Safe DAO Tool Report For 2025

What Is Safe Global

Safe Global, formerly known as Gnosis Safe, operates as the most trusted smart contract wallet infrastructure for managing digital assets through multi-signature technology. The platform transformed from its Gnosis Safe origins into an independent ecosystem in 2023, establishing SafeDAO for governance and launching its SAFE token in April 2024.

Safe enables multiple parties to jointly control a single wallet. Each transaction requires approval from a predetermined number of signers. A treasury managed by five team members might need three signatures to execute any transfer. This approach reduces the risk of a single compromised key destroying an entire operation.

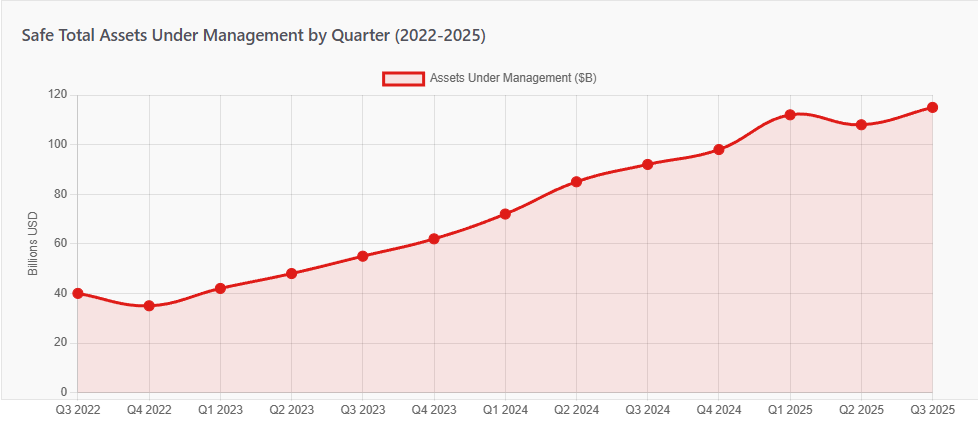

Safe handles more than $100 billion in secured assets across its network. The platform powers treasury management for 200+ projects, including major names like Uniswap DAO, Worldcoin, Morpho Labs, and World Foundation. Individual users include Vitalik Buterin and major organizations like Shopify and Reddit.

The transition from Core Contributors GmbH to Safe Labs GmbH in October 2025 brought technical improvements. Safe Labs now operates Safe{Wallet} with enhanced security standards and alignment with SafeDAO governance. Users could migrate their data or start fresh with the new infrastructure.

Core Features and Capabilities in 2025

Multi-Signature Security Architecture

Safe allows customizable M-of-N signature requirements. Organizations configure setups like 2-of-3, 4-of-7, or any combination that suits their security model. The flexibility extends beyond simple signature counts. Teams can implement role-based access controls, set daily spending limits, and establish approval thresholds for different transaction sizes.

The platform supports integration with hardware wallets including Ledger and Trezor. Users can connect MetaMask, WalletConnect, or other Ethereum-compatible wallets as signers. This creates layered security where different key types protect the same assets.

Transaction Batching

Safe enables users to bundle multiple operations into one signing step. Instead of approving five separate transfers, signers review and sign once. This cuts gas costs and reduces the administrative burden of multi-signature operations.

Transaction simulation allows teams to preview outcomes before execution. The built-in scanner flags potential risks in smart contracts and dApps. This prevents costly mistakes and protects against malicious contracts.

Network Coverage and Compatibility

Safe operates on 14+ blockchain networks in 2025. The platform covers Ethereum, Gnosis Chain, Avalanche, and popular Layer-2 solutions like Arbitrum, Optimism, Base, Polygon, and zkSync. Each network maintains the same security standards and user experience.

Bottom Line: Safe provides institutional-grade multi-signature infrastructure with flexible configurations, transaction batching capabilities, and support across 14+ EVM-compatible networks while securing over $100 billion in digital assets.

Safe Global Network Support Across Chains

Data: Safe Global documentation, blockchain explorers

Safe's multi-chain strategy addresses a core challenge in Web3. Users no longer need separate wallets for different networks. Treasury managers can oversee assets on Ethereum mainnet, move stablecoin payments through Polygon, and deploy DeFi strategies on Arbitrum from a single interface.

The expansion to Base in 2025 brought Safe closer to institutional adoption. Base's regulatory positioning makes it attractive for traditional financial entities exploring blockchain. Safe's presence on Base enables these organizations to maintain familiar security standards while entering DeFi.

Safe Global Growth Metrics 2020-2025

Data: Safe Global, CoinMarketCap

Safe created over 8 million accounts by April 2023, processing more than 40 million transactions. The platform saw accelerated adoption following major centralized exchange failures in 2022. Users moved assets to self-custodial solutions, with Safe becoming the default choice for organizations requiring multi-party control.

The 2024-2025 period brought new user segments. Gaming projects adopted Safe for guild treasury management. DAOs standardized on Safe for proposal execution. NFT communities used it for collective purchasing and asset management.

Competitor Comparison: Safe Global vs Major Alternatives

| Platform | Technology Type | Target Users | Starting Cost | Key Advantage |

|---|---|---|---|---|

| Safe Global | Smart Contract Multisig | DAOs, Teams, Individuals | Gas fees only | Open source, battle-tested, widest adoption |

| Fireblocks | MPC Technology | Institutions, Exchanges | Enterprise pricing | Lower gas costs, faster transactions |

| BitGo | MPC Multisig Hybrid | Institutions, Custodians | Enterprise pricing | Regulated custody, insurance |

| Casa | Bitcoin Multisig | Bitcoin Holders | $250-2100/year | Bitcoin-focused, hardware integration |

| Electrum | Bitcoin Multisig | Advanced Users | Free | Full customization, no fees |

| Argent | Smart Contract Wallet | Mobile Users | Free | Social recovery, mobile-first |

Data: Platform documentation, industry reports, market analysis

Safe dominates the Ethereum multisig space but faces competition from MPC solutions. Fireblocks and BitGo target institutions with different security models. MPC distributes key generation across multiple parties without on-chain visibility. This reduces gas costs but introduces trust assumptions in the MPC provider.

Safe's smart contract approach keeps all security logic on-chain and auditable. Anyone can verify how a Safe operates. The tradeoff comes in higher transaction costs. Each Safe interaction executes complex smart contract logic, resulting in gas fees 300-400% higher than simple transfers.

Casa and Electrum serve Bitcoin users with different philosophies. Casa offers managed services with fixed key configurations. Electrum provides complete control with steep learning curves. Neither competes directly with Safe's Ethereum focus.

Safe Global Market Position Analysis

Data: DeFiLlama, Safe Global ecosystem data

Safe powers critical infrastructure for top DeFi protocols. Uniswap DAO manages over $2 billion through a 4-of-7 Safe. Morpho Labs uses Safe across multiple networks for daily operations. These integrations demonstrate institutional trust in Safe's security model.

The platform captured approximately 60-65% of the Ethereum multisig market by transaction volume. Competitor fragmentation works in Safe's favor. No single alternative matches Safe's combination of security, flexibility, and ecosystem support.

What Changed in 2025: New Developments

Organizational Restructuring

Safe Labs GmbH replaced Core Contributors GmbH as the primary interface provider in October 2025. The change aligned operational control with SafeDAO governance. Users received clear migration paths for their data and settings. The transition maintained backward compatibility with existing Safes.

Enhanced Security Standards

Safe introduced improved transaction simulation capabilities. The built-in scanner now detects more attack vectors. Real-time risk assessment helps prevent malicious contract interactions. These features respond to the evolving threat landscape in DeFi.

Expanded Network Coverage

Safe extended support to additional Layer-2 networks. The platform optimized for Base, anticipating institutional adoption. Gas optimization improvements reduced costs on high-fee networks. Cross-chain coordination became smoother with unified interfaces.

Developer Tools

Safe released updated SDKs for easier integration. The Protocol Kit and API Kit simplified development. Teams can now embed Safe functionality into custom applications. This modularity attracts projects building on Safe's infrastructure.

Security Incidents and Lessons: 2024-2025

Data: Blockchain security firms, incident reports

Safe's smart contracts maintained their unblemished security record through 2025. Zero exploits occurred at the protocol level. The contracts remained formally verified and audited. However, two major incidents highlighted vulnerabilities in the broader security stack.

Bybit Incident - February 2025

Hackers stole $1.5 billion from Bybit's cold wallet using Safe. The attack exploited UI manipulation, not Safe's contracts. Malicious JavaScript injected into AWS S3 resources altered transaction data during signing. Signers saw legitimate transactions on their screens while signing malicious operations.

The Lazarus Group executed the attack through sophisticated phishing. They compromised signer devices and manipulated Safe's front-end interface. The exploit used delegatecall functions to replace Safe's implementation with attacker-controlled contracts.

This incident exposed the difference between smart contract security and operational security. Safe's on-chain logic worked perfectly. The weakness existed in the trusted front-end infrastructure and human verification processes.

Radiant Capital Attack - October 2024

Radiant Capital lost $51 million through similar UI manipulation. Attackers infected signer devices with malware. The malware altered Safe's interface, showing legitimate transaction data while signing malicious operations. This 3-of-11 multisig fell because attackers compromised enough signers.

Industry Response

These incidents prompted industry-wide changes. Teams now implement multi-channel transaction verification. Signers verify transaction hashes through independent tools. Hardware wallets with on-device verification gained prominence. The community developed best practices for operational security.

Safe can't prevent all attack vectors. The platform protects on-chain security but relies on users for off-chain security. Organizations need comprehensive security stacks including device management, network security, and verification procedures.

Pros and Cons: Honest Assessment

Advantages

Battle-tested security: Safe's contracts have secured $100+ billion without exploits. Multiple audits and formal verification provide confidence. The open-source nature allows independent security review.

Flexibility: Organizations customize signature requirements, spending limits, and access controls. The modular design supports various governance models. Teams adapt Safe to their specific needs rather than conforming to rigid structures.

Ecosystem integration: Safe connects with 200+ dApps and protocols. DeFi, NFT, and gaming platforms support Safe natively. This integration density makes Safe the default choice for Web3 operations.

No ongoing costs: Users pay only blockchain gas fees. No subscription charges or platform fees exist. This makes Safe accessible to organizations of all sizes.

Disadvantages

High gas costs: Smart contract operations consume 300-400% more gas than simple transfers. This becomes expensive during network congestion. Large organizations execute hundreds of transactions monthly, accumulating substantial costs.

Technical complexity: Setting up and managing Safe requires blockchain knowledge. New users face learning curves with key management and transaction signing. Mistakes in configuration can create security vulnerabilities.

Recovery challenges: Lost keys create permanent access problems if too many signers become unavailable. Social recovery modules exist but require careful planning. Organizations must document key holder information and backup procedures.

Network limitations: Safe works only on EVM-compatible chains. Bitcoin, Solana, and other non-EVM networks remain unsupported. This forces organizations to use different solutions for multi-chain operations.

UI security dependence: Recent incidents showed that Safe's security extends only to on-chain operations. Front-end manipulation and phishing can bypass multisig protections. Users need additional verification tools and procedures.

Integration Ecosystem: Safe Global Connected Platforms

| Category | Notable Integrations | Use Case | Implementation Status |

|---|---|---|---|

| DeFi Protocols | Uniswap, Morpho, Aave, Curve | Treasury management, liquidity provision | Full support |

| Payment Systems | Gnosis Pay, Request Network | Real-world payments, invoicing | Active |

| Identity Solutions | Worldcoin, ENS | Identity verification, naming | Integrated |

| NFT Platforms | OpenSea, Blur, LooksRare | Collective NFT management | Native support |

| Gaming | Guild treasuries, gaming DAOs | Shared asset management | Growing adoption |

| Development Tools | Hardhat, Foundry, Remix | Smart contract deployment | Full compatibility |

Data: Safe Global ecosystem directory, platform documentation

Safe's integration network creates powerful synergies. A DAO can hold assets in Safe, govern through Snapshot, execute through Tally, and report through Dune Analytics. This composability makes Safe the hub for decentralized operations.

The Safe Apps ecosystem extends functionality without compromising security. Third-party developers build tools that run inside Safe's interface. Transaction batching apps, token management tools, and analytics dashboards enhance core capabilities.

How to Use Safe Global: Practical Guide

Initial Setup

Visit app.safe.global and connect an Ethereum-compatible wallet. Choose your network from the supported list. Name your Safe for easy identification. This name exists only in your local interface, not on-chain.

Configure Owners and Threshold

Add wallet addresses for all designated owners. Each owner should control their own private keys. Set the signature threshold - how many approvals each transaction requires. Common configurations include 2-of-3 for small teams and 4-of-7 for larger organizations.

Never set a 1-of-1 configuration. This defeats the purpose of multisig security. Consider operational efficiency when choosing thresholds. Too many required signatures can slow critical operations.

Deploy and Fund

Review all settings carefully. Deploy the Safe by confirming the transaction in your wallet. Pay the one-time deployment gas fee. Once deployed, send assets to your Safe's address. The Safe appears ready for transactions.

Create Transactions

Initiate transfers or smart contract interactions through the Safe interface. Other owners receive notifications to review and sign. Each signer approves using their connected wallet. Once the threshold reaches, anyone can execute the transaction.

Advanced Features

Set up spending limits for specific owners. Configure role-based permissions through modules. Enable social recovery for lost key scenarios. Use transaction batching to reduce gas costs and signing overhead.

Future Roadmap and Development Plans

Safe continues pushing toward its vision of making every Ethereum account a smart account. The team focuses on account abstraction, enabling features like gasless transactions and social recovery. These improvements aim to make multisig accessible to mainstream users.

Enhanced privacy features are in development. Users will gain optional privacy controls for sensitive transactions while maintaining transparency where required. This balances compliance needs with privacy desires.

Cross-chain functionality expands beyond EVM networks. Safe explores bridges and interoperability protocols. The goal involves managing assets across fundamentally different blockchain architectures from a single interface.

Developer tools receive continued investment. Next-generation SDKs will simplify Safe integration. No-code solutions will allow non-technical teams to deploy custom Safe configurations. The platform evolves toward a complete Web3 infrastructure stack.

SafeDAO governance grows more sophisticated. Token holders gain more direct influence over protocol development. The decentralized governance model aims to prevent capture by any single entity while maintaining development velocity.

FAQ: Safe Global Questions and Answers

Conclusion: Safe Global's Position in 2025

Safe Global maintains dominance in Ethereum multisig infrastructure. The platform secured over $100 billion in assets while processing millions of transactions without protocol-level exploits. Recent security incidents tested operational practices rather than core technology.

The transition to Safe Labs and enhanced SafeDAO governance positions the platform for long-term sustainability. Open-source development, community auditing, and decentralized control reduce risks of capture or mismanagement. Safe's architectural choices prioritize transparency over cost efficiency.

Competition from MPC solutions poses questions about technical tradeoffs. Organizations must decide whether on-chain transparency or lower gas costs matter more. Safe's ecosystem integration and proven security give it advantages despite higher operational costs.

Safe works best for organizations that value decentralization, require flexible governance, and operate primarily on Ethereum. Teams managing substantial treasuries, DAOs coordinating complex operations, and projects requiring auditable security find Safe indispensable. Individual users with modest holdings may find simpler solutions more appropriate.

The platform's future depends on account abstraction adoption and cross-chain expansion. If Safe successfully abstracts complexity while maintaining security, it could become the default for all Web3 operations. The alternative involves fragmentation as specialized solutions capture specific use cases.

Sources and References

Official Documentation: Safe Global website and documentation, Safe Labs announcements

Market Data: CoinMarketCap, DeFiLlama, blockchain explorers

Security Analysis: Check Point Research, Sygnia, AnChain.AI, OpenZeppelin

Industry Reports: Dune Analytics State of Wallets 2025, Gemini Global Crypto Survey 2025

Platform Reviews: WalletReview, Milk Road, Cyfrin, Bitbond

Competitor Analysis: Fireblocks blog, company documentation from BitGo, Casa, Argent

News Sources: The Block, CoinTelegraph, CoinMarketCap Academy

Technical Resources: Ethereum Stack Exchange, GitHub repositories

Additional resources: Dashboard of DAO tools | List of DAOs