Nansen DAO Tool Report For 2025

What Is Nansen

Nansen operates as a blockchain intelligence platform founded in 2020 by Alex Svanevik, Evgeny Medvedev, and Lars Bakke Krogvig. Based in Singapore, this analytics tool serves crypto investors, institutions, and Web3 teams. The platform labels over 500 million wallet addresses across 25+ blockchains. Users track Smart Money movements, monitor whale activity, and discover on-chain opportunities before mainstream markets react.

The company raised $88.2 million across three funding rounds. Accel led the $75 million Series B in December 2021, joined by Andreessen Horowitz, Tiger Global, and GIC. The valuation reached $750 million. Clients include Three Arrows Capital, OpenSea, MakerDAO, and a16z. In 2025, the service introduced Nansen AI, an agentic trading assistant trained on blockchain data.

According to Tracxn, annual revenue hit $8.87 million as of December 2023. The platform lowered entry pricing from $99 to $69 monthly in September 2025. Free tiers track up to 10 wallets. Professional subscriptions unlock Token God Mode, Smart Alerts, and API access for institutional clients.

How Nansen Works

Nansen indexes blockchain transactions in real time. The system connects to node networks across Ethereum, Solana, Arbitrum, Avalanche, Polygon, and 20 other chains. Machine learning algorithms scan petabytes of data daily. Google Cloud's BigQuery handles infrastructure, delivering query speeds 60x faster than traditional methods.

The labeling engine tags addresses algorithmically. More than 99% of labels come from automated inference. The platform identifies exchanges, venture capital wallets, DeFi protocols, NFT collectors, and individual traders. Users follow specific entities or set conditions to watch activity patterns. When Smart Money wallets purchase tokens, alerts fire instantly via Telegram, Discord, or email.

Token God Mode displays holder distribution, exchange flows, and top transactions for any asset. Users analyze accumulation patterns before price movements. The Wallet Profiler reveals token balances, transaction histories, and counterparty interactions. Research teams can run SQL queries through Nansen Query for custom analysis. The platform serves both retail traders seeking alpha and institutions conducting due diligence.

Key Metrics For Nansen In 2025

Data: Nansen platform statistics and public reports

The platform tracks over 500 million labeled wallet addresses as of Q3 2025. This represents growth from 100 million labels in December 2021. Blockchain coverage expanded from Ethereum-only in 2020 to 25+ networks by 2025. Supported chains include EVM networks, Solana, Bitcoin Layer 2 solutions, and emerging ecosystems like Scroll and TRON.

User base quadrupled between June and December 2021, per Blockworks reporting. The company hired 55 team members across 28 countries during that period. The workforce expanded further to build institutional products. Conversion rates improved when users activated Smart Alerts. Trial users with one alert showed 400% higher subscription probability, according to Google Cloud case study data.

Query performance delivers results in milliseconds. Real-time indexing updates every hour across all chains. The infrastructure processes billions of transactions daily. Teams at OpenSea, Coinbase, and ConsenSys use Nansen Query for production analytics. Over $2 billion in assets under management utilize the platform for portfolio decisions.

What Changed In 2025 For Nansen

Nansen AI launched in September 2025 as the platform's first mobile-native product. The conversational interface replaces traditional dashboards with natural language queries. Users ask questions about tokens, wallets, or market trends. The AI agent responds with data drawn from 500 million labeled addresses across 25 chains. The app works on iOS and Android devices.

Pricing dropped to make analytics more accessible. The Pro Monthly plan fell from $99 to $69. Annual subscriptions offer further savings at $589. Free users access portfolio tracking for 10 wallets and limited Expert prompts. The company targets broader adoption among retail traders while maintaining institutional products.

The platform acquired StakeWithUs in September 2024 to expand into staking services. This Singapore-based provider supports SOL, SUI, OSMO, and ATOM. Non-custodial staking became available within Nansen's interface. Users earn yields while maintaining analytics access. The move diversified revenue beyond subscriptions into financial services.

Autonomous trading capabilities entered testing phases. The AI Trading Agent prepares orders based on user-defined strategies. Humans retain final approval before execution. Full autonomous features target Q4 2025 release. Safety protocols prevent the system from trading on incorrect data. The agent monitors volatility thresholds and executes 24/7 without human oversight once approved.

Nansen Features And Capabilities

Token God Mode For Nansen Deep Token Analysis

Token God Mode provides multi-dimensional views of any cryptocurrency. The dashboard displays holder distribution through pie charts. Users see what percentage the top 10, 50, or 100 wallets control. Distribution scores warn about concentration risks. Scores below 40% for top three holders register as healthy. Higher concentration suggests manipulation potential.

Exchange flow tracking shows tokens moving in or out of trading platforms. Net outflows typically precede price increases. The system plots weekly DEX trades, latest transactions, and top movements. Smart Money balance changes appear in real time. When known profitable traders accumulate, the data surfaces immediately.

Smart Alerts And Real Time Monitoring For Nansen

Smart Alerts watch blockchain activity automatically. Users create conditions for wallets, tokens, protocols, or NFT collections. When criteria match, notifications fire across multiple channels. The system supports Telegram bots, Discord webhooks, Slack integration, and email.

Five main alert types cover different scenarios. SM Token Flows track Smart Money purchases above custom thresholds. Signal alerts notify when AI detects anomalies. Wallet alerts monitor specific addresses for transactions. Token alerts watch for balance changes. NFT alerts catch floor price movements or volume spikes.

Smart Money Tracking In Nansen

The platform labels historically profitable wallets as Smart Money. These include venture capital funds like Pantera Capital, successful traders, and early crypto adopters. Users filter tokens by Smart Money ownership. The system shows which addresses bought tokens before major rallies. Replicating these strategies forms a core use case for retail investors.

The Wallet Profiler reveals detailed histories. Every transaction appears chronologically. Token holdings display with current values. Counterparty analysis shows which protocols or entities interact most frequently. Users identify patterns like recurring DeFi yield farming or NFT flipping strategies.

Nansen AI Agent Conversational Interface

The 2025 AI agent transforms how users access data. Instead of navigating dashboards, traders ask natural questions. Examples include "show me tokens Smart Money bought today" or "analyze this wallet address." The agent responds with formatted data, charts, and actionable insights. The training dataset includes transaction histories and wallet relationships.

The mobile app integrates portfolio tracking. Users connect unlimited wallets across all supported chains. Automatic P&L calculation shows gains and losses. The agent attributes performance to specific trades. Portfolio holders receive alerts when their assets experience unusual activity.

Nansen Competitor Analysis 2025

| Platform | Labeled Addresses | Chains Supported | Starting Price | Key Strength |

|---|---|---|---|---|

| Nansen | 500M+ | 25+ | $69/month | Smart Money tracking, AI agent |

| Dune Analytics | Community-driven | 20+ | Free tier | SQL queries, open dashboards |

| Arkham Intelligence | 400M+ | 10+ | Free tier | Entity identification, bounties |

| Messari | Limited | Multiple | Enterprise | Research reports, metrics |

| DefiLlama | N/A | 200+ | Free | TVL tracking, DeFi focus |

| Token Metrics | N/A | Multiple | $60/year | AI predictions, multi-chain |

Data: Platform websites and feature comparisons as of Q4 2025

Dune Analytics competes through community-created dashboards. Users write SQL queries to extract custom insights. The platform offers free access to basic features. Power users pay for priority query execution. Dune excels in transparency and collaborative research but lacks proprietary wallet labels.

Arkham Intelligence focuses on entity identification through bounties. Users submit wallet ownership information. The platform labels addresses connected to exchanges, funds, and notable traders. Arkham provides free tools but monetizes through premium alerts and API access. The approach differs from Nansen's algorithmic labeling.

Token Metrics uses machine learning for price predictions. The service covers Bitcoin, Ethereum, Polkadot, and Binance Smart Chain. Monthly subscriptions start at $60 yearly. The platform targets forward-looking insights rather than on-chain activity tracking. This makes it complementary rather than directly competitive to Nansen.

DefiLlama dominates Total Value Locked monitoring. The free platform tracks 200+ chains. Users compare protocol sizes, yields, and growth rates. DefiLlama doesn't offer wallet-level analytics or Smart Money tracking. The specialized focus on DeFi metrics creates minimal overlap with Nansen's broader toolkit.

Nansen Pricing Structure And Plans

Data: Nansen pricing page as of November 2025

The Free plan provides portfolio tracking for 10 wallets. Users run five Expert prompts or 10 Fast prompts monthly. Smart Search accesses basic blockchain data. The tier serves newcomers learning on-chain analysis. Limitations include restricted historical data and no Smart Alerts.

Pioneer costs $69 monthly or $589 annually. This tier unlocks Nansen Labels covering 300 million addresses across 12 chains. Token, wallet, and NFT analytics expand beyond free limits. Improved table filtering allows custom label sorting. Users create Smart Alerts and access on-chain signals. Pioneer suits serious individual traders.

Professional targets institutions requiring API access. Pricing varies based on query volume and data needs. Features include Nansen Query for SQL-based extraction, dedicated support, and custom integrations. Teams at hedge funds, exchanges, and protocols use this tier. The package includes priority feature requests and white-glove onboarding.

Enterprise serves large organizations needing specialized solutions. Contracts include custom blockchain support, private label databases, and embedded analytics. Pricing negotiates per use case. Clients receive service level agreements and direct engineering support. The tier accommodates compliance requirements and proprietary workflows.

Nansen Security Incident History

Data: Nansen official statements and security reports from September 2023

A third-party vendor breach occurred on September 20, 2023. Attackers gained administrative access to an authentication provider. The compromised vendor served Fortune 500 companies and multiple blockchain firms. Nansen detected unauthorized activity within 48 hours and shut down access.

The breach affected 6.8% of users. These accounts had email addresses exposed. A smaller subset saw password hashes compromised. The smallest group experienced blockchain address exposure. CEO Alex Svanevik confirmed no private keys or wallet funds faced direct risk. The company never stores private keys in its systems.

Nansen emailed affected users on September 21, 2023. All impacted accounts received password reset instructions. The platform recommended password changes for all users as precautionary measures. Some users reported credit card compromises on social media. Nansen didn't confirm payment data exposure in official statements.

The vendor refused public identification. Nansen requested they issue statements in case other clients suffered exposure. BleepingComputer reported the vendor as established with strong security reputation. The incident reinforced third-party risk management importance. Post-incident, Nansen reviewed security protocols and vendor relationships.

Nansen Roadmap And Development History

Data: Nansen blog posts, funding announcements, and feature releases

Alex Svanevik discovered Ethereum in 2017 while working in data science. He previously led teams at Schibsted Media Group in Barcelona. His first crypto venture, CoinFi, failed during the 2018 bear market. The experience taught lessons about financial management and product focus. Svanevik founded Nansen in October 2019 with two co-founders.

The platform launched publicly in 2020 with Ethereum-only coverage. Mechanism Capital and Skyfall Ventures led the $1.2 million seed round in October 2020. Robot Ventures, Volt Capital, and Fabric Ventures participated. Angel investors included Ethereum developer Eric Conner and Dragonfly's Kevin Hu. Early traction came from DeFi yield farmers tracking profitable wallets.

Series A funding arrived in June 2021 with $12 million led by Andreessen Horowitz. The round valued the company at approximately $150 million. During the following six months, the user base grew 400%. The team expanded from solo founder to 55 employees across 28 countries. Polygon and Binance Smart Chain support launched during this period.

The December 2021 Series B raised $75 million at $750 million valuation. Accel led with participation from GIC, Tiger Global, and SCB 10X. The capital funded blockchain expansion to Avalanche, Fantom, Celo, and Ronin. NFT analytics became a focus area. The platform reached market leadership in NFT tracking by covering 18,000 collections.

Product evolution continued through 2022-2024. Nansen Query launched for institutional clients. The API opened programmatic access. OpenSea, a16z, and MakerDAO adopted the service. StakeWithUs acquisition in September 2024 added staking capabilities. The 2025 AI agent represents the latest transformation toward conversational analytics and autonomous trading.

Advantages And Disadvantages Of Nansen

Advantages

The most valuable feature remains Smart Money tracking. Users replicate strategies from historically profitable wallets. This democratizes access to institutional-grade insights. Three Arrows Capital and DeFiance Capital use identical tools to retail subscribers. Early opportunity discovery often leads to outsized returns.

Multi-chain coverage sets Nansen apart from single-blockchain tools. Portfolio tracking across 25 networks provides unified views. Traders managing assets on Ethereum, Solana, and Arbitrum see complete positions. Cross-chain analysis reveals arbitrage opportunities and liquidity migrations before general awareness.

Real-time alerts prevent missed opportunities. Smart Alerts fire within seconds of on-chain activity. Users catch whale purchases before price impact materializes. The system saved users millions during the UST Curve pool drainage in 2022. Early exit signals came from Smart Alert notifications.

Token God Mode condenses hours of research into dashboard views. Holder concentration, exchange flows, and top transactions appear instantly. Due diligence speeds up dramatically. The tool helped users identify pump-and-dump schemes through distribution analysis. Projects with concentrated holdings trigger red flags.

Disadvantages

Professional features require paid subscriptions. The $69 monthly cost excludes budget-conscious traders. Free tiers limit wallet tracking to 10 addresses. Competitive platforms like Dune Analytics and DefiLlama offer zero-cost alternatives. Cost barriers reduce accessibility for emerging market users and students.

The interface presents learning curves. New users face dashboard overload. Understanding which tools solve specific problems takes time. Token God Mode, Wallet Profiler, and Hot Contracts serve different purposes. Documentation helps but practical experience proves necessary for mastery.

EVM chain focus leaves non-EVM ecosystems underserved. Solana receives separate tracking with fewer features. Bitcoin Layer 2 support remains limited compared to Ethereum tools. Users analyzing Cosmos, Polkadot, or Cardano find reduced functionality. The platform prioritizes where most DeFi activity occurs.

Data accuracy depends on labeling algorithms. While 99% automation works well, errors happen. Misidentified wallets can mislead analysis. Users should verify critical decisions with multiple sources. The September 2023 breach exposed vendor risk despite strong internal security.

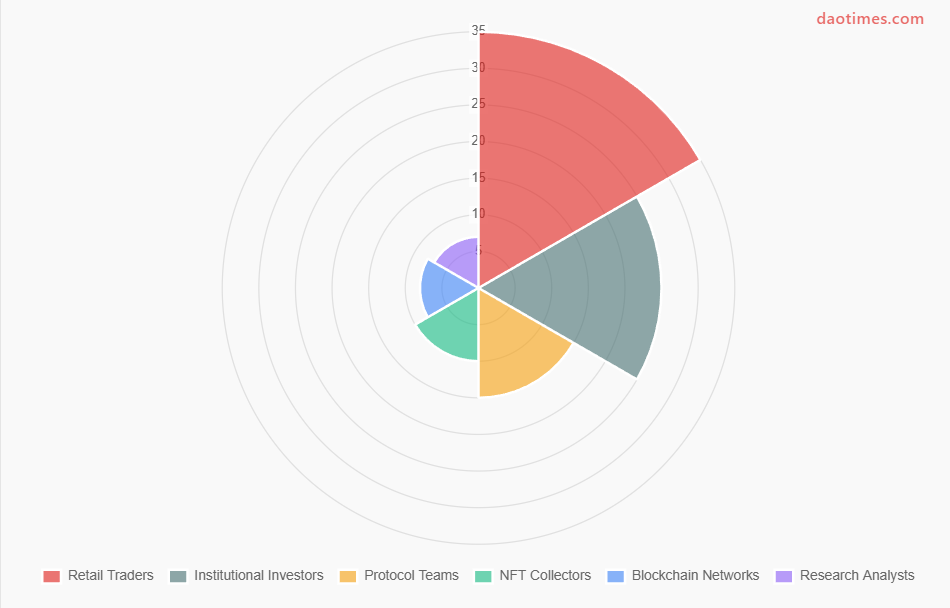

Use Cases For Nansen Platform

Data: Nansen solutions page and customer testimonials

Retail traders use Nansen to discover early opportunities. Following Smart Money wallets reveals tokens before mainstream attention. Users set alerts on venture capital addresses. When funds like Pantera or Polychain purchase assets, notifications fire immediately. Traders replicate buys at similar entry points. This approach generated significant returns during previous bull markets.

Institutional investors conduct due diligence through Nansen Query. Hedge funds analyze token holder distribution before large positions. Exchange flows help predict supply squeezes. The platform tracks competitor fund movements. Teams at Three Arrows Capital and Genesis Block Ventures rely on real-time dashboards. Investment decisions incorporate on-chain data alongside traditional metrics.

Protocol teams monitor ecosystem health. DeFi projects track user retention, liquidity flows, and whale behavior. Teams identify top users for VIP treatment. Sybil attack detection uses wallet clustering analysis. Axie Infinity, Polygon, and Lido use Nansen to optimize tokenomics and governance. Incentive programs target genuine users rather than farming accounts.

NFT collectors track collection performance. Floor price movements and wash trading filters reveal true market activity. Smart Money NFT wallets guide purchasing decisions. Collectors avoid collections with concentrated holdings or suspicious volume. The platform helped users exit prominent collections before major price drops.

Blockchain networks themselves use Nansen for growth. Layer 1 and Layer 2 teams analyze adoption metrics. Chains measure active developers, transaction patterns, and capital inflows. Competitors compare ecosystem sizes. Marketing teams target high-value users for migration campaigns. Networks like Avalanche and Scroll partnered with Nansen for dedicated analytics.

Frequently Asked Questions

What Blockchains Does Nansen Support In 2025?

Nansen covers 25+ blockchain networks including Ethereum, Solana, Arbitrum, Optimism, Polygon, Avalanche, BNB Chain, Fantom, Base, Scroll, and Bitcoin Layer 2 solutions. EVM-compatible chains receive full feature support. Non-EVM chains like Solana have dedicated tracking but fewer advanced tools.

How Much Does Nansen Cost?

The Free plan tracks 10 wallets with limited features. Pioneer costs $69 monthly or $589 annually. Professional and Enterprise tiers use custom pricing based on API usage and data needs. Pricing dropped from $99 in September 2025 to increase accessibility.

What Is Smart Money In Nansen?

Smart Money refers to historically profitable wallets labeled by Nansen. These include venture capital funds, successful traders, and early adopters. The platform tracks their purchases, sales, and on-chain activity. Users follow Smart Money to replicate profitable strategies before opportunities become public.

Can Nansen Track My Wallet Automatically?

Yes, users connect wallets through the portfolio tracking feature. The system monitors balances, transactions, and P&L across all supported chains. Free users track up to 10 wallets. Paid plans support unlimited connections. The mobile app provides automatic synchronization.

Does Nansen Offer An API?

Nansen Query provides SQL-based API access for institutional clients. Teams run custom queries against blockchain datasets. Query speeds reach 60x faster than building in-house solutions. OpenSea, Coinbase, and a16z use the API for production analytics. The feature requires Professional tier or higher.

What Happened In The 2023 Nansen Security Breach?

A third-party authentication vendor suffered compromise in September 2023. Attackers gained admin rights affecting 6.8% of users. Email addresses, some password hashes, and limited blockchain addresses exposed. No private keys or wallet funds faced direct threat. Nansen detected and stopped activity within 48 hours, requiring affected users to reset passwords.

How Does Nansen AI Agent Work?

The 2025 AI agent uses natural language processing trained on 500 million labeled addresses. Users ask questions like "show tokens Smart Money bought today." The agent responds with data, charts, and analysis. The mobile app integrates portfolio tracking and autonomous trading preparation with human approval.

What Is Token God Mode?

Token God Mode displays complete analytics for any cryptocurrency. Features include holder distribution, Smart Money activity, exchange flows, top transactions, and liquidity analysis. Users assess concentration risk, accumulation patterns, and whale movements. The dashboard consolidates multiple data sources into single views.

Who Are Nansen Main Competitors?

Dune Analytics competes with SQL-based community dashboards. Arkham Intelligence focuses on entity identification. Messari provides research reports. DefiLlama tracks Total Value Locked. Token Metrics offers AI price predictions. Each platform serves different niches with Nansen distinguished by Smart Money tracking and comprehensive wallet labeling.

Can I Use Nansen For Free?

The Free tier provides limited access. Users track 10 wallets, run five Expert or 10 Fast AI prompts monthly, and access basic blockchain searches. Full features require Pioneer subscription at $69 monthly. The free plan helps beginners learn on-chain analysis before committing to paid tiers.

Sources

Nansen Official Website

Axios: Nansen Launches New Crypto Trading Chatbot (September 2025)

Cointelegraph: Nansen Unveils AI Agent For Crypto Traders (September 2025)

Google Cloud: Nansen Customer Case Study

MEXC Blog: What Is Nansen Complete Guide (July 2025)

Tracxn: Nansen Company Profile And Funding (July 2025)

IQ Wiki: Alex Svanevik Biography

Blockworks: Nansen Data Breach Security Alert (September 2023)

BleepingComputer: Crypto Firm Nansen Security Incident (September 2023)

Crunchbase: Nansen Funding Rounds

Globe Newswire: Nansen Series B Announcement (December 2021)

CryptoNinjas: Nansen Review Features And Pricing (May 2025)

NFT Plazas: Nansen Review 2025