Protocol-owned liquidity is an investment, DappRadar on ApeSwap Treasury Bills campaign

Liquidity is arguably the lifeblood of decentralized finance (DeFi). It represents how easily an asset can be bought or sold without drastic price swings. Many decentralized protocols rely on liquidity pools to facilitate transactions like decentralized trading and lending.

A liquidity pool is a collection of digital assets locked in a smart contract to enable trading on a decentralized exchange. Think of them as crowdfunded reservoirs of cryptocurrencies that can be accessed by anybody. Liquidity providers (LPs) who fund these reservoirs are rewarded with a percentage of transaction fees for each interaction by users.

While the big catalyst for DeFi was Compound’s issuance of COMP tokens to suppliers and borrowers in its markets through liquidity mining, there is a growing shift towards protocol-owned liquidity. In particular, liquidity mining is more or less a double-edged sword – great for initial growth but bad for long-term sustainability. That being said, DappRadar recently passed a proposal to launch a Treasury Bills campaign on ApeSwap, an initiative that will increase the protocol-owned liquidity of DappRadar’s DAO.

In this interview, we spoke to the DappRadar team about the pros and cons of their current liquidity program and how protocol-owned liquidity seems to be the way forward.

The DAO currently employs two liquidity programs - rented liquidity and protocol-owned liquidity. What are the pros and cons of both options?

Rented liquidity was largely responsible for the growth of DeFi in the Summer of 2021 when DeFi protocols attempted to bootstrap liquidity and user acquisition by offering users that provided liquidity, native tokens rewards with high APR. The issue? Although it helped to raise significant funds for the protocol, but it was a short-term solution. Many investors had a mercenary attitude and once the APRs started to fall to lower levels, they would sell their token on the market, and look for another protocol with high APR levels, meaning both the user and their liquidity would disappear. Low liquidity means high slippage and bad trading conditions for traders attempting to purchase the token - a scenario that all protocols want to avoid.

Protocol-owned liquidity attempts to resolve this issue by changing the dynamic of locking liquidity, instead of relying on the investors to keep their liquidity on the protocol, the investor exchanges their liquidity with the protocol, for vested tokens. The investor receives token rewards and the protocol gets liquidity. The possibility that the investor could sell the tokens still exists, however the vesting schedule of the rewards dampens the selling pressure on the token price.

DappRadar launched its protocol-owned liquidity program in July through ApeSwap on BNB Chain. How has the program performed so far?

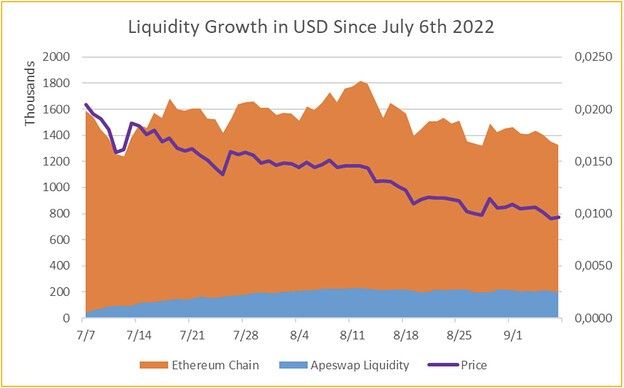

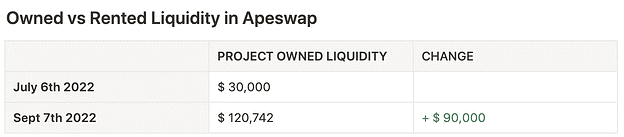

When DappRadar launched its first protocol-owned liquidity program in July, we wanted to experiment on how we could achieve better return on investment for maintaining and growing RADAR liquidity. On SushiSwap we were initially rewarding liquidity providers with approximately 555k RADAR/day to achieve a liquidity of $1,590,552. In dollar terms, this was a sunk cost of roughly $3885 a day. By focusing on our protocol-owned-liquidity program where we rewarded liquidity providers on ApeSwap 261k RADAR/day through the rewards, we were able to earn $120,742 in LP tokens and maintain a liquidity of approximately $200,000. Imagine what would happen if we scale these programs.

Ultimately, while maintaining sufficient liquidity on BNB, for every $1 that we spent, we received $0.87 (pre-ApeSwap success fee). Rather than liquidity being an operational cost, it became an asset.

After working closely with the team at ApeSwap DAO, we reduced the incentivization of rented liquidity and increasing the incentivization of protocol-owned liquidity. By lowering Sushi’s rewards and APR by 20-25%, it had a minimal impact on liquidity in Sushi’s protocol but lowered our expenses by 20%. The amount of savings achieved equates to around $360K per year.

You’ve already started lowering the spending on rented liquidity and increasing the incentivization of protocol-owned liquidity. Do you think protocol-owned liquidity will eventually replace rented liquidity? What’s the end goal behind this move?

Our end goal is to ensure that we have deep liquidity, supplied by the team or investors, an incentivization strategy that minimizes dilution for our token holders while increasing stable liquidity levels. Although our volume of protocol-owned liquidity will grow as we issue more Treasury Bill programs, rented liquidity will always have its place in our industry due to its unique proposition of effectively raising liquidity quickly. Additionally, not every chain that we deploy will have protocol-owned-liquidity and bonding programs like ApeSwap Treasury Bills available. Lastly, having rented liquidity also decentralizes our liquidity strategy rather than solely relying on our team to provide liquidity. Therefore, it remains likely that we will continue to focus on POL but balance it with rented liquidity.

The ApeSwap Treasury Bills program is supposed to create more sustainable liquidity for the DAO and provide treasury revenue in the long term. How does this benefit the average Joe and other members of the ecosystem?

As mentioned above, protocol-owned liquidity programs such as ApeSwap Treasury Bills have clearer benefits as a better alternative than the current renting of liquidity. With ApeSwap Treasury Bills we can take that same renting allocation and turn it into an investment. We invest the RADAR balance sheet rather than spend the balance sheet. Treasury Bills turns that $0 return into an 87% return. That’s a no-brainer.

Can you provide a brief breakdown of how the ApeSwap Treasury Bills program will operate? Does someone need to be a part of the DAO to enjoy its benefits?

In July, DappRadar launched its own protocol-owned liquidity program through ApeSwap on BNB Chain. A user doesn’t necessarily need to be part of our DAO to join this program. By providing liquidity to the BNB-RADAR pool, users receive liquidity pool (LP) tokens. On ApeSwap, these LP tokens are then used to purchase a RADAR Jungle Bill. Ultimately, this allows users to get a bonus token rewards. In short, these are the benefits of having protocol-owned liquidity:

- DappRadar DAO becomes a big stake holder in the liquidity, aligning it with the future of the project and helping to stabilize the price of RADAR.

- DappRadar DAO also doesn’t need to throw incentivization rewards at liquidity providers, who can jump out once the rewards aren’t interesting enough.

- The RADAR community receives rewards paid in the native tokens for their participation.

The title of the recently-passed proposal is “Restarting DappRadar’s ApeSwap Treasury Bills Campaign.” Out of curiosity, was there ever a campaign on the DeFi platform? If yes, what were the results of the previous campaign? What results do you hope to achieve with the new campaign?

There was no previous campaign.

Are there other financial commitments the DAO needs to make beyond the 40,769,233 RADAR allocation to the program?

ApeSwap Treasury Bills come with three main fees:

- A cut-up front for overhead costs (a small percentage of the overall token allocation).

- A success fee of 5% of the net LPs raised

- Gas fees to transfer tokens

That being said, as one of the organizations that joined in ApeSwapDAO’s early program for Treasury Bills, DappRadar doesn’t have to pay the initial overhead cost. This emphasizes our long-term partnership with them.

What other DAO projects should we keep attention to? Maybe some of the DappRadar team members are also participating in other DAOs that are worth watching closely?

Our Head of DAO has participated in the following DAOs and still actively follows their developments to ensure that DappRadar DAO is working and iterating according to the best standards in the industry:

- Maker DAO

- UniSwap DAO

- OceanDAO

How do you keep track of DAO news? Maybe you can recommend news channels or influencers.

DAO news comes from different areas as it intersects with many disciplines, including law, finance, governance, business operations and tokenomics. As there are many people involved that focus on different areas, the goal is to follow as many individuals in the area as possible. It’s mainly focused on Twitter, as the heart of all ‘crypto alpha’. We also recommend these accounts to follow for DAO news and insights:

@SchorLukas, @lex_node, @_Daniel_Ospina, @awrigh01, @chaserchapman, @ddwchen, @seedclubhq, @JonathanHillis, @ASvanevik, @pet3rpan_, @cryptohun3y, @js_horne