Hedgey Finance DAO Tool Report For 2025

What Is Hedgey Finance

Hedgey Finance launched in 2021 as a Delaware-based company. The platform provides free onchain token vesting and lockup infrastructure. DAOs and Web3 teams use it to distribute tokens to employees, investors, and communities.

The team consists of 8 employees working from New Castle, DE. Fifteen investors back the project, including Acrew Capital, Blockchange Ventures, Protocol VC, and WAGMI Ventures. As of 2025, the platform serves over 500 projects.

Users like Gitcoin, Gnosis, Shapeshift, and Arbitrum rely on Hedgey. The platform processes approximately $600 million in total value locked. Token teams can create vesting schedules in minutes without coding knowledge.

Hedgey operates as non-custodial infrastructure. Smart contracts hold tokens in audited escrow. Recipients get custom dashboards to track and claim their allocations. The system supports cliff dates, linear vesting, and milestone unlocks.

How Hedgey Finance Works In 2025

Teams connect wallets like MetaMask, WalletConnect, or Safe multisig. The interface offers three main products: token vesting plans, investor lockups, and airdrop campaigns. Each tool operates through audited smart contracts on supported chains.

Creating a vesting plan takes five steps. First, select the token. Second, define the schedule with cliffs and unlock periods. Third, add recipient addresses. Fourth, review terms. Fifth, execute the transaction. The process completes in under 10 minutes.

Recipients receive portal access automatically. They view unlock schedules, claim available tokens, and check vesting progress. Optional features include voting rights and delegation during lockup. Teams can revoke unvested tokens if needed.

Hedgey supports governance integration with both onchain and Snapshot voting. Locked tokens retain voting power. This solves a common DAO problem where vesting tokens cannot participate in governance decisions. Check out the comprehensive DAO tooling guide for more information on similar solutions.

Hedgey Finance Blockchain Network Coverage Analysis

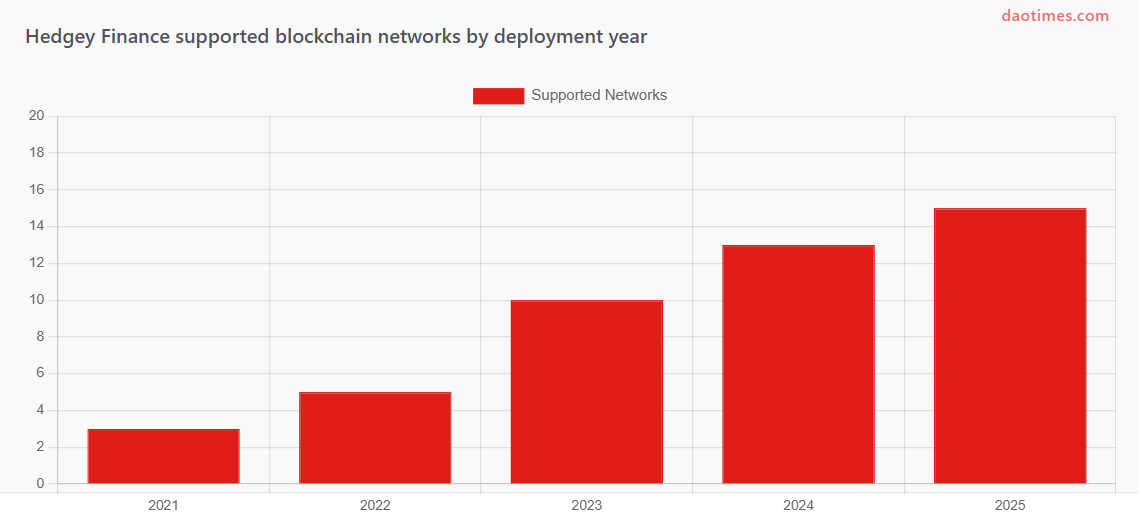

Hedgey Finance expanded network support throughout 2022-2025. The platform now covers 15+ EVM chains. Ethereum remains the primary network with highest TVL. Layer 2 solutions like Arbitrum and Optimism gained traction in 2024.

The expansion strategy prioritizes chains with active DAO ecosystems. Base, Blast, and Worldchain represent newer additions. Each network uses identical smart contracts for consistency. Teams can deploy vesting plans across multiple chains simultaneously.

According to Hedgey's official documentation, they support Ethereum, Arbitrum, Optimism, Base, Blast, Gnosis, Evmos, Polygon, Avalanche, Celo, OKXChain, Boba, and Fantom. Custom network integration requires direct team contact.

Data: Hedgey Finance official website and documentation

Hedgey Finance Competitive Positioning Against Token Vesting Platforms

| Platform | Base Cost | Onchain | Audited | Governance | Networks |

|---|---|---|---|---|---|

| Hedgey Finance | Free | Yes | 5+ Audits | Yes | 15+ |

| Team Finance | 1% Fee | Yes | Yes | Limited | 12 |

| TrustSwap | 1% Fee | Yes | Yes | No | 3 |

| TokenSoft | $500+/mo | Yes | Yes | Yes | 5 |

| Unvest | Free | Yes | Yes | No | 8 |

| TokenOps | $299/mo | Yes | Yes | Limited | 6 |

Hedgey Finance competes with Team Finance, TrustSwap, and TokenSoft. The free pricing model stands out. Most competitors charge 1% transaction fees or monthly subscriptions between $299-$500.

Only Hedgey and Unvest offer completely free onchain vesting. Hedgey provides governance rights integration, which Unvest lacks. TokenSoft targets enterprise clients with compliance features. TrustSwap focuses on smaller projects across three chains.

The competitive advantage lies in three areas. First, zero-cost infrastructure. Second, governance integration for locked tokens. Third, wide network support across 15+ chains. Teams save $5,000-$20,000 annually using Hedgey instead of paid alternatives.

Data: Platform websites and documentation, Request Finance research

Hedgey Finance April 2024 Security Incident Analysis

On April 19, 2024, Hedgey experienced a smart contract exploit. Initial reports claimed $44.7 million stolen. Actual liquid losses totaled approximately $2.1 million on Ethereum and illiquid BONUS tokens on Arbitrum.

The vulnerability existed in the ClaimCampaigns contract. The attacker used the createLockedCampaign function to gain unauthorized token approvals. After creating campaigns, they cancelled them. The contract withdrew tokens but failed to revoke approvals.

Halborn and CertiK analyzed the incident. The root cause was missing input validation. One line of code to revoke approvals could have prevented the exploit. The attacker funded the operation through ChangeNOW exchange.

Hedgey responded within hours. They contacted users to cancel active claims. The team sent onchain messages to the attacker requesting fund returns. Smart contracts underwent additional audits post-incident. New security measures now validate all input parameters.

The BONUS token confusion inflated reported losses. Media multiplied stolen token quantity by market price. This calculation ignored actual liquidity. The attacker still holds 76.8 million BONUS tokens with limited exit liquidity.

Data: CertiK, Halborn, Cyvers security reports

Major Organizations Using Hedgey Finance In 2025

Gitcoin uses Hedgey for contributor token distribution. The platform helped simplify grant payment workflows. Kyle Weiss from Gitcoin Foundation noted the mechanism simplicity combined with community value.

Protocol Labs chose Hedgey for investor dashboard management. Brad Holden stated it surpasses older lockup systems. The investor portal provides real-time tracking and unlock scheduling. Shapeshift integrated Hedgey into their DAO operations.

Arbitrum deployed Hedgey for their STIP grant program. The tool distributed onchain grants to protocols building on Arbitrum. Celo Foundation adopted it for human resources operations. Thomas Kwon reported that it shifted work from Finance to People Operations.

GnosisDAO uses the platform for DAO-to-DAO token swaps. The escrowless OTC functionality enables trustless partnerships. Graph Paper Capital relies on Hedgey for pretoken company support. They cite unmatched resources and free tools. Explore more about these organizations in this comprehensive DAO list.

Data: Hedgey Finance case studies and testimonials

Hedgey Finance Features And Product Offerings In 2025

The platform offers four core products. Token Vesting Plans automate employee and contributor distributions. Teams set up linear vesting, cliff periods, and milestone unlocks. The system handles revocation for terminated team members.

Investor Lockups manage token unlock schedules for funding rounds. Investors receive dashboards showing vesting progress. The feature prevents early dumps while maintaining transparency. Integration with Safe multisig enables institutional custody compatibility.

Airdrops and Claims (Airstreams) distribute tokens to communities. Teams upload recipient lists via CSV. The tool supports merkle tree verification for gas efficiency. Options include instant claims or streaming distributions over time.

Hedgey PreToken serves companies before token launch. The product costs $150 monthly. Teams model token allocations, access service providers, and prepare distribution infrastructure. The workflow streamlines token generation event preparation.

Additional features include DAO-to-DAO token swaps, delegated claim campaigns, and LP token locking. The governance integration supports both onchain voting and Snapshot. Custom vesting NFTs create visual representations of locked tokens.

Hedgey Finance TVL Growth And Platform Metrics

Hedgey Finance reached $600 million TVL by 2025 according to grant proposals. The platform serves 500+ projects across 15 blockchain networks. Growth accelerated after adding Layer 2 support in 2023.

The team completed 5+ security audits with firms including Consensys Diligence and Hacken. Audit findings helped strengthen contract security. Post-April 2024 incident, additional reviews focused on input validation.

User adoption increased following Arbitrum STIP integration. The grant program demonstrated scalability for large distributions. Protocol Labs, Celo Foundation, and other enterprises validated the platform for institutional use.

Free pricing removes barriers to entry. Competitors charge $5,000-$20,000 annually. Hedgey captures market share from projects unable to afford paid solutions. The business model monetizes PreToken subscriptions and custom development.

Data: Filecoin DevGrants proposal, PitchBook company profile

Token Vesting Platform Market Share Comparison

TokenSoft leads enterprise adoption with compliance-focused features. The platform targets larger projects requiring KYC integration. Hedgey Finance captures the mid-market and DAO segment. Team Finance serves smaller projects with simple requirements.

The free tier strategy expanded Hedgey's user base rapidly. Projects testing token launches choose zero-cost options. Premium features like PreToken monetize serious projects. This freemium model differs from competitors' pay-to-play approach.

DAO adoption specifically favors Hedgey and Team Finance. Governance integration requirements limit alternatives. Traditional vesting platforms lack voting delegation for locked tokens. This creates switching costs for DAOs using Hedgey.

Data: Industry analysis and platform documentation

Advantages And Limitations Of Hedgey Finance

Key Advantages

Zero-cost infrastructure eliminates budget barriers. Projects save thousands annually compared to competitors. The free model democratizes access to professional token distribution tools.

Governance integration solves a DAO pain point. Locked tokens retain voting rights. This enables participation in protocol decisions during vesting. Few competitors offer this functionality.

Wide network support covers 15+ chains. Teams deploy vesting across ecosystems simultaneously. Consistent contract addresses simplify multi-chain operations. Layer 2 availability reduces transaction costs.

Non-custodial architecture maintains security. Users control private keys throughout. Smart contracts hold funds in audited escrow. This design reduces central points of failure.

Current Limitations

The April 2024 exploit damaged reputation. Trust rebuilding requires time. Security-conscious teams may prefer competitors despite improvements. The incident affected approximately $2 million in liquid value.

Limited customer support compared to paid services. Free users receive community support. Premium TokenSoft clients get dedicated account managers. Response time differences matter for enterprise deployments.

PreToken product lacks maturity. The $150 monthly offering competes with established cap table software. Features remain limited compared to specialized pretoken platforms. Integration with legal providers needs expansion.

No native token exists for platform governance. Hedgey Finance operates as traditional company. This centralized structure contrasts with DAO-native alternatives. Protocol governance remains founder-controlled.

Getting Started With Hedgey Finance

Visit hedgey.finance and click "Open App". Connect your wallet using MetaMask, WalletConnect, or Safe. Select your blockchain network from the dropdown menu. The interface defaults to Ethereum mainnet.

Choose between Token Vesting, Investor Lockups, or Airdrops. Each product has guided setup flows. Token Vesting requires token address, recipient list, and vesting schedule. Upload CSV files for bulk distributions.

Configure schedule parameters. Set cliff duration, vesting period, and unlock frequency. Options include linear vesting, milestone-based, or custom curves. Add governance rights if needed. Review terms before executing.

Transaction approval requires wallet signature. Gas fees apply based on network congestion. Recipients receive email notifications automatically. They access custom portals to view and claim tokens.

Documentation lives at hedgey.gitbook.io. Telegram support operates at @hedgeysupport. The team offers 24/7 community assistance. Book founder calls at calendly.com/lindseywinder for complex implementations.

Frequently Asked Questions About Hedgey Finance

What blockchain networks does Hedgey Finance support in 2025?

Hedgey supports 15+ EVM chains including Ethereum, Arbitrum, Optimism, Base, Blast, Gnosis, Polygon, Avalanche, Celo, OKXChain, Boba, Fantom, and Evmos. Contact the team for additional network requests.

How much does Hedgey Finance cost to use?

Onchain vesting and lockup tools are 100% free. No transaction fees or monthly costs. PreToken product for pre-launch companies costs $150 monthly.

Is Hedgey Finance safe after the 2024 security incident?

The April 2024 exploit affected one contract. Hedgey completed additional audits post-incident. New input validation prevents similar attacks. Total liquid losses were $2 million, not $44 million as initially reported.

Can locked tokens participate in governance with Hedgey?

Yes. Hedgey supports both onchain and Snapshot voting for locked tokens. Users can delegate voting power during vesting. This feature distinguishes Hedgey from most competitors.

Does Hedgey Finance custody tokens?

No. Hedgey operates as non-custodial infrastructure. Smart contracts hold tokens in audited escrow. Users maintain control of private keys. The platform cannot access or freeze funds.

Which major DAOs use Hedgey Finance?

Gitcoin, Gnosis, Shapeshift, Arbitrum, Protocol Labs, and Celo Foundation use Hedgey. Over 500 projects rely on the platform. Total value locked exceeds $600 million.

How does Hedgey compare to Team Finance and TrustSwap?

Hedgey offers free service while competitors charge 1% fees. Hedgey supports 15+ chains versus 3-12 for alternatives. Governance integration and broader network coverage provide advantages.

What audits has Hedgey Finance completed?

Consensys Diligence audited core contracts. The platform completed 5+ total audits with leading firms. Additional reviews occurred post-April 2024 incident. Reports are publicly available.

Can Hedgey handle enterprise token distributions?

Yes. Protocol Labs, Celo Foundation, and Arbitrum use Hedgey for large distributions. The platform scales to thousands of recipients. Safe multisig integration supports institutional requirements.

What happens if team members leave before vesting completes?

Admins can revoke vesting plans. Only unvested tokens return to the treasury. Vested portions remain claimable by recipients. This protects projects from paying departed contributors.

Conclusion

Hedgey Finance established itself as a leading free token vesting platform. The zero-cost model expanded access for DAOs and Web3 projects. Support for 15+ blockchains and governance integration differentiate the offering.

The April 2024 security incident tested the platform's resilience. Actual liquid losses of $2 million proved manageable. Additional audits and improved validation restored confidence. Over 500 projects continue using Hedgey.

Competition from Team Finance, TrustSwap, and TokenSoft remains active. Hedgey's free tier and governance features provide advantages. The platform serves mid-market DAOs effectively. Enterprise clients may prefer paid alternatives with dedicated support.

Looking ahead, Hedgey focuses on private market liquidity and expanded features. The PreToken product targets companies before token launch. Network expansion continues with new Layer 2 integrations. The platform aims to facilitate $50 billion in locked token value.

Sources

Hedgey Finance official website

CertiK Hedgey Finance incident analysis

Halborn security report on April 2024 exploit

PitchBook company profile for Hedgey Finance

Request Finance guide to token vesting platforms

Superchain Eco project profile

Hedgey Finance GitHub repositories

Filecoin DevGrants proposal documentation

DappRadar protocol overview

Token Terminal fundamental metrics