dYdX DAO slashes trading rewards by 45%

On Saturday night, dYdX DAO passed a proposal seeking to reduce trading rewards by approximately 45% to 1,582,192 DYDX per epoch. More than 90% of the votes, which accounted for around 28M worth of DYDX tokens, were in support of the initiative.

The proposal was brought before the community by Callen earlier this month. Citing current market conditions, he argued that the trading rewards were excessively high and the highest contributor to yearly token inflation.

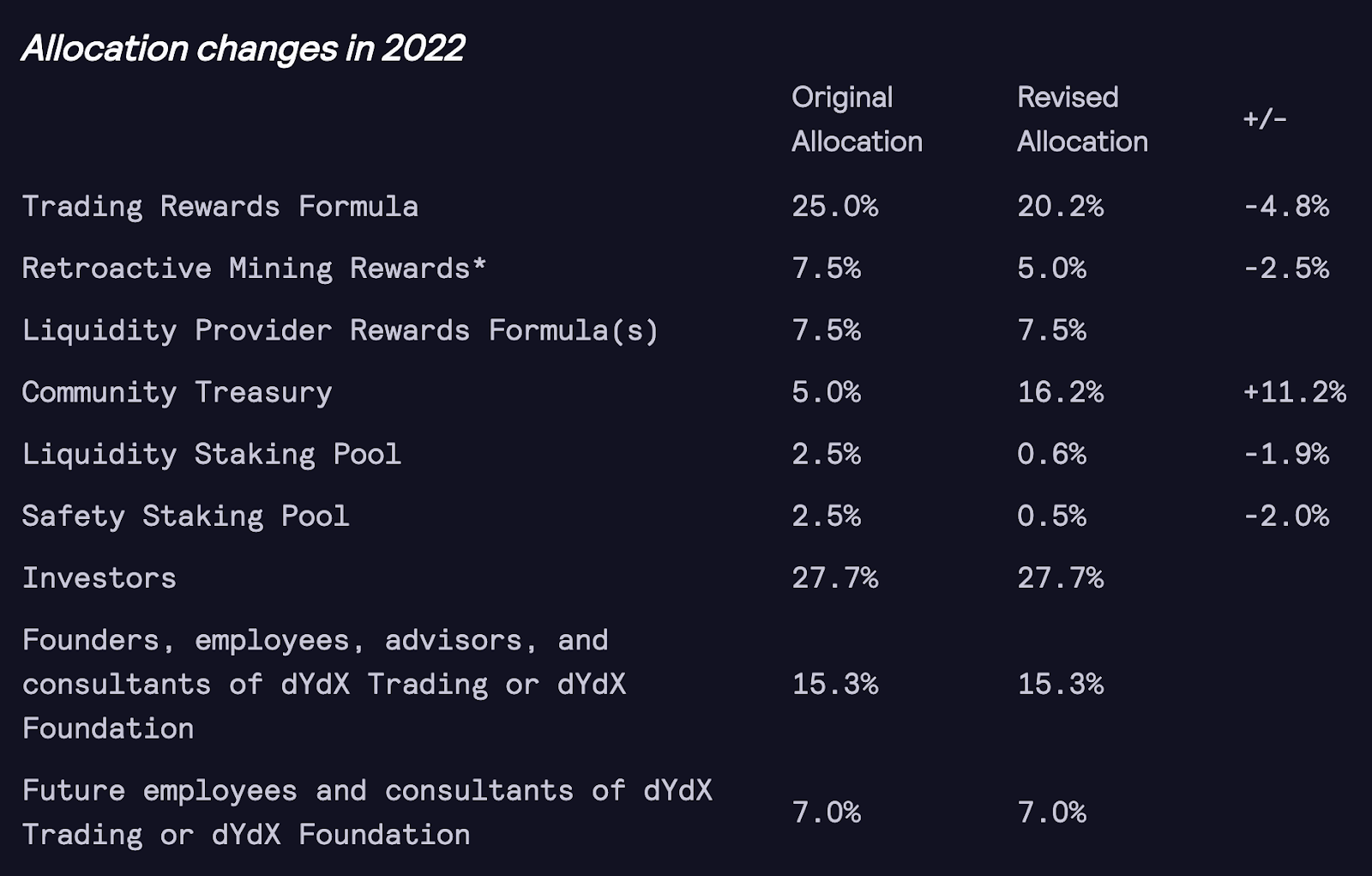

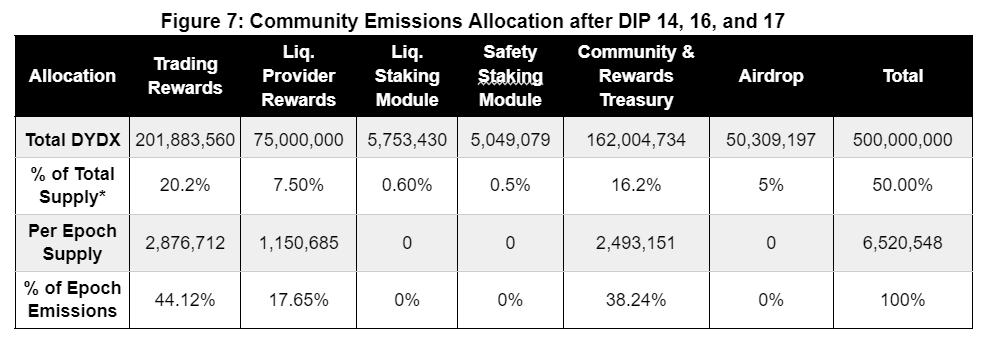

He explained that 50% (500,000,000 DYDX) of the total supply of DYDX had been allocated to the community over 5 years. The remaining 50% had been earmarked for investors, employees, and trading activities.

As seen in the image above, Callen notes that the excess emissions of 1,726,028 DYDX for each epoch are retained in the Rewards Treasury and are available to the DAO via on-chain votes. It also reveals that Trading Rewards are ~44% of all community emissions per epoch, despite the recent 25% reduction. He wrote:

We’d argue this remains excessively high given the current market conditions and dampening of volume across the entire ecosystem. On the other hand, the wind-down of the SSM and LSM has significantly reduced the supply pressure of DYDX as their emissions are now retained within the Rewards Treasury.

Following the approval of the proposal, Trading Rewards will now be reduced from a current 2,876,712 DYDX to 1,582,192 DYDX per epoch.

Although the proposal was passed with seemingly massive support from the community, some members voiced their disapproval of the move over at the forum. Argo opined that the proposal was biased and favors larger holders, stating that:

I thought about the proposal more and I think there is a fundamental bias. Voting power is proportional to DYDX holdings. Reducing rewards fundamentally increases the value of DYDX by reducing the expected circulating supply. Therefore, big DYDX holders will obviously vote in favor of reducing rewards and might easily win the vote.

Similarly, Fox Labs wrote:

Reducing rewards by a further 45% after only recently being reduced by 25% is not a good idea. DYDX is still in a growth phase, so there needs to be more reasons for traders to join and stay with DYDX. Not less. If you reduce rewards further, it reduces the rebates on fees that traders receive. This is likely a massive reason why most traders use DYDX instead of Binance.

Check BTC Peers guide of the most promising crypto