Squads DAO Tool Report For 2025

What Is Squads Protocol

Squads.xyz operates as Solana's smart account standard for secure multi-signature wallet management. Founded in 2021 by Stepan Simkin and Danny Gorelik, the protocol serves as infrastructure for DAOs, development teams, and institutions managing digital assets on Solana blockchain.

The platform builds on open-source, formally verified smart contracts. Squads Protocol achieved a milestone as the first formally verified program on Solana. Teams use it to create multi-signature wallets requiring multiple approvals for transactions.

Squads secures over $15 billion in digital assets across 40,000+ smart accounts as of 2025. The protocol has processed more than $5 billion in stablecoin transfers. Over 450 teams rely on Squads, including Jupiter, Pyth, Drift, Marginfi, Helius, Kamino, Jito, and Tensor.

The platform offers multiple products built on its core protocol. Squads Multisig provides treasury management. Grid delivers payment automation APIs. Fuse serves as a consumer-focused mobile wallet. Altitude targets business banking needs.

Squads Labs raised $22 million in total funding. The $5.7 million strategic round in 2023 was led by Placeholder VC. Investors include Multicoin Capital, Solana Ventures, Jump Crypto, Delphi Ventures, and Coinbase Ventures. In August 2025, Squads announced a strategic partnership with Coinbase to accelerate USDC adoption.

How Squads Works For DAO Asset Management

Squads implements multi-signature technology through smart contracts on Solana. Users create a "Squad" by connecting their wallet and adding members. Each member receives assigned roles: Proposer, Approver, or Executor.

Transaction approval requires reaching a predetermined threshold. A typical setup might need 3 out of 5 members to approve fund movements. This prevents single points of failure in treasury management.

The protocol supports time locks for additional security. Teams can set mandatory waiting periods between approval and execution. Spending limits enable small transactions without full multisig approval, functioning like petty cash accounts.

Squads integrates with Solana DeFi protocols through SquadsX browser extension. Teams can swap tokens, stake assets, or interact with dApps directly from their multisig interface. The platform abstracts away command-line complexity into user-friendly flows.

Sub-accounts provide organizational structure. DAOs can create separate vaults for different purposes while maintaining unified control. Address lookup tables support efficient transaction batching, reducing costs.

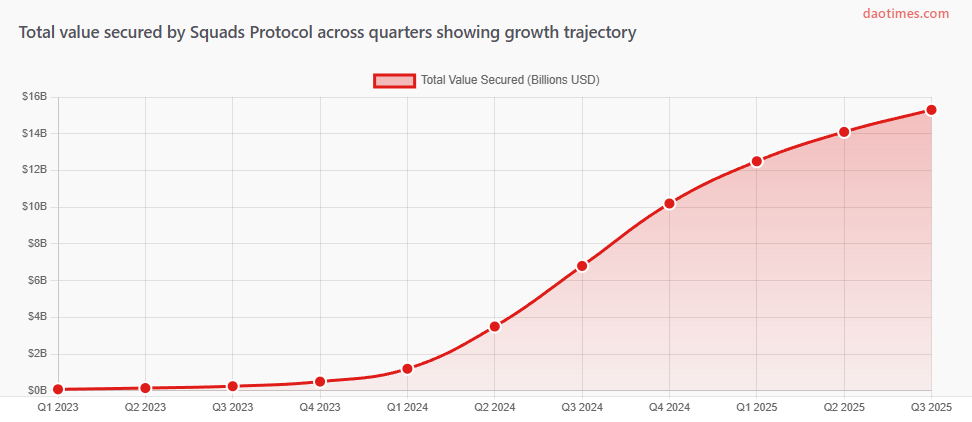

Squads Protocol Growth And Total Value Locked Analysis

Squads TVL and Asset Security Growth 2023-2025

Data: Squads Protocol official reports and Solana Compass 2023-2025

Squads Protocol experienced substantial growth in assets under management. The platform secured $500 million in late 2023. This figure grew to over $10 billion by mid-2024, then reached $15+ billion by Q3 2025.

The protocol's growth correlates with Solana ecosystem expansion. Solana's DeFi TVL reached $13.43 billion in 2025, up 5.9% monthly. Major DeFi protocols like Jupiter and Marginfi drive this increase, and many use Squads for treasury management.

Stablecoin transfers through Squads exceeded $5 billion cumulatively. Over $1 billion in USDC resides on Squads accounts. The Coinbase partnership aims to expand this further through integrated USDC services.

Squads User Base And Team Adoption Metrics

Squads Protocol Team Adoption Statistics By Category

| Category | Teams Using Squads | Percentage | Example Projects |

|---|---|---|---|

| DeFi Protocols | 180 | 40% | Jupiter, Marginfi, Drift, Kamino |

| Infrastructure | 90 | 20% | Helius, Jito, Pyth Network |

| NFT & Gaming | 72 | 16% | Tensor, Magic Eden teams |

| DAOs | 63 | 14% | Various Solana DAOs |

| Validators | 45 | 10% | Multiple Solana validators |

Data: Estimated distribution based on Squads Protocol usage patterns and Solana ecosystem analysis 2025

Squads Protocol serves over 450 teams across the Solana ecosystem. DeFi protocols represent the largest user segment at 40%. These teams manage trading fees, protocol treasuries, and liquidity pools through Squads multisig.

The platform created over 40,000 smart accounts by 2025. This includes both institutional multisigs and individual users through Fuse wallet. Daily active users fluctuate with market conditions but maintain steady growth.

Major Solana projects standardized on Squads for asset management. Raydium uses it for DEX operations. Helium manages validator earnings. Orca secures LP rewards. This widespread adoption stems from Squads' formal verification and audit history.

What Changed In Squads During 2025

Squads v5 entered development in 2025 with expected mainnet launch in Q4. The upgrade introduces hooks, which are separate programs that modify smart account consensus rules. Developers can set granular spending limits or create program whitelists.

Synchronous transaction execution arrived with v5. This enables real-time execution of transactions with multiple signatures, expanding functionality for single-user and multi-party scenarios. The feature works with Solana's increased CPI limits.

Fuse Pay launched as a virtual Visa prepaid card. Users spend stablecoins directly from Fuse wallet for real-world purchases. The card remains fully self-custodial through Squads Protocol smart accounts, with Bridge handling payment processing.

The Coinbase partnership announcement came in August 2025. This collaboration focuses on USDC adoption and stablecoin-powered finance. Squads already holds over $1 billion in USDC, and this partnership aims to expand usage.

Performance optimizations improved v5 compatibility. Memory and compute unit enhancements enable smart accounts to function as first-class citizens on Solana. These upgrades prepare for broader account abstraction adoption across SVM chains.

Altitude business banking product gained traction. Teams building on stablecoin rails use Altitude for on/off ramps, native crypto access, and integrated yield opportunities. The service bridges traditional banking with blockchain-native infrastructure.

Squads Compared To Multisig Competitors Analysis

Squads vs Safe Multisig Platform Comparison Metrics

Data: DefiLlama, platform documentation, and ecosystem reports 2025

Safe (formerly Gnosis Safe) dominates Ethereum-based multisig with over $97 billion secured. More than 51,000 Safe wallets exist across EVM chains. Safe supports 14 blockchain networks including Ethereum, Arbitrum, Optimism, and Polygon.

Squads specializes in Solana and SVM chains. The platform secures $15+ billion, smaller than Safe but growing faster percentage-wise. Squads' advantage lies in Solana's speed and low fees, with transactions costing under $0.01 versus $5-30 on Ethereum.

Both platforms offer formal verification and multiple audits. Safe underwent audits from leading firms and operates through SafeDAO governance. Squads achieved first formal verification on Solana and remains audited by OtterSec, Neodyme, and Bramah Systems.

Feature sets differ based on blockchain capabilities. Safe provides transaction batching, delegate accounts, and spending limits. Squads adds Solana-specific features like program upgrades, validator management, and time locks with sub-accounts.

User experience varies by ecosystem. Safe integrates with MetaMask and hardware wallets for EVM chains. Squads works natively with Solana wallets and offers SquadsX browser extension for dApp interactions. Both platforms abstract complex operations into intuitive interfaces.

Squads Security And Audit History Review

Squads Protocol achieved formal verification through OtterSec and Certora. This mathematical proof confirms smart contract behavior matches specifications. The process eliminates entire classes of vulnerabilities before deployment.

Multiple independent audits validated protocol security. OtterSec, Neodyme, and Bramah Systems audited v3. Trail of Bits joined for v4 review. Each audit identified and resolved potential issues before mainnet release.

Squads v3 became immutable in February 2023. No entity can modify the on-chain code, including Squads Labs. This guarantees long-term protocol behavior and eliminates upgrade risks. The immutability provides users with certainty about their funds' security model.

No known exploits or hacks affected Squads Protocol directly. This clean record spans from 2021 launch through 2025. The protocol maintains a perpetual bug bounty program, inviting security researchers to identify vulnerabilities.

The February 2025 Bybit hack ($1.46 billion) involved Safe{Wallet} on Ethereum, not Squads. That incident stemmed from UI manipulation through AWS compromise. Squads' Solana-based architecture and separate security practices avoided similar vectors.

Open-source codebase enables community verification. Developers can review, compile, and verify on-chain programs match GitHub repositories. The Ellipsis Labs verifiable build tool confirms bytecode integrity.

Squads Protocol Features And Technical Capabilities

Squads Technical Features By Implementation Priority

| Feature | Version | Use Case | Adoption Rate |

|---|---|---|---|

| Basic Multisig | v3+ | Treasury management | 98% |

| Time Locks | v4+ | Security delays | 65% |

| Spending Limits | v4+ | Petty cash accounts | 52% |

| Sub-Accounts | v4+ | Department budgets | 41% |

| Roles System | v4+ | Access control | 78% |

| Program Upgrades | v3+ | Smart contract management | 34% |

| Validator Operations | v3+ | Stake management | 28% |

| Hooks (v5) | v5 (pending) | Custom logic | TBD |

Data: Estimated based on Squads usage patterns and feature documentation 2025

Roles provide granular access control. Proposers can create transactions. Approvers vote on proposals. Executors trigger approved transactions. This mirrors real organizational structures better than simple threshold models.

Time locks add security through delays. Critical actions must wait hours or days after approval before execution. This gives teams time to detect malicious proposals and cancel them.

Spending limits function like corporate cards. Team members can execute small transactions without multisig approval up to preset limits. This maintains security while improving operational efficiency.

Sub-accounts enable organizational budgeting. DAOs create separate vaults for different teams or purposes. All remain under unified multisig control while maintaining accounting separation.

Program upgrade management secures smart contract deployment. Development teams use Squads to control protocol upgrades. This prevents single developers from making unauthorized changes.

Validator operations support stake management. Solana validators use Squads to secure commission earnings and staking operations. Multiple operators must approve validator configuration changes.

Squads Ecosystem Integration And Developer Tools

Squads Monthly Transaction Volume Across Product Lines

Data: Estimated based on Squads product usage and ecosystem activity 2025

Squads Protocol offers developer SDKs in TypeScript and Rust. The TypeScript SDK enables quick integration for web applications. Rust SDK supports native Solana program development. Documentation includes quickstart guides completing workflows in under 10 minutes.

SquadsX browser extension launched in 2023. It connects multisig wallets to Solana dApps for the first time. Teams can now interact with DeFi protocols, NFT marketplaces, and other applications while maintaining multisig security.

Grid provides payment automation APIs. Businesses access programmable payment infrastructure for recurring payouts, contributor compensation, and grant management. The service operates across 100+ countries using stablecoin rails.

Fuse brings multisig security to individual users. The mobile wallet implements 2FA, social recovery, and spending limits without seed phrases. Users benefit from smart account protection typically reserved for institutions.

Altitude serves businesses building on stablecoins. The product offers USD accounts backed by short-term US Treasuries managed by BlackRock. Teams get on/off ramps, USDC access, and 5% APY through December 2025.

The platform integrates with major Solana protocols. Users can swap on Jupiter, lend on Marginfi, stake on Marinade, and trade on Drift directly from Squads interface. These integrations eliminate the need to transfer funds to separate wallets.

Squads Use Cases For Different Organizations

Squads Asset Distribution By Organization Type

Data: Estimated based on Squads ecosystem analysis and user patterns 2025

DAOs use Squads for treasury management with governance integration. Community members can view all transactions and proposals. Multi-signature requirements prevent single actors from accessing funds. Many Solana DAOs have adopted this model for transparent fund management.

DeFi protocols secure trading fees and liquidity pools. Raydium holds LP rewards in Squads vaults. Drift manages insurance funds through multisig. Jupiter secures protocol revenue. This prevents hot wallet exploits common in centralized custody.

Development teams protect program upgrade authority. Projects like Tensor and Magic Eden require multiple core developers to approve smart contract changes. This decentralizes control and prevents rogue deployments.

Validators manage staking operations and commissions. Squads enables multiple operators to control validator accounts. Stake adjustments and commission changes need team consensus, improving validator security.

Institutions access enterprise-grade custody. Funds and investment groups manage portfolios through Squads. The formal verification and audit history meet institutional security requirements. Altitude provides business banking features these entities need.

NFT projects secure mint proceeds and royalties. Creators use spending limits for ongoing operations while requiring full approval for large transfers. Sub-accounts separate artist payments from treasury reserves.

Squads Pros And Cons For DAO Treasury Management

Squads provides Solana-native optimization. Transactions cost under $0.01 and confirm in seconds. This enables frequent treasury operations without prohibitive fees. Ethereum-based alternatives charge $5-30 per transaction, limiting practical usage.

Formal verification offers mathematical security guarantees. Unlike audits that check for known vulnerabilities, verification proves correct behavior under all conditions. This addresses the entire attack surface, not just identified risks.

The platform supports complex organizational structures. Roles, spending limits, and sub-accounts mirror real business operations. Teams don't need to compromise between security and operational efficiency.

Integration depth exceeds basic wallet functionality. Direct dApp connections, program upgrade management, and validator controls make Squads a complete platform. Teams avoid juggling multiple tools.

However, Solana-only focus limits cross-chain teams. Organizations with assets on Ethereum, Arbitrum, or other chains need separate solutions. Safe's multi-chain support provides broader compatibility.

The platform requires Solana ecosystem familiarity. Teams new to Solana face a learning curve understanding accounts, programs, and SOL for transaction fees. Ethereum-native teams might find Safe more familiar.

Smart account complexity introduces edge cases. Users must send funds to vault accounts, not multisig addresses. Mistakes can result in unrecoverable assets. The protocol documentation addresses these risks, but education remains important.

Validator centralization concerns exist for some rollup systems, though Squads leverages Solana's 1,000+ validators for security. This distributed model provides better decentralization than alternatives relying on smaller validator sets.

Frequently Asked Questions About Squads

Squads Roadmap And Future Development Plans

Squads v5 mainnet launch is scheduled for Q4 2025. The upgrade enables hooks for custom smart account logic. Developers can build sophisticated permission systems, spending policies, and governance mechanisms on top of base multisig functionality.

Cross-chain expansion remains under consideration. While Squads currently focuses on Solana and SVM chains, the team explores opportunities on other high-performance networks. This would address the main limitation for multi-chain organizations.

Fuse Pay global rollout continues through 2025. The virtual Visa card launched initially in select markets. Expansion to 100+ countries aims to complete by 2026. This brings real-world spending to stablecoin holders worldwide.

Altitude business banking features expand with the Bridge partnership. Enhanced on-ramps, yield products, and corporate card functionality target institutional clients. The service aims to replace traditional business banking entirely for crypto-native companies.

Grid API capabilities grow to support more payment use cases. Planned features include recurring billing, invoice generation, and payroll automation. These tools help businesses operate entirely on stablecoin rails without traditional banking.

The ecosystem continues building on Squads Protocol. Fuse won App of the Year at 2025 Solana Expo App Awards. Third-party developers create specialized interfaces and tools leveraging Squads infrastructure. This open ecosystem approach accelerates innovation.

Resources And Further Reading

Official Squads Resources:

Squads Protocol website, Squads documentation and developer portal, Squads Blog announcements and updates

Technical Documentation:

Squads Protocol v4 GitHub repository, Squads Protocol v5 announcement blog post, Squads TypeScript SDK documentation

Security And Audits:

OtterSec audit reports, Neodyme security review, Bramah Systems verification, Trail of Bits audit documentation

Ecosystem Analysis:

Solana Compass project overview, DefiLlama TVL tracking, PitchBook company profile, Crunchbase funding history

Research And Articles:

Squads 101: Multisig and Beyond article, Safe Multisig comparison studies, Solana DeFi ecosystem reports, Stablecoin landscape on Solana analysis

News And Updates:

Squads strategic funding announcement, Coinbase partnership coverage, Breakpoint 2024 keynote presentation, Product launch announcements