Tally DAO Tool Report For 2025

What is Tally and Why It Matters in 2025

Tally stands as the industry standard for on-chain governance. The platform enables decentralized autonomous organizations to create proposals, vote, delegate power, and manage treasuries. Founded in 2014 and based in New York City, Tally powers governance for over $31 billion in protocol value across Ethereum and other EVM chains.

DAOs use Tally because it integrates with OpenZeppelin Governor contracts. These contracts are battle-tested and secure. The platform serves as the frontend interface where community members participate in real governance. Tally processes more on-chain proposals than any competing platform, managing over 200,000 delegations since inception.

In 2025, Tally manages governance for leading protocols including Arbitrum, Uniswap, ZKsync, Wormhole, EigenLayer, Obol, and Hyperlane. The platform's CEO, Dennison Bertram, has positioned Tally as infrastructure for credibly neutral protocol governance. Users can create proposals, vote on decisions, and execute transactions directly on the blockchain without intermediaries.

Major 2025 Developments at Tally

Series A Funding and Growth

Tally raised $8 million in Series A funding in April 2025. AppWorks and Blockchain Capital led the round, with participation from BitGo, 1kx, CyberFund, Placeholder, Bloccelerate, Notation, MetaWeb Ventures, and Collab+Currency. This brings total funding to $15.69 million across three rounds.

The funding addresses low voter participation in DAOs through economic incentives. Tally introduced liquid staked governance tokens that reward active participants. Token holders can now earn yields while maintaining voting rights. This solves the previous dilemma where users chose between DeFi rewards or governance participation.

Security Audit Completed

In February 2025, Sherlock completed a security audit of Tally's Governance Staking System. The audit team included renowned security specialists who examined the Staker system architecture and codebase. Results confirmed secure implementation with only low-level optimizations needed. Tally addressed all identified issues with documented solutions available on GitHub.

The audit reinforces Tally's position as a trusted partner for protocol governance managing over $60 billion in assets. This security milestone matters because DAOs require reliable infrastructure to protect their treasuries and voting systems.

New Chain Integrations

Tally expanded to Flow Chain and Viction Chain in early 2025. Flow brings its unique blockchain architecture to Tally's governance toolkit. Viction Chain adds another option for DAOs seeking specific technical features. These integrations allow DAOs to operate governance on chains beyond Ethereum mainnet and major Layer 2 networks.

Protocol Launches

The Obol Collective launched their governance token with Tally in February 2025. Tally worked with the team to create a two-house governance system for proof-of-stake infrastructure. Adventure Gold (AGLD) also launched governance through Tally, bringing gaming and NFT communities into decentralized decision-making.

How Tally Works: Core Features

On-Chain Proposal System

Users create proposals through Tally's interface. The platform offers no-code proposal creation tools. Anyone can draft a proposal, simulate its execution, and check for errors using Diff Checker. Proposals include executable code that runs automatically when passed.

The system supports arbitrary executables. This means proposals can do anything a smart contract can do: transfer funds, upgrade protocols, change parameters, or modify governance rules. MEV protection ensures treasury swaps execute safely without front-running attacks.

Voting and Delegation

Token holders vote directly or delegate voting power to representatives. Delegates build profiles showing their values, past activity, and external accounts. This helps token holders make informed delegation choices. The platform tracks all votes on-chain for transparency.

Tally introduced Relay in 2024, allowing DAOs to sponsor gas fees for members. This removes financial barriers to participation. Users on Layer 2 networks typically pay cents in gas fees instead of dollars.

MultiGov for Cross-Chain Governance

Tally partnered with Wormhole to build MultiGov. This system lets DAO members govern from any supported chain. A user on Arbitrum can vote on a proposal that affects Ethereum mainnet contracts. This lowers barriers and reaches users across different networks.

Tally Protocol and Liquid Staking

The Tally Protocol creates liquid staked tokens (tLSTs) for governance tokens. Users stake tokens and receive tLSTs that earn rewards while maintaining voting power. These tLSTs work in DeFi protocols and restaking systems. Token holders no longer choose between earning yields or participating in governance.

The protocol includes auto-delegation features. When tLSTs sit in DeFi or cold storage, their voting power activates through backup delegates. This keeps governance secure even when tokens are locked. Each DAO controls its own tLST parameters to align with protocol goals.

Tally Market Position in 2025

Data: Tally platform metrics, CoinDesk reports, L2BEAT governance reviews

Tally powers 10 times more on-chain DAOs than competing platforms. The service manages $31 billion in protocol value as of 2025. This represents protocols across DeFi, infrastructure, and Layer 2 networks. Over $661 million has transferred through Tally proposals since inception.

Major protocols choose Tally for its proven track record. Arbitrum uses Tally for Security Council elections managing its billion-dollar ecosystem. Uniswap processes governance votes through Tally's interface. The platform handles thousands of proposals annually with reliable execution.

| Protocol | Governance Value | Use Case | Launch Date |

|---|---|---|---|

| Arbitrum | $18B TVL | Layer 2 Governance & Security Council | March 2023 |

| Uniswap | $5.4B TVL | DEX Protocol Governance | 2020 |

| ZKsync | $120M TVL | Community Funding & Upgrades | 2024 |

| Wormhole | Cross-chain | Multichain Governance with MultiGov | 2024 |

| EigenLayer | $11B TVL | Restaking Protocol Governance | 2024 |

| Obol Collective | Proof-of-Stake | Two-House Governance System | February 2025 |

Data: Protocol documentation, TVL data from DefiLlama, Tally newsletter

Tally vs Competitors: Platform Comparison

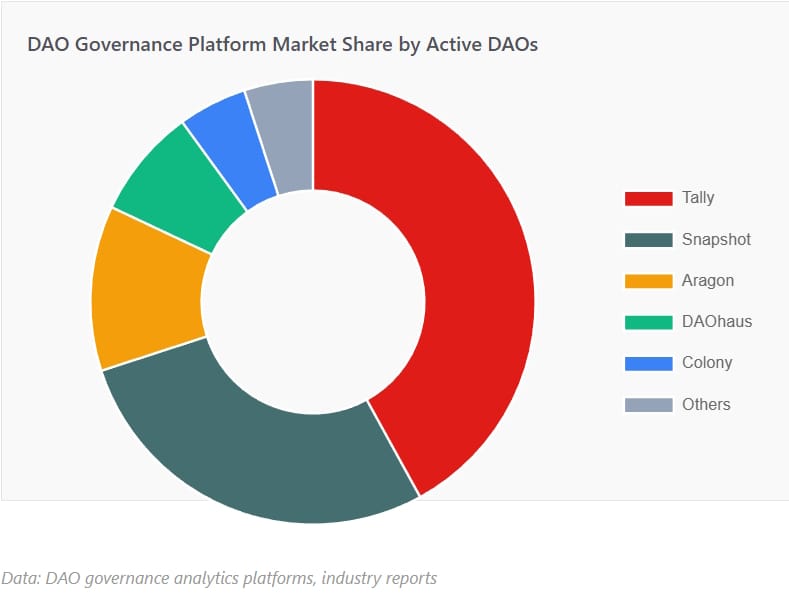

Data: DAO governance analytics platforms, industry reports

Tally Strengths

Tally excels at on-chain execution. Every vote and proposal lives on the blockchain with full transparency. The platform integrates deeply with OpenZeppelin Governor, the most audited governance framework. Tally offers complete DAO operations from token launch to treasury management.

The platform's liquid staking protocol sets it apart. No competitor offers integrated staking that maintains voting power while earning yields. Tally also provides white-label solutions with custom domains. Large protocols get dedicated support and infrastructure.

Snapshot Comparison

Snapshot operates off-chain, making votes gasless. This reduces costs but sacrifices automatic execution. Snapshot works well for signaling and temperature checks. Many DAOs use Snapshot for preliminary votes, then Tally for binding on-chain execution.

Snapshot saw 45% usage growth in 2025 alongside Tally. The platforms serve different needs. Snapshot fits cost-conscious communities making frequent decisions. Tally suits protocols managing real assets and requiring enforceable outcomes.

Aragon Position

Aragon offers a full DAO framework with customizable governance. The platform provides dispute resolution and treasury tools. Aragon 3.0 introduced enhanced security and cross-chain capabilities in 2025. However, Aragon targets smaller DAOs building from scratch.

Tally focuses on mature protocols with existing tokens. The platform works with DAOs managing billions in value. Aragon suits new communities experimenting with governance structures. Both platforms saw increased adoption as DAO tooling matured.

| Feature | Tally | Snapshot | Aragon | DAOhaus |

|---|---|---|---|---|

| Execution Type | On-chain | Off-chain | On-chain | On-chain |

| Gas Fees | Yes (L2: ~$0.15-$0.30) | No (gasless) | Yes | Yes |

| Liquid Staking | Yes (tLST protocol) | No | No | No |

| Custom Branding | Yes (white-label) | Limited | Yes | Limited |

| Treasury Value | $31B+ | $10B+ | $8B+ | $2B+ |

| Best For | Large protocols | Quick polling | New DAOs | Grant DAOs |

Data: Platform documentation, governance analytics, market research reports

Governance Metrics and Participation in 2025

Data: On-chain governance analytics, protocol-specific metrics

DAO voter participation averages 17% across the ecosystem in 2025. Leading DAOs on Tally reach 22-28% turnout for major proposals. Arbitrum's Security Council elections and Uniswap's treasury decisions see higher engagement. Lower-priority proposals typically get 10-15% participation.

Tally's liquid staking aims to improve these numbers. Early pilots show 12% increases in voter turnout when economic incentives activate. Token holders participate more when they earn rewards for governance work. This addresses the historical problem of apathy in DAO decision-making.

The top 50 delegates in major DAOs control 56% of voting power. This concentration creates efficiency but raises decentralization concerns. Tally's delegate profiles and transparency features help smaller token holders make informed choices. The platform tracks delegate activity, voting records, and forum participation.

| Metric | 2023 | 2024 | 2025 | Change |

|---|---|---|---|---|

| Total DAOs on Platform | 450 | 580 | 720 | +24% |

| Governance Value Managed | $22B | $28B | $31B | +11% |

| Active Delegates | 280K | 350K | 434K | +24% |

| Proposals Created | 12,500 | 16,800 | 21,000 | +25% |

| Average Participation Rate | 14% | 15% | 17% | +2pts |

| Supported Blockchains | 12 | 15 | 17 | +2 |

Data: Tally platform metrics, on-chain analysis, governance research reports

Security and Infrastructure

Audit Results and Security Practices

Tally's February 2025 security audit by Sherlock examined the Staker system. The team found no problems with private key management, system design, or critical vulnerabilities. Code quality received high marks for organization and best practices. Documentation aids security researchers in understanding intended functionality.

The platform builds on OpenZeppelin Governor contracts. These contracts have undergone extensive audits across multiple years. Tally adds a user-friendly layer without modifying core security properties. All proposal execution happens through audited, time-tested smart contracts.

No major security incidents affected Tally in 2025. The platform experienced minor connectivity issues in August affecting UK customers on specific ISPs. These resolved within 48 hours. Email notifications faced a brief disruption in July due to provider issues, restored the same day.

Infrastructure Scalability

Tally's architecture handled 235,000 concurrent eligibility checks during the Hyperlane HYPER token launch. The system maintained performance without degradation. Over 95% of users paid less than $1 in claim fees across multi-chain distribution.

The platform operates across Ethereum mainnet and 16 additional chains. Layer 2 networks like Arbitrum, Optimism, Base, and Polygon provide low-cost governance. Cross-chain support through MultiGov allows unified governance across multiple networks.

Data: Tally platform analytics, blockchain network statistics

Pros and Cons of Using Tally

Advantages

Proven at Scale: Tally manages $31 billion across leading protocols. The platform has processed thousands of proposals without major incidents. Large DAOs trust Tally with treasury operations and protocol upgrades.

Complete Governance Stack: Users get token launches, proposals, voting, delegation, and staking in one platform. The API allows integration into custom applications. White-label solutions provide branded experiences.

Liquid Staking Innovation: The tLST protocol solves a core DAO problem. Token holders earn yields while maintaining governance rights. This incentivizes participation and strengthens protocol security.

Multi-Chain Support: Tally works across 17 blockchains including Ethereum, Solana, and major Layer 2 networks. MultiGov enables true cross-chain governance. DAOs reach users wherever they operate.

Developer-Friendly: The public API provides access to DAO data, proposals, and delegates. Documentation supports integration projects. Open-source components allow community contributions.

Disadvantages

Gas Costs: On-chain voting requires transaction fees. While Layer 2 networks reduce costs to $0.15-$0.30, frequent voting still accumulates expenses. Snapshot offers gasless alternatives for signaling.

Complexity for Small DAOs: Tally targets protocols with existing tokens and governance needs. New communities might find the platform overwhelming. Simpler tools like DAOhaus or Colony suit smaller groups.

Delegate Concentration: Top delegates control majority voting power across DAOs. This creates efficiency but reduces decentralization. Tally provides transparency but cannot force power distribution.

Learning Curve: Understanding proposals, delegation, and voting mechanics takes time. Non-technical users may struggle with smart contract execution concepts. Education resources help but entry barriers exist.

Platform Dependence: While built on decentralized contracts, Tally provides centralized interface services. The company's continued operation matters for user experience. However, core governance remains on-chain even if Tally disappears.

Use Cases and Real-World Applications

Protocol Upgrades and Parameter Changes

Arbitrum uses Tally for Security Council elections every six months. The council handles emergency responses to protect $18 billion in total value locked. In 2024, the council fixed a sequencer bug protecting $100 million across dApps. A 2025 proposal expanded council powers to handle Layer 3 chain emergencies.

Uniswap processes protocol upgrade decisions through Tally. The DAO voted on v4 features, fee structures, and cross-chain deployments. Monthly trading volume of $170 billion makes governance decisions material to users and liquidity providers.

Treasury Management

ZKsync manages community funding through Tally proposals. The DAO allocates resources for development, grants, and ecosystem growth. Proposals specify exact fund transfers with on-chain execution. No manual intervention occurs after approval.

DAOs on Tally have transferred over $661 million through governance proposals. MEV protection ensures treasury swaps execute at fair prices. No-code transfer tools allow non-technical teams to propose fund movements.

Token Launches

Hyperlane launched HYPER tokens across five blockchains simultaneously using Tally. The platform handled native multichain deployment through Hyperlane's Warp Asset framework. Users claimed tokens on Ethereum, Arbitrum, Base, Optimism, and BNB Chain. Liquid staking (stHYPER) launched concurrently.

The Obol Collective used Tally to launch governance tokens with a two-house system. This structure suits proof-of-stake infrastructure where different stakeholder groups need representation. Tally provides the technical implementation for complex governance designs.

Integration with Other DAO Tools

Tally works alongside broader DAO infrastructure. The platform integrates with Gnosis Safe for treasury management. Proposals can execute actions on Safe multisigs. This provides security through multiple signatures while maintaining DAO control.

Snapshot integration allows temperature checking before on-chain votes. Communities poll sentiment through Snapshot's gasless voting. Popular proposals then move to Tally for binding execution. This two-stage process saves gas costs while maintaining legitimacy.

Communication happens through Discord, Telegram, and governance forums. Tally's API enables notification bots. When proposals activate, delegates receive alerts. When votes close, results post automatically. This connects on-chain governance to off-chain coordination.

Analytics platforms like DeepDAO and DAOlytics track Tally governance metrics. These services provide dashboards showing participation trends, proposal outcomes, and delegate performance. Tally's public API makes this data accessible for third-party analysis.

For those exploring the ecosystem, resources like comprehensive DAO lists help discover organizations using Tally for governance. The platform serves both well-known protocols and emerging projects building decentralized structures.

Getting Started with Tally

For Token Holders

Visit tally.xyz and connect your wallet. The interface shows DAOs where you hold governance tokens. Browse active proposals to understand current decisions. Read proposal details including executable code and discussion links.

Delegate your voting power to an active participant. Search delegate profiles to find representatives aligned with your values. Delegation takes one transaction. You can change delegates anytime. Alternatively, vote directly on every proposal.

Consider staking tokens through Tally Protocol where available. Stake to earn rewards while maintaining voting rights. The liquid staked token (tLST) works in DeFi protocols. Unstaking is instant without lock-up periods.

For DAO Operators

Contact Tally for Governance Launcher services. The platform deploys Governor and Timelock contracts. Tally advises on governance parameters like proposal thresholds, quorum requirements, and voting periods. Custom domains provide branded experiences.

Launch tokens through Tally's infrastructure. Configure airdrops, initial distributions, and vesting schedules. Deploy across multiple chains simultaneously. Integrate staking from day one to incentivize participation.

Use the public API to build custom governance interfaces. Access DAO data, proposal information, and delegate metrics. Integrate governance into your application or game. Documentation provides implementation examples.

For Developers

Explore Tally's GitHub repositories. The organization maintains open-source governance contracts and tools. Contribute to projects like Tally Zero, a minimal-dependency voting application. Review audit reports and technical documentation.

Build on the Tally API to create governance analytics, notification systems, or voting interfaces. The API returns structured data about DAOs, proposals, and votes. Rate limits allow reasonable usage for public goods.

Future Roadmap and Industry Trends

Tally plans to expand liquid staking across more protocols. The tLST protocol launched for select DAOs in 2024. Wider deployment could activate dormant governance tokens worth billions. This addresses security concerns where voting power sits locked in DeFi.

Regulatory clarity in the United States opens opportunities for institutional DAO participation. Organizations that depend on blockchain infrastructure will want governance rights. Tally positions itself as enterprise-grade infrastructure for these participants.

Cross-chain governance through MultiGov continues evolving. As Layer 2 networks and alternative Layer 1 chains grow, DAOs need unified governance. Tally's partnerships with Wormhole and Hyperlane enable communication between chains. Future versions may support even more networks.

AI integration represents an emerging trend. Tally's MCP server enables AI agents to interact with DAO governance. This allows automated analysis of proposals, voting patterns, and delegate behavior. AI tools could help voters make informed decisions at scale.

The DAO market collectively manages $24.5 billion across 13,000 organizations with 11.1 million governance token holders. Growth continues at roughly 30% annually. Tally captures the largest protocols in this expanding ecosystem. As DAOs mature, demand for reliable governance infrastructure increases.

FAQ

Sources

Company Information: Tally.xyz official website, Tally Newsletter, Tally GitHub repositories, Tally documentation

Financial Data: CoinDesk - On-Chain Governance Provider Tally Raises $8M Series A (April 2025), Business Wire - Tally Unveils New Liquid Staked Governance Protocol (June 2024), Tracxn Company Profile

Technical Analysis: Tally Docs - Governance Launcher, Staking Documentation, Liquid Staking specifications, Sherlock Security Audit Report (February 2025)

Market Research: Stablecoin Insider - Best DAO Tools for 2025, Markaicode - DAO-as-a-Service Platforms Compared, HeLa - List of DAO Tools, Sablier - DAO Governance Voting Tools Guide

Industry Statistics: CoinLaw - Decentralized Autonomous Organizations Statistics 2025, L2BEAT Governance Reviews, DeepDAO analytics

Protocol Information: Arbitrum DAO documentation, Uniswap governance forum, TheStandard.io - Arbitrum Deep Due Diligence Report, Medium - Arbitrum's Governance Model

Competitive Analysis: Cross-Comparing DAO Governance Models - Aragon vs DAOstack vs Snapshot, DAO Tools Comparison focusing on DeFi use cases