Cleanverse debuts in Singapore, one of world's first Trust Layer embedding TradFi Governance into Blockchain

● Programmed interlocking of verified identity with regulated assets on every value transfer guarantees travel rule compliance in real time, not post-facto.

● Chain agnostic, wallet-neutral multi-layer compliance layer that sits atop any public blockchain to close the trust gaps in Web3 with a single infrastructure

● Managed layer of access by way of membership provides pathway to a global, member-led consortium shaping shared standards for trusted on-chain finance and governance

The future of on-chain finance demands rails that are as trusted as they are open. Cleanverse International (Cleanverse) is a compliance-native infrastructure layer that programmed an interlocking of verified identity with regulated stablecoins, embedding trust, traceability and Travel Rule compliance into every on-chain transfer.

Traditional finance has long depended on systems like SWIFT, where clear rules govern how money moves across borders. Blockchain, by contrast, was built on anonymity and self-custody — features that have slowed its adoption by institutions. Cleanverse solves this by building compliance directly into the network, so the same safeguards that protect global finance can now apply seamlessly on-chain.

At its Core, Cleanverse Delivers Three Breakthroughs

- Proven Trust: Wallets are bound to APASS, a reusable, non-transferable identity credential that proves bank-verified account ownership.

- Programmed Compliance: Built-in compliance is enforced through the interlocking of verified identity with regulated assets on every value transfer, not after the fact.

- Shared Global Standards: Cleanverse is designed to scale into a member-led consortium, bringing together banks, asset issuers, licensed Web3 service providers, and regulators to co-develop a SWIFT-like rulebook for on-chain finance.

Charles Huang, Founder, Cleanverse International:

"Cleanverse builds on Web2's proven compliance logic and uses blockchain to create a more efficient compliance network on Web3. By embedding compliance directly into every transfer, we give institutions the confidence that value moves only between verified parties and verified funds. This is a new-generation of financial compliance: built-in, not bolted-on."

Bringing institutional trust to Web3's rapid expansion

● APAC leads growth: Crypto transaction volumes rose from USD $1.4T to $2.36T in the year ending June 2025.

● Global adoption accelerating: Blockchain volumes topped $10T in 2023, with tokenised assets projected to reach $16T by 2030.

● AI Agents: Autonomous AI agents are increasingly managing financial transactions and micro-payments. These agents require compliance rails with embedded KYC and AML capabilities to ensure they operate safely and transparently within regulated global financial ecosystems

● Compliance is the bottleneck: As regulators tighten Travel Rule enforcement, financial institutions and VASPs need certainty before onboarding or issuing real-world assets on-chain.

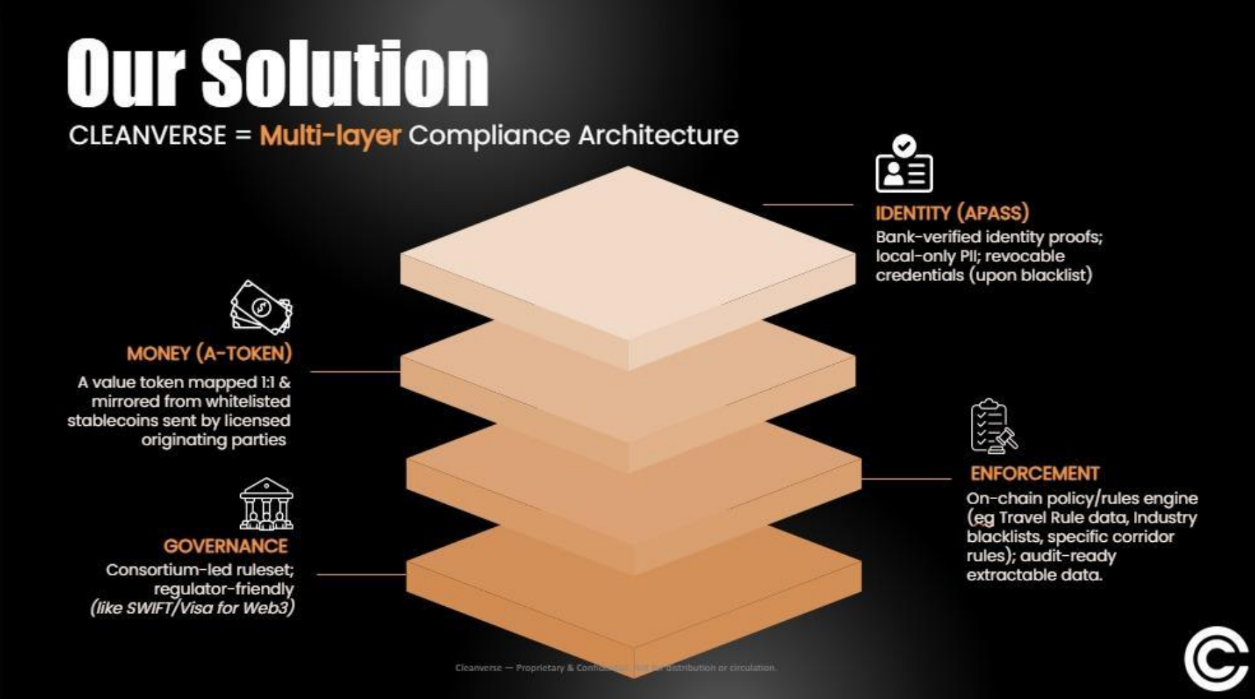

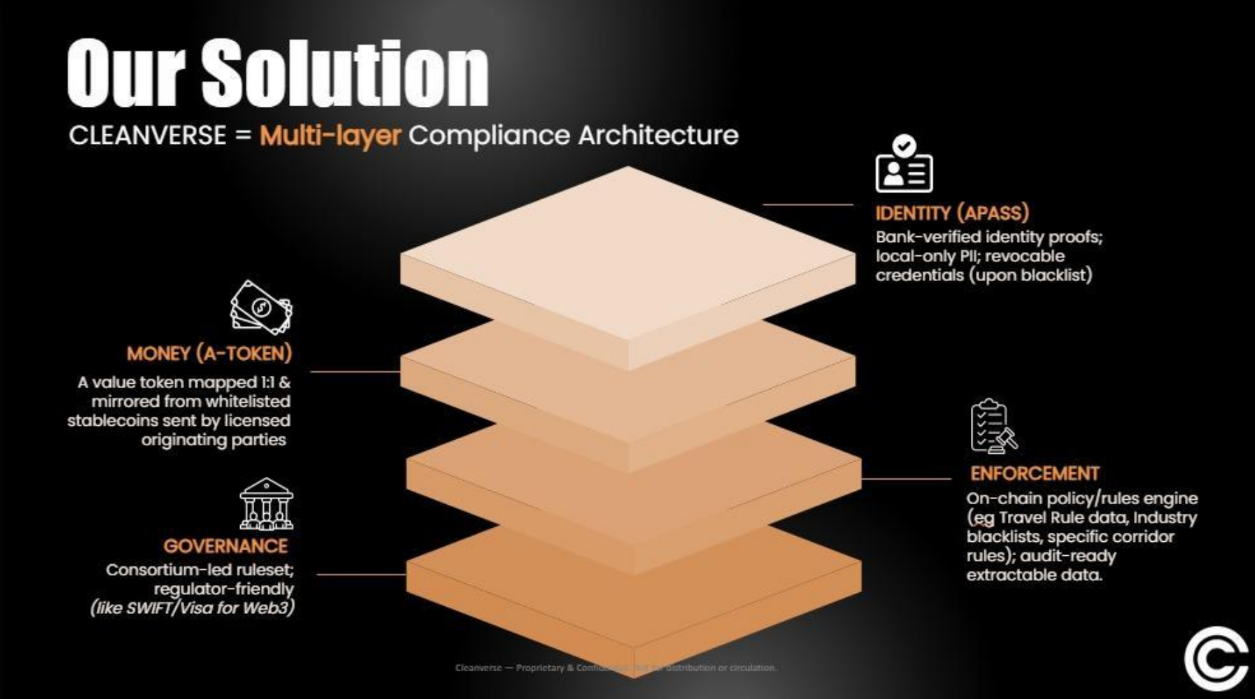

Cleanverse responds with one of the world's first multi-layer compliance architectures: Identity, money, enforcement, and governance interlocked to deliver unified on-chain compliance.

- Identity (APASS): Transacting wallets are bound to bank-verified identities via APASS - a non-transferable and reusable identity credential, ensuring that only clean identities transact.

- Money (A-token or access token): Only regulated stablecoins can transact on Cleanverse. For clean traceability and control, these stablecoins are mirrored into access tokens (A-tokens), transferable only among APASS-verified wallets.

- Enforcement: An on-chain policy engine enforces the interlocked rule on every value transfer that is also autonomously embedded with Travel Rule metadata, blacklist controls and jurisdiction-specific rules.

- Governance: Consortium-led rulebook that evolves global TradFi standards for Web3.

"Compliance is not a hurdle; it is the gateway to participation in on-chain finance," said Ceridwen Choo, CEO of Cleanverse International. "Just as Apple Pay links a verified Apple ID to regulated bank cards, Cleanverse interlocks a verified wallet identity with regulated stablecoins. Our vision is to give institutions and innovators the assurance to scale on-chain finance with the same trust they expect in traditional banking."

Creating a Network Effect of Compliance

Cleanverse launches with a founding circle of members including dtcpay, DigiFT, FOMO Group and KUN — early advocates from Web3 payments, tokenised finance and digital asset infrastructure. Together, they are defining initial standards, testing real-world transfers, and proving that compliance can be embedded natively on-chain. Their participation signals that institutions are ready to co-create the trusted rails needed for large-scale adoption.

Cleanverse is now inviting more industry players to join the consortium. Each new member strengthens the system, compounds trust, and accelerates the shift from isolated pilots to a unified network of clean, compliant value transfer. This is the invitation: to help shape the global standards of on-chain finance, and to ensure that the future of Web3 is governed by clean money, clean hands, and shared trust.

About Cleanverse International (www.cleanverse.com)

Cleanverse is a chain-agnostic, wallet-neutral compliance-native infrastructure layer designed to interlock verified identity with verified money, enabling regulation-ready, traceable, and fully compliant value transfers across public blockchains. This creates on-chain traceability from fund origins to enforcement, ensuring every transfer involves verified participants and regulated assets.

The infrastructure is powered by two core primitives:

✅ APASS (Clean Hands): A non-transferable, on-chain identity credential proving a user's bank-verified identity.

✅ A-token (Clean Money): Access tokens that act as mirrors of regulated stablecoins. They move only within Cleanverse, between APASS-verified members, ensuring every transfer is travel rule compliant, in real-time.

Cleanverse bridges the gap between traditional finance (TradFi) and on-chain finance (DeFi). Its multi-layer compliance framework — spanning identity, asset provenance, regulatory enforcement, and governance — eliminates anonymity risks, standardises on-chain transaction rules, and makes institutional-grade adoption of Web3 for finance services not only possible but inevitable.

Follow @Cleanverse on social media

LinkedIn: @Cleanverse

X: @TheCleanverse / https://x.com/TheCleanverse

For queries, please contact:

SPRG

Pooja Shah

Senior Account Executive

Tel: +65 88891321

Email: pooja.shah@sprg.com.sg