New Data Shows Bitcoin's Volatility Stabilizing

Bitcoin, the world's leading cryptocurrency, has long been known for its extreme price volatility. However, recent analysis from Forbes suggests that this trend may be changing, with Bitcoin's volatility showing signs of stabilization in 2024.

This shift could have significant implications for Bitcoin's role in investment portfolios and its perception in the broader financial market.

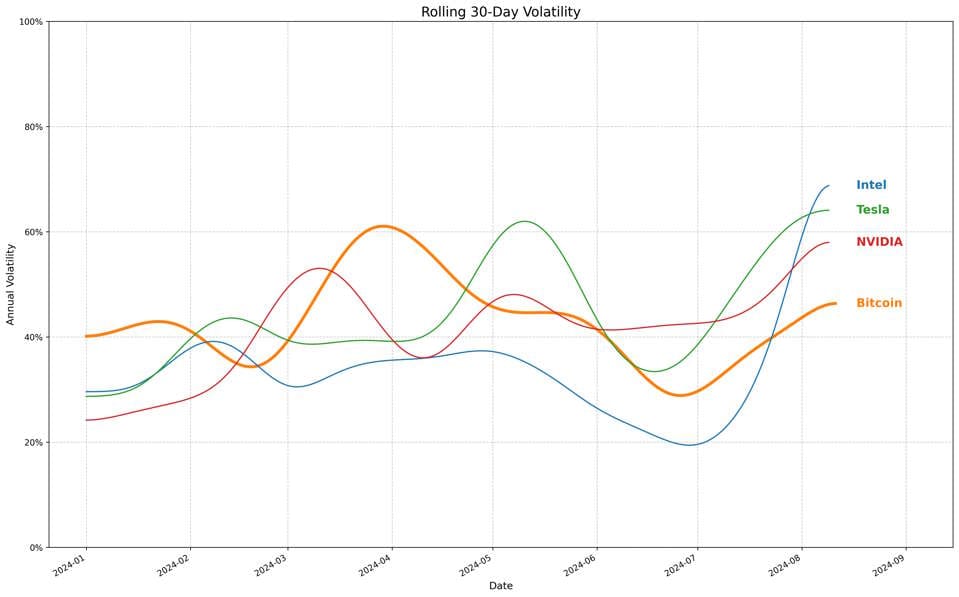

Over the last 12 months, Bitcoin's average annual volatility has decreased to 35.48%. While still higher than other assets, the gap has narrowed considerably. The most striking change is seen when comparing Bitcoin to high-volatility tech stocks. Bitcoin's volatility is now only 1.09 times higher than Tesla's (32.54%) and 1.17 times higher than NVIDIA's (30.42%).

Interestingly, in the past few months, Bitcoin's volatility has even dipped below that of Intel, Tesla, and NVIDIA. While this short-term trend doesn't warrant sweeping conclusions, it suggests that Bitcoin may be behaving more like other high-risk investments, particularly tech stocks.

Despite this trend towards stabilization, Bitcoin remains significantly more volatile than traditional financial institutions. Its volatility still exceeds that of Visa by 3.7 times and JPMorgan Chase by 3.2 times. This indicates that while Bitcoin is becoming more stable, it hasn't yet reached the level of established financial giants.

The evolving volatility profile of Bitcoin comes at a time of increased institutional acceptance. The approval of Bitcoin ETFs in the U.S., heightened attention from presidential candidates, and the legalization of mining in Russia all point to a shifting attitude towards cryptocurrencies at the institutional level. As adoption increases, it remains to be seen how Bitcoin's volatility will continue to evolve, potentially reshaping its role in the global financial landscape.

Editor's Opinion:

While the decreasing volatility of Bitcoin is often viewed positively as a sign of maturation, it's crucial to remember that volatility itself isn't inherently negative. Bitcoin's historical volatility has been a double-edged sword, attracting risk-tolerant investors and driving innovation in the crypto space.

The true value of Bitcoin lies not in its price stability, but in its ability to provide a censorship-resistant, borderless financial system. As we navigate this new phase of reduced volatility, the challenge will be to maintain Bitcoin's revolutionary spirit while broadening its appeal as a stable store of value.