Streamflow Finance DAO Tool Report For 2025

What Is Streamflow Finance

Streamflow Finance operates as a multichain token management platform. Founded in 2021, it serves over 5,000 Web3 projects across Solana, Aptos, and Sui blockchains. The platform reached 1.1 million users in 2024. Jump Crypto led its $3.1M seed funding round. Total funding stands at $8.1M from 26 investors including Amber Group and GBV Capital.

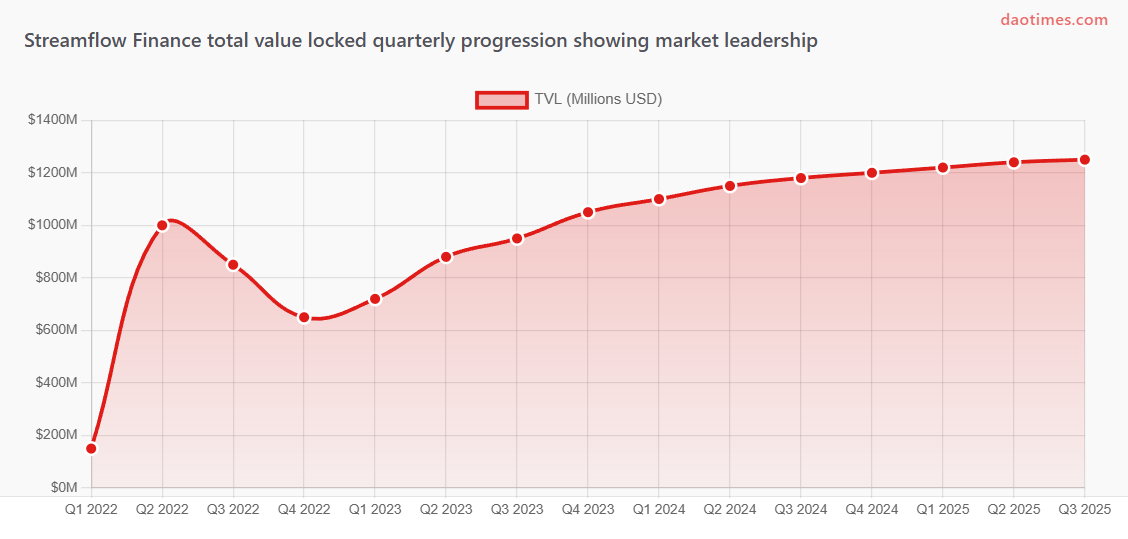

Streamflow accumulated over $1.2 billion in total value locked (TVL) by late 2024. In Q2 2022, the platform became the market leader in token vesting on Solana with $1 billion TVL. The company maintains headquarters in Tortola, British Virgin Islands with a distributed team of 17 employees. Founded by CEO Mališa Stanojević, it expanded to multiple blockchain ecosystems within three years.

The platform launched its STREAM governance token on December 17, 2024. Token holders can stake for rewards and vote on protocol upgrades. The token trades on Bybit, MEXC, and Gate exchanges with a market cap around $22M as of December 2025. It operates as both governance and utility token within the ecosystem.

Streamflow competes with platforms like Sablier, Zebec, Superfluid, and LiquiFi in the token streaming space. However, it differentiates through multichain support and comprehensive feature sets. The platform underwent audits by FYEO, OPCODES, OtterSec, and MoveBit across different chains. These security reviews confirm the reliability of its smart contracts.

Streamflow Finance Core Features And Use Cases

Token vesting allows projects to create customizable schedules for investors and team members. Linear and non-linear distributions ensure proper token release timing. The system supports cliff periods and multiple recipient management. Over $1 billion has been vested through the platform since launch.

Airdrop campaigns can reach up to 1 million recipients through the platform. Projects choose between instant or vested token distributions. The system handles bulk recipient management and CSV file uploads. Major projects like Bonk and Whales Markets used these tools for their token launches.

Token locks secure liquidity pool tokens and standard tokens until specified dates. The feature builds community trust by proving long-term commitment. Projects can create time-based locks with transparent on-chain verification. Public dashboards display all locked tokens for community review.

Programmable payments automate recurring transfers for payroll and contractor payments. The system reduces gas fees by requiring only one transaction setup. Recipients receive tokens automatically based on predetermined schedules. This eliminates manual payment processing for DAOs and companies.

Staking-as-a-service lets projects create custom staking pools in minutes. Communities can stake any Solana, Aptos, or Sui token through the platform. Projects customize APY rates and reward distribution parameters. The service saves development time and operational costs for token projects.

Token minting creates and issues new tokens without coding knowledge. The no-code interface guides users through the creation process. Projects can launch tokens on supported blockchains within minutes. This democratizes token creation for non-technical teams.

Streamflow Finance Multichain Blockchain Support Comparison 2025

| Blockchain | Launch Year | Audit Firm | Key Features | Programming Language |

|---|---|---|---|---|

| Solana | 2021 | FYEO, OPCODES | Full Suite | Rust |

| Aptos | 2022 | OtterSec | Vesting, Locks, Payments | Move |

| Sui | 2023 | MoveBit | Vesting, Locks, Payments | Move |

| EVM Chains | 2024 | FYEO | Core Features | Solidity |

Data: Streamflow documentation and audit reports 2021-2025

What Changed For Streamflow Finance In 2025

Price-based token locks launched in March 2025 as a major platform update. Users set price targets instead of fixed unlock dates. Tokens unlock automatically when market conditions reach specified prices. The system checks prices every minute for real-time accuracy. This removes rigid timeframes from token management. Teams can now align unlocks with market performance rather than arbitrary dates.

Lock Wars Season 2 began in 2025 as a gamified competition. Projects compete by locking tokens to earn STREAM rewards. The top 20 tokens by TVL share up to 1M STREAM tokens. First place receives 30% of the prize pool. The competition runs for limited periods with minimum one-month lock durations. Community participation drives project rankings on the leaderboard.

STREAM token staking rewards went live in early 2025. Protocol fees fund hourly buybacks for staker rewards. The system allocates protocol-generated fees toward dynamic rewards. Stakers participate in weekly governance votes. APY rates reached 36.62% based on 30-day averages with weekly compounding. This creates sustainable engagement tied to ecosystem activity.

The referral system launched to reward ecosystem growth. Users share referral codes and compete on leaderboards. Successful referrals earn STREAM token rewards. The system tracks conversions and ranks top referrers publicly. This incentivizes community-driven user acquisition and platform growth.

Sybil checker tools help projects detect wallet manipulation. The system analyzes addresses to identify single-entity control. Projects use it to block abuse in airdrops and voting. The tool prevents Sybil attacks on token distributions. This protects fair allocation across genuine community members.

Dust collector functionality helps Solana users reclaim rent. The tool identifies empty token accounts from past trades. Users recover SOL locked in unused accounts. This addresses a common pain point in the Solana ecosystem. The feature improves capital efficiency for active traders.

Streamflow Finance TVL Growth Pattern 2022-2025

Data: Streamflow Finance public data and Datawisp analytics 2022-2025

Streamflow Finance Competitive Position Analysis

Sablier operates primarily on Ethereum with focus on token streaming. It launched in 2019 and serves projects like Shapeshift and NounsDAO. The protocol raised $4.5M in seed funding during 2024. Sablier V3 remains in stealth development as of 2025. The platform emphasizes simplicity but lacks multichain support. DAO tooling ecosystems continue evolving with specialized platforms.

Zebec Network raised $35M across 41 investors including Coinbase Ventures. The platform processes real-time crypto payroll with compliance features. It expanded from Solana to Ethereum and layer-2 solutions. Zebec claims 250+ enterprise clients but hasn't disclosed transaction volumes. The platform acquired traditional payroll firms to bridge Web2 and Web3. Critics question actual adoption beyond marketing claims.

Superfluid focuses on programmable money streams for DeFi subscriptions. The protocol operates across multiple EVM chains. It serves decentralized applications with recurring payment needs. Superfluid hasn't entered regulated payroll markets. The platform maintains strong developer communities on Ethereum.

LiquiFi was acquired by Coinbase in July 2025 for undisclosed terms. The platform specialized in token compliance and tax withholdings. It served early-stage crypto projects with launch management tools. The acquisition validated the token management market opportunity. Coinbase integrated LiquiFi's technology into its institutional offerings.

Streamflow's multichain approach differentiates it from Ethereum-focused competitors. Support for Solana, Aptos, and Sui attracts projects in emerging ecosystems. The platform's comprehensive feature set covers vesting, locks, airdrops, and staking in one interface. This reduces the need for multiple service providers. Security audits across all chains build enterprise trust.

Streamflow Finance Feature Comparison With Major Competitors

| Platform | Founded | Funding | Chains Supported | Users | Key Strength |

|---|---|---|---|---|---|

| Streamflow | 2021 | $8.1M | 4+ (Multi-chain) | 1.1M | Full Suite |

| Sablier | 2019 | $4.5M | Ethereum | Not Disclosed | Simplicity |

| Zebec | 2021 | $35M | 3 (Solana, ETH, L2) | 250+ Enterprise | Compliance |

| Superfluid | 2020 | Not Disclosed | EVM Chains | Not Disclosed | DeFi Focus |

| LiquiFi | 2021 | Not Disclosed | Multiple | Not Disclosed | Acquired 2025 |

Data: Company announcements, PitchBook, CBInsights 2019-2025

Streamflow Finance Security And Trust Measures

Multiple security audits validate Streamflow's smart contracts across chains. FYEO audited Solana and EVM implementations. OPCODES provided additional Solana protocol review. OtterSec examined the Aptos codebase for vulnerabilities. MoveBit conducted comprehensive Sui protocol analysis. These firms represent top blockchain security companies.

Audit reports are publicly available on Streamflow's documentation site. Transparency allows projects to verify security measures before integration. The company addresses any findings before mainnet deployments. Regular re-audits occur when adding new features. This maintains security as the protocol evolves.

No major security incidents affected Streamflow through December 2025. The platform maintained a clean record during crypto market volatility. Competitors like Balancer suffered flash loan attacks in previous years. Streamflow's careful approach to security prevented similar issues. The distributed team monitors contracts continuously.

Public dashboards provide transparency for all token operations. Users verify vesting schedules and locked amounts on-chain. This builds trust with project communities and investors. Anyone can check contract statuses without platform access. Transparency differentiates Streamflow from opaque financial systems.

Multi-signature wallet support adds security layers for large operations. Projects require multiple approvals for sensitive transactions. This prevents single points of failure in treasury management. DAOs use this feature for decentralized fund control. The system supports custom threshold configurations.

Streamflow Finance Platform Usage Distribution By Service Type

Data: Streamflow Finance platform analytics 2024-2025

How To Use Streamflow Finance Platform

Connect your wallet to access Streamflow's application interface. Supported wallets include Phantom, Solflare, and Backpack for Solana. Aptos and Sui users connect through respective ecosystem wallets. The platform automatically detects your blockchain network. No account creation or email verification required.

Select your desired service from the left navigation menu. Options include vesting, airdrops, locks, staking, or token minting. Each service offers a streamlined setup wizard. The interface guides users through required parameters step-by-step. Most configurations complete in under five minutes.

For token vesting, upload recipient lists via CSV files. Define unlock schedules with cliff periods and release frequencies. Choose between linear or non-linear distribution curves. Preview the vesting schedule before confirming. The system creates individual contracts for each recipient.

Airdrop campaigns support up to 1 million recipients per distribution. Upload your allocation spreadsheet with wallet addresses and amounts. Select instant or vested distribution type. Configure any vesting parameters if applicable. The platform processes large batches efficiently within minutes.

Token locks require selecting the lock duration or price target. Enter the token amount and recipient wallet address. Choose between time-based or price-based unlock conditions. For price-based locks, set target price or FDV thresholds. Confirm the transaction and tokens lock immediately.

Staking pools take minutes to create with the no-code builder. Select your token and define reward parameters. Set APY targets and funding schedules. Customize the staking interface with your branding. Deploy the pool and share the link with your community.

Monitor all operations through the unified dashboard interface. Track vesting progress, lock statuses, and airdrop claims. Export reports for accounting and compliance purposes. The dashboard updates in real-time as transactions occur. Users access historical data for all past operations.

Streamflow Finance Token Distribution Model Breakdown

Data: Streamflow Foundation token documentation December 2024

Streamflow Finance Pricing Structure

Token vesting fees range from 0.19% to 0.25% of distributed amounts. The exact percentage depends on contract complexity and volume. Network fees apply separately for transaction processing. Solana transactions cost approximately 0.0247 SOL per contract. Higher volumes receive discounted rates through enterprise plans.

Token locks charge 0.09 SOL for contract creation on Solana. This covers rent for the on-chain account storage. Service fees add another 0.0247 SOL per lock transaction. Price-based locks use the same fee structure. No ongoing maintenance fees apply after initial setup.

Airdrop campaigns scale based on recipient count. Small distributions under 1,000 recipients have minimal fees. Large campaigns reaching millions receive volume discounts. The platform handles all distribution logistics for the flat fee. Gas optimization reduces costs compared to manual distributions.

Staking pool creation includes one-time setup fees. Monthly costs depend on pool size and reward distribution frequency. Enterprise customers negotiate custom pricing packages. Priority support comes with premium tier subscriptions. The team provides detailed quotes for large projects.

SDK integration remains free for developers and projects. Teams access full functionality through the JavaScript SDK. Technical documentation provides implementation guidance. Community support available through Discord channels. This encourages ecosystem growth and adoption.

Streamflow Finance Quarterly User Growth Trajectory

Data: Streamflow Finance user metrics and platform analytics 2023-2025

Streamflow Finance Future Plans And Development

The launchpad product enters beta testing in 2025. Projects will launch tokens directly through Streamflow infrastructure. Integrated vesting and distribution tools streamline token generation events. Early access partners test features before public release. The launchpad competes with established platforms like Raydium.

Secondary marketplace development continues for digital assets. Users will trade locked and vesting positions peer-to-peer. This creates liquidity for otherwise illiquid token allocations. Smart contracts ensure security during position transfers. The marketplace targets institutional investors needing liquidity.

Additional blockchain integrations expand the multichain vision. Teams evaluate Base, Arbitrum, and other layer-2 networks. Each integration requires thorough security audits before launch. The goal remains serving all major blockchain ecosystems. This positions Streamflow as the universal token infrastructure layer.

Governance mechanisms evolve with STREAM token utility expansion. Token holders vote on protocol upgrades and treasury allocations. Fee structures adjust based on community proposals. Progressive decentralization transfers control from the core team. The roadmap aims for full DAO governance by 2026.

Enhanced analytics dashboards provide deeper insights for projects. Real-time tracking of vesting progress and claim rates. Comparative metrics against industry benchmarks. Export capabilities for investor reporting needs. These tools help projects optimize their tokenomics strategies.

Compliance features address regulatory requirements in key jurisdictions. Tax reporting automation for US and EU users. KYC integration options for regulated token sales. Audit trail generation for regulatory submissions. DAO structures benefit from built-in compliance tooling. The platform adapts to evolving crypto regulations globally.

Streamflow Finance Advantages And Limitations

Advantages

Multichain support eliminates the need for multiple platforms. Projects manage tokens across Solana, Aptos, and Sui from one interface. This reduces operational complexity for cross-chain teams. No other competitor offers this breadth of blockchain coverage. The unified experience saves time and reduces errors.

Comprehensive feature set covers the full token lifecycle. Vesting, airdrops, locks, staking, and minting all available in one place. Projects avoid integrating multiple vendors for different functions. The all-in-one approach simplifies financial operations. Users familiar with one feature easily adopt others.

Strong security track record builds confidence for large deployments. Multiple audits by respected firms validate smart contracts. No major hacks or exploits occurred since launch in 2021. Public dashboards provide transparency for community verification. Enterprise clients trust the platform with billions in TVL.

Active development brings regular feature updates. Price-based locks and Lock Wars launched in 2025. The team responds to user feedback with new capabilities. SDK improvements help developers integrate smoothly. Innovation keeps the platform competitive against newer entrants.

Limitations

Fees can accumulate for high-volume operations. Large airdrops and frequent vesting contracts add up. Enterprise pricing helps but may not suit all budgets. Competitors like Superfluid offer different pricing models. Teams should calculate total costs before committing.

Limited to supported blockchains excludes some ecosystems. Ethereum support came late compared to EVM competitors. Projects on Cosmos or Polkadot cannot use Streamflow. The team prioritizes chains strategically rather than covering all. This may force multichain projects to use multiple platforms.

Learning curve exists for advanced features. Price-based locks and complex vesting schedules require understanding. New users may need documentation review. The interface assumes basic crypto knowledge. Support resources help but don't eliminate initial friction.

STREAM token launched recently with limited exchange availability. Liquidity remains concentrated on smaller exchanges. Major CEX listings would improve accessibility. Price volatility affects staking rewards denominated in STREAM. The token needs time to establish stable trading patterns.

Frequently Asked Questions

What Makes Streamflow Different From Traditional Token Vesting?

Streamflow operates entirely on-chain with smart contracts. Traditional vesting uses spreadsheets and manual transfers. The platform provides automatic execution and public verification. Recipients track vesting in real-time through transparent dashboards. This eliminates trust requirements between parties.

Can Locked Tokens Be Unlocked Early?

Standard time-locks cannot be cancelled once created. This ensures projects keep commitments to communities. Price-based locks unlock automatically when targets hit. The system prioritizes security and transparency over flexibility. Projects should carefully plan lock parameters before execution.

How Does Streamflow Generate Revenue?

Service fees range from 0.19% to 0.25% per transaction. Network fees cover blockchain operation costs separately. High-volume users receive discounted enterprise pricing. Staking pools include setup and maintenance charges. Revenue funds protocol development and STREAM buybacks.

Which Projects Use Streamflow Finance?

Over 5,000 projects deployed Streamflow for token management. Major names include Bonk, Solend, and Whales Markets. Honeyland used it for 34% of HXD token supply vesting. Genopets integrated the SDK for airdrop distributions. The platform serves both emerging and established crypto projects.

Is Streamflow Finance Secure?

Multiple security firms audited the platform across chains. FYEO, OPCODES, OtterSec, and MoveBit conducted reviews. No major exploits occurred since 2021 launch. Public audit reports verify smart contract safety. Users should always verify contract addresses before interacting.

What Blockchains Does Streamflow Support?

Solana received support at launch in 2021. Aptos integration went live in 2022. Sui followed in 2023 with MoveBit audit. EVM-compatible chains launched in 2024. Additional chains enter roadmap based on ecosystem growth.

How Do Price-Based Token Locks Work?

Users set target prices instead of unlock dates. Streamflow checks token prices every minute automatically. Locks release within one minute of hitting targets. FDV thresholds provide alternative unlock conditions. This aligns unlocks with market performance rather than time.

Can Streamflow Handle Million-Recipient Airdrops?

The platform supports up to 1 million recipients per campaign. Users upload CSV files with allocation details. Batch processing handles large distributions efficiently. Both instant and vested airdrops scale to these volumes. Major projects trust Streamflow for massive token distributions.

What Is The STREAM Token Used For?

STREAM enables governance voting on protocol changes. Stakers earn rewards from protocol fee buybacks. Lock Wars competitions distribute STREAM as prizes. The token launched December 17, 2024 with 1B supply. Community receives 70% allocation for ecosystem growth.

How Much Does Streamflow Cost To Use?

Basic vesting fees start at 0.19% of distributed amounts. Token locks cost 0.0247 SOL plus 0.09 SOL creation fee. Airdrop pricing scales with recipient count. Enterprise plans offer volume discounts and priority support. SDK access remains free for all developers.

Sources

Streamflow Finance Official Website - Platform documentation and feature descriptions

PitchBook - Funding data and investor information

Nasdaq - Datawisp partnership and TVL analytics report

Decrypt - STREAM token launch announcement

Solana Compass - Platform review and technical analysis

CB Insights - Competitor analysis and market positioning

CryptoRank - Token metrics and pricing data

CoinGecko - Market capitalization and trading volume statistics

Streamflow Documentation - Technical specifications and user guides

GitHub Streamflow-Finance - Open source SDK and development activity