Top 10 DAOs spent $55 million on product and development initiatives in 2022, Messari reports

According to Messari’s recently published “State of DAO Funding” report, a large chunk of DAO resources was allocated to product and development initiatives in 2022.

Published by Messari Governance Analyst, Ryan Holloway, the report takes a look at the internal DAO labor (aka working groups) within ten leading decentralized organizations – MakerDAO, ENS, Gitcoin, ShapeShift, Balancer, mStable, Threshold, PoolTogether, Rook, and Bankless.

Working Groups, subDAOs, and Workstreams

Holloway defines a working group as a “lean and autonomous group of contributors focused on predetermined tasks within the DAO.” This suggests that a DAO can be made up of multiple working groups, subDAOs, guilds, or workstreams.

While the use of working groups in decentralized organizations offers benefits such as rapid response, concentrated efforts, and optimized strategies, they have their own downsides. For instance, there could be competition from several working groups for scarce DAO resources or the DAO could decide not to deploy more funds due to market volatility. Nevertheless, a handful of DAOs still utilize working groups.

DAO internal funding data

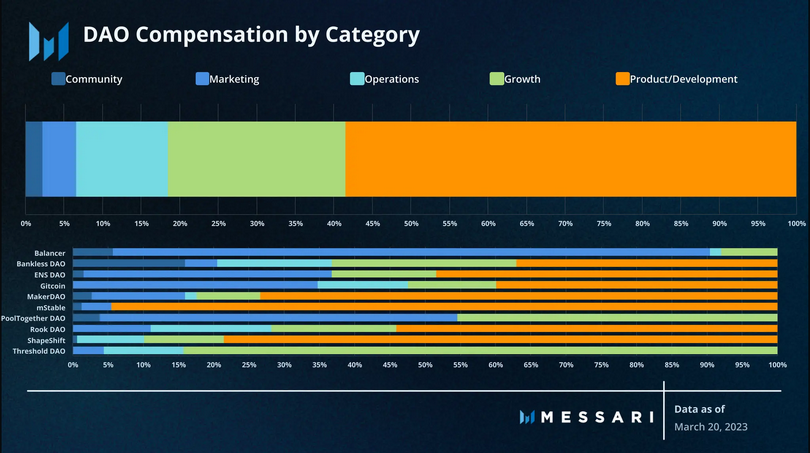

Messari’s State of DAO Funding analyzed the payment data to working groups in the aforementioned DAOs in 2022. The payment data was further broken down into five categories – Product & Development, Growth, Operational, Marketing, and Community.

Throughout 2022, Messari estimates that about $102 million was transferred from the treasuries of DAOs to their respective internal DAO labor. More than 58% of this figure was channeled toward Product & Development, which generally involves the technical aspects of a protocol, such as security, scalability, and the protocol’s developments. The Growth category received the second-largest allocation of 22%.

As seen in the image above, mStable, ShapeShift, and MakerDAO had the highest allocations to Product & Development. Surprisingly, some organizations like Balancer, PoolTogether, and Threshold DAO had zero allocations to Product & Development. Balancer, for instance, prioritized its marketing initiatives, while PoolTogether focused on Growth.

Comparing the fund allocations across several DAOs, Holloway revealed that in addition to being the highest-funded category, Product & Development received the highest average payment of $460,000 in 2022.

Keep Building

Holloway concluded his report by stating that there was a need for DAOs to explore innovative funding methods to attract and retain top talents. Notably, a lot of work needs to be done in the areas of performance measurement, accountability, and contributor satisfaction. He explained:

To improve accountability, DAOs could seek to implement rigorous and standardized performance metrics for working groups. While the lack of performance metrics has not posed any significant issues yet, DAOs might need to become strict in a scarce funding environment.

Check BTC Peers guide of the most promising crypto