Snapshot DAO Tool Report For 2025

What Is Snapshot

Snapshot is an off-chain voting platform designed for DAOs, DeFi protocols, and NFT communities. The tool enables organizations to conduct gasless voting without transaction fees on Ethereum or other blockchains. Snapshot uses IPFS decentralized storage to record votes through signed messages rather than blockchain transactions.

Created by pseudonymous founder Fabien in August 2020 while working at Balancer, Snapshot quickly became the standard for DAO governance. The platform operates as open-source software under MIT license, allowing anyone to fork or modify the code. Early adopters included Yam Finance and Yearn, followed by top DeFi protocols like Aave, Uniswap, and Sushi.

The tool requires only an ENS domain to create a space, which functions as an organization's profile. Proposals and votes connect to these spaces, with administrators setting rules for proposal creation and voting through customizable strategies. Voting power calculations can range from simple token balance checks to complex reputation systems.

Snapshot Market Position in 2025

Snapshot maintains dominant market position in DAO governance. The platform serves 96% of decentralized autonomous organizations, according to Coindesk data from 2024. This near-monopoly status reflects widespread adoption across DeFi, NFT, and protocol governance sectors.

Data: Coindesk 2024, Sablier Blog Analysis

Over 21,000 spaces operate on Snapshot as of August 2023, according to IQ.wiki documentation. The number grew from 2,000 communities in November 2021 when Snapshot raised $4 million in seed funding. The platform processes votes across 52 blockchain networks including testnets, with Ethereum hosting approximately 10,000 spaces and Polygon supporting 1,500 communities.

Medium data from DeXe Protocol shows nearly 29,000 users authored over 84,000 proposals by mid-2023. More than 1.7 million voters cast approximately 10.4 million votes on the platform. PancakeSwap leads in proposal volume with over 1,700 submissions, while Optimism Collective tops voting activity with over 1 million votes cast.

Key Features and How Snapshot Works

Core Architecture

Snapshot operates on three-tier architecture. The logic tier runs snapshot-hub node.js server exposing GraphQL API. The data tier combines MySQL database for indexing and IPFS for storage of configurations, proposals, and votes. MySQL indexes content while IPFS holds actual data referenced by CIDs in database fields.

The platform built Pineapple microservice with pineapple.js client library to simplify IPFS uploads. This service races content uploads to multiple pinning services simultaneously, returning success when first service responds. This redundancy ensures data availability across IPFS network.

Voting Mechanisms

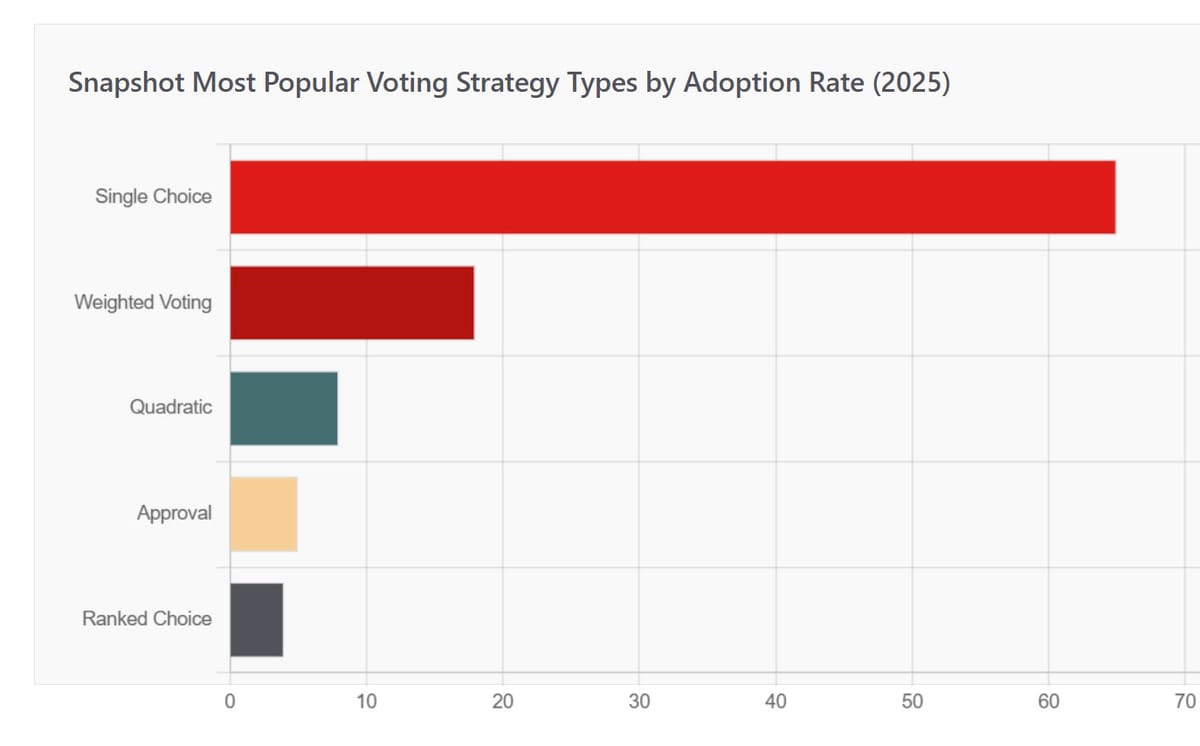

Snapshot supports multiple voting types. Single choice voting allows one option selection per user. Approval voting permits selecting multiple choices with equal power per choice. Weighted voting distributes power across choices based on user preference. Quadratic voting reduces whale influence by requiring more tokens for additional votes.

Basic voting includes abstain option that counts toward quorum without affecting outcome. Ranked choice voting uses instant runoff, eliminating weakest options until one achieves majority. Each voting type serves different governance needs, from simple yes/no decisions to complex multi-option proposals.

Voting Strategies

The platform offers over 400 voting strategies determining power calculations. ERC-20 balance strategy assigns votes based on token holdings. NFT strategies grant power per owned token from specific collections. Delegation strategies recognize voting power assigned to representatives.

Custom strategies allow DAOs to create unique power models. Compound-style checkpoint strategies work with delegated balances. OpenZeppelin checkpoint strategies support alternative delegation systems. Communities can combine multiple strategies, aggregating voting power from different sources for single proposals.

What Changed in 2025

Snapshot v2 Launch

Snapshot v2 represents complete interface redesign uniting governance flow on single platform. The update reduces friction between discussion, delegation, voting, and execution phases. Mirror.xyz announcement describes vision as seamless experience replacing multi-platform workflows.

Proposal feed homepage shows active proposals from followed spaces directly upon login. Users can vote from feed for basic voting proposals without opening full proposal page. Draft system manages multiple proposals before publishing. AI-powered summaries provide quick overviews of lengthy proposals.

Audio playback converts text proposals to speech for accessibility. In-app Intercom widget enables direct support contact within platform. WalletConnect treasury login allows DAO treasuries to connect web3 apps and populate transactions into proposals automatically.

Snapshot X Onchain Protocol

Snapshot X launched in September 2024 as fully onchain voting protocol built on Starknet. The system maintains flexibility and modularity while adding blockchain security and execution capabilities. Storage proofs verify asset existence across chains without third-party bridges.

Transaction costs run 10-50x cheaper than Ethereum L1 while maintaining similar security guarantees. The protocol supports same 400+ voting strategies available in off-chain version. Voting executes on Starknet using Cairo smart contracts with cross-chain verification through storage proofs developed by Herodotus.

Starknet became first major protocol to migrate governance to Snapshot X. The platform conducted staking proposal vote through custom Governance Hub interface September 10-13, 2024. This demonstrated production readiness for protocols requiring onchain execution and censorship resistance.

Boost Incentive System

Boost addresses voter apathy problem where DAO participation typically falls below 20%. The feature incentivizes members to vote through reward mechanisms. Snapshot Labs positions this as direct response to low engagement threatening decentralized governance effectiveness.

The system allows DAOs to offer rewards for proposal participation. Rewards can include tokens, NFTs, or reputation points. Boost aims to make voting both duty and rewarding experience, increasing overall governance participation rates.

| Feature | Description | Launch Date | Impact |

|---|---|---|---|

| Snapshot v2 | Complete interface redesign with integrated governance flow | 2024 | Reduced platform switching, improved UX |

| Snapshot X | Fully onchain voting protocol on Starknet | Sept 2024 | Added execution capabilities, 10-50x cheaper gas |

| Boost | Reward system for voting participation | 2024-2025 | Addresses voter apathy, increases engagement |

| Discourse Integration | Forum discussions within Snapshot interface | 2024 | Unified discussion and voting |

| Delegate Dashboard | Visualize and sort complete delegate list | 2024 | Better delegation transparency |

| Read-Only Execution | Add transactions without SafeSnap/oSnap | 2024 | Easier transaction review |

Data: Snapshot Mirror Blog, Starknet Official Blog

Snapshot Usage Statistics and Trends

Data: DAOBase Medium Study, IQ.wiki, DeXe Protocol Analysis

Platform activity shows consistent growth since late 2020 launch. Nearly 20,000 spaces existed by mid-2023 according to DAOBase research. Over 50,000 authors submitted close to 130,000 proposals during same period. Monthly active users reached approximately 600,000 in recent months.

Ethereum maintains network dominance with roughly 70% of active spaces and votes. Layer 2 solutions like Optimism and Arbitrum gained momentum starting early 2022, challenging Alt-L1 networks including BNB Chain, Polygon, and Avalanche. Optimism monthly votes declined sharply after February 2023, potentially due to governance airdrop conclusion.

| Network | Active Spaces | Market Share | Notes |

|---|---|---|---|

| Ethereum | ~10,000 | 70% | Dominant network for governance |

| Polygon | ~1,500 | 10.5% | Popular for low-cost operations |

| BNB Chain | ~1,300 | 9.1% | Strong DeFi presence |

| Optimism | ~400 | 2.8% | Declined post-airdrop completion |

| Arbitrum | ~350 | 2.5% | Growing L2 adoption |

| Other Networks | ~700 | 5.1% | Includes 47+ other chains |

Data: DAOBase Medium Analysis (2023), Network distribution estimates

Most Active DAOs on Snapshot

Optimism Collective recorded highest voting activity with over 1 million votes cast across approximately 93 proposals. PancakeSwap leads proposal count with over 1,700 submissions but faces issues with off-topic proposals and duplicate spaces. STG DAO also exceeded 1 million votes, demonstrating high community engagement.

Vote participation varies widely between communities. Some DAOs achieve near-unanimous voting suggesting healthy disagreement and proposals with real stakes. Others face low turnout despite large token holder bases. The average DAO voter turnout remains below 20%, according to Snapshot Labs data.

Data: DeXe Protocol Medium Analysis

Comparing Snapshot with Competitors

The DAO governance tools market includes several platforms with different approaches. Snapshot leads in off-chain voting while competitors like Tally, Aragon, and DAOhaus focus on onchain execution. Each platform targets different use cases and governance philosophies.

Snapshot vs Tally

Tally provides fully onchain governance platform for Ethereum-based DAOs. The tool powers over 10x more onchain DAOs than competitors, securing over $30 billion in assets. Tally supports proposals, voting, and delegation with real-time analytics and transparent records.

Voters pay gas fees since transactions execute onchain. This increases censorship resistance and transparency compared to off-chain voting. Tally integrates with Compound, ENS, and Uniswap DAOs. The platform works best for mature DAOs requiring full decentralization and accountability through onchain execution.

Snapshot vs Aragon

Aragon launched in 2017 as comprehensive DAO framework providing onchain governance systems. The platform enables no-code DAO deployment through modular architecture. Aragon 3.0 introduces enhanced smart contract security, cross-chain governance capabilities, and improved scalability for large DAOs.

Decisions and outcomes live directly on blockchain through smart contract execution. No manual steps needed after votes pass. The platform charges gas fees but offers stronger enforceability than off-chain systems. Aragon suits serious DAOs managing large treasuries or requiring trustless governance enforcement.

Snapshot vs DAOhaus

DAOhaus builds on MolochDAO framework focused on Ethereum infrastructure funding. The platform allows DAO setup including voting platform and Safe multisig wallet with cross-chain execution capabilities. Supported networks include Ethereum, Gnosis, Optimism, Arbitrum, Polygon, and Celo.

Core features remain free with onchain governance and treasury management. The community-centered approach supports experimentation and iteration in DAO design space. DAOhaus works well for community DAOs and grant-making organizations preferring established governance patterns.

| Platform | Type | Gas Fees | Best For |

|---|---|---|---|

| Snapshot | Off-chain + Onchain (X) | None (off-chain), Low (X) | Cost-efficient signaling, high participation |

| Tally | Fully onchain | Yes (L2 reduces cost) | Transparent onchain execution, analytics |

| Aragon | Fully onchain | Yes | Custom governance, large treasuries |

| DAOhaus | Fully onchain | Yes | Community DAOs, Moloch-style governance |

| Colony | Onchain | Yes | Reputation-based, work-driven DAOs |

Data: Sablier Blog, Markaicode Platform Comparison

Hybrid Approaches

Many DAOs combine tools for optimal governance. Common pattern uses Snapshot for off-chain signaling to gauge community sentiment, then executes binding votes through onchain platforms like Tally or Aragon. This approach reduces costs while maintaining execution security.

SafeSnap and oSnap integrate Snapshot with Gnosis Safe multisig wallets. These tools enable automatic execution of passed proposals through Safe contracts. UMA provides validation layer ensuring execution matches voter intent. This bridges gap between gasless voting and trustless execution.

Security Considerations and Risks

Off-Chain Trust Model

Snapshot relies on off-chain voting stored on IPFS rather than blockchain. While this eliminates gas costs, it reduces censorship resistance compared to onchain systems. Votes cannot execute automatically, requiring manual implementation by proposal creators or governance teams.

The platform depends on IPFS network availability and pinning services. Pineapple microservice mitigates risk by uploading to multiple services simultaneously. However, long-term data availability requires ongoing maintenance of IPFS pins. Projects must trust Snapshot infrastructure to maintain vote records accurately.

Phishing and Governance Attacks

Snapshot faces phishing threats common across crypto platforms. Attackers create fake proposal links, impersonate official accounts, or deploy malicious websites mimicking Snapshot interface. The platform acknowledges these risks in Mirror blog posts warning users about scams.

Blog post from Snapshot Labs describes phishing links appearing on Twitter, blog posts, and emails. As popular governance tool, Snapshot becomes attractive target for scammers manipulating proposals for financial gain. Users must verify URLs and proposal authenticity through official channels.

Gitcoin Passport integration addresses sybil attack risks. The validation system requires users to verify information proving humanity without revealing identity. This enables democratic voting systems like quadratic voting by increasing confidence that votes come from real humans rather than bots.

Flash Loan Vulnerabilities

Snapshot system uses snapshot block numbers to determine voting power at specific points in time. This prevents flash loan attacks where actors temporarily acquire tokens to manipulate votes. Voting power calculation occurs at block specified in proposal, typically when proposal created.

However, sophisticated attackers could still accumulate tokens before snapshot block if they anticipate proposal timing. Research paper from arxiv.org (May 2025) discusses time-weighted snapshot frameworks as additional defense mechanism against flash loan manipulation in DAO governance.

Snapshot X Security Model

Snapshot X introduces onchain execution with Starknet smart contracts. This adds attack surface through contract vulnerabilities but increases transparency and execution guarantees. The protocol undergoes security audits but remains newer than battle-tested Governor contracts.

Storage proof technology provides cross-chain security without bridges. Mathematical verification eliminates third-party trust requirements when proving asset ownership across blockchains. This reduces bridge exploit risks while maintaining decentralization properties.

Analysis based on Snapshot Documentation and Security Reviews

Roadmap and Future Development

Snapshot Labs raised $4 million seed funding in November 2021 led by 1kx. Investors included Coinbase Ventures, The LAO, MetaCartel Ventures, Gnosis, StarkWare, BoostVC, Scalar Capital, and others. Funding supports background integration improvements and scaling for hundreds of thousands of users.

Founder Fabien mentioned potential token launch and community ownership structure. However, tokenization remains non-priority with focus on solving voting problems first. The project previously relied on Gitcoin grants and donations from MetaCartel DAO, ENS, Curve DAO, and Balancer.

Integration Ecosystem

Snapshot aims for inclusion in DAO development kits like DeepDAO and Boardroom. The platform supports integrations with Colony protocol for reputation scores. SafeSnap and oSnap enable execution through Gnosis Safe multisig wallets with UMA validation.

Recent additions include Lido staking integration allowing one-click ETH staking proposals. WalletConnect support enables treasury logins to web3 apps with automatic transaction population. Better treasury support manages wider asset range including NFTs.

Cross-Chain Expansion

Snapshot X represents first major cross-chain governance solution using storage proofs. The technology allows proving asset existence on any EVM chain without moving tokens. This enables DAOs to maintain voting power across multiple networks simultaneously.

Platform supports 52 blockchain networks as of 2023. Continued expansion focuses on emerging L2 solutions and alternative L1 chains. The architecture remains flexible enough to add new networks without protocol changes.

AI Integration

AI proposal summaries launched in Snapshot v2 provide quick overviews of complex governance proposals. Audio playback converts proposals to speech using text-to-speech technology. These features improve accessibility and reduce time needed to understand proposals.

Future AI applications might include proposal impact analysis, voting pattern insights, or automated governance recommendations. The tool could help identify potential conflicts of interest or voting anomalies requiring community attention.

How to Use Snapshot

Creating a Space

Organizations need ENS domain to create Snapshot space. Visit snapshot.box and connect wallet with ENS ownership. Click create space button and fill organization details including name, description, symbol, and social accounts. Add administrator wallet addresses with space management permissions.

Configure voting strategies determining power calculations. Common choice involves erc20-balance-of strategy using token contract address. Specify token decimals and any additional requirements like minimum holding for proposal creation. Set default voting type and proposal duration.

Custom branding options allow spaces to use own color schemes and domain names. Add contact list for frequently used addresses when creating proposals. Configure validation strategies if requiring specific criteria like Gitcoin Passport stamps for voter eligibility.

Creating Proposals

Navigate to DAO space on Snapshot and click new proposal button. Write clear, concise title describing proposal content. Provide detailed description with context, arguments for and against, and relevant links or data.

Define voting options appropriate for proposal type. Common formats include Yes/No/Abstain for simple decisions or multiple specific options for complex choices. Select voting system matching decision requirements, with single choice being most common.

Set voting window with start and end dates. Snapshot block determines automatically based on current block, ensuring fair voting power calculations from proposal creation time. Add transaction details if using read-only execution to preview onchain actions.

Voting on Proposals

Visit snapshot.org or snapshot.box and search for DAO with proposals. Active proposals display green badge on organization logo. Connect web3 wallet like MetaMask to participate in voting.

Review proposal details including voting system, snapshot block, current results, and end date. Voting power displays based on token holdings or delegations at snapshot block. Select desired option and click vote button.

Sign message with wallet to submit vote. No gas fees required since transaction remains off-chain. Vote appears in voter list after confirmation. Users can delegate voting power to other addresses through delegate section if desired.

Delegation

Access delegate section within Snapshot space or global delegation settings. Enter delegate wallet address receiving voting power. Specify spaces for delegation or leave blank to delegate across all spaces.

Confirm delegation through wallet signature. Delegate receives voting power for future proposals in specified spaces. Original token holder can revoke delegation anytime through same interface. Delegate dashboard shows all delegates with voting power and delegator counts.

Frequently Asked Questions

Conclusion

Snapshot established itself as dominant DAO governance platform with 96% market share. The tool solved critical problem of high gas costs preventing widespread participation in onchain governance. Over 21,000 spaces and 10 million votes demonstrate platform success since 2020 launch.

Recent developments expand Snapshot beyond simple signaling tool. Snapshot v2 unifies governance workflows reducing platform switching. Snapshot X adds onchain execution while maintaining cost advantages. Boost addresses engagement through participation rewards.

Platform faces competition from fully onchain solutions like Tally and Aragon. However, gasless voting remains compelling for many communities prioritizing participation over maximum decentralization. Hybrid approaches combining Snapshot signaling with onchain execution provide balanced governance models.

Looking ahead, cross-chain governance through storage proofs and continued feature development position Snapshot for sustained growth. The DAO ecosystem increasingly recognizes governance as core infrastructure requiring specialized tooling. Snapshot role as standard interface for decentralized decision-making appears secure through 2025 and beyond.

For DAO builders and participants, Snapshot offers tested solution with extensive documentation and community support. The platform lowers barriers to governance participation while maintaining sufficient security for most use cases. Whether launching new organization or improving existing governance, Snapshot provides accessible entry point to decentralized coordination.

Additional resources for understanding and implementing DAO governance can be found in the comprehensive dashboard of DAO tools and the detailed list of DAOs available for exploration and research.

Sources

Snapshot Labs Official:

Snapshot Documentation (docs.snapshot.box)

Snapshot Mirror Blog (snapshot.mirror.xyz)

Introducing Snapshot v2 Article

Industry Analysis:

Coindesk: Popular DAO Voting Platform Snapshot Labs Raises $4M (November 2021)

Coindesk: Snapshot Popular DAO Voting Platform Finally Moves On-Chain Atop Starknet (September 2024)

The Block: Snapshot Labs Raises $4 Million in Seed Funding

Decrypt: Snapshot Labs Raises $4 Million to Shape Future of DAO Voting

Research and Data:

IQ.wiki: Snapshot Platform Overview (August 2023)

DAOBase Medium: Exploring DAO Governance Empirical Study on Snapshot (December 2023)

DeXe Protocol Medium: Is Snapshot Off-Chain Voting Working for DAOs (April 2023)

IPFS Documentation: Snapshot Case Study

Comparative Analysis:

Sablier Blog: DAO Governance Voting Tools Ultimate Guide (November 2024)

Markaicode: DAO-as-a-Service Platforms Compared (May 2025)

HeLa Labs: List of DAO Tools to Look for in 2025 (September 2025)

Technical Resources:

Starknet Blog: Snapshot X Onchain Governance Powered by Starknet (May 2025)

Arxiv: Balancing Security and Liquidity Time-Weighted Snapshot Framework for DAO Governance Voting (May 2025)

Bitbond Resources: Setting Up DAO Voting with Snapshot and Token Tool (September 2025)