Riseworks DAO Tool Report For 2025

What Is Riseworks

Riseworks operates as a hybrid payroll platform designed for global teams. The company bridges traditional finance with Web3 infrastructure. Founded in 2019 by Hugo Finkelstein, it serves DAOs, blockchain protocols, and traditional companies.

The platform processes payments in 190 countries. It supports over 100 cryptocurrencies and 90 local currencies. Teams can fund payroll from bank accounts or crypto wallets. Contributors choose their preferred payout method.

Riseworks holds FinCEN registration 31000261420870 as a Money Service Business. The company achieved SOC 2 Type II certification in 2025. This validates security standards for handling sensitive payroll data.

Major clients include Lido DAO, t3rn, InFlux Technologies, and ZenAcademy. The platform has processed over $800 million in total transactions. More than 100,000 contractors use the service globally.

Key Riseworks Metrics For 2025

Transaction volume reached $800 million by August 2025. This represents growth from $700 million earlier in the year. The platform serves 150+ active business customers.

User satisfaction improved to 4.5 out of 5 on Trustpilot. The platform received 5,079 total reviews as of September 2025. Rating climbed from 3.3 in mid-2024 to current levels.

The company raised $6.3 million in Series A funding during November 2024. Total funding stands at $10 million. Draper Associates and Polymorphic Capital led the round.

Processing fees remain at $2.50 per transaction on Layer 1 blockchains. Layer 2 transactions cost nothing. Monthly contractor management costs $50 per person or 3% of payment volume.

Riseworks Platform Growth 2023-2025

Data: Riseworks public reports, Trustpilot reviews, company announcements 2023-2025

What Changed For Riseworks In 2025

Brand refresh launched at the start of 2025. The company updated visual identity and messaging. New focus targets remote payment infrastructure modernization.

SOC 2 Type II certification completed following Type I in 2024. This adds third-party validation of security controls. The certification covers availability, confidentiality, and processing integrity.

Partnership with Circle expanded USDC integration capabilities. Riseworks became an official Circle partner. This relationship provides direct access to USDC infrastructure and support.

Employer of Record service expanded to 60+ countries by year end. Previously available only in US, UK, and Canada. This allows companies to hire full-time employees without local entities.

Customer support response improved based on user feedback. Earlier complaints about slow support decreased. The platform added multilingual 24/7 chat assistance.

Trustpilot score rose from 3.3 average to 4.5. This reflects resolution of payment delay issues. Crypto payouts became faster than fiat transfers for many users.

Riseworks Competitor Comparison 2025

| Platform | Countries | Crypto Support | Fee Structure | Layer 2 Cost |

|---|---|---|---|---|

| Riseworks | 190 | 100+ cryptos | $2.50 or 3% | Free |

| Deel | 150 | USDC, USDT only | 2% + network fees | N/A |

| Bitwage | 140 | Limited crypto | 1% minimum | N/A |

| Toku | 100 | Token-only | Custom pricing | N/A |

| Gusto | 120 (contractors) | None | $40/month base | N/A |

Data: Platform comparison analysis Q3 2025, company websites

New Riseworks Features In 2025

Rise ID became available as self-sovereign identity solution. Users mint on-chain professional identities. The ID works across platforms accepting Rise verification.

Automated KYC and KYB checks integrated with Sumsub partnership. This speeds contractor onboarding to under 10 minutes. Previously required 48-72 hours for verification.

Smart contract automation expanded for payroll scheduling. Payments trigger automatically based on predefined conditions. This removes manual payment processing steps.

Direct Payroll product entered development for 2025 launch. This allows companies to manage full-time employees directly. Currently in beta with select customers.

API access improved for custom integration needs. Developers can build automated workflows. This helps larger enterprises connect existing systems.

Split payout functionality added for mixed payment preferences. Contractors receive partial payment in crypto, partial in fiat. This addresses diverse team needs across regions.

Gnosis Safe integration enhanced for DAO treasury management. Teams pay directly from multisig wallets. Support expanded for additional wallet providers.

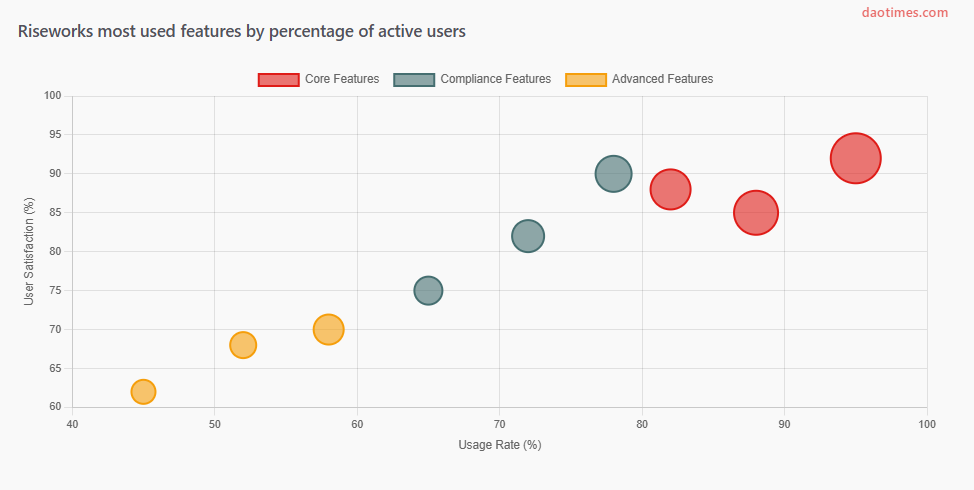

Riseworks Feature Adoption Among Users 2025

Data: Riseworks user analytics Q2 2025

Riseworks Security Status

No security incidents reported for Riseworks in 2024 or 2025. The platform maintains clean security record. Independent audits validate infrastructure protection.

SOC 2 Type II certification provides ongoing compliance verification. Third-party auditors assess controls annually. This covers data security, availability, and confidentiality.

Multi-factor authentication protects all platform access. High-level encryption secures stored information. Unauthorized access becomes difficult to achieve.

Smart contracts prevent fraud even if accounts face compromise. Blockchain immutability provides additional protection layer. Transaction records remain tamper-resistant.

Partnership with Sumsub ensures robust KYC verification. This prevents identity fraud and money laundering. AML checks run automatically for all users.

Regular security audits occur throughout the year. Palo Alto Networks and similar firms provide consulting. The company maintains insurance coverage for potential incidents.

Riseworks Security Measures Implementation

Data: Riseworks security documentation, SOC 2 reports 2024-2025

Riseworks History And Roadmap

Hugo Finkelstein founded Riseworks in 2019. Initial focus addressed crypto payroll gaps. Early customers came from Web3 and DAO communities.

Seed funding closed in 2020 at undisclosed amount. Platform launched first version in 2021. Support covered basic cryptocurrency payments initially.

Expansion to 190 countries occurred by 2023. Fiat integration added hybrid payment capabilities. This attracted traditional businesses alongside crypto-native teams.

Series A funding of $6.3 million closed November 2024. Total funding reached $10 million. Draper Associates and Polymorphic Capital led investments.

SOC 2 Type I certification achieved in 2024. Type II followed in 2025. Brand refresh launched early 2025.

Upcoming roadmap includes Direct Payroll full release. EOR expansion targets 60+ countries by end of 2025. Enhanced API capabilities planned for enterprise clients.

Additional wallet integrations scheduled for Q4 2025. Support for new blockchains under development. Tax automation features planned for 2026.

Riseworks Stablecoin Market Share 2025

Data: Pantera Capital Compensation Survey 2025, Riseworks transaction data

How Riseworks Serves DAOs

DAOs use Riseworks to pay contributors compliantly. The platform connects to multisig wallets directly. Teams fund payroll from treasury without manual conversions.

Smart contract automation handles payment distribution. Contributors receive funds based on predetermined schedules. This removes administrative overhead for DAO operators.

Rise ID provides on-chain identity verification. Contributors remain pseudonymous to other members. Personal information stays private while meeting KYC requirements.

The platform handles tax compliance across jurisdictions. Forms generate automatically for different countries. This protects DAOs from regulatory penalties.

Agent of Record service shields DAOs from classification risks. Riseworks becomes legal intermediary for contractors. This prevents employment misclassification issues.

Treasury diversification becomes easier with hybrid payroll. DAOs hold assets in native tokens or stablecoins. Contributors receive preferred payment currency regardless.

Major DAO clients include Lido Finance through Pool Maintenance Labs. The protocol manages over $20 billion in total value locked. Other clients span DeFi, gaming, and governance sectors.

According to DeepDAO data, 4,800 DAOs manage 4.1 million members. Combined treasury exceeds $11.3 billion. Riseworks serves growing segment of this ecosystem. You can explore more about different DAOs and their structures to understand the landscape better.

Riseworks Pricing Structure

Global Contractor Pay costs $50 monthly per contractor. Alternative pricing uses 3% of total payment volume. Companies choose the lower option automatically.

Transaction fees add $2.50 for Layer 1 blockchain payments. Layer 2 transactions process for free. Fiat withdrawals follow standard banking timelines.

Agent of Record service pricing varies by country. This includes legal protection and compliance management. Custom quotes provide specific costs.

Employer of Record starts at $399 monthly per employee. This covers full employment services including benefits. Available in US, UK, Canada, and expanding locations.

No setup fees apply for new accounts. Onboarding completes in under 10 minutes. Integration support comes standard with all plans.

Enterprise pricing available for large teams. Volume discounts apply above certain thresholds. Dedicated account management included at this tier.

Riseworks Advantages And Limitations

Platform advantages include lowest crypto payroll fees. Layer 2 transactions cost nothing. Coverage spans 190 countries with 100+ cryptocurrency options.

Hybrid treasury support sets Riseworks apart. Companies fund from bank or wallet. Contributors choose payout currency independently.

Smart contract automation reduces manual work. Payments execute automatically on schedule. This saves administrative time for operators.

SOC 2 Type II certification validates security. FinCEN registration ensures regulatory compliance. No security breaches recorded to date.

Limitations include newer market position versus competitors. Founded 2019 makes it younger than Deel or Gusto. Some users report longer fiat transfer times.

Customer support faced criticism in 2024. Recent improvements show better response times. 24/7 support now available but quality varies.

Integration options remain limited versus traditional platforms. API exists but requires technical knowledge. Not all HR software connects natively.

Some countries face banking partner restrictions. This causes occasional transfer delays. Crypto payouts work faster than fiat in these cases.

For broader context on DAO tooling options and comparisons, teams should evaluate multiple platforms before choosing.

Riseworks Use Cases

Web3 startups use Riseworks for global team payments. Engineers receive USDC or USDT directly. This avoids traditional banking friction.

DAOs manage contributor compensation through the platform. Treasury funds route to worldwide members. Compliance happens automatically across jurisdictions.

Traditional companies hiring remote contractors benefit from coverage. Teams spread across continents get paid uniformly. Currency preferences accommodate individual needs.

Prop trading firms use Riseworks for funded trader payouts. Fast processing meets trading industry demands. Crypto withdrawal option attracts participants.

AI and tech startups leverage hybrid payroll capabilities. They compete for global talent with flexible compensation. 10-minute onboarding speeds hiring cycles.

Marketing agencies manage international freelancer networks. Project-based payments work alongside recurring salaries. Split payouts accommodate mixed preferences.

Remote-first companies eliminate geographic hiring limits. Benefits packages work globally through EOR services. Local compliance handled automatically.

Frequently Asked Questions

What Makes Riseworks Different From Other Payroll Platforms?

Riseworks combines fiat and crypto in one system. Most competitors offer only one or the other. The platform supports 100+ cryptocurrencies versus limited options elsewhere. Layer 2 transactions cost nothing. Smart contract automation reduces manual processing. Coverage extends to 190 countries.

How Long Does Riseworks Onboarding Take?

New contractors complete onboarding in under 10 minutes. This includes KYC verification through Sumsub partnership. Traditional platforms require 48-72 hours typically. Companies can begin paying workers same day. Rise ID minting adds minimal time if desired.

Can DAOs Pay From Multisig Wallets?

Yes, Riseworks integrates with Gnosis Safe and other multisigs. DAOs connect treasury wallets directly. Payments execute through smart contracts automatically. No manual withdrawal and redeposit needed. This maintains security while enabling payroll.

What Cryptocurrencies Does Riseworks Support?

The platform supports over 100 cryptocurrencies. This includes USDC, USDT, ETH, BTC, and SOL. Stablecoins represent most transactions. USDC holds 63% market share for crypto payroll. USDT accounts for 28.6% according to 2025 data.

How Much Does Riseworks Cost?

Contractor payments cost $50 monthly or 3% of volume. Layer 1 transactions add $2.50 each. Layer 2 processing is free. Employer of Record starts at $399 per employee monthly. No setup fees apply.

Is Riseworks Secure?

The platform maintains SOC 2 Type II certification. No security breaches occurred in 2024 or 2025. Multi-factor authentication protects all accounts. Smart contracts prevent unauthorized fund access. FinCEN registration validates compliance standards.

What Countries Does Riseworks Serve?

Service covers 190 countries worldwide. This includes 90+ local currency options. Employer of Record available in US, UK, Canada, and expanding. Some regions face banking partner limitations. Crypto payouts work everywhere with internet access.

How Fast Are Riseworks Payments?

Crypto payouts process in minutes typically. Layer 2 transactions complete fastest. Fiat transfers take 4-7 business days usually. Some countries experience longer bank processing. Stablecoin payments offer quickest settlement.

Does Riseworks Handle Tax Compliance?

The platform auto-generates W-9, W-8BEN, and 1099 forms. Tax reporting follows country-specific requirements. This covers 190 countries automatically. Agent of Record service adds legal protection. Companies avoid classification penalties.

Who Uses Riseworks Currently?

Clients include Lido DAO, t3rn, InFlux Technologies, and ZenAcademy. More than 150 companies use the platform. Over 100,000 contractors receive payments. User base spans Web3 startups, DAOs, and traditional businesses. AI companies and prop trading firms represent growing segments.

Sources

Riseworks official website and blog

Trustpilot Riseworks reviews 2024-2025

Pantera Capital Compensation Survey 2025

BlockEden.xyz user analysis report April 2025

PitchBook company profile data

Prop Firm Plus Riseworks review May 2025

Crunchbase company information

ZoomInfo Rise Works profile

G2 product reviews

DeepDAO ecosystem statistics

Riseworks Series A funding announcement November 2024

Circle partnership announcements

Crypto payroll market reports Q3 2025