Ora Protocol DAO Tool Report For 2025

What Is ORA Protocol

ORA is a verifiable oracle protocol that brings artificial intelligence and complex computations on-chain. Founded in 2022 and formerly known as Hyper Oracle, ORA enables developers to integrate AI models directly into smart contracts through its Onchain AI Oracle (OAO) infrastructure.

The protocol uses opML (Optimistic Machine Learning) technology. This approach lets any ML model run on blockchain networks without limits. OAO works similar to optimistic rollups used by Optimism and Arbitrum.

ORA raised $20-23 million from investors including Polychain Capital, HashKey Capital, HF0, and SevenX Ventures. The protocol is trusted by Compound, Uniswap, and the Ethereum Foundation for its practical AI solutions.

The platform addresses a core blockchain limitation. Smart contracts cannot natively access AI capabilities or complex computations. ORA solves this through verifiable oracle technology that maintains trustless execution.

Core Products And Services

Onchain AI Oracle (OAO)

OAO enables smart contracts to access AI inference directly on blockchain. The system supports models like LLaMA 3 and Stable Diffusion. Developers can integrate these models into their dApps with verifiable proofs.

The oracle uses opML framework for verification. Results are posted on-chain and validators can challenge incorrect outputs. This creates a fraud-proof system similar to optimistic rollups.

Initial Model Offering (IMO)

IMO tokenizes AI models through the ERC-7641 standard. This mechanism lets AI model creators raise funds and share revenue with token holders. The first IMO launched OpenLM (OLM token) in April 2024.

Over 20 traditional AI companies approached ORA for IMO launches. This shows strong demand for monetization solutions in the AI sector. Token holders earn revenue from model usage and participate in governance.

Resilient Model Services (RMS)

RMS launched in January 2025. The service provides high-performance AI inference APIs with verifiable computation. It supports DeepSeek R1 at rates lower than competitors.

ORA plans three additional RMS stages in the first half of 2025. The service handles both on-chain and off-chain AI computations. This expands ORA's capabilities beyond pure on-chain operations.

opAgent Framework

opAgent creates autonomous AI agents on blockchain. These agents own digital assets through smart-contract wallets. The framework eliminates private key vulnerabilities through mathematical consensus.

AI agents can perform DeFi operations, create assets, and interact with users. All actions are verifiable through RMS and OAO. This enables truly decentralized artificial intelligence.

ORA Protocol Funding And Investors For 2025

Total Funding Raised By ORA Protocol

Data: ORA Protocol funding rounds 2024-2025, Crunchbase, PitchBook

ORA secured between $20-23 million across funding rounds. The main round closed in June 2024 at $20 million. Polychain Capital led the investment.

HashKey Capital, HF0 (Hacker Fellowship Zero), and SevenX Ventures participated. Additional backers include IOBC Capital, GeekCartel, and Alpen Capital. The funding supports research and infrastructure development.

Funds target opML advancement and ecosystem growth. ORA focuses on making AI models accessible through blockchain technology. The capital also supports IMO platform development.

ORA Protocol Compared To Major Oracle Competitors

| Oracle Protocol | TVS/TVL | Technology | Supported Chains | Primary Use Case |

|---|---|---|---|---|

| Chainlink | $65B TVS | Decentralized oracle network | Multiple blockchains | Price feeds, VRF, automation |

| Chronicle Protocol | $7B TVS | Publisher-based oracle | Ethereum, Layer 2s | DeFi price data |

| Pyth Network | $3.2B TVS | Pull-model oracle | 60+ blockchains | High-frequency price feeds |

| RedStone | $2.5B TVS | Modular push/pull | 110+ blockchains | Custom data feeds |

| Supra | $873M TVS | Threshold AI oracle | 67 mainnets | AI-native DeFi |

| ORA Protocol | Not disclosed | opML (Optimistic ML) | Ethereum, Optimism, Base, Polygon | AI inference on-chain |

| Band Protocol | $143M TVS | Cross-chain oracle | Multiple chains | Real-time data feeds |

Data: DefiLlama Oracle TVS rankings June 2025, protocol documentation

Chainlink dominates with $65 billion in total value secured. Chronicle Protocol serves Sky (formerly MakerDAO) with $7 billion TVS. Pyth Network focuses on high-frequency price feeds across 60+ chains.

ORA differentiates through AI-specific functionality. Other oracles provide price feeds and data. ORA enables actual AI model inference on blockchain. This creates a distinct market position.

The protocol competes in a growing sector. Two major attacks occurred in 2025. KiloEx lost $7.5 million in April through price manipulation. Vow token lost $1.2 million in August from oracle exploitation.

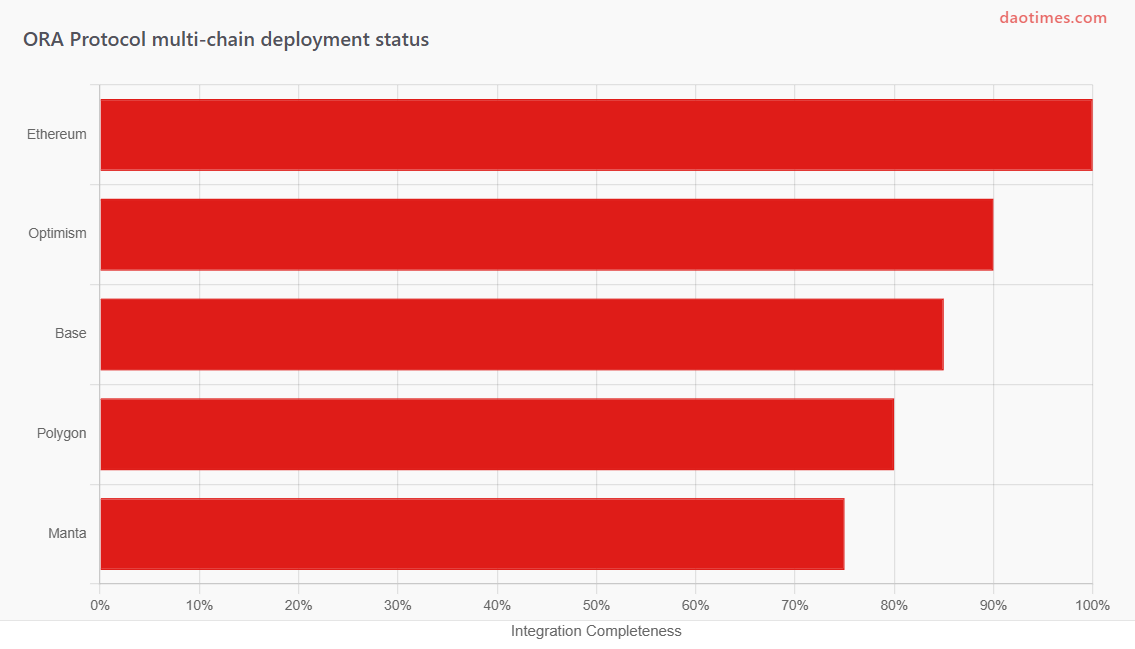

Blockchains Supported By ORA Protocol In 2025

Data: ORA Protocol documentation, Blockworks announcement March 2024

ORA launched OAO on Ethereum mainnet in March 2024. The protocol expanded to Optimism, Base, Polygon, and Manta within weeks. Ethereum remains the primary deployment chain.

The chain-agnostic infrastructure supports EVM-compatible networks. Developers can deploy AI oracles across multiple Layer 2 solutions. This provides flexibility for different use cases.

Base integration enables Coinbase user onboarding. Optimism and Polygon offer lower transaction costs. Manta provides privacy-focused AI applications. Additional chain support is planned.

ORA Protocol Growth Metrics Through 2025

Data: ORA Protocol announcements, Chainwire press releases 2024-2025

ORA completed multiple product launches in 2024-2025. The OAO mainnet went live in March 2024. First IMO sold 500 million OLM tokens for 150 ETH in April 2024.

RMS and opAgent launched in January 2025. These services expand beyond pure on-chain operations. The protocol now handles off-chain AI computation with verification.

ORA points program allocates 10% of total token supply. Users earn points through OAO interactions, staking, and referrals. The program incentivizes ecosystem participation ahead of token launch.

OpenLM Token Performance For ORA Protocol

| Metric | Value | Date | Notes |

|---|---|---|---|

| IMO Launch Price | $0.001 | April 13, 2024 | 3e-7 ETH per token |

| All-Time High | $0.071101 | October 27, 2024 | 60x from launch |

| All-Time Low | $0.00000505 | September 2, 2025 | -99.5% from ATH |

| Current Price (Nov 2025) | $0.00001393 | November 28, 2025 | Down 99.8% from ATH |

| Total Supply | 1 billion OLM | - | Fixed max supply |

| IMO Raise | 150 ETH | April 2024 | ~$500,000 USD |

Data: Bybit, BeInCrypto, ORA Protocol IMO documentation

OLM launched as the first tokenized AI model. The IMO sold out in 72 hours. Initial buyers paid 0.01-1 ETH per transaction. Demand exceeded supply at launch.

The token peaked at $0.071 in October 2024. Early participants saw 60x returns. Price subsequently declined 99.8% by November 2025. This reflects broader crypto market conditions and limited utility.

Token holders receive revenue shares every 90 days. They can also burn tokens through a buyback mechanism. 10% went to OpenLM contributors. 30% provides liquidity. 10% went to ORA team.

What Changed For ORA Protocol In 2025

Resilient Model Services Launch

RMS entered production in January 2025. The service provides verifiable off-chain AI computation. Stage 1 offers DeepSeek R1 support at rates lower than competitors.

Three additional stages are planned for first half 2025. This expands ORA beyond purely on-chain operations. Developers get access to more powerful models with reduced latency.

opAgent Framework Release

opAgent enables autonomous AI agents on blockchain. These agents hold assets through smart-contract wallets. No private keys are required for operation.

The framework combines RMS and OAO for full verification. AI agents can execute DeFi transactions, create tokens, and interact with users. All actions are mathematically verifiable.

Expanded AI Model Support

ORA now supports LLaMA 3, Stable Diffusion, and DeepSeek R1. Earlier versions supported LLaMA 2 and basic image generation. The platform can integrate any open-source ML model.

Developers use the opML framework to add new models. This creates a bring-your-own-model capability. Custom models can be deployed with fraud-proof verification.

Points Program And Token Preparation

ORA points program allocates 10% of total supply. Users earn through OAO usage, staking ETH/OLM/STONE, and referrals. Points convert to future tokens at launch.

The program ran with 10,000 ETH cap. Daily point settlement tracks ecosystem participation. This builds community before mainnet token deployment.

How ORA Protocol Technology Works

Optimistic Machine Learning (opML)

opML applies optimistic rollup principles to ML inference. Computations run off-chain with results posted on-chain. Validators can challenge incorrect outputs within a dispute period.

The system uses fraud proofs for verification. This approach is more efficient than zero-knowledge machine learning (zkML). zkML requires 1000x computational overhead while opML avoids proof generation costs.

Verification Game Mechanism

When an AI request is submitted, servers compute the result. Results are committed on-chain through the opML contract. Verifiers check outputs against expected values.

If results are incorrect, a dispute game begins. An arbitration smart contract resolves the challenge. The losing party is penalized. This creates economic security.

Privacy Through opp/ai Framework

opp/ai combines opML and zkML for privacy-preserving AI. Sensitive computations use zero-knowledge proofs. Less sensitive operations use opML for efficiency.

The framework lets developers balance privacy and cost. Models can be split into public and private components. This addresses opML's transparency limitation.

Real World Applications Of ORA Protocol

Data: ORA Protocol documentation, developer use cases

DeFi protocols use ORA for dynamic pricing. AI analyzes complex parameters to value assets. This works for blue chips, memecoins, NFTs, and real-world assets.

Insurance claims can be processed automatically. AI examines claim data against policy rules. Smart contracts execute payouts based on verified analysis.

Prediction markets use AI for settlement. Models analyze data to determine outcomes. This removes human bias from resolution processes. Gaming applications generate on-chain content. NFT projects create AI-generated artwork with provenance.

Developer tools include AI code review and security analysis. Models scan smart contracts for vulnerabilities. Anomaly detection identifies unusual transaction patterns. Lending protocols assess borrower risk through on-chain AI analysis.

You can find real implementations at DAO tools dashboard and explore additional projects at DAO directory.

Security Status And Incidents For ORA Protocol

No major security incidents were reported for ORA Protocol through 2025. The protocol has not experienced hacks, exploits, or fund losses. This distinguishes it from some oracle competitors.

The broader oracle market saw two attacks in 2025. KiloEx lost $7.5 million in April through price manipulation. Vow token lost $1.2 million in August from internal oracle manipulation.

ORA's opML design includes multiple security layers. The fraud-proof mechanism allows challenges to incorrect results. Economic penalties discourage malicious behavior. Smart contracts handle dispute resolution.

The protocol is trusted by established projects. Compound, Uniswap, and Ethereum Foundation use ORA technology. This suggests confidence in security architecture.

Open-source model requirements in opML create transparency. All models must be public for network participants to verify. The opp/ai framework addresses privacy needs when required.

Users should monitor the protocol's security practices. Regular audits and ongoing development are needed. The system is still relatively new compared to established oracles.

ORA Protocol Roadmap And Future Plans

Short Term (2025 H1)

Complete RMS stages 2-4 rollout. Expand AI model library with additional open-source models. Launch ORA token with governance capabilities. Increase supported blockchain networks.

Medium Term (2025 H2)

Deploy additional IMOs for AI model tokenization. Enhance opAgent framework with more DeFi integrations. Build developer tools and SDKs. Expand node operator network.

Long Term Vision

Create ecosystem of AI-powered dApps. Enable true verifiable agentic economy. Make any AI model accessible on-chain. Build standard infrastructure for blockchain AI integration.

ORA aims to become the default AI oracle. The protocol targets developers building next-generation dApps. Focus remains on trustless, verifiable AI execution.

ORA Protocol Competitive Position In Oracle Market

Data: DefiLlama oracle rankings June 2025

Chainlink leads with 85.4% market dominance. Chronicle Protocol holds 9.2% serving MakerDAO. Pyth Network has 4.2% focused on perpetuals. Other oracles share remaining 1.2%.

ORA targets a different market segment. Traditional oracles provide price feeds and data. ORA enables AI model inference. This creates new use cases rather than competing directly.

The AI oracle niche is emerging. Projects like Oraichain and Supra explore similar concepts. ORA's opML approach offers unique advantages. Lower costs and higher scalability versus zkML alternatives.

Growth depends on AI adoption in crypto. More projects need on-chain AI capabilities. ORA must prove real-world utility. Developer adoption will determine long-term success.

Advantages And Limitations Of ORA Protocol

Key Strengths

Unique AI focus differentiates from traditional oracles. opML enables any-size model without computation limits. Strong backing from top-tier investors provides resources. Trusted by established protocols like Compound and Uniswap.

IMO mechanism creates new monetization for AI developers. Revenue sharing aligns incentives between creators and users. opAgent enables truly autonomous AI agents. Multiple blockchain support provides flexibility.

Main Challenges

No disclosed TVL makes market position unclear. OLM token declined 99.8% from peak. Limited production use cases shown publicly. Newer protocol with less battle-testing than Chainlink.

opML requires public models which limits some applications. Seven-day challenge period creates latency for finality. Smaller validator network than established competitors. Success depends on AI adoption in blockchain space.

Market Risks

Regulatory uncertainty around AI and crypto. Competition from both traditional oracles and AI-specific solutions. Technical complexity may limit developer adoption. Token economics untested at scale.

Frequently Asked Questions About ORA Protocol

Sources And References

Research Sources:

Blockworks - "ORA's on-chain AI oracle is now available on Ethereum mainnet"

Chainwire - "Resilient Model Services and opAgent Are Now Live on ORA Protocol"

Cointelegraph - "ORA raises $20M in funding for tokenizing AI models"

ORA Protocol Documentation - "Onchain AI Oracle Overview"

ORA Protocol Mirror Blog - "OAO: Onchain AI Oracle Launch", "World's First Initial Model Offering for OpenLM"

IQ.wiki - "ORA Protocol Project Analysis"

CoinLaunch - "ORA Protocol Project Analysis, Rating, Review"

DefiLlama - "Oracle Rankings by Total Value Secured June 2025"

Medium (Coinmonks) - "Blockchain Oracles in 2025: AI and Intent-Based DeFi"

Frontiers in Blockchain - "Can artificial intelligence solve the blockchain oracle problem"

DAO Times - Comprehensive DAO Tooling Guide

DAO Times - Comprehensive List of DAOs to Explore

Additional Data Sources:

CoinMarketCap, Bybit, BeInCrypto - Token price and market data

Crunchbase, PitchBook, Tracxn - Funding and investor information

RedStone Blog - "Blockchain Oracles Comparison 2025"

RootData - "ORA Verifiable Oracle Protocol Analytics"