Dune DAO Tool Report For 2025

What Is Dune and Why It Matters

Dune transforms raw blockchain data into accessible insights. Founded in 2018 by Fredrik Haga and Mats Olsen, this Oslo-based platform lets anyone query on-chain data using SQL. Think of it as the analytics backbone for Web3.

The platform serves blockchain developers, crypto analysts, DeFi traders, DAO members, and institutional investors. Users create custom dashboards, track protocol performance, and analyze wallet behavior without running blockchain nodes.

Dune reached unicorn status with $1 billion valuation in February 2022. The company raised $79.4 million across three funding rounds from Coatue, Dragonfly Capital, Union Square Ventures, and Multicoin Capital.

Over 700,000 dashboards now exist on the platform. Monthly site visits reached 1.1 million as of September 2025, according to Similarweb data. The community includes 6,000 Web3 teams and enterprises signed up.

Dune supports 100+ blockchains as of March 2025. Coverage spans Ethereum, Solana, Polygon, Base, Arbitrum, Optimism, and dozens more. The platform provides human-readable smart contract data and pre-decoded blockchain information.

2025 Developments and New Features

Dune Echo Platform Launch

Dune launched Echo in November 2024 as a multichain real-time developer platform. Echo provides sub-300ms latency data across 30+ blockchains through two APIs: Transactions and Balances.

According to co-founder Mats Olsen, Echo helps developers access tools to build protocol frontends wherever deployed. The platform handles blockchain reorgs seamlessly and delivers data within 300 milliseconds of block propagation.

Echo supports developers building real-time applications that require instant market response. Token balances and transaction data refresh almost immediately after on-chain events.

smlXL Acquisition for Real-Time Data

Dune acquired smlXL in November 2024 to strengthen real-time blockchain capabilities. The deal brought sim Studio product and EVM.codes node technology into Dune's infrastructure.

smlXL conducts real-time blockchain transaction simulations. Integration enhances Dune's speed and on-chain data processing capacity. CEO Dor Levi joined Dune's team to lead simulation technology development.

Dune Index for Blockchain Adoption Tracking

The Dune Index launched in November 2024 tracks blockchain adoption through meaningful on-chain activity. It analyzes transactions, fees paid, and net value transfers across 20 chains.

Traditional metrics focus on active addresses and total value locked. Dune Index provides broader adoption views by examining actual blockchain traction. As of January 2025, the Index stands at 89 points.

Solana, Ethereum, and Bitcoin contribute most to the overall blockchain adoption measurement. The index updates in real-time based on network activity changes.

100 Blockchain Milestone

Dune reached 100 supported chains in March 2025. The expansion includes major networks and emerging Layer 2 solutions. Recent additions include Ronin, with plans for Unichain, Abstract, Viction, TON, Berachain, Flare, Boba, Sonic, and Lens.

The platform started as Ethereum-focused but doubled down on multichain coverage. Alternative Layer 1 blockchains like Solana, Avalanche, and Aptos now receive full support.

Dune Platform Usage Growth 2023-2025

Data: Similarweb traffic analytics and Dune platform statistics 2023-2025

Website traffic grew 8.25% month-over-month in September 2025 based on Similarweb data. The platform now attracts 1.1 million monthly visits with 75.53% male and 24.47% female audience composition.

United States sends most desktop traffic to Dune, followed by European and Asian markets. The global ranking improved from 49,487 to 48,519 over three months.

Dashboard creation accelerated in 2024 and 2025. The community now maintains over 700,000 dashboards covering DeFi protocols, NFT marketplaces, and blockchain metrics. Popular dashboards track everything from gas prices to whale wallet movements.

Dune Pricing Tiers Comparison

| Feature | Free | Plus ($399/mo) | Premium ($999/mo) |

|---|---|---|---|

| Query Credits | 2,500 | 25,000 | 100,000 |

| Storage | 1 MB | 15 GB | 50 GB |

| Data Points/Credit | 1,000 | 5,000 | 25,000 |

| CSV Exports | No | Yes | Yes |

| Private Queries | No | No | Yes |

| API Access | Yes | Yes | Yes |

| Unlimited Teammates | Yes | Yes | Yes |

| Materialized Views | Yes | Yes | Yes |

Data: Dune pricing structure June 2025

Dune maintains free access forever for basic users. This approach democratizes blockchain data analytics and builds community engagement.

Plus tier at $399 monthly or $4,188 annually offers 10x query credits and CSV exports. Premium tier at $999 monthly or $10,188 annually adds private query capabilities for proprietary research.

All tiers include unlimited free teammates, unlimited free executions, and API access. Enterprise plans exist with custom pricing for institutional clients requiring higher query volumes.

The platform partners with Orb for usage-based billing. Dune underwent two pricing changes since November 2022, simplifying from four tiers to current three-tier structure.

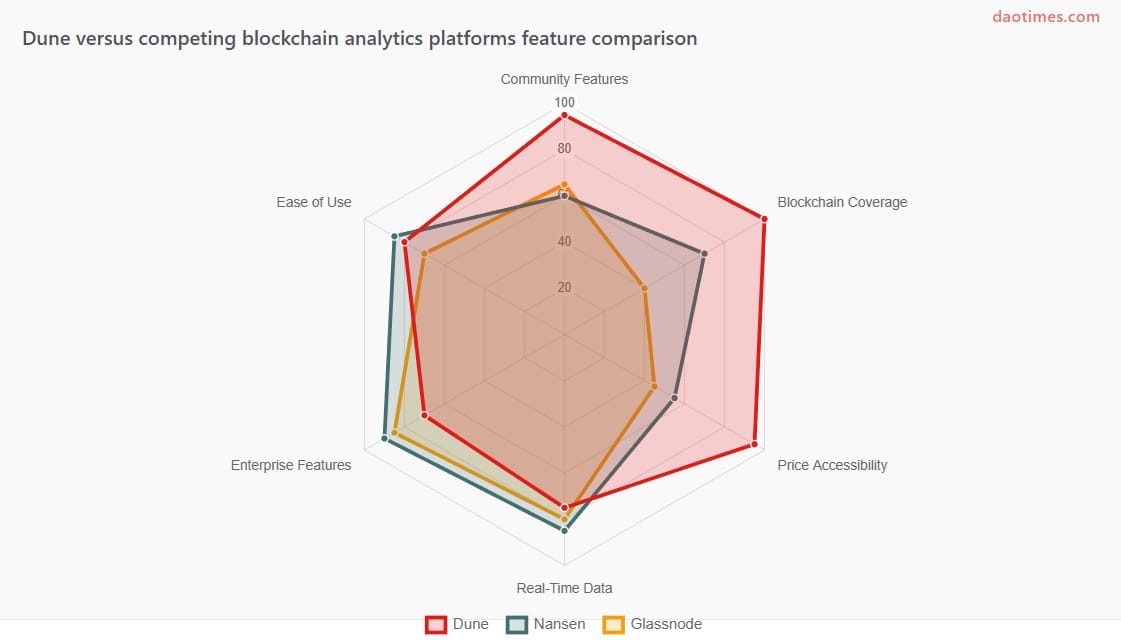

Dune Competitor Platform Analysis

Data: Platform analysis across Dune, Nansen, Glassnode, and Chainalysis 2025

Dune competes with Nansen, Glassnode, Chainalysis, Messari, and Token Terminal. Each platform targets different user segments within blockchain analytics.

Nansen focuses on wallet labeling and tracking smart money with 500 million labeled wallets. Standard plans cost $199 monthly. The platform excels at NFT whale tracking and DeFi flow analysis.

Glassnode specializes in Bitcoin and Ethereum fundamental analysis with proprietary metrics like SOPR and MVRV Z-Score. Professional tier costs $833.33 monthly. Glassnode Academy provides educational resources.

Chainalysis serves law enforcement and financial institutions for crypto crime detection and regulatory compliance. Enterprise pricing with government focus sets it apart from Dune's community approach.

Dune differentiates through community-driven dashboards and SQL-first approach. Users share queries freely, creating collaborative environment. This contrasts with Nansen's internal team building proprietary tools.

According to CB Insights, Dune ranks as Outperformer among 15 blockchain analytics companies. The platform serves over 6,000 Web3 teams versus competitors' institutional client focus.

Dune Blockchain Coverage Expansion

Data: Dune chain integration announcements 2018-2025

Dune began as Ethereum-only platform in 2018. Early focus made sense given Ethereum's dominance in DeFi and smart contracts.

The platform added Polygon, Optimism, Binance Smart Chain, and xDai by 2021. Layer 2 solutions and alternative networks gained support as multichain ecosystem evolved.

Solana integration marked entry into non-EVM chains. The high-throughput blockchain generates massive transaction volumes requiring specialized indexing infrastructure.

TON blockchain integration arrived December 2024, expanding coverage into Telegram-native ecosystem. NEAR protocol joined October 2024 for additional Layer 1 diversity.

March 2025 milestone of 100 chains positions Dune as most comprehensive analytics platform. Coverage now spans major networks, Layer 2s, and emerging appchains.

Future roadmap includes Unichain, Abstract, Viction, Berachain, Flare, Boba, Sonic, and Lens. The platform commits to adding new blockchains as they launch and gain traction.

How to Use Dune for DAO Analytics

DAOs benefit from Dune's transparent on-chain data tracking. Treasury management, governance participation, and token distribution all become queryable through SQL.

Start by exploring existing DAO dashboards on Dune. Popular templates track treasury balances, proposal voting patterns, token holder distribution, and contributor rewards.

Treasury Tracking

Query DAO treasury addresses to monitor asset holdings across chains. Track incoming contributions, outgoing payments, and asset allocation changes over time. Visualize treasury health through balance charts.

Governance Analysis

Analyze proposal participation rates by querying governance contract events. Track voter turnout, delegation patterns, and voting power concentration. Dashboard widgets display quorum achievement and proposal outcomes.

Token Distribution

Monitor token holder counts, wallet concentration, and transfer patterns. Gini coefficient calculations reveal distribution equality. Time-series charts show how holdings evolve across community members.

Creating Custom Queries

Write SQL queries against decoded smart contract tables. Filter by date ranges, aggregate by time periods, and join multiple data sources. Fork existing queries to modify for your DAO's specific needs.

Use the query editor to test and refine logic. Create visualizations as bar charts, line graphs, counters, or pie charts. Combine multiple visualizations into comprehensive dashboard layouts.

Share dashboards publicly or embed them in DAO documentation sites. Community members access real-time data without technical blockchain knowledge. For more comprehensive tooling options, explore DAO tool resources that complement Dune's analytics capabilities.

Dune Community and Ecosystem

Data: Dune platform statistics and DuneCon attendance 2022-2025

DuneCon conference grew from small meetups to 900 attendees in Bangkok November 2024. The event serves as community gathering for analysts, developers, and blockchain projects.

Net Promoter Score reached 96 in 2024, showing exceptionally high user satisfaction. This score surpasses most SaaS platforms and reflects community-driven approach success.

The platform fosters knowledge sharing through public dashboards. Users fork and modify existing queries, building on community work. This collaborative model differs from closed analytics tools.

Discord and support channels connect users with Dune team and fellow analysts. Documentation includes tutorials, SQL guides, and data catalog references for all supported chains.

Popular analysts like @hildobby gain followings through high-quality dashboards. Star rating system surfaces best work, creating meritocratic visibility.

Partnerships include Snowflake for DataShare product and Chainstory for on-chain communication tools. These integrations expand Dune's ecosystem reach beyond core analytics platform.

Security and Reliability

Dune has not reported security breaches or data compromises since founding in 2018. The platform handles read-only blockchain data rather than storing user funds or private keys.

All blockchain data comes directly from nodes or partner indexing services. Queries run against pre-processed decoded tables, not raw blockchain state. This architecture limits attack surface.

API access requires authentication tokens but does not expose sensitive data. Users control query privacy through Premium tier settings. Free tier queries remain public by default.

The platform published dashboard in November 2024 tracking $2.5 billion lost across 5,500 crypto hacks, exploits, and phishing scams. Data sources include Scamsniffer and Forta Network.

This transparency tool helps community understand ecosystem security threats. Dune positions itself as data provider helping users make informed decisions about protocol risks.

Enterprise customers receive service level agreements for uptime and performance. The platform maintains redundant infrastructure to ensure query execution reliability.

Query execution times vary based on complexity and cluster load. Performance tiers offer 2-4x computational power at higher subscription levels.

Platform Strengths and Limitations

Key Advantages

Free forever access democratizes blockchain analytics. Anyone can explore data without payment barriers. This approach built large engaged community.

SQL-first design appeals to analysts familiar with database querying. No proprietary syntax to learn. Standard SQL works across all supported chains.

Community dashboards provide instant value. Users discover insights without building queries from scratch. Fork functionality enables customization of existing work.

100+ blockchain coverage exceeds most competitors. Multichain queries allow cross-network comparisons. Developers build once and deploy insights everywhere.

Real-time Echo API serves applications requiring sub-second latency. Traditional Dune analytics refresh within minutes. Combined offerings address both use cases.

Current Limitations

Query execution queues create delays during high usage periods. Free tier users wait longer than paid subscribers. Complex queries can timeout on large datasets.

SQL knowledge required for custom analytics. Non-technical users depend on community dashboards. Learning curve steeper than point-and-click tools.

Data lags behind real-time by minutes for standard queries. While acceptable for research, traders need faster updates. Echo addresses this but requires separate integration.

Private query feature only available on Premium tier at $999 monthly. Analysts building proprietary research must pay premium. This limits some institutional use cases.

Mobile experience lacks polish compared to desktop interface. Dashboard creation requires larger screens. Mobile users primarily consume rather than create.

Dune Revenue Model Analysis

Data: Estimated revenue breakdown based on pricing tiers and user base 2023-2025

Dune reported 4.07 million NOK annual revenue as of December 2023 according to Tracxn. This converts to approximately $375,000 USD at 2023 exchange rates.

The platform operates freemium model with majority of users on free tier. Revenue comes from Plus and Premium subscriptions plus Enterprise contracts.

With 6,000 Web3 teams signed up, conversion rate to paid tiers drives monetization. Even 5% conversion at Plus tier generates $1.4 million annually per 300 paying teams.

Enterprise clients likely contribute largest revenue share. Custom pricing for high-volume API access and white-label solutions provides recurring income.

DataShare partnership with Snowflake creates additional revenue stream. Organizations pay to access Dune's blockchain data within Snowflake environment.

Echo developer platform introduces new monetization through API usage-based pricing. Real-time data commands premium over standard analytics queries.

The company raised $79.4 million in funding, providing runway for continued growth. Burn rate remains undisclosed but supports 50-person team in Oslo.

Frequently Asked Questions

What makes Dune different from other blockchain analytics platforms?

Dune offers free community-driven analytics using SQL queries. Users share dashboards publicly unlike competitors with closed proprietary tools. Platform supports 100+ blockchains versus narrower coverage elsewhere.

Do I need to know SQL to use Dune?

Not for basic use. Explore 700,000 existing dashboards created by community. Fork and modify queries without starting from scratch. Learning SQL unlocks full platform potential for custom analysis.

Which blockchains does Dune support in 2025?

Dune supports 100+ networks including Ethereum, Solana, Polygon, Base, Arbitrum, Optimism, BSC, Avalanche, TON, NEAR, and dozens more. Coverage spans major Layer 1s, Layer 2s, and emerging chains.

How much does Dune cost?

Free tier includes 2,500 query credits monthly with unlimited dashboards. Plus costs $399 monthly with 25,000 credits. Premium runs $999 monthly with private queries. All tiers include API access.

Can I use Dune for my DAO's analytics?

Yes. Track treasury balances, governance participation, token distribution, and contributor activity. Query smart contracts directly to monitor on-chain DAO operations. Share dashboards with community members.

How accurate is Dune's blockchain data?

Data comes directly from blockchain nodes and partner indexing services. Platform pre-processes and decodes smart contracts into readable tables. Query results match on-chain state with minutes of latency for standard queries.

What is Dune Echo and how does it differ from standard Dune?

Echo provides real-time API access with sub-300ms latency across 30+ chains. Standard Dune refreshes within minutes and optimizes for analytics queries. Echo serves applications needing instant data updates.

Can I export data from Dune?

Plus and Premium tiers include CSV exports. Free tier users can copy query results manually. Enterprise plans support custom export formats and API integrations with external systems.

How does Dune compare to Nansen and Glassnode?

Dune emphasizes community and SQL flexibility at lower cost. Nansen specializes in wallet tracking with proprietary smart money insights at $199 monthly. Glassnode focuses on Bitcoin fundamentals and advanced metrics at $833 monthly.

Is Dune suitable for institutional investors?

Yes. Premium tier offers private queries for proprietary research. Enterprise plans provide custom solutions, higher rate limits, and SLA guarantees. DataShare enables Snowflake integration for existing data infrastructure.

Sources and References

Tracxn: Dune Analytics Company Profile, Team, Funding, Competitors & Financials

PitchBook: Dune Analytics Valuation, Funding & Investors

CB Insights: Digital Assets Market Data & Insights Analysis

Dune Analytics: Introducing Echo: Multichain Real-Time Developer Platform

Dune Analytics: 2024 Reflections and Platform Updates

Crowdfund Insider: Crypto Data Platform Dune Now Supports 100 Chains

Similarweb: dune.com Traffic Analytics & Audience Data

Cryptopolitan: Dune Analytics Expands Offerings with Echo and smlXL

CoinDesk: Dune Launches Dashboard Tracking $2.5B Lost to Crypto Hacks

Nansen: Top Crypto Analytics Platforms 2025 Guide

Medium: Dune Onchain Analytics Using SQL

BeInCrypto: Dune Analytics: What Is It? How Does It Work?

Cointelegraph: Crypto Price Analysis Platforms That Can Improve Your Trades

Orb: How Dune Stays Flexible and Evolves Its Pricing Strategy