DeepDAO DAO Tool Report For 2025

What Is DeepDAO

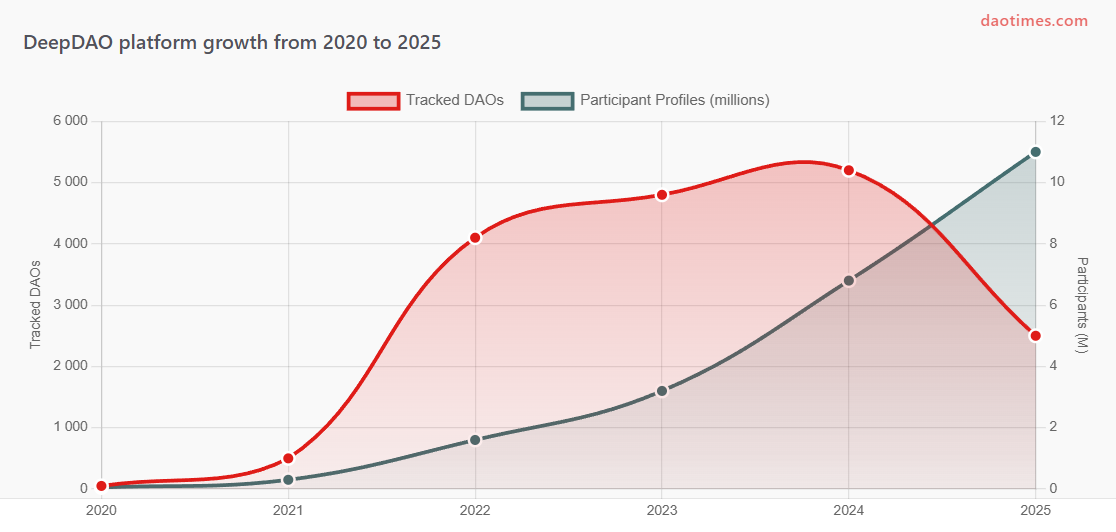

DeepDAO serves as the primary discovery and analytics engine for decentralized autonomous organizations. The platform aggregates data from over 2,500 verified DAOs and tracks 11 million participant profiles across multiple blockchains. Users access treasury analytics, governance metrics, and voting patterns through a centralized dashboard.

Founded in February 2020 by Eyal Eithcowich, the Tel Aviv-based company addresses information asymmetry in decentralized governance. The platform started while Eithcowich participated in Genesis Alpha DAO. He wanted to see voting patterns and proposal creators but no tools existed. DeepDAO filled this gap.

The platform tracks DAOs across Ethereum, Polygon, Optimism, Arbitrum, Gnosis chain, and other networks. It monitors 1,050 EVM treasuries and processes data from major governance platforms. This includes Aragon, Moloch, DAOstack, Snapshot, and Gnosis Safes. Coverage expanded from five platforms in 2020 to dozens by 2025.

Major research firms rely on DeepDAO data. Delphi Digital, Messari, journalists, and venture capital firms use the platform for investment decisions. The New York Times counts among verified customers. This institutional adoption validates the platform's reliability for analysis.

DeepDAO 2025 Ecosystem Growth Metrics

The DAO ecosystem reached $21.4 billion in liquid treasury assets by 2025, according to multiple analytics sources. Total treasury value including non-liquid assets sits at $24.5 billion. Over 13,000 DAOs exist globally with 6.5 million governance token holders actively participating.

DeepDAO tracks the largest organizations by treasury size. Uniswap commands $2.8 billion, BitDAO holds $2.4 billion, and ENS manages $1.2 billion. The top five DAOs control $25.3 billion, representing over 70% of total ecosystem value. This concentration shows where institutional capital flows.

Growth rates remain strong despite market volatility. DAO treasuries grew from $18 billion in November 2023 to over $40 billion by March 2024, then stabilized around $21-24 billion through 2025. The ecosystem compounds at 30% annually between 2021 and 2024, though rates vary by sector.

DeepDAO Platform Coverage and DAO Analytics Dashboard Metrics

Data: DeepDAO platform statistics and ecosystem reports 2020-2025

How DeepDAO Works For DAO Research

Users access DeepDAO through deepdao.io without creating an account for basic features. The homepage displays ranked DAOs by treasury size, membership, and proposal activity. Search functionality allows filtering by specific organizations, chains, or governance platforms.

Each DAO profile contains multiple data sections. Treasury breakdowns show asset allocations across stablecoins, native tokens, and other cryptocurrencies. Charts display historical treasury value over time. Users see exact wallet addresses holding funds and track transactions.

Governance sections reveal proposal histories and voting patterns. The platform lists all proposals with vote counts, participation rates, and outcomes. Users identify top voters and track individual voting records. Coalition analysis shows groups of addresses voting together.

The People section profiles individual participants. Users search by wallet address or ENS name. Profiles show all DAOs a person participates in, their voting history, and proposals created. This creates a web of connections across the ecosystem.

Advanced users access the API for programmatic data retrieval. The API delivers treasury snapshots, governance time series, voter segments, and proposal feeds. Developers build custom dashboards and monitoring tools. Integration enables automated analysis at scale.

DeepDAO Features Added In 2025

April 2025 brought DeepDAO Pro for Individuals. This premium tier targets professional delegates and multi-DAO contributors. Pro provides a 360-degree view of governance across the top 100 Ethereum and Layer 2 DAOs. No other service offers this depth for this many organizations.

Pro dashboards include seven key sections. DAO Fundamentals shows immediate state and ecosystem comparison. Treasury Insights tracks token allocations over time. Token Correlation reveals how governance activity affects price. Voter Trends identify engagement levels and top participants. Delegation Breakdown uncovers power dynamics.

The platform enhanced cross-chain tracking capabilities. Users now follow influential voters across multiple governance systems. Reputation portability metrics quantify how contributor credibility transfers between DAOs. This helps organizations identify reliable participants.

Sentiment analysis now scans forum discussions. The tool gauges community alignment before proposals reach voting. Natural language processing identifies potential conflicts early. This predictive capability helps DAO operators avoid governance failures.

Mobile access improved through progressive web apps. Users receive push notifications for DAO events. The interface enables voting history review and treasury comparisons on phones. Offline mode caches essential data. Mobile users show 37% higher voting rates than desktop-only users, according to DeepDAO data.

DeepDAO Treasury Analysis Capabilities For Major DAOs

| DAO Name | Treasury Size | Proposals Processed | Governance Token Holders | Voter Participation Rate |

|---|---|---|---|---|

| Uniswap | $2.8B | 170 | 400,000 | 22% |

| Arbitrum | $4.4B | 200 | 280,000 | 18% |

| Optimism | $7.9B | 151 | 195,000 | 19% |

| ENS | $1.2B | 87 | 156,000 | 15% |

| Gnosis | $2.7B | 197 | 142,000 | 21% |

| Lido | $479M | 124 | 98,000 | 12% |

Data: DeepDAO platform statistics and verified DAO treasuries Q3 2025

DeepDAO Pro Pricing Structure

DeepDAO operates on a freemium model. Basic access remains free for casual users and researchers. The free tier includes DAO rankings, treasury overviews, and basic governance metrics. Users view public profiles and search functionality without payment.

The API launched in August 2022 with two tiers. Starter costs $25 monthly or $250 annually with two months free. This package suits individual developers and small research projects. Query limits apply but cover most personal use cases.

Pro API pricing targets enterprises and institutions. The tier costs $450 monthly or $4,500 annually. Pro removes query restrictions and adds priority support. Features include coalition mapping, whitelist generation, and full governance time series. Major funds and compliance teams subscribe to this level.

DeepDAO Pro for Individuals launched April 2025. Pricing remains undisclosed publicly. The service appears positioned between API tiers and free access. Educational institutions receive discounts for academic research.

Revenue models face challenges in DAO tooling. Parcel, a competing treasury management platform, shut down in 2025 despite processing $250 million in payments. The closure highlights monetization difficulties. DeepDAO's diverse revenue streams may provide better sustainability.

DeepDAO API Pricing Comparison With Competitors

Data: Platform pricing pages and public documentation 2025

DeepDAO Main Competitors In 2025

Tally emerged as the primary competitor for on-chain governance. The platform powers voting interfaces for protocols managing over $5 billion in assets. Tally specializes in Compound-style governance and Governor contracts. Usage surged 45% in 2025 as DAOs sought accessible voting tools.

DAOlytics provides competing analytics services. The platform improved tracking and visualization features by 30% in 2024. DAOlytics focuses on treasury transparency and governance accessibility. Both DeepDAO and DAOlytics supply ecosystem statistics to media and research firms.

Boardroom Labs offers digital governance solutions for DAOs. The platform provides decision-making infrastructure and voting interfaces. Boardroom targets enterprise adoption with white-label solutions. The company raised institutional funding and serves major protocols.

Messari competes in the research and data sector. The crypto intelligence firm provides broader market analysis beyond DAOs. Messari's reports include governance trends, token economics, and protocol comparisons. Subscriptions cost significantly more than DeepDAO's offerings.

Nansen delivers blockchain analytics with DAO tracking features. The platform focuses on wallet intelligence and capital flows. Nansen's strength lies in identifying smart money movements. Price points exceed DeepDAO by several multiples, targeting institutional clients.

Dune Analytics allows custom SQL queries across 100+ blockchains. Users build DAO dashboards from raw on-chain data. Dune reached 96 Net Promoter Score in 2024. The free tier includes 2,500 monthly credits. Dune suits technical users comfortable writing queries.

DeepDAO Market Position Against Top DAO Analytics Competitors

Data: Platform capabilities comparison and market positioning analysis

DeepDAO Security And Reliability

No major security incidents affected DeepDAO through 2025. The platform operates as a read-only analytics service. DeepDAO does not hold user funds or execute transactions. This architecture limits attack surface compared to financial protocols.

Data integrity relies on accurate blockchain indexing. DeepDAO pulls information directly from chain states and governance contracts. The team curates treasury addresses manually to ensure accuracy. Incorrect addresses would misrepresent DAO holdings.

Platform availability remained stable throughout 2025. No extended downtime reports surfaced in public channels or social media. Continuous data updates suggest reliable infrastructure. Daily treasury snapshots and proposal tracking require consistent uptime.

Third-party integrations create potential vulnerabilities. DeepDAO connects to multiple APIs and blockchain nodes. Node failures or API changes could disrupt data flows. The platform likely maintains redundant data sources to mitigate this risk.

Privacy concerns exist around wallet tracking. The platform maps voting patterns and coalition behavior across addresses. Users cannot opt out if they participate in tracked DAOs. This transparency serves governance health but reduces pseudonymity.

DeepDAO Development History And Roadmap

Eyal Eithcowich founded DeepDAO in February 2020. The project started as a tool for Genesis Alpha DAO members. Initial coverage included five platforms: Aragon, Moloch, DAOstack, OpenLaw, and Colony. All operated on Ethereum or xDAI networks.

June 2021 brought a $3 million seed round. Hypersphere Ventures and DFG led the funding. Other investors included YBB Foundation, Waterdrip Capital, Illusionist Group, and SevenX. The capital funded platform expansion and team growth.

January 2022 saw the DeepDAO 2022 launch. This version introduced the People discovery engine. Over 4,000 DAOs and 1.6 million participant profiles went live. The platform evolved from simple rankings to relationship mapping. Users could search by wallet address or ENS name.

August 2022 brought API access. The Data API provided programmatic access to ecosystem statistics, organization data, and voter profiles. Two pricing tiers launched: Starter at $25 monthly and Pro at $450 monthly. This marked the first revenue generation.

Treasury health APIs launched November 2023. New endpoints tracked stablecoin holdings, ETH allocations, and DeFi positions. Organizations could assess financial stability through automated metrics. Over 1,050 EVM treasuries across six chains entered tracking.

April 2025 introduced DeepDAO Pro for Individuals. The premium service targets professional delegates with cross-DAO dashboards. Coverage focuses on top 100 Ethereum and Layer 2 organizations. This represents a shift toward serving power users.

The roadmap emphasizes predictive analytics and AI integration. Machine learning models will identify governance failures before they occur. Enhanced social network mapping will visualize contributor relationships. Cross-chain expansion continues with plans for Cosmos, Polkadot, and Solana support.

DeepDAO Platform Evolution And Key Milestones Timeline

Data: DeepDAO company announcements and platform statistics

DeepDAO Advantages For Users

DeepDAO consolidates fragmented DAO data into one interface. Users avoid checking multiple governance forums, explorers, and documentation sites. Treasury tracking across 1,050 addresses would require manual work without aggregation. The platform saves hours of research time.

Historical data enables trend analysis. Users see how DAOs evolved over months and years. Treasury growth patterns, participation changes, and proposal frequencies become visible. This longitudinal view helps predict future behavior.

Coalition mapping reveals hidden power structures. Traditional tools show individual voting records. DeepDAO identifies groups voting together consistently. This transparency helps smaller token holders understand true governance dynamics. It also allows DAOs to detect potential attacks.

Cross-DAO participation tracking shows contributor reputation. Users see all organizations a person participates in. High activity across respected DAOs suggests credible contributors. This helps DAOs recruit talent and assess delegate qualifications.

API access enables custom workflows. Developers build monitoring tools, investment dashboards, and automated alerts. Integration with proprietary systems allows institutions to track exposure. This flexibility serves diverse use cases beyond the standard interface.

Free basic access democratizes research. Anyone can explore DAO rankings and treasury sizes without payment. This openness contrasts with paywalled competitors. Students, journalists, and retail investors benefit from free data access.

DeepDAO Limitations And Drawbacks

Coverage gaps exist for newer chains and platforms. DeepDAO focuses on Ethereum and EVM-compatible networks. Solana, Cosmos, and other ecosystems receive limited tracking. DAOs on these chains lack visibility despite significant activity.

Manual curation introduces delays and errors. The team manually verifies treasury addresses and DAO metadata. New organizations may take weeks to appear. Incorrect categorization occasionally occurs despite quality control efforts.

Data presentation assumes technical literacy. Charts and metrics require blockchain knowledge to interpret. Newcomers struggle understanding terms like "AUM" or "governance token holders." The platform lacks educational content explaining basics.

Coalition analysis raises privacy questions. Tracking voting patterns across addresses reveals real-world relationships. Users cannot hide their participation if they vote on-chain. This transparency conflicts with crypto's pseudonymous culture.

Predictive features remain unproven. DeepDAO promotes machine learning for governance failure prediction. However, no public case studies demonstrate effectiveness. The models may generate false positives or miss actual problems.

Monetization challenges persist across DAO tooling. Parcel's 2025 shutdown despite $250 million processed shows business model difficulties. DeepDAO's long-term sustainability depends on converting free users to paid tiers. Current conversion rates remain undisclosed.

Frequently Asked Questions

What Blockchain Networks Does DeepDAO Support?

DeepDAO tracks DAOs across Ethereum, Polygon, Optimism, Arbitrum, Gnosis chain, and other EVM-compatible networks. The platform monitors 1,050 treasuries across these chains. Expansion plans include Cosmos, Polkadot, and Solana in future updates.

How Much Does DeepDAO Cost To Use?

Basic DeepDAO access remains free for all users. API access costs $25 monthly for Starter or $450 monthly for Pro tier. DeepDAO Pro for Individuals launched in 2025 with undisclosed pricing. Academic institutions receive research discounts.

How Does DeepDAO Compare To Tally?

DeepDAO provides analytics and discovery across 2,500 DAOs. Tally specializes in governance voting interfaces and proposal creation. Tally powers $5 billion in protocol assets but serves fewer organizations. DeepDAO offers broader ecosystem views while Tally enables direct participation.

Can DeepDAO Track Individual Wallet Addresses?

Yes, DeepDAO creates profiles for every governance participant. Users search by wallet address or ENS name. Profiles show all DAO memberships, voting history, and proposals created. This transparency helps assess contributor reputation across organizations.

Does DeepDAO Work With Non-Ethereum DAOs?

DeepDAO primarily tracks Ethereum and EVM-compatible chains. Coverage expanded to Layer 2 networks like Polygon, Optimism, and Arbitrum. Plans exist for Cosmos, Polkadot, and Solana integration. These additions will significantly increase tracked organizations.

How Accurate Is DeepDAO Treasury Data?

DeepDAO pulls treasury values directly from blockchain states. The team manually curates wallet addresses for accuracy. Real-time updates reflect current holdings. However, manual verification introduces delays for new DAOs. Users should verify critical decisions with multiple sources.

What Security Measures Protect DeepDAO Users?

DeepDAO operates as a read-only analytics platform. The service does not hold funds or execute transactions. No security incidents affected the platform through 2025. Users access public blockchain data without creating accounts or connecting wallets.

How Does DeepDAO Identify Voting Coalitions?

The platform analyzes voting patterns across addresses. Algorithms detect wallets consistently voting together on proposals. Coalition mapping shows 2, 3, or up to 10-person groups. This reveals power dynamics invisible in individual voting records.

Can DAOs Request Listing On DeepDAO?

DAOs can contact DeepDAO at info@deepdao.io for listing requests. The team manually verifies organizations before adding them. Listing requires active governance and verifiable treasury addresses. Coverage prioritizes established DAOs with significant assets or membership.

What Alternatives Exist To DeepDAO?

Major alternatives include Tally, DAOlytics, Boardroom Labs, and Messari. Dune Analytics allows custom blockchain queries. Each platform serves different needs. Tally excels at voting interfaces, Dune at custom analysis, Messari at research. DeepDAO offers the broadest DAO-specific coverage.

Sources

DeepDAO official website and platform documentation

DeepDAO Substack newsletter and ecosystem updates

DeepDAO LinkedIn company profile and announcements

Crunchbase DeepDAO funding and investor information

Decrypt article on DeepDAO search engine launch

Medium article by Eyal Eithcowich on DeepDAO introduction

DAOtimes DAO tool reports and ecosystem statistics 2025

CoinLaw decentralized autonomous organizations statistics 2025

CoinLaw DAO treasury holdings statistics 2025

PatentPC DAO growth statistics and treasury analysis

Webopedia biggest DAOs in 2025 report

Yellow.com DAO tools and platform guide 2025

SourceForge DeepDAO reviews and integrations 2025

Tracxn DeepDAO company profile and competitors

CB Insights DeepDAO alternatives and competitors analysis

Incora Software DeepDAO case study

Soocial DAO statistics reference

LAB Blockchain Summit DeepDAO analysis

Dealroom Deep DAO company information