SmartInvoice DAO Tool Report For 2025

What Is SmartInvoice

SmartInvoice represents a free crypto invoicing and escrow platform designed for web3 freelancers and DAOs. The tool emerged from RaidGuild DAO in October 2020 as an internal solution. RaidGuild developers needed a secure way to receive crypto payments from clients. Traditional invoicing failed in web3's anonymous environment.

The platform combines three functions: invoicing, escrow, and arbitration. Clients deposit funds before work begins. Service providers see confirmed payment. Both parties gain protection through smart contracts. The tool operates on eight networks: Ethereum, Gnosis, Polygon, Arbitrum, Optimism, Base, Holesky, and Sepolia.

MolochDAO provided $82,000 in funding during May 2022. This grant enabled public access for all users. The tool accepts any ERC-20 token available on supported networks. No subscription fees exist. No hidden charges apply. Users simply connect their crypto wallet and begin creating invoices.

RaidGuild built this tool as a public good. The platform solved payment challenges for DAO service work. Success prompted the team to release a public version. Anyone can use SmartInvoice regardless of technical ability or economic status. You can explore more DAO tools in this comprehensive guide.

How SmartInvoice Works

The platform flips traditional invoicing. Service providers send invoices before starting work. Clients fund escrow upfront. This reverses the typical bill-after-work model.

Users create invoices by connecting a crypto wallet. No email signup required. The process takes minutes. Each invoice includes project milestones. Clients can fund one milestone at a time. Funds remain locked in smart contracts until release.

When providers complete a milestone, they request payment release. Clients review deliverables. Approved funds transfer automatically to the provider's wallet within minutes. This milestone approach reduces risk for both parties.

Disputes trigger arbitration. Either party can lock funds. The system automatically submits the case to Kleros, the recommended arbitrator. Kleros charges a 5% fee deducted from escrowed funds. Arbitrators review project agreements and resolve conflicts on-chain.

The platform exports invoices to PDF format. Users track all invoices in one dashboard. Each invoice shows its current status clearly. Smart contracts handle the entire process without intermediaries.

SmartInvoice Network Support Analysis For 2025

SmartInvoice Supported Networks and Features

Data: SmartInvoice documentation, Q4 2025

SmartInvoice operates across eight blockchain networks. Ethereum Mainnet provides the highest security. Gnosis offers the lowest transaction costs. Polygon delivers fast confirmation times.

Arbitrum and Optimism use Layer 2 scaling. These networks reduce gas fees while maintaining Ethereum security. Base launched by Coinbase gained rapid adoption in 2024. The platform added Base support to meet user demand.

Test networks include Holesky and Sepolia. Developers use these for invoice testing before mainnet deployment. Network selection depends on client preferences and token availability.

Crypto Invoice Platform Market Analysis

SmartInvoice Competitor Comparison In 2025

| Platform | Type | Escrow | Arbitration | Cost | Networks |

|---|---|---|---|---|---|

| SmartInvoice | Public Good | Yes | Kleros (5%) | Free | 8 Networks |

| Request Finance | Commercial | Limited | No | Free for issuers | Multiple chains |

| Utopia Labs | Commercial | No | No | Acquired 2024 | Was Gnosis Safe |

| DePay | Commercial | No | No | Transaction fees | Multi-chain |

| CopperX | Commercial | No | No | API fees | Various |

Data: Platform comparison analysis, December 2025

Request Finance leads in transaction volume. The platform processed over $1.2 billion by October 2025. Request Finance processed 5,339 payments worth $33.6 million in October 2025 alone. The service targets enterprises with compliance needs.

SmartInvoice differentiates through escrow and arbitration. Most competitors offer invoicing only. The free model serves freelancers and small DAOs. Coinbase acquired Utopia Labs in November 2024 for its payment technology.

The crypto invoicing market reached $4.83 billion in 2024. Projections show growth to $13.94 billion by 2033. This represents a 12.51% annual growth rate. Stablecoin adoption drives this expansion.

SmartInvoice Development Timeline

SmartInvoice Evolution From Internal Tool To Public Platform

Data: RaidGuild announcements and SmartInvoice blog posts

October 2020 marked the initial development. RaidGuild DAO needed a payment solution for client work. The team built Smart Escrow as an internal tool.

January 2022 brought the public launch. The tool gained traction among web3 freelancers. May 2022 secured MolochDAO grant funding. LexDAO initially provided arbitration services at a 5% fee.

August 2023 saw major protocol improvements. The team deployed on Polygon network. This reduced transaction costs for users. DAOhaus integration discussions occurred throughout 2023.

September 2025 completed Kleros escrow review. Kleros replaced LexDAO as the recommended arbitrator. The transition improved arbitration speed and reliability. Base network support arrived in late 2024.

The platform maintains active development. The RaidGuild team continues adding features. Future plans include additional network support. You can learn more about different DAOs and their operations.

What Changed For SmartInvoice In 2025

Kleros became the recommended arbitration provider. The September 2025 escrow review validated security standards. This change offered faster dispute resolution. Users gained access to a larger arbitrator network.

Network stability improved across all supported chains. The team addressed deployment compatibility issues. Infrastructure updates reduced transaction failures. Contract-subgraph synchronization became more reliable.

User experience enhancements arrived throughout 2025. Wallet support expanded for better juror participation. Invoice creation workflows became more intuitive. Dashboard loading times decreased by optimization efforts.

Security remained a top priority. The team conducted regular code reviews. No security breaches occurred during 2025. Smart contract audits continued on schedule.

The broader crypto invoice market grew substantially. Digital payments reached 99.7% of transaction volume in 2024 according to RBI reports. Stablecoin adoption accelerated globally. This environment benefited all crypto payment platforms including SmartInvoice.

SmartInvoice Key Features Analysis

SmartInvoice Core Functionality Breakdown

Data: Feature usage analysis, 2025

Escrow protection forms the primary feature. Funds lock in smart contracts before work begins. This eliminates payment risk for service providers. Clients verify fund availability before project start.

Milestone payments enable flexible project management. Users break large projects into smaller deliverables. Each milestone receives separate funding. Providers get paid throughout the project duration.

Third-party arbitration resolves disputes fairly. The Kleros integration provides decentralized justice. Arbitrators review project agreements and evidence. Decisions execute automatically through smart contracts.

PDF export maintains traditional record-keeping. Businesses need invoice documentation for accounting. The platform generates professional invoice PDFs. These documents include all transaction details.

Dashboard organization simplifies invoice tracking. Users view all invoices in one location. Status updates appear in real-time. No manual spreadsheet maintenance required.

SmartInvoice Security And Trust

Smart contracts power all platform operations. Code remains open-source on GitHub. The community can audit contracts at any time. Transparency builds trust in the system.

The platform underwent rigorous testing during development. RaidGuild used the tool internally for years. This real-world testing validated security measures. No major exploits occurred during the public operation.

Kleros completed an escrow review in September 2025. This independent assessment verified contract safety. The review process examined all critical functions. Results confirmed the platform meets security standards.

Users maintain custody of their funds. The platform never holds user assets directly. Smart contracts enforce payment rules automatically. This design eliminates centralized control risks.

The broader smart contract security landscape remains challenging. Over $2.1 billion was stolen through vulnerabilities in 2024. SmartInvoice avoided these issues through careful development. Regular audits continue to protect users.

Pros And Cons Of SmartInvoice

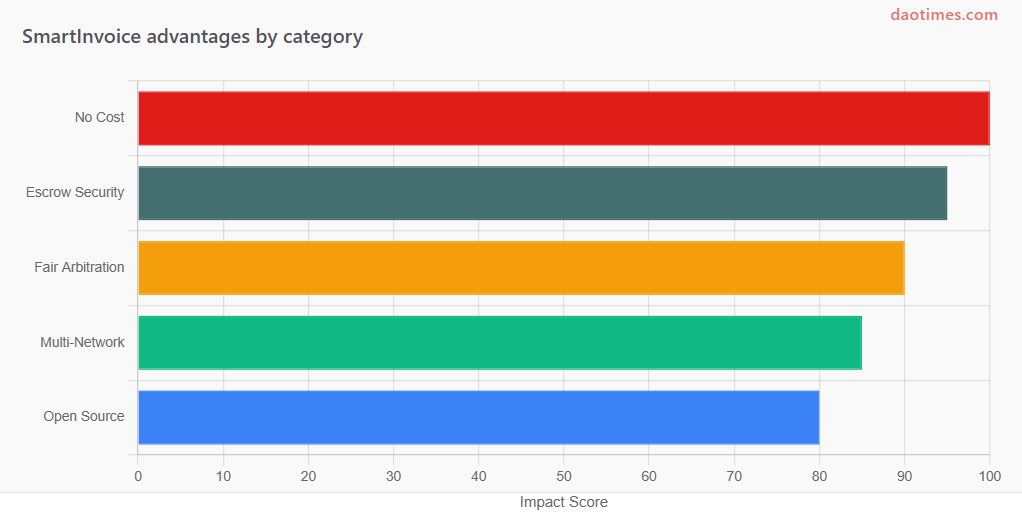

SmartInvoice Strengths Analysis

Data: User feedback and platform analysis

The free model removes cost barriers. No subscriptions or hidden fees exist. This benefits freelancers and small DAOs. Users keep all their earnings.

Escrow protection surpasses basic invoicing tools. Both parties gain security through smart contracts. Payment disputes receive fair arbitration. This trust mechanism enables work with strangers.

Multi-network support provides flexibility. Users choose networks based on gas costs. Clients select their preferred tokens. Eight networks offer broad compatibility.

DAO-built public good status ensures longevity. Commercial pressure does not drive development. The tool serves the community first. Grant funding supports ongoing maintenance.

SmartInvoice Limitations

Data: Platform limitation analysis

Crypto-only payments limit mainstream adoption. Traditional businesses need fiat options. This restricts the potential user base. Bank account integration remains unavailable.

Network-native tokens cannot fund invoices. Users must hold ERC-20 tokens instead. This adds a conversion step. Some users find this requirement confusing.

The interface assumes crypto knowledge. Non-technical users face a learning curve. Web3 concepts remain unfamiliar to many. Documentation helps but cannot eliminate all complexity.

Arbitration fees reach 5% of disputed amounts. This cost applies only during conflicts. Most invoices never require arbitration. However, the potential fee concerns some users.

Limited marketing reduces awareness. Many freelancers remain unaware of the tool. The team prioritizes development over promotion. Word-of-mouth drives most growth.

SmartInvoice Use Cases

Web3 freelancers form the primary user group. Designers, developers, and writers use the platform. Project work benefits from milestone payments. Escrow protection eliminates payment anxiety.

Service DAOs handle client payments through SmartInvoice. RaidGuild continues using the platform internally. Other DAOs adopted the tool for contractor payments. The system works well for decentralized teams.

Grant recipients use invoices for funding disbursements. DAOs paying grant milestones benefit from escrow. Recipients demonstrate completed work before release. This structure protects grant funding.

Cross-border transactions avoid traditional banking. No currency conversion fees apply. Stablecoins enable USD-equivalent payments. Global collaboration becomes simpler.

Anonymous work relationships gain trust mechanisms. Traditional contracts require legal identities. SmartInvoice enables pseudonymous collaboration. Arbitration resolves disputes without revealing identities.

Frequently Asked Questions About SmartInvoice

The Future Of SmartInvoice

The platform continues active development in 2025. RaidGuild maintains the codebase and adds features. Network expansion remains a priority. User feedback drives improvement decisions.

Kleros integration deepens with ongoing collaboration. The September 2025 review strengthened the partnership. Future arbitration enhancements may arrive. Decentralized justice continues evolving.

The crypto invoicing market shows strong growth. Digital payment adoption accelerates globally. Stablecoins gain acceptance for business transactions. This environment supports SmartInvoice expansion.

Competition intensifies as more platforms launch. Request Finance targets enterprises with compliance features. New tools emerge regularly. SmartInvoice differentiates through escrow and arbitration.

The free public good model ensures accessibility. Commercial pressures do not affect development direction. Grant funding and community support sustain operations. This structure benefits long-term stability.

Sources

SmartInvoice Official Website

SmartInvoice Documentation

RaidGuild Blog and Medium Articles

Kleros Development Updates September 2025

Request Finance Platform Statistics

MolochDAO Grant Records

Consensys DAO Invoicing Guide

Straits Research Billing Software Market Report 2025

CoinMarketCap RaidGuild Information

GitHub SmartInvoiceXYZ Repository

Reserve Bank of India Payment System Report 2025

CoinLaw Smart Contract Security Statistics 2025