The DAO landscape and treasuries, a DAO annual report

Earlier this month, ThePass took a deep dive into the world of decentralized autonomous organizations (DAOs) and their treasuries. The DAO aggregator and treasury tracking platform explored the development of DAOs from a treasury perspective. Here are some key takeaways from the DAO annual report.

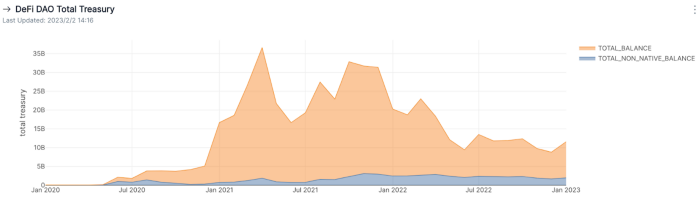

- The bull market played a huge role in fueling DAO growth: Although DAO arguably became a buzzword in the last few months, leading to a proliferation in the number of decentralized organizations, the 2021 bull market played a major role in the rapid expansion of DAO treasuries. Notably, the total value locked (TVL) in DAO treasuries reached a peak of almost $35 billion in mid-2021. As of January 2023, the treasury size of DAOs had shrunk to $12.4 billion, possibly due to the ongoing crypto winter and dwindling crypto prices.

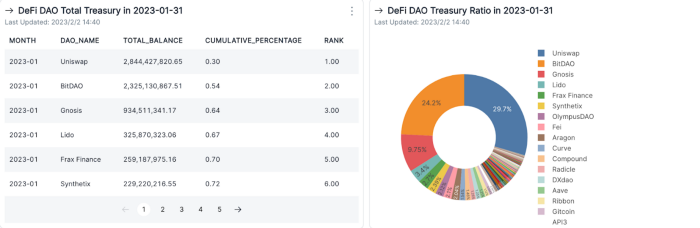

- DeFi-centric DAOs are leading the pack: According to the report, DeFi-based DAOs account for about 82% of the current DAO treasury assets. It appears other categories of DAOs, such as gaming and investment DAOs were grouped into NFT-focused organizations, accounting for the remaining 18% of the January figure.

- In terms of treasury size, 2021 was the year of DAOs: Although 2021 has often been touted as the year of NFTs, it was also the year of DAOs. The TVL in DAO treasury grew from $1 billion to $35 billion between mid-2020 and mid-2021, representing an increase of over 3500% within a year. However, the TVL remained between $15 billion and $30 billion from mid-2021 to the end of 2021. The market began experiencing a downturn in mid-2022, plunging to a low of $7 billion.

- Less than 20 DAOs account for 90% of the total DeFi treasury size: Collectively, the top 19 DAOs have a TVL of over $8.5 billion. This accounts for more than 90% of the total value of treasury assets. Protocols like Uniswap, BitDAO, Gnosis, Lido, FraxFinance, Synthetix, and OlympusDAO are currently leading the pack.

- DAOs prefer to hold their native tokens:A significant percentage of the top DAOs held a larger part of their treasury in their own native tokens. BitDAO, for instance, held 76.9% of its treasury in its native BIT token.

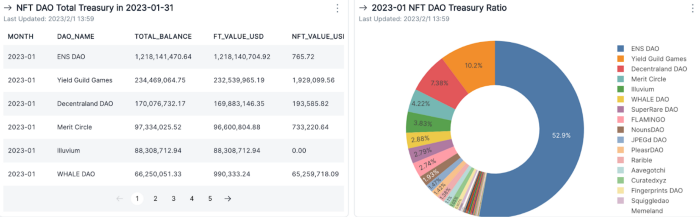

- NFT-based DAOs are also booming: Following the NFT frenzy in 2021, the niche has also enjoyed a fair share of DAO participation. The total volume of NFT-related DAO organizations is $2.3 billion, with the top 15 organizations accounting for more than 95% of the total volume. Similar to DeFi DAOs, NFT-centric DAOs also hold a huge part of their portfolio in their native token.

Mia Bao, co-founder of ThePASS commented:

"DAO treasury is a key reflex of how the DAO has grown and evolved. By unlocking the data of it, we feel super amazed how clear it is who is the real hardcore player."

Meanwhile, there is a rise in the number of collector DAOs, such as WHALE DAO, FLAMINGO, Curatedxyz, and Fingerprints DAO. In terms of collected value, NFT DAOs prefer works from artists like X COPY, Pak, Snowfro, Tyler Hobbs, Dmitri Cherniak, Edward Snowden, Hackatao, Golid, Emilyxie, Torproject, Williamapan, and Josh Katzenmeyer.