How to Create a DAO in 2025

Key Takeaways

Creating a DAO in 2025 costs $0-200 using platforms like Aragon or Snapshot, taking 30 minutes to 4 hours for basic setup. Over 13,000 active DAOs manage $24.5 billion collectively, according to CoinLaw. You need: defined purpose, community of aligned members, governance framework, token distribution plan, and technical platform. Aragon supports 3,000+ DAOs, Snapshot handles 96% of DAO voting, Tally secures $30 billion in assets.

Main platforms: Aragon (customizable, on-chain), Snapshot (free, gasless), Tally (transparent governance), DAOhaus (simple grants), Syndicate (investment focus). Wyoming legally recognizes DAOs as LLCs in 2025. Security audits cost $15,000-50,000 but prevent hacks like The DAO's $60 million loss in 2016. Voter participation averages below 18% across ecosystem, requiring delegation systems and participation incentives.

Quick Start: Launch Your DAO in Under 2 Hours

For those who want to start immediately:

Go to Snapshot.org (free, no gas fees). Connect your wallet. Click "Create Space" and enter your DAO name. Set voting strategy (token-based or NFT-based). Choose voting type (single choice, approval, or quadratic). Write first proposal. Share space link with your community. Done.

Or use DAOhaus.club for on-chain governance. Connect wallet. Click "Summon DAO". Choose network (Ethereum, Polygon, Arbitrum). Set parameters: proposal period, voting period, quorum percentage. Deploy (costs $30-100 gas). Invite members. Treasury automatically created with Gnosis Safe integration.

What you get: Working voting system, member management, proposal creation, treasury (DAOhaus only), basic governance. What you need next: Community building, token distribution if needed, detailed governance rules, legal structure consideration, security review.

Complete Step by Step Guide

Step One: Define Purpose and Governance Model

Start by clarifying your DAO's core mission. Write a concise statement explaining what problems you solve and why decentralization matters for your use case. BitDAO focuses on supporting decentralized projects across blockchains, while MolochDAO funds Ethereum infrastructure development. Your purpose should attract contributors who share your values and goals.

Choose a governance framework that matches your needs. Token-weighted voting gives power proportional to holdings, common in DeFi protocols like Uniswap. Reputation-based systems reward active contributors regardless of token ownership, used by Colony. Quadratic voting reduces whale dominance by making additional votes exponentially expensive. For simple grant allocation, Moloch-style rage quit mechanisms let dissenting members exit with their funds.

Document decision-making thresholds clearly. Specify what percentage approval proposals need and minimum quorum requirements. Lido DAO requires 5% of total LDO supply voting for proposals to pass. Consider implementing time locks on critical changes, giving members notice before execution. These parameters balance efficiency against security and fairness.

Step Two: Build Your Community

Identify your target audience and where they gather online. DeFi enthusiasts congregate on Discord and Telegram, while creators prefer Twitter and Farcaster. Launch social channels before your DAO formally exists. Friends With Benefits grew to nearly 6,000 token holders by building community first through exclusive access and shared interests.

Create member roles that reflect different contribution types. Technical contributors, governance participants, content creators, and fund managers each play distinct parts. DAOhaus emphasizes collaboration over hierarchy with its "go together" philosophy. Establish clear paths for new members to get involved without overwhelming them.

Use comprehensive DAO tooling resources to equip your community with proper infrastructure. Communication platforms, voting tools, and treasury management systems form your operational backbone. Gitcoin DAO distributed over $45 million in grants through coordinated community action. Early engagement determines long-term success.

Step Three: Structure Treasury and Funding

Design your economic model around sustainability. Investment DAOs like MetaCartel Ventures pool capital for crypto startup funding, distributing returns to members. Protocol DAOs earn fees from their services, allocating profits through governance votes. Grant DAOs rely on external donations or initial endowments.

Decide whether to sell tokens or distribute them freely. Token sales generate immediate capital but create regulatory considerations. The SEC classified The DAO's 2016 tokens as securities, affecting subsequent launches. Free distribution builds community without financial barriers but requires alternative funding sources. Aragon supports over 3,000 DAOs with various economic structures.

Implement treasury management safeguards. Multi-signature wallets require multiple approvals for large transactions, preventing single points of failure. Gnosis Safe provides secure treasury solutions used by leading DAOs. Time-locked contracts delay execution of approved changes, allowing review periods. Venus DAO uses sub-DAOs for different treasury functions, separating research from financial operations.

Step Four: Launch Governance Tokens

Governance tokens represent voting power in your DAO. Uniswap's UNI token holders control protocol parameters, treasury allocation, and upgrade proposals. Design token distribution carefully to prevent concentration. Analysis by CoinLaw shows less than 0.1% of holders control 90% of voting power in ten major DAOs.

Consider vesting schedules for team allocations. Gradual token release aligns long-term interests and prevents immediate dumping. Curve Finance pioneered vote-escrowed tokens where users lock tokens for extended periods, gaining boosted voting weight. This mechanism encourages commitment over speculation.

Plan token utility beyond governance. Some DAOs require tokens for access to services or communities. Bankless DAO uses tokens to gate content creation roles and event participation. Others integrate tokens into their protocol economics. Kelp DAO's liquid restaking protocol holds $1.19 billion in total value locked, with governance tokens directing protocol development.

Step Five: Deploy Smart Contracts and Infrastructure

Smart contracts automate your DAO's operations without human intermediaries. OpenZeppelin provides audited contract templates for governance systems. Solidity dominates Ethereum development, while newer languages like Rust support cross-chain DAOs. Security audits are non-negotiable before mainnet deployment.

Test thoroughly on testnets before going live. Goerli and Sepolia networks let you verify contract behavior without risking real funds. The 2016 DAO hack drained $60 million due to recursive call vulnerability, splitting Ethereum into ETH and ETC. Tapioca DAO lost $4.4 million in 2024 through social engineering attacks on private keys. These incidents emphasize security's importance.

Implement defense-in-depth strategies. Multi-signature requirements prevent single compromised keys from draining treasuries. Time locks give members window to detect malicious proposals. Consider insurance protocols like Nexus Mutual for additional protection. Regular security reviews catch vulnerabilities before attackers exploit them.

Platform Comparison and Selection Guide

Which Platform Should You Choose?

| Platform | Key Features | Voting Type | DAOs Supported | Best For |

|---|---|---|---|---|

| Aragon | Modular apps, customizable governance, OSx framework | On-chain | 3,000+ | Complex organizations |

| Snapshot | Gasless voting, off-chain signaling, Snapshot X for on-chain | Off-chain/On-chain | Used by 96% of DAOs | Cost-effective voting |

| Tally | On-chain governance, proposal creation, delegation | On-chain | 10x more than competitors | Transparent governance |

| DAOhaus | Moloch framework, Safe multisig, cross-chain execution | On-chain | 300+ | Grant allocation |

| Syndicate | Investment protocols, legal compliance, treasury tools | On-chain | 150+ | Investment clubs |

| Colony | Reputation-based, task-driven, payments system | Reputation | 100+ | Project management |

Data: Aragon documentation, Snapshot Labs, Tally platform statistics, DAOhaus public metrics

Decision Matrix: Choosing Your Platform

Choose Aragon if: You need customizable governance that evolves over time, plan complex voting mechanisms, require integration with multiple DeFi protocols, or want modular architecture with plugins.

Choose Snapshot if: Budget is tight (free platform), community can't afford gas fees, you want to test sentiment before on-chain execution, or need quick setup without technical knowledge.

Choose Tally if: Transparency and on-chain record are critical, you manage substantial treasury (billions), community accepts gas costs for security, or you need delegation features.

Choose DAOhaus if: Focus is grant allocation, you want simple Moloch-style rage quit, community is small to medium size, or you need cross-chain functionality.

Choose Syndicate if: Creating investment DAO, legal compliance is priority, need traditional fund structures, or focusing on off-chain asset investment.

Choose Colony if: Managing distributed teams, compensation based on contribution, reputation matters more than token holdings, or running task-based organization.

Platform selection depends on your governance complexity and technical requirements. Aragon offers the most flexibility with its plugin system, allowing DAOs to evolve governance over time. Decentraland and numerous DeFi protocols use Aragon infrastructure. Snapshot dominates voting with 96% market penetration, according to StarkWare partnership announcements.

Tally secures over $30 billion in assets and processes nearly $700 million in on-chain proposal execution. Its transparency appeals to protocols prioritizing censorship resistance. DAOhaus serves community-focused projects with simpler needs, offering free open-source solutions. Colony's task-based approach suits freelance networks and development teams.

Costs and Resource Requirements

What Will Creating Your DAO Actually Cost?

| Platform | Setup Cost | Gas Fees | Ongoing Costs | Technical Skill | Time to Launch |

|---|---|---|---|---|---|

| Aragon | Free platform | $50-200 deployment | Gas for votes | Low to Medium | 1-3 hours |

| Snapshot | Free | None (off-chain) | None | Low | 30 minutes |

| Tally | Free interface | $50-150 setup | Gas per vote | Medium | 2-4 hours |

| DAOhaus | Free | $30-100 deployment | Minimal gas | Low | 1-2 hours |

| Syndicate | Service fees vary | $100-300 | Management fees | Low to Medium | 1-2 days |

| Custom Development | $20,000-100,000+ | Variable | Maintenance costs | High | 2-6 months |

Data: Platform documentation, developer community estimates, Layer-2 gas price analysis

Additional Costs to Consider

Security Audits: $15,000-50,000 for professional smart contract audit. Multiple audits recommended before handling significant funds. Trail of Bits, Consensys Diligence, and OpenZeppelin offer audit services.

Legal Structure: $5,000-25,000 for legal entity formation if needed. Wyoming LLC formation for DAOs costs around $250 plus legal consultation. International structures may cost more.

Community Infrastructure: Discord Nitro ($10/month), domain names ($10-50/year), website hosting ($5-50/month), design work ($500-5,000 one-time). Professional community management if needed.

Token Creation: Token contract deployment $50-200 on Layer-2, up to $500-1,000 on Ethereum mainnet during high gas periods. Liquidity provision if creating tradeable token: varies widely based on initial market cap.

Layer-2 solutions dramatically reduce costs. Optimism and Arbitrum transactions cost cents rather than dollars. DAOhaus supports cross-chain execution on multiple EVM chains including Polygon and Gnosis. This accessibility lowers barriers for smaller communities.

Snapshot eliminates gas fees entirely through off-chain voting. Users sign messages with wallets rather than submitting blockchain transactions. Results can later move on-chain through Snapshot X for execution. This hybrid approach balances cost with security. Free platforms democratize DAO creation, though custom development provides maximum flexibility for complex requirements.

Types of DAOs: Which Model Fits Your Needs?

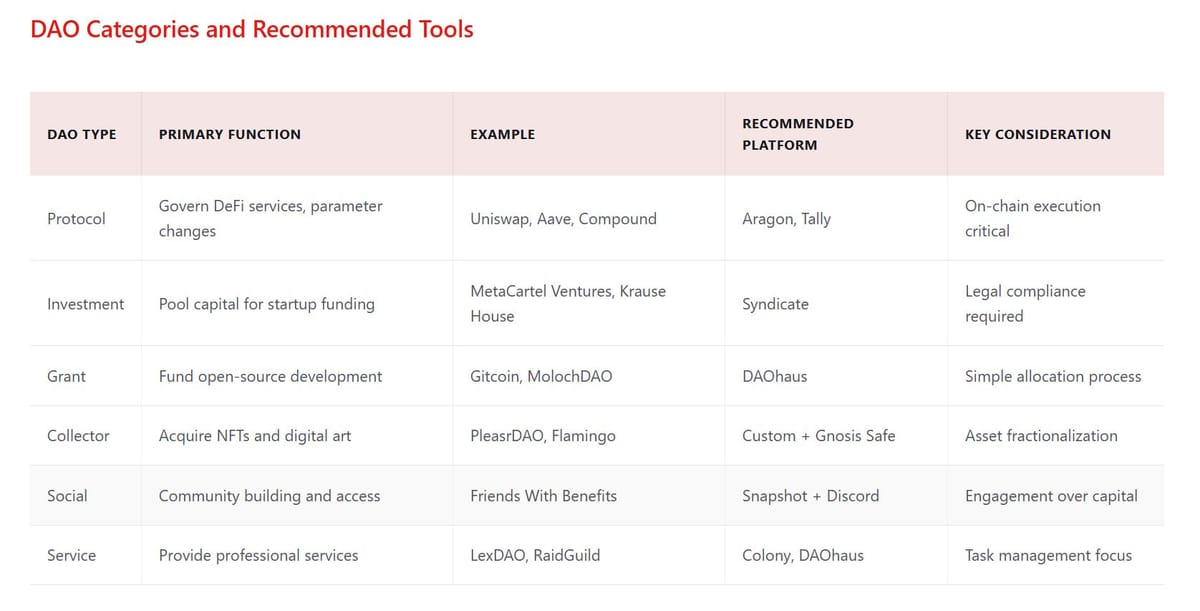

DAO Categories and Recommended Tools

| DAO Type | Primary Function | Example | Recommended Platform | Key Consideration |

|---|---|---|---|---|

| Protocol | Govern DeFi services, parameter changes | Uniswap, Aave, Compound | Aragon, Tally | On-chain execution critical |

| Investment | Pool capital for startup funding | MetaCartel Ventures, Krause House | Syndicate | Legal compliance required |

| Grant | Fund open-source development | Gitcoin, MolochDAO | DAOhaus | Simple allocation process |

| Collector | Acquire NFTs and digital art | PleasrDAO, Flamingo | Custom + Gnosis Safe | Asset fractionalization |

| Social | Community building and access | Friends With Benefits | Snapshot + Discord | Engagement over capital |

| Service | Provide professional services | LexDAO, RaidGuild | Colony, DAOhaus | Task management focus |

Data: Analysis of DAO structures from DeepDAO, industry reports, platform documentation

Protocol DAOs dominate by total value with 70 organizations holding $7.5 billion. Lido leads liquid staking with $334.9 million treasury growing 5.2% in 24 hours, per CoinLaw data. These DAOs allocate governance tokens to users, creating aligned incentives. Uniswap distributes UNI tokens to liquidity providers and traders.

Investment DAOs democratize venture capital. The Krause House pools funds to potentially purchase an NBA team. Syndicate simplifies investment DAO creation with legal and technical infrastructure. Collector DAOs like PleasrDAO purchased the original Doge meme NFT for $4 million, fractionalizing ownership among members. Social DAOs create exclusive communities where tokens grant access to events, content, and networking.

For exploring existing organizations across all these categories, check out this comprehensive list of DAOs. Understanding different models helps you position your organization effectively and learn from successful implementations.

Security: Protecting Your DAO from Hacks

Critical Security Incidents and Lessons

Smart contract vulnerabilities represent the greatest technical risk. The original DAO hack exploited recursive call bugs, draining one-third of raised funds. Tapioca Foundation lost $4.4 million when North Korean Lazarus Group used social engineering to steal private keys. Developers fell for fake job postings that installed malware during skills assessments.

Implement comprehensive security practices. Conduct multiple independent audits before mainnet launch. Use established audit firms like Trail of Bits, Consensys Diligence, or OpenZeppelin. Deploy bug bounty programs encouraging white-hat hackers to find vulnerabilities before malicious actors do. Immunefi facilitates blockchain bug bounties with clear disclosure policies.

Operational security matters beyond code. Use hardware wallets for treasury management. Never store private keys digitally or share them via messaging apps. Require multiple signatures for large transactions through Gnosis Safe or similar multisig solutions. Implement time locks delaying critical changes, giving the community review periods. Regular security training for team members prevents social engineering attacks.

Costs and Resource Requirements

What Will Creating Your DAO Actually Cost?

| Platform | Setup Cost | Gas Fees | Ongoing Costs | Technical Skill | Time to Launch |

|---|---|---|---|---|---|

| Aragon | Free platform | $50-200 deployment | Gas for votes | Low to Medium | 1-3 hours |

| Snapshot | Free | None (off-chain) | None | Low | 30 minutes |

| Tally | Free interface | $50-150 setup | Gas per vote | Medium | 2-4 hours |

| DAOhaus | Free | $30-100 deployment | Minimal gas | Low | 1-2 hours |

| Syndicate | Service fees vary | $100-300 | Management fees | Low to Medium | 1-2 days |

| Custom Development | $20,000-100,000+ | Variable | Maintenance costs | High | 2-6 months |

Data: Platform documentation, developer community estimates, Layer-2 gas price analysis

Additional Costs to Consider

Security Audits: $15,000-50,000 for professional smart contract audit. Multiple audits recommended before handling significant funds. Trail of Bits, Consensys Diligence, and OpenZeppelin offer audit services.

Legal Structure: $5,000-25,000 for legal entity formation if needed. Wyoming LLC formation for DAOs costs around $250 plus legal consultation. International structures may cost more.

Community Infrastructure: Discord Nitro ($10/month), domain names ($10-50/year), website hosting ($5-50/month), design work ($500-5,000 one-time). Professional community management if needed.

Token Creation: Token contract deployment $50-200 on Layer-2, up to $500-1,000 on Ethereum mainnet during high gas periods. Liquidity provision if creating tradeable token: varies widely based on initial market cap.

Layer-2 solutions dramatically reduce costs. Optimism and Arbitrum transactions cost cents rather than dollars. DAOhaus supports cross-chain execution on multiple EVM chains including Polygon and Gnosis. This accessibility lowers barriers for smaller communities.

Snapshot eliminates gas fees entirely through off-chain voting. Users sign messages with wallets rather than submitting blockchain transactions. Results can later move on-chain through Snapshot X for execution. This hybrid approach balances cost with security. Free platforms democratize DAO creation, though custom development provides maximum flexibility for complex requirements.

Types of DAOs: Which Model Fits Your Needs?

DAO Categories and Recommended Tools

| Platform | Setup Cost | Gas Fees | Ongoing Costs | Technical Skill | Time to Launch |

|---|---|---|---|---|---|

| Aragon | Free platform | $50-200 deployment | Gas for votes | Low to Medium | 1-3 hours |

| Snapshot | Free | None (off-chain) | None | Low | 30 minutes |

| Tally | Free interface | $50-150 setup | Gas per vote | Medium | 2-4 hours |

| DAOhaus | Free | $30-100 deployment | Minimal gas | Low | 1-2 hours |

| Syndicate | Service fees vary | $100-300 | Management fees | Low to Medium | 1-2 days |

| Custom Development | $20,000-100,000+ | Variable | Maintenance costs | High | 2-6 months |

Data: Platform documentation, developer community estimates, Layer-2 gas price analysis

Layer-2 solutions dramatically reduce costs. Optimism and Arbitrum transactions cost cents rather than dollars. DAOhaus supports cross-chain execution on multiple EVM chains including Polygon and Gnosis. This accessibility lowers barriers for smaller communities.

Snapshot eliminates gas fees entirely through off-chain voting. Users sign messages with wallets rather than submitting blockchain transactions. Results can later move on-chain through Snapshot X for execution. This hybrid approach balances cost with security. Free platforms democratize DAO creation, though custom development provides maximum flexibility for complex requirements.

DAO Ecosystem Statistics and Trends

Growth and Market Size

Data: DeepDAO, CoinLaw analysis of DAO ecosystem statistics

The DAO ecosystem experienced 30% compound annual growth between 2021 and 2024, according to industry analytics. DeepDAO tracks 2,353 analyzed organizations from a total of 12,108 DAOs. DeFi dominates with 70 active DAOs holding $7.5 billion in combined assets. Infrastructure DAOs follow with 30 organizations managing $800 million. This expansion reflects blockchain's maturation and wider acceptance of decentralized governance models.

Conference attendance grew 40% in 2025, showing deeper community engagement. More than 6,000 DAOs maintain regular activity levels, per CoinLaw data. Governance tool usage jumped 45% year-over-year, with Snapshot and Tally processing millions of votes.

Largest DAOs by Treasury Size

Data: DeepDAO rankings, Blockchain Reporter analysis, CryptoDep research April 2025

Mantle DAO leads with $2.7 billion in treasury assets, comprising $1 billion in USD and Ethereum-based funds. Uniswap DAO holds $2.2 billion primarily in UNI tokens. Optimism's treasury contains $5.5 billion, giving it 22% market share. ENS manages $1.1 billion supporting blockchain domain services, while Arbitrum's $1.1 billion treasury funds Layer-2 development.

Sector Distribution and Asset Holdings

Data: CoinLaw industry analysis, categorization of 13,000+ active DAOs

DeFi represents the largest category with 70 DAOs controlling $7.5 billion. Infrastructure follows with 30 organizations managing $800 million. Venture capital DAOs number 25 with $200 million allocated to startup investments. NFT-focused DAOs maintain 20 organizations holding $500 million. Philanthropy DAOs hold $300 million across 10 organizations, while creative DAOs support content creators with $100 million.

Governance Participation Rates

Data: DeepDAO participation analytics, CoinLaw governance research

Protocol DAOs achieve highest participation at 22% average turnout for major proposals. Financial stakes drive engagement when votes directly affect treasury or protocol parameters. Investment DAOs follow at 18% participation as capital allocation decisions attract member attention. Social DAOs struggle with 12% turnout despite strong community bonds. Grant DAOs maintain 15% participation when distributing funds to developers. These rates remain below traditional corporate shareholder participation, raising questions about governance legitimacy.

Future Outlook and Emerging Trends

DAO-as-a-Service platforms simplify creation further. These providers offer ready-made templates, governance modules, and treasury tools. Customization without coding makes DAOs accessible to non-technical founders. The market grows at 18% CAGR, reaching projected widespread adoption by 2030.

Reputation-based governance gains traction as alternative to token-weighted voting. Systems reward consistent contributors regardless of capital. Colony pioneered this approach where earned reputation determines influence. This model suits talent networks and professional service DAOs better than pure capital allocation.

Legal frameworks continue evolving. Anti-money laundering requirements tightened with FATF classifying most DAOs as Virtual Asset Service Providers. Transaction monitoring, member screening, and reporting thresholds increased. DAOs operating across jurisdictions face complex compliance requiring legal entity separation by function.

Web3 integration deepens as decentralized social networks and applications adopt DAO structures. By some projections, 60% of blockchain projects will incorporate DAO governance by end of 2025. This shift toward community ownership represents fundamental rethinking of digital infrastructure and value distribution.

Frequently Asked Questions

Sources

CoinLaw: Decentralized Autonomous Organizations Statistics 2025: Market Growth, Governance, and Industry Adoption

DeepDAO: Discovery Engine for DAO Ecosystem, Treasury and Governance Analytics

Blockchain Reporter: Top 15 DAOs Ranked by Treasury Size: Mantle, UniSwap & Optimism Lead

BeInCrypto: Top DAO Projects on BNB Chain 2025

Medium - Predict: DeFi & DAO Marketing in 2025: Building Community & Governance

InsideBitcoins: Best DAO Crypto Projects in October 2025

RockNBlock: DAO Development Trends to Watch in 2025

Gate Learn: 69 Trends in 2025-Era DAO Design

Rapid Innovation: Top 7 DAO Platforms Compared: Ultimate Guide for 2024

AI and DAOs: 7 Best Tools for DAO Creation and Management

Sablier Blog: DAO Governance Voting Tools: The Ultimate Guide

Journal of Internet Services and Applications: A Comparative Analysis of Platforms for Decentralized Autonomous Organizations

Gemini Cryptopedia: The DAO Hack: How a Vulnerability Split Ethereum

Halborn Security: Explained: The Tapioca DAO Hack (October 2024)

CoinDesk: Snapshot, Popular DAO Voting Platform, Finally Moves On-Chain, Atop Starknet

Market.us: DAO-as-a-Service (DAOaaS) Market Size Report

P2P Models: DAOs: The Impact of a New Decision-Making Process