Swiss Web3 Wallet THORWallet Rolls Out USDC Cashback Program After Record Trading Activity

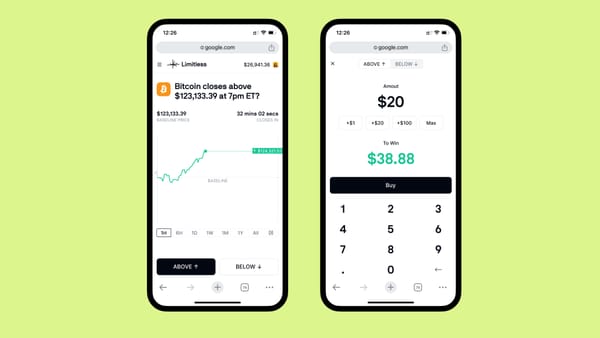

THORWallet, a Switzerland-based cryptocurrency wallet, has announced the launch of TITN, a utility token that provides USDC cashback rewards for users executing DeFi swaps and transactions. According to Cointelegraph, the token represents a loyalty cashback mechanism that directly links platform activity with user rewards. TITN holders receive reduced fees across various services and earn USDC rewards when trading through the platform.

The wallet supports multisignature functionality and collaborative asset management across multiple devices on mobile platforms. THORWallet founder Marcel Harmann stated the platform serves DAOs, institutions, retail users, and large traders through its combination of multisignature capabilities, cross-chain liquidity, and DeFi accessibility. The utility token launch accompanies a Mastercard debit card that enables cryptocurrency spending in over 70 countries, converting digital assets to fiat currencies including Swiss franc, US dollar, euro, and Chinese yuan.

Record Trading Volume Drives Platform Growth

THORWallet generated over $450 million in trading volume during 2025, contributing to cumulative totals exceeding $1.1 billion across mobile and web interfaces. More than 1,350 large transactions above $100,000 occurred this year, with the largest individual trade involving 150 BTC exchanged for $8.7 million USDC. These activities produced over $900,000 in protocol fees, demonstrating sustained usage by high-value participants.

FinanceFeeds reports that USDC cashback programs have emerged as a competitive trend among cryptocurrency platforms in 2025. Bybit introduced similar USDC reward mechanisms for cardholders in April 2025, targeting user loyalty in an increasingly saturated market. The move reflects a broader industry shift toward stablecoin-based incentives that provide stable value during market volatility periods.

According to Circle, USDC circulation grew more than 78% year-over-year, faster than other major global stablecoins. Monthly transaction volume reached $1 trillion in November 2024 while surpassing $18 trillion in cumulative volume. The stablecoin now serves more than 500 million end-user wallet products through expanding partnerships with exchanges, banks, and wallets.

DeFi Cashback Mechanisms Gain Traction

CryptoPotato identifies cashback and reward mechanisms as emerging DeFi trends in 2025, enhancing liquidity and driving broader adoption of decentralized applications. These systems transform traditional holding strategies into active participation models where users earn while engaging with protocols. USDC's programmable nature enables developers to create automated reward distribution systems that operate transparently on blockchain networks.

Cross-chain functionality represents another key development area for DeFi platforms. Messari data shows THORChain processed $4.66 billion in swaps during the week ending March 2, 2025, demonstrating demand for cross-chain trading solutions. THORChain enables native asset swaps between Bitcoin, Ethereum, and other blockchains without requiring wrapped tokens or centralized intermediaries.

The platform's growth coincides with increased institutional interest in cross-chain DeFi solutions. 99Bitcoins reports USDC staking rewards range from 3.68% to 10.88% across major platforms, with Binance offering the highest annual percentage rates. These yield opportunities attract institutional capital seeking stable returns without exposure to volatile cryptocurrency price movements.

Market Context And Future Implications

THORWallet's USDC cashback program launches amid broader cryptocurrency market developments favoring utility-focused tokens and real-world applications. The platform's selection for the Cointelegraph Accelerator program and features in CoinMarketCap sessions with over 219,000 listeners indicate growing recognition of functional DeFi solutions that prioritize infrastructure over speculation.

DL News predicts traditional financial institutions will transition to blockchain-based systems faster than expected in 2025. The favorable regulatory environment under current US administration policies may accelerate institutional adoption of DeFi protocols with strong security and compliance records. This trend could benefit platforms like THORWallet that combine traditional financial features with decentralized infrastructure.

The success of USDC cashback programs may influence other DeFi platforms to implement similar reward mechanisms. Stablecoin-based incentives provide predictable value propositions compared to volatile cryptocurrency rewards, potentially attracting mainstream users seeking familiar financial experiences. THORWallet's integration of multisignature security, cross-chain functionality, and traditional payment methods positions the platform to serve both cryptocurrency-native users and institutions exploring decentralized finance applications.

Related Reading on DAO Times

For readers interested in understanding the broader ecosystem of decentralized tools and governance mechanisms, DAO Times offers a comprehensive guide to DAO tools for 2025. This detailed resource examines treasury management platforms, governance systems, and cross-chain interaction tools that enable decentralized organizations to operate effectively. The guide covers platforms like Aragon OSx, Safe multisignature contracts, and analytics tools that help DAOs make informed decisions about their operations and investments. Readers will gain insights into how modern DAOs utilize sophisticated toolsets to manage multi-million dollar treasuries, coordinate global contributors, and implement transparent governance processes that could influence the future of organizational structures.