2025 DAO Annual Report

DAO Treasuries and Landscape in 2025

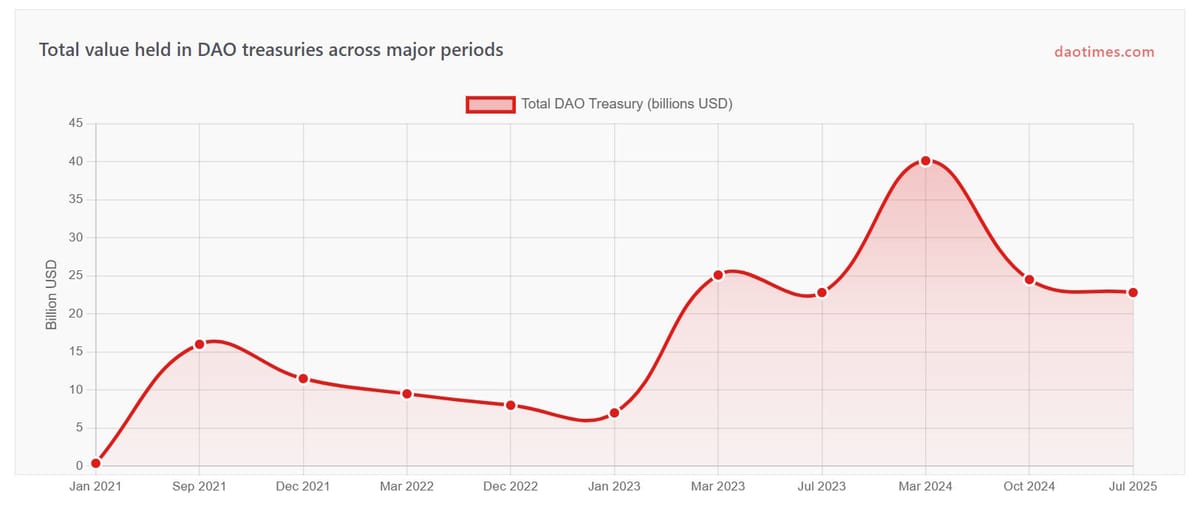

DAO treasuries experienced volatility through 2024-2025. After reaching $40.1 billion in March 2024, the total value dropped to $24.5 billion by October 2024. As of July 2025, DeepDAO reports treasury holdings at $22.8 billion across 21,362 DAOs.

The treasury concentration remains high. Just 123 DAOs manage over $1 million each, while only 2,311 DAOs have assets under management worth tracking. This represents a maturing ecosystem where larger, established protocols dominate the landscape.

Optimism Collective leads by treasury size at $3.8 billion, followed by Uniswap at $2.9 billion, Mantle at $2.7 billion, Arbitrum at $2.4 billion and GnosisDAO at $1.7 billion. These top five DAOs control the majority of total assets, reflecting the concentration of capital in Layer 2 infrastructure and major DeFi protocols.

The treasury composition tells an important story. Most DAOs hold predominantly their own governance tokens, creating risk from price volatility. Only 23% of DAOs held stablecoins as of mid-2024, while 85% store treasuries in a single asset. This lack of diversification exposes organizations to market downturns.

Real World Assets emerged as a treasury diversification solution. MakerDAO allocated $1 billion toward tokenized US Treasuries through BlackRock-Securitize, Superstate and Centrifuge. The broader RWA tokenization market reached $25-33 billion by October 2025, with private credit accounting for $16.8 billion and tokenized treasuries at $7.5 billion.

DAO categories expanded beyond DeFi. Infrastructure DAOs managing Layer 2 solutions now command the largest treasuries. Gaming DAOs like Yield Guild Games manage $520 million in digital assets. Media and content DAOs comprise 18% of organizations. Environmental and DeSci DAOs represent growing categories, with 500-600 sustainability-focused organizations operating globally.

DAO Treasury Evolution 2020 to 2025

DAO treasuries grew from $380 million in January 2021 to peak at $16 billion by mid-2021. The market experienced a downturn reaching $7 billion in early 2023, then recovered to $25 billion by March 2023 and $40 billion in March 2024 before settling around $22-25 billion through 2025.

Data: DeepDAO, ChainCatcher, CCN.com October 2024-July 2025

Top 15 DAOs by Treasury Value

| Rank | DAO Name | Treasury Value | Primary Assets | Category |

|---|---|---|---|---|

| 1 | Optimism Collective | $3.8B | OP, ETH, USDC, USDT | Infrastructure |

| 2 | Uniswap DAO | $2.9B | UNI | DeFi |

| 3 | Mantle DAO | $2.7B | MNT, USD, ETH | Infrastructure |

| 4 | Arbitrum DAO | $2.4B | ARB, ETH | Infrastructure |

| 5 | Gnosis DAO | $1.7B | GNO | DeFi |

| 6 | ENS DAO | $1.1B | ENS, ETH | Infrastructure |

| 7 | The Graph DAO | $1.0B | GRT | Infrastructure |

| 8 | dYdX DAO | $743M | DYDX | DeFi |

| 9 | Yield Guild Games | $520M | YGG, gaming NFTs | Gaming |

| 10 | Aevo DAO | $489M | AEVO | DeFi |

| 11 | Lido DAO | $479M | LDO | DeFi |

| 12 | DeXe Protocol | $348M | DEXE | DeFi |

| 13 | Compound DAO | $280M | COMP | DeFi |

| 14 | MakerDAO | $250M+ | MKR, DAI, RWA | DeFi |

| 15 | Solana DAO Ecosystem | $700M+ | SOL, derivatives | Multiple |

Layer 2 infrastructure DAOs dominate with Optimism, Arbitrum and Mantle in the top five. Uniswap remains the largest DeFi-focused DAO. Gaming and media categories show growing treasury sizes. Note that MakerDAO figures exclude its substantial USDC and DAI holdings in the peg stability module.

Data: ChainCatcher, CCN.com, DAO Times October 2024

Treasury Composition and Asset Holdings

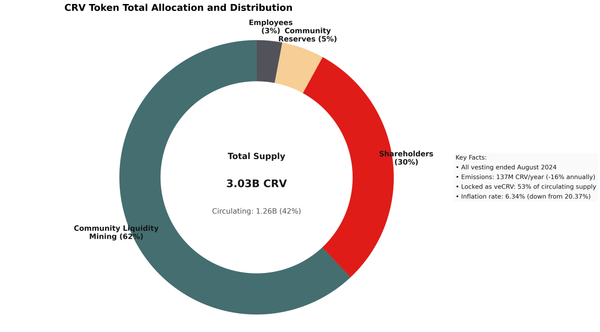

Treasury composition reveals how DAOs manage their assets. The data shows most organizations heavily favor their native governance tokens, creating concentration risk.

Token Holdings Patterns

Uniswap holds 99% of its treasury in UNI tokens, valued at $2.9 billion. This creates exposure to token price movements. Gnosis, Maker and similar protocols also maintain over 99% native token holdings. Only 23% of DAOs hold stablecoins for stability.

ENS DAO demonstrates partial diversification with substantial ETH holdings alongside its ENS tokens. Users pay ETH for domain registrations, naturally building this reserve. Lido DAO holds LDO tokens plus ETH from liquid staking operations, with DAI as its third-largest asset.

MakerDAO presents a unique case with RWA integration. Beyond MKR tokens, the treasury holds USDC and DAI in the peg stability module. The DAO allocated $1 billion across tokenized US Treasuries: $500 million to BlackRock-Securitize, $300 million to Superstate and $200 million to Centrifuge.

Diversification Strategies

Smaller DAOs with treasuries under $125 million tend to hold stablecoins more frequently. The treasuries of Aave, Maker, API3 and Yearn consist of 95% stablecoins after excluding protocol native assets. This provides stability during market downturns.

Blue-chip cryptocurrency holdings offer another diversification path. Many DAOs hold ETH for gas fees on Ethereum and Layer 2 networks. Some maintain BTC for long-term value storage. Staked tokens like stETH provide yield while maintaining exposure to base assets.

Data: DeepDAO treasury analysis, Bankless DAO research 2024

Real World Assets in DAO Treasuries

Tokenized Real World Assets provide DAOs with stable yield opportunities beyond volatile crypto markets. The RWA market reached $25-33 billion by October 2025, with institutional players actively participating.

Tokenized US Treasuries

US Treasury tokenization grew 415% from $775 million in 2024 to nearly $4 billion in early 2025. Projections estimate $28 billion by year-end 2025. These products offer 24/7 trading and fractional ownership of government debt.

BlackRock's BUIDL fund, Franklin Templeton's BENJI and Ondo's USDY token enable DAOs to earn 4-5% APY on treasury reserves. Settlement occurs in real-time rather than traditional T+2 cycles. This reduces counterparty risk and frees capital.

Private Credit Tokenization

Private credit reached $16.8 billion in tokenized form. Figure tokenized over $12 billion in home equity lines of credit. Apollo and Maple Finance operate on-chain credit vaults. Centrifuge channeled $220 million through MakerDAO with transparent lending conditions.

Private credit offers higher yields than treasuries but requires careful risk management. DAOs can now access asset classes previously limited to institutional investors. This democratizes lending markets while providing steady returns.

Real Estate and Commodities

Real estate tokenization reached approximately $80 million in assets. Propchain launched the first DAO dedicated to tokenized real estate. Token holders vote on platform development and asset selection. DAMAC initiated a $1 billion real estate tokenization project.

Corporate bonds and commodities joined the tokenized mix. Siemens issued bonds on distributed ledger with two-hour settlement. Tokenized gold provides hedging against crypto volatility. These assets offer diversification beyond digital-native holdings.

Data: rwa.xyz, XBTO, Brickken RWA Report October 2025

DAO Categories and Sector Distribution

The DAO ecosystem expanded beyond DeFi into diverse sectors. Each category serves different purposes with varying treasury strategies.

Infrastructure DAOs

Layer 2 protocols command the largest treasuries. Optimism ($3.8B), Arbitrum ($2.4B) and Mantle ($2.7B) allocate funds for ecosystem grants, developer incentives and network growth. ENS DAO ($1.1B) and The Graph ($1.0B) support decentralized infrastructure services.

DeFi Protocol DAOs

DeFi remains the largest category. Uniswap ($2.9B) governs the leading decentralized exchange. MakerDAO manages DAI stablecoin issuance and RWA integration. Aave, Compound and Lido operate lending and staking protocols. These DAOs earn revenue from protocol fees.

Gaming DAOs

Yield Guild Games manages $520 million in gaming assets and NFTs. The organization operates as a guild helping players earn through play-to-earn games. Gaming DAOs invest in virtual land, in-game items and player scholarships.

Media and Content DAOs

Media DAOs represent 18% of organizations. Bankless DAO produces DeFi educational content with member voting on editorial decisions. These organizations pool resources for content creation, event hosting and community building.

Environmental and DeSci DAOs

Environmental DAOs grew to 500-600 organizations globally. KlimaDAO and Toucan focus on carbon credit tokenization. DeSci DAOs fund scientific research through decentralized governance. Charity DAOs like Giveth distributed over $35 million to social causes in 2025.

Data: CoinLaw DAO statistics, DeepDAO 2025

Historical Context and Market Cycles

DAO treasuries followed crypto market cycles closely. The 2021 bull market drove explosive growth. The subsequent bear market tested organizational resilience. Recovery began in 2023-2024 before stabilizing in 2025.

2021 Bull Market Expansion

DAO treasuries grew from $380 million in January 2021 to $16 billion by September 2021, representing 40-fold expansion. By year-end, the total reached $11.5 billion. Uniswap and BitDAO each commanded $2+ billion treasuries.

The growth stemmed from token price appreciation and new DAO formations. DeFi protocols generated revenue from trading fees and lending interest. Layer 2 networks launched with substantial token allocations for ecosystem development.

2022-2023 Bear Market

Treasury values plummeted during the crypto winter. Total holdings dropped from $15 billion to $7 billion by early 2023. Token price declines directly impacted DAOs holding primarily native assets. Organizations faced difficult choices about spending priorities.

Some DAOs dissolved due to treasury depletion. Others implemented cost-cutting measures. The downturn revealed risks of holding undiversified treasuries. Protocols with stablecoin reserves weathered the period more successfully.

2023-2025 Recovery

Recovery began in March 2023 when treasuries crossed $25 billion. Layer 2 DAOs emerged as major players with Arbitrum, Optimism and Polygon launching tokens. By March 2024, total value reached $40.1 billion.

The subsequent stabilization saw treasuries settle around $22-25 billion through mid-2025. This represents maturation rather than decline. Organizations focused on sustainable operations, revenue generation and strategic treasury management rather than pure token appreciation.

Data: DeepDAO historical data, Messari, Cointelegraph 2021-2025

Frequently Asked Questions

Sources and References

DeepDAO - Primary DAO analytics platform tracking 21,362 DAOs with treasury data, governance metrics and organizational statistics through July 2025.

ChainCatcher - DAO treasury value reporting showing decline from $37 billion in March to $24.5 billion in October 2024 with top DAO rankings.

CCN.com - DAO treasury analysis published March 2024 documenting $40.1 billion peak valuation and top DAO breakdowns.

rwa.xyz - Real World Asset market tracking showing $33.84 billion in tokenized assets as of October 2025 including treasuries and private credit.

XBTO and Brickken - Institutional RWA tokenization reports covering treasury allocation strategies, market projections and asset class breakdowns.

Bankless DAO - Treasury composition analysis examining asset holdings, diversification patterns and stablecoin usage across major DAOs.

CoinLaw - DAO statistics covering category distribution, gaming DAOs, media organizations and environmental projects published August 2025.

Cointelegraph - Historical DAO treasury data from 2021-2023 tracking growth cycles, peak valuations and bear market impact.

Messari - DAO treasury holdings analysis from 2021 examining composition, native token concentration and top protocol rankings.

DAO Times - Weekly newsletter tracking DAO treasury changes, new organizations and ecosystem developments through 2023-2025.