LayerZero DAO Tool Report For 2025

What Is LayerZero

LayerZero operates as an omnichain interoperability protocol. It enables smart contracts on different blockchains to exchange data and assets. The protocol launched in March 2022 and has processed over $150 billion in transaction volume by October 2025.

Unlike traditional bridges, LayerZero uses a messaging system. Developers can build applications that work across multiple chains simultaneously. The protocol connects 132 blockchain networks as of December 2025, including Ethereum, Solana, Avalanche, and others.

LayerZero controls 75% of cross-chain bridge volume. It handles approximately $293 million in daily transfers. The protocol processes 1.5 million cross-chain messages monthly, making it the dominant infrastructure for blockchain interoperability.

The system uses Ultra Light Nodes (ULNs) instead of full nodes. These smart contracts verify transactions using block headers and proofs. This approach reduces costs while maintaining security. Applications can configure their own security parameters through Decentralized Verifier Networks (DVNs).

LayerZero Token Price Performance 2024-2025

Data: CoinMarketCap, CoinGecko - December 2025

The ZRO token launched in June 2024 through a community airdrop. Initial trading began at approximately $3.50. The token reached an all-time high of $7.53 on December 6, 2024.

By October 2025, ZRO hit its all-time low of $0.90. This represented an 81% decline from its peak. As of December 7, 2025, ZRO trades at $1.38, showing a 53% recovery from the October low.

Current market metrics show a circulating supply of 244 million tokens. Total supply is capped at 1 billion ZRO. Market capitalization stands at $337 million, ranking the token at position 123 on CoinMarketCap.

Daily trading volume averages $30 million across exchanges. Andreessen Horowitz purchased $55 million worth of ZRO in April 2025 under a three-year lockup. This investment demonstrates institutional confidence despite price volatility.

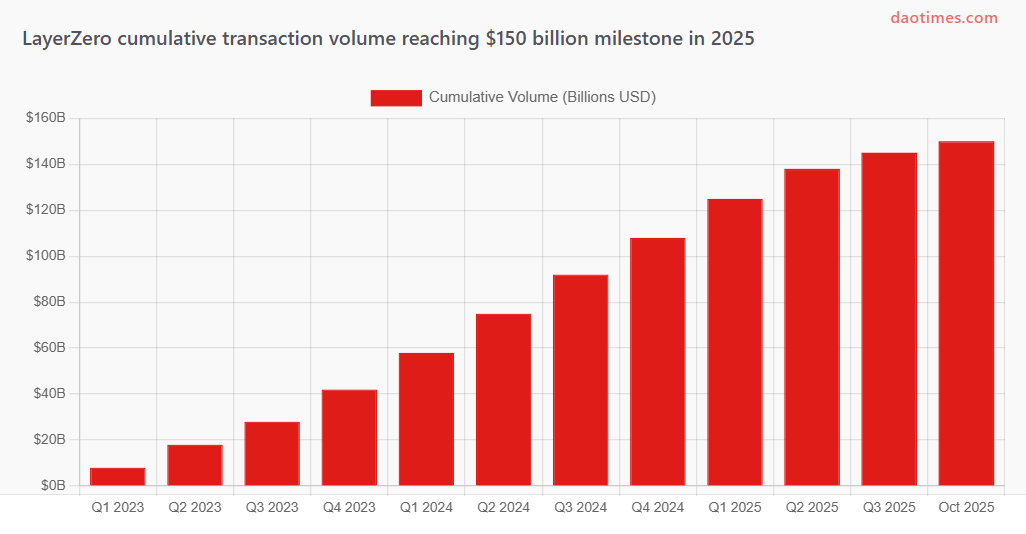

LayerZero Transaction Volume Growth

Data: LayerZero Scan, DefiLlama - October 2025

LayerZero crossed $50 billion in transaction volume during 2023. The protocol reached $100 billion in early 2024. By October 2025, total volume exceeded $150 billion - a milestone achieved in just 134 days from the previous $50 billion mark.

The acceleration shows adoption by both developers and users. Daily transaction volume averages $293 million. Weekly volume ranges between $1.8-2.1 billion across supported chains.

The Stargate acquisition in August 2025 added $70 billion in historical volume. Stargate now operates as part of LayerZero's infrastructure. Combined, the platforms control 85% of all cross-chain transaction volumes.

Blockchain Network Coverage Comparison

LayerZero Network Support Expansion

| Protocol | Chains Supported | Market Share | Daily Volume | Total Volume |

|---|---|---|---|---|

| LayerZero | 132+ | 75% | $293M | $150B+ |

| Wormhole | 30+ | 12% | $45M | $70B |

| Axelar | 64 | 8% | $28M | $8.7B |

| Chainlink CCIP | 15+ | 3% | $12M | $3.5B |

| Others | Various | 2% | $8M | $2.1B |

Data: Messari, DefiLlama - September 2025

LayerZero supports the most extensive network of blockchains. The protocol connects both EVM and non-EVM chains. Recent additions include IOTA Mainnet (December 2025), Monad (planned for mainnet launch), and Sui blockchain.

Competitors face challenges matching this coverage. Wormhole focuses on selected high-volume chains. Axelar uses a proof-of-stake validator network. Chainlink CCIP targets enterprise use cases with fewer supported chains.

What Changed In 2025

Stargate Finance Acquisition

LayerZero acquired Stargate Finance for $110 million in August 2025. The deal dissolved Stargate DAO. STG token holders swapped their tokens for ZRO at a 1:0.08634 ratio. Nearly 95% of votes approved the acquisition.

Wormhole made a competing $120 million cash offer. Axelar and Across also expressed interest. The acquisition proceeded despite these counter-bids. Stargate now operates under LayerZero's infrastructure, contributing $2 million in annual revenue.

Token Buyback Program

The LayerZero Foundation bought back 50 million ZRO tokens from early investors. The buyback started in September 2025. Stargate revenue funds these purchases. The first $1.2 million buyback completed in December 2025.

This strategy reduces circulating supply. Token holders with 10,000 ZRO or more receive a 15% fee rebate. Monthly credits apply to message fees. The mechanism incentivizes long-term holding.

Institutional Partnerships

PayPal expanded PYUSD stablecoin to multiple chains using LayerZero in September 2025. The stablecoin now operates on Tron, Avalanche, and Sei networks. Dinari integrated LayerZero in November 2025 for tokenized U.S. equities (dShares). The system enables trading of 200 stock tokens across four blockchains.

Wyoming launched a state-regulated stablecoin pilot (WYST) using LayerZero. Settlement between agencies completes in under five seconds. This compares to 48 hours in legacy systems. The integration demonstrates government adoption of blockchain infrastructure.

Protocol Fee Activation Vote

Community members voted on protocol fee activation in June 2025. The proposal passed with 50.40% quorum participation. Fees will fund ZRO token burns. Implementation reduces circulating supply by an estimated 5-10% annually depending on message volume.

A follow-up vote is scheduled for December 2025. Token holders will finalize revenue distribution parameters. The Parameter DAO structure launches in 2026 for on-chain governance of fee curves and DVN requirements.

LayerZero Market Share Breakdown

Data: Messari, DefiLlama - October 2025

LayerZero processes 75% of all cross-chain bridge transactions. The protocol handles 61% of stablecoin infrastructure operations. After the Stargate merger, combined market control reached 85% for certain transaction types.

Wormhole maintains 12% market share. The protocol focuses on Solana and Ethereum connectivity. Axelar holds 8% with its Cosmos-based architecture. Smaller protocols combined account for less than 5% of total volume.

New Features And Technical Updates

LayerZero V2 Architecture

V2 launched across 40+ blockchains in December 2023. The upgrade introduced Decentralized Verifier Networks (DVNs). These replace the V1 oracle system. Any entity can operate a DVN by deploying verification contracts.

The security stack uses an X-of-Y-of-N configuration. Applications choose how many DVNs must verify messages. For example, "2 of 3 of 5" requires two specific DVNs plus three of five total verifiers. This flexibility allows customization based on security needs.

Executors handle message delivery on destination chains. They operate as a permissionless role. Gas costs decreased 50-90% through improved encoding. Message delivery times dropped to under five minutes for most transfers.

Out-of-Order Execution

V2 enables messages to execute in any sequence. V1 required strict ordering, causing delays if one message stalled. The new system maintains censorship resistance while improving throughput. Protocol capacity now matches destination chain limits.

Omnichain Fungible Token Standard

The OFT standard uses burn-and-mint mechanics. Tokens burn on the source chain and mint on the destination. Total supply remains constant across all networks. This eliminates wrapped token risks and liquidity fragmentation.

PancakeSwap adopted OFT for CAKE token in late 2024. The implementation removed wrapped versions across six chains. Daily volume increased 23% within one month. Farming rewards now auto-route to chains with highest yields.

Omnichain Vault Design

LayerZero announced OVault in September 2025. The system connects ERC-4626 vaults with LayerZero-supported networks. Users can deposit assets on one chain and earn yields from vaults on others. Capital efficiency improves through dynamic reallocation.

Google Cloud Integration

Google Cloud operates as the default oracle for LayerZero messages. The infrastructure provides enterprise-grade security. Projects can still choose alternative DVNs. The integration attracts institutional users requiring compliance standards.

Security Assessment And Incidents

Core Protocol Security

LayerZero has not experienced a core protocol exploit since launch. The protocol underwent audits from OpenZeppelin, Trail of Bits, and other firms. Total security spending exceeded $5 million by 2023.

The bug bounty program offers up to $15 million for critical vulnerabilities. This represents the largest bounty in the cryptocurrency industry. The program launched in May 2023 through partnership with Immunefi. Over $50 billion has been processed without losing user funds from protocol failures.

GriffinAI Exploit September 2025

An unauthorized LayerZero peer initialization occurred in September 2025. The GriffinAI project suffered a $3 million hack. Attackers created a fraudulent LayerZero peer on Ethereum. They minted 5 billion counterfeit GAIN tokens.

The exploit bridged tokens to Binance Smart Chain for liquidation. GAIN token price crashed 84% in 24 hours. Proceeds of 2,956 BNB ($3 million) were laundered through Tornado Cash. This incident stemmed from misconfigured project settings, not a core protocol vulnerability.

LayerZero recommends all projects configure custom DVN sets. Default configurations provide basic security. High-value applications should implement multiple independent verifiers. Projects must properly initialize peer contracts on each supported chain.

Backdoor Controversy 2023

Nomad CTO James Prestwich published allegations in January 2023. He claimed LayerZero had undisclosed backdoor capabilities. CEO Bryan Pellegrino acknowledged the team can modify messages using default configurations.

Applications can eliminate this risk by setting custom security parameters. The configuration option exists in LayerZero's documentation. Stargate voted to change from default settings following the controversy. Most major projects now use custom DVN configurations.

Security Best Practices

Applications should select multiple independent DVNs. Combining Google Cloud, Polyhedra, and project-specific verifiers provides strong security. Projects can run their own DVN for maximum control. This approach suits applications with specific compliance requirements.

Competitor Analysis Metrics

LayerZero Versus Major Competitors Performance Comparison

Data: Messari, DeFiLlama - October 2025

Wormhole uses a Guardian network of validators. The system provides trust minimization through distributed verification. Message finality takes slightly longer than LayerZero. Wormhole focuses on Ethereum-Solana connectivity and gaming applications.

Axelar operates as a Layer 1 blockchain using Cosmos SDK. The proof-of-stake network provides full-stack interoperability. Transaction volume reached $8.66 billion by May 2024. Axelar launched the Interchain Amplifier in Q4 2025 for permissionless chain connections.

Chainlink CCIP targets enterprise users with compliance features. The protocol supports 15 blockchains. Banks and financial institutions prefer CCIP for regulated use cases. Volume remains smaller compared to LayerZero and Wormhole.

Brief History And Roadmap

Founding And Early Development

Bryan Pellegrino, Ryan Zarick, and Caleb Banister co-founded LayerZero Labs in 2021. The team raised $135 million in a Series B round during March 2022. Sequoia Capital, Andreessen Horowitz, and PayPal Ventures participated.

A second Series B round closed in April 2023, raising $120 million. The protocol launched on Ethereum mainnet in March 2022. Initial focus targeted messaging between Ethereum, Avalanche, and Polygon.

2024 Milestones

ZRO token launched in June 2024 through community airdrop. Over 1.3 million addresses received allocations. The distribution targeted active users and developers. PancakeSwap integrated OFT standard for CAKE token in late 2024.

2025 Development

Stargate acquisition completed in August 2025. Protocol fee mechanism received community approval. Major integrations included PayPal PYUSD, Dinari tokenized equities, and Wyoming stablecoin pilot. IOTA Mainnet connected in December 2025.

Upcoming Roadmap

Q4 2025 targets include finalizing Stargate integration and Grant DAO launch. The Grant DAO will allocate quarterly developer funding through token-holder snapshots. ULN-v3 testing continues with focus on 90%+ gas reduction compared to V1.

2026 plans involve Parameter DAO implementation. Token holders will control DVN whitelists, fee curves, and relayer slashing through on-chain proposals. Relayer staking launches to require ZRO deposits. Operators face slashing penalties for censorship or fraud.

The team plans support for hundreds of additional chains. Non-EVM blockchain integration continues expanding. Zero-knowledge proof verification may integrate into V3. Enterprise adoption focuses on tokenized securities and regulated stablecoins.

Token Economics Distribution

LayerZero ZRO Token Allocation Structure

| Category | Allocation | Percentage | Vesting Period | Status |

|---|---|---|---|---|

| Community Incentives | 520M ZRO | 52% | 48 months | Unlocking |

| Core Contributors | 255M ZRO | 25.5% | 4 years | Locked |

| Strategic Partners | 322M ZRO | 32.2% | 3 years | Partially Locked |

| Ecosystem Grants | 120M ZRO | 12% | Quarterly | Active |

| Buyback Reserve | 50M ZRO | 5% | Completed | Bought Back |

| Circulating Supply | 244M ZRO | 24.4% | N/A | Trading |

Data: Tokenomist, LayerZero Foundation - December 2025

Maximum supply caps at 1 billion ZRO tokens. Community incentives represent the largest allocation. Linear unlocking occurs over 48 months, ending November 2028. The last major tranche releases in Q4 2028.

Strategic partners include Andreessen Horowitz with a three-year lockup. Core contributors receive tokens over four years. The 50 million buyback targets early investors. These tokens remove from circulation permanently.

Future distributions use request-for-proposal (RFP) mechanisms. Token holders vote on ecosystem grants quarterly. The Grant DAO targets launch in Q4 2025. Allocations reward developers building on LayerZero infrastructure.

Pros And Cons Assessment

Advantages

Market dominance provides network effects. LayerZero controls 75% of cross-chain volume. The extensive blockchain support (132+ chains) exceeds competitors. No core protocol exploits have occurred since launch in 2022.

Flexible security configuration allows customization per application. Projects choose their own DVN sets and verification requirements. Gas cost reductions of 50-90% through V2 architecture benefit users and developers.

Strong institutional backing includes Andreessen Horowitz ($55 million in 2025), Sequoia Capital, and PayPal Ventures. Total funding exceeds $318 million. Major partnerships with PayPal, Dinari, and government entities validate the technology.

The OFT standard eliminates wrapped token problems. Native asset transfers maintain fungibility across chains. This approach has attracted major DeFi protocols. Developer tools include open-source SDKs in TypeScript, Rust, and Solidity.

Disadvantages

Token price declined 81% from all-time high. Current trading at $1.38 represents weak short-term performance. High fully diluted valuation of $1.42 billion creates overhang. Only 24% of tokens currently circulate.

Default configuration security concerns persist. Projects using defaults face potential risks. The 2023 backdoor controversy damaged trust. While mitigation exists through custom settings, many projects still use defaults.

The GriffinAI exploit in September 2025 shows implementation risks. Projects must properly configure LayerZero or face vulnerabilities. This creates complexity for smaller development teams. Security requires active management and understanding.

Competition intensifies from Wormhole and Axelar. These protocols improve their offerings continuously. Regulatory uncertainty around cross-chain bridges affects the entire sector. Smart contract risk exists despite audits. The DAO tooling landscape continues evolving rapidly.

Use Cases And Applications

DeFi Protocols

Radiant Capital uses LayerZero for cross-chain money markets. Users deposit collateral on one chain and borrow on another. Deposits grew from $110 million to $290 million in Q1 2025. The system reduces idle capital by following loan demand dynamically.

PancakeSwap implemented omnichain CAKE tokens. The change abolished wrapped versions across six chains. Farming rewards automatically route to chains with highest annual percentage yields. This optimization increased daily volume 23% within one month.

Stablecoins

PayPal's PYUSD operates across multiple chains via LayerZero. The stablecoin launched on Tron, Avalanche, and Sei in September 2025. Wyoming's WYST pilot demonstrates government adoption. State agencies settle payments in under five seconds using the technology.

Gaming And NFTs

Starborne X allows spaceship skins to move between Polygon and Sui. Players avoid bridging fees when trading assets. Secondary market liquidity increased 37% post-launch. Lil Pudgys NFT collection bridges to Arbitrum, Polygon, and BNB Chain using ONFT standard.

Tokenized Securities

Dinari launched dShares for U.S. equities in November 2025. Each token represents one share of public stock. The system maintains shareholder rights and compliance. Initial launch covers 200 tickers across four blockchains. LayerZero's OFT standard ensures unified supply across networks.

Enterprise Solutions

J.P. Morgan's Onyx Digital Assets used LayerZero for portfolio management proof-of-concept. The project falls under Singapore's Project Guardian. Conflux developed blockchain SIM cards (BSIM) using LayerZero. The product enables cross-chain transactions on mobile devices. If you're exploring different tools, check out this comprehensive list of DAOs for additional context.

Frequently Asked Questions

Sources

- LayerZero Official Documentation (docs.layerzero.network)

- CoinMarketCap - LayerZero (ZRO) Price and Market Data

- DefiLlama - LayerZero Protocol Analytics

- Messari - LayerZero vs Axelar Comparison Report

- The Block - Stargate DAO Acquisition Coverage

- Stablecoin Insider - LayerZero in 2025 Analysis

- Blockchain Reporter - LayerZero $150 Billion Volume Milestone

- Halborn - Month in Review DeFi Hacks September 2025

- TechCrunch - LayerZero Bug Bounty Program Announcement

- CoinDesk - Dinari Integration and Lido DAO Vote Coverage

- Cryptonomist - IOTA LayerZero Integration Report

- Binance Research - Cross-Chain Interoperability Analysis

- Tokenomist - LayerZero Token Economics

- Yellow Network - Cross-Chain Messaging Protocol Comparison

- LayerZero Medium - V2 Launch Announcement