulting services grew as organizations sought expert guidance navigating complex regulations.

The professionalization of treasury management might reduce misuse. As DAOs hire dedicated treasury teams and adopt enterprise software, oversight improves. However, this adds costs and centralization. The challenge is maintaining decentralization while implementing professional practices.

What Needs to Change

The current system needs reform. Token-based voting will always favor large holders. Identity verification could help but creates privacy concerns. Some DAOs explore reputation systems where voting power depends on contributions, not just tokens. This makes manipulation harder but introduces subjectivity.

Grant programs need professional staff. Volunteer committees can't review hundreds of complex proposals. Paying reviewers creates its own conflicts, but beats the alternative. Arbitrum's Watchdog program recognized this by offering bounties. Economic incentives align better than relying on goodwill.

Retroactive funding shows promise. Instead of betting on future promises, reward past results. This eliminates the risk of teams collecting grants then disappearing. However, it doesn't help new projects without track records. The best approach combines both: small upfront grants for promising ideas, larger retroactive rewards for proven success.

Legal frameworks remain unclear. When DAO members can be held liable as general partners, participation becomes risky. The Lido DAO case in California established that participants might face liability for others' actions. This uncertainty chills involvement from sophisticated actors who could improve governance.

Education matters. Many voters don't understand proposals they're voting on. Some delegate to others without vetting delegates. Better tools for evaluating proposals and delegates would help. So would clearer documentation requirements. If voters can't understand a proposal, it shouldn't pass.

The fundamental problem is human nature meeting new technology. DAOs tried to eliminate hierarchy but created new power dynamics. They wanted transparency but enabled sophisticated fraud. They promised community ownership but delivered plutocracy. Until these contradictions resolve, the dark side will persist.

Frequently Asked Questions

Resources and Data Sources

ChainCatcher - DAO treasury data October 2024 showing decline from $37B to $24.5B

CoinJournal and Invezz - Across Protocol allegations coverage June 2025

CoinDesk - Across Protocol team response and ACX price impact June 2025

Unchained and Blockworks - Arbitrum Gaming Catalyst Program updates January-March 2025

GAM3S.GG and BlockchainGamer.biz - Gaming Catalyst Program controversy March 2025

Bitcoin.com News - DAO treasury valuation changes throughout 2024

PatentPC - DAO Growth Stats: Treasury Sizes, Governance Votes & Activity

CoinLaw - Decentralized Autonomous Organizations Statistics 2025

DataIntelo - DAO Treasury Management Market Research Report 2033

Arbitrum Foundation - Official grant program documentation and governance forum

Optimism Collective - Governance documentation and RetroPGF reports 2023-2024

Entropy Advisors - Watchdog Program proposal and implementation details May 2025

Quantuma - DAO investments analysis and fraud investigation framework 2024

Blockworks - DAO governance trends and treasury spending analysis 2023-2025

The Block - Coverage of Arbitrum Gaming Catalyst Program development

DL News - Investigative reporting on Optimism and Arbitrum grant controversies

MEXC and PANews - Across Protocol vote manipulation analysis June 2025

ResearchGate - Decentralized Autonomous Organization (DAO) Fraud, Hacks, and Controversies (2024)

U.S. GAO - Fraud Risk Management showing $162B improper payments FY 2024

Collider VC - Grant Theft DAO: Grant programs are broken analysis

For a comprehensive list of active DAOs across different sectors, check our comprehensive list of DAOs to explore.