DAOs Show Resilience Through November 2025 Bear Market

Executive Summary

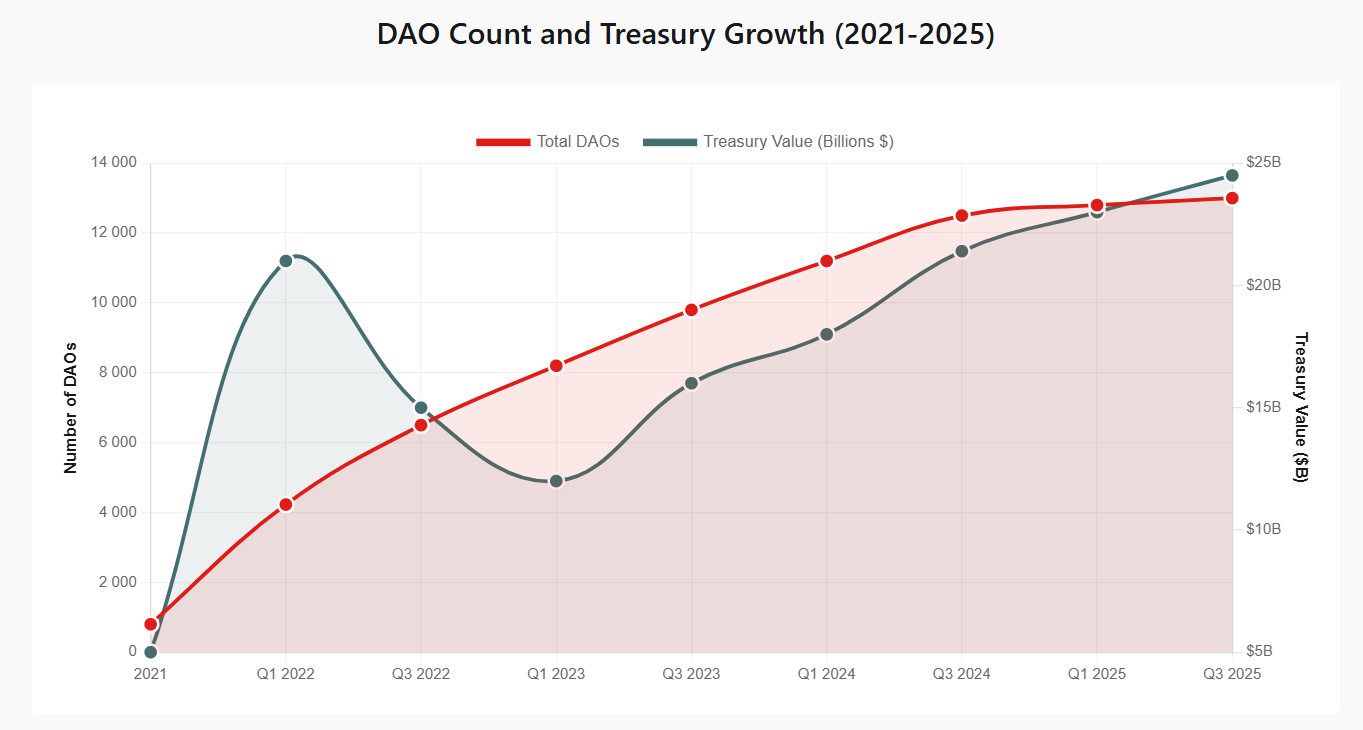

Decentralized Autonomous Organizations entered 2025 managing over 13,000 entities globally with combined treasury holdings reaching $24.5 billion. Despite crypto markets experiencing downturn conditions starting in February 2025, DAOs demonstrated resilience through sustained growth in participation and governance sophistication. Active DAO count reached 6,000 organizations conducting regular governance activities across Ethereum, Polygon, Arbitrum and emerging Layer 2 networks.

The ecosystem accommodates 11.1 million governance token holders according to DeepDAO analytics platforms. Treasury concentration remains high with top DAOs like Uniswap ($2.8 billion), BitDAO ($2.4 billion), and ENS ($1.2 billion) commanding significant capital reserves. Voter participation averages 17% across all DAOs, while leading organizations achieve 22-28% turnout on major proposals through improved tooling and delegation mechanisms.

DeFi sector maintains dominance with 70 protocol DAOs managing $7.5 billion in assets. Infrastructure DAOs follow with 30 entities holding $0.8 billion combined. New categories emerged including 500-600 sustainability-focused DAOs addressing climate action through tokenized governance. AI-assisted governance tools launched in 2025 summarize proposals and flag malicious submissions, improving participation efficiency for time-constrained members.

DAO Ecosystem Growth Trajectory and Market Position

Data: DeepDAO analytics, Dune Analytics governance trackers, and CoinLaw statistics (2021-2025)

DAO formations accelerated at approximately 30% compound annual growth rate between 2021 and 2024. Early ecosystem featured fewer than 100 tracked organizations in 2019. The count surged to 4,227 DAOs by January 2022 following DeFi expansion. By mid-2024, the ecosystem supported over 10,000 registered entities across multiple blockchains.

Treasury accumulation paralleled entity growth. Combined holdings rose from $10 billion in early 2022 to $21 billion liquid assets by mid-2024. Total treasury value including illiquid positions reached $24.5 billion by August 2025 despite bear market conditions reducing token valuations 30-40% from December 2024 peaks.

Geographic expansion shows Asia-Pacific leading adoption with China, South Korea and India driving regional growth. Conference attendance measuring DAO community engagement increased 40% in 2025. Analytics platforms including DeepDAO, DAOlytics and Tally improved tracking features by 30% during 2024, enhancing transparency across governance data.

DAO Categories and Distribution Across Sectors

DAO Category Breakdown for 2025

| Category | Number of DAOs | Total Assets | Primary Function |

|---|---|---|---|

| DeFi Protocol DAOs | 70 | $7.5 billion | Govern lending, trading and yield protocols |

| Infrastructure DAOs | 30 | $0.8 billion | Manage blockchain networks and Layer 2 solutions |

| Venture Capital DAOs | 25 | $0.2 billion | Pool capital for early-stage investments |

| NFT and Collector DAOs | 20 | $0.5 billion | Acquire digital art and collectibles |

| Grant and Public Goods DAOs | 15+ | $0.3 billion | Fund open-source development and public goods |

| Social and Community DAOs | 12+ | $0.1 billion | Connect members around shared interests |

| Media and Content DAOs | 8+ | $0.08 billion | Produce decentralized journalism and content |

| Storage and Infrastructure | 2 | $0.2 billion | Decentralized storage solutions |

| Sustainability DAOs | 500-600 | Varies | Address climate and environmental initiatives |

Data: CoinLaw statistics, DeepDAO sector analysis, and governance platform reports (2025)

DeFi protocol DAOs command largest treasury holdings and member counts. These organizations govern automated market makers, lending protocols and yield aggregators including Uniswap, Aave, Compound and Curve. Governance covers interest rate parameters, collateral additions, treasury allocations and protocol upgrades. Token holders vote using native governance tokens like UNI, AAVE, COMP and CRV.

Infrastructure DAOs manage blockchain networks themselves. Arbitrum DAO oversees Layer 2 scaling solution with hundreds of millions in treasury funding developer grants. Optimism DAO pioneered Retroactive Public Goods Funding distributing tens of millions to ecosystem builders. These entities democratize network control beyond core development teams.

Venture DAOs like MetaCartel Ventures pool member capital for early-stage crypto investments. Members collectively evaluate opportunities and share profits. This model democratizes venture capital access for individuals excluded from traditional funds. Social DAOs including Friends With Benefits create exclusive communities around shared interests, using token-gated access for events and collaboration.

Grant DAOs like Gitcoin and MolochDAO fund open-source development through quadratic funding mechanisms. Small donations receive amplified matching based on community support breadth. This approach directs resources toward public goods with broad stakeholder consensus rather than large individual preferences.

Leading DAOs by Treasury Size and Activity

Top DAOs by Treasury Holdings for 2025

| DAO Name | Treasury Value | Category | Primary Chain | 24h Growth Rate |

|---|---|---|---|---|

| Uniswap DAO | $2.8 billion | DeFi DEX | Ethereum | 0.8% |

| BitDAO | $2.4 billion | Investment | Ethereum | 1.2% |

| ENS DAO | $1.2 billion | Infrastructure | Ethereum | 0.5% |

| Gnosis DAO | $1.0 billion | Infrastructure | Multi-chain | 0.3% |

| Lido DAO | $334.9 million | Liquid Staking | Ethereum | 5.2% |

| Aave DAO | $1.3 billion | DeFi Lending | Multi-chain | 1.1% |

| MakerDAO | $950 million | Stablecoin | Ethereum | 0.4% |

| Arbitrum DAO | $700 million | Layer 2 | Arbitrum | 2.3% |

Data: DeepDAO treasury tracking, CoinLaw DAO statistics, and protocol governance dashboards (2025)

Uniswap maintains position as largest DAO by treasury holdings. The decentralized exchange governs $2.8 billion through UNI token voting. Governance covers fee tier structures, protocol grants, ecosystem partnerships and treasury deployment. Monthly participation averages 3.2 million UNI tokens representing 5-8% of eligible voting power. The DAO conducts temperature checks via Snapshot before on-chain execution.

Lido demonstrated highest 24-hour growth rate at 5.2% reflecting expanding liquid staking adoption. The protocol coordinates governance across Ethereum, Polygon and Arbitrum using multi-chain voting strategies. Monthly cycles involve over 500,000 LDO token holders. Proposals cover node operator recruitment, fee structures and treasury management across multiple blockchain deployments.

Arbitrum DAO pioneered multi-layered governance through subDAO structures. Specialized teams handle specific grant programs and projects. Treasury funds support developer incentives, infrastructure buildout and ecosystem growth. This decentralized model proves blockchain networks can operate under genuine community ownership rather than foundation control.

Governance Participation Metrics and Voting Behavior

Data: Snapshot governance analytics, Tally voting records, and Dune DAO dashboards (2025)

Voter participation averages 17% across measured DAOs with considerable variation by proposal importance and organization maturity. Leading protocol DAOs including Aave and MakerDAO maintain 22% turnout on critical governance votes affecting protocol parameters. Participation drops below 10% for routine administrative proposals lacking material financial impact.

Token concentration remains governance challenge. Top 20% of stakeholders control 78% of governance tokens across major DAOs. This concentration enables coordinated actions by large holders despite broader community preferences. Quadratic voting adoption grew to over 100 DAOs including Gitcoin and Optimism-based projects, reducing whale influence through mathematical vote weighting.

Delegation mechanisms improved participation efficiency. Token holders delegate voting power to active participants rather than abstaining. Snapshot and Tally platforms added delegate leaderboards, public statements and reputation tracking. Usage of governance platforms surged 45% in 2025 reflecting demand for accessible voting infrastructure beyond raw smart contract interaction.

Proposal quality varies widely. High-engagement DAOs produce detailed proposals with economic modeling, security audits and implementation timelines. Lower-quality submissions lack specificity or fail to address community concerns. AI-assisted governance tools introduced in 2025 automatically summarize lengthy proposals and flag suspicious elements, reducing burden on voters reviewing multiple submissions.

Governance Tool Adoption Comparison

| Platform | Active DAOs | Key Features | Cost Model |

|---|---|---|---|

| Snapshot | 4,000+ | Off-chain gasless voting, 400+ strategies | Free |

| Tally | 500+ | On-chain execution, Governor contracts | Free for basic |

| Aragon | 200+ | Full DAO deployment, treasury management | Gas fees only |

| Colony | 50+ | Reputation-weighted voting, payments | Platform fees |

Data: Platform documentation, governance tool analytics, and DAO infrastructure reports (2025)

DAO Resilience During 2025 Bear Market Conditions

Crypto markets entered correction territory in February 2025 following Bitcoin's January peak of $109,350. Total crypto market capitalization excluding Bitcoin declined 41% from December 2024 high of $1.6 trillion to $950 billion by mid-April 2025. Altcoin values dropped more steeply than Bitcoin due to lower liquidity and higher volatility.

Despite market downturn, DAO operational metrics showed resilience. Active organization count grew from approximately 5,500 in Q4 2024 to over 6,000 by Q3 2025. Treasury values measured in dollar terms declined with token price depreciation, but asset quantities held by DAOs remained stable or grew. Many protocols continued governance activities without interruption.

DeFi user activity measured by Dune Analytics grew 279% quarter-over-quarter in 2024, continuing into early 2025 before stabilizing. This participation increase reflected genuine usage rather than speculative trading. Established DAOs like Uniswap, Aave and Curve maintained proposal submission rates and voting participation throughout market volatility.

Bear market conditions separated sustainable projects from purely speculative entities. DAOs with functional products, active communities and treasury diversification weathered downturn effectively. Organizations lacking revenue models or product-market fit saw member attrition and governance inactivity. The ecosystem demonstrated maturation through selection pressure favoring legitimate decentralized organizations over short-term experiments.

New DAO formations continued despite adverse market conditions. Sustainability-focused DAOs expanded to 500-600 entities globally by early 2025. Climate action DAOs including KlimaDAO and Toucan attracted environmentally-conscious participants. Social DAOs and grant funding organizations maintained operations funded by existing treasuries rather than relying on continuous token appreciation.

Security Incidents and Risk Management in 2025

DAO security incidents in 2025 primarily involved social engineering attacks rather than smart contract vulnerabilities. Chorus One reported May 10 breach where unauthorized entity accessed hot wallet linked to Lido Oracle duties, transferring 1.46 ETH ($3,800). Lido Finance initiated emergency DAO vote replacing compromised oracle. The decentralized oracle system ensured remaining nodes remained unaffected.

Social media account takeovers plagued multiple DAOs. Tron DAO suffered X account compromise on May 2, with hackers soliciting approximately $45,000 through fake promotional offers. Curve Finance experienced similar breach on May 5, with attackers posting fraudulent CRV airdrop links. Account control was silently transferred without client-side compromise evidence.

These incidents differed from historical smart contract exploits like the 2016 DAO hack that drained $60 million. Modern protocol DAOs employ multiple security audits, formal verification tools and bug bounty programs. Smart contract vulnerabilities decreased as development practices matured. Attack surface shifted toward off-chain infrastructure including admin keys, social accounts and governance frontends.

Crypto breaches across the industry exceeded $2 billion in losses during 2025 according to Hacken reports. Flash loan governance attacks continued threatening DAOs using token-weighted voting. Attackers temporarily acquire voting power through borrowed tokens, pass malicious proposals, then execute and repay loans atomically. Defense mechanisms include time-locked proposals, snapshot-based voting and multi-signature execution requirements.

Risk management improvements included treasury diversification strategies, multi-chain deployment reducing single-point failures, and professional security audits becoming standard. Leading DAOs allocated portions of treasuries to stablecoins and traditional assets. Insurance protocols emerged offering coverage against smart contract failures and governance attacks. Security tooling vendors provided monitoring services detecting unusual voting patterns or treasury movements.

Technological Developments and 2025 Innovations

Key DAO Technology Advancements

Cross-chain governance frameworks achieved production readiness in 2025. DAOs operating on multiple blockchains can conduct unified voting affecting assets across Ethereum, Polygon, Arbitrum and Optimism simultaneously. Storage proof technology verifies token balances on Layer 1 while voting occurs on lower-cost Layer 2 networks. This reduces participation costs from $5-50 per vote to $0.01-0.05.

AI integration transformed governance workflows. Natural language processing models automatically summarize lengthy proposals into digestible formats. Machine learning algorithms flag potentially malicious submissions by detecting unusual treasury withdrawal patterns or suspicious voting coalitions. These tools reduced cognitive burden on voters reviewing multiple concurrent proposals.

Delegation systems matured beyond simple voting power transfers. Platforms introduced delegate reputation scores, public policy statements and voting records. Token holders select representatives based on demonstrated expertise and alignment rather than anonymous addresses. This professionalization improved governance quality as dedicated participants replaced passive token holders.

Mobile governance interfaces launched prioritizing accessibility. Push notifications remind members of upcoming deadlines. Simplified voting interfaces abstract technical complexity. The DAO-as-a-Service market reached $123.6 million in 2023 with projections for $680.6 million by 2033 at 18.6% CAGR. Template-based DAO creation reduced setup time from hours to minutes for standard configurations.

Legal recognition advanced in multiple jurisdictions. Wyoming, Marshall Islands and Switzerland's Zug canton allow DAOs to register as recognized entities. This provides legal personality, liability protection and regulatory clarity. Traditional organizations increasingly adopt DAO governance structures for transparency and stakeholder participation benefits. Hybrid models combine Web2 operational tools with Web3 governance backends.

Comparison with Traditional Organizational Models

DAO Advantages Over Traditional Structures

DAO Limitations Compared to Conventional Models

DAO Tooling Ecosystem and Infrastructure Platforms

Comprehensive tooling emerged supporting every DAO lifecycle stage. Creation platforms including Aragon, DAOstack and Colony provide templates and smart contract frameworks. These reduce technical requirements for launching governance organizations. Users configure parameters through web interfaces rather than writing custom code.

Treasury management solutions like Gnosis Safe enable multi-signature control over DAO funds. Multiple key holders must approve transactions preventing single-point failures. Parcel and Multis add banking-style interfaces with recurring payments, invoicing and accounting integrations. This professionalization attracts traditional organizations evaluating DAO models.

Communication infrastructure relies on Discord for discussions, Discourse for long-form proposals and Telegram for announcements. Tools like Commonwealth and Boardroom aggregate governance activity across platforms. Members track proposals, delegate votes and participate without visiting individual DAO websites. This aggregation reduces monitoring overhead for multi-DAO participants.

For comprehensive analysis of available solutions, the Comprehensive DAO Tooling Guide and List of DAO Tools provides detailed comparisons across governance platforms, treasury solutions and operational infrastructure categories.

Analytics platforms including DeepDAO, DAOlytics and Dune Analytics provide transparency into governance health. Dashboards track treasury values, voter participation, proposal success rates and token distribution. These metrics enable comparative analysis identifying well-governed versus struggling organizations. Transparency builds trust attracting quality participants to high-functioning DAOs.

Future Outlook and Emerging Trends

DAO ecosystem trajectory suggests continued growth despite short-term market volatility. Treasury holdings may reach $40-50 billion by end of 2025 assuming modest recovery from current bear market levels. Organization count could exceed 15,000 entities as template-based creation tools reduce formation barriers.

Institutional adoption represents major growth vector. Traditional companies explore DAO governance for transparency and stakeholder engagement benefits. Hybrid models combining conventional legal structures with token-based voting gain traction. This bridges Web2 operational requirements with Web3 governance advantages.

Regulatory clarity will determine mainstream adoption pace. Jurisdictions providing legal frameworks will attract DAO formations. Clear tax treatment, liability rules and compliance requirements reduce uncertainty deterring institutional participants. Industry expects gradual regulatory convergence across major markets throughout 2025-2027.

Cross-chain interoperability becomes standard rather than experimental. DAOs will operate assets and conduct governance across dozens of blockchains simultaneously. This mirrors traditional organizations with global subsidiaries coordinated through unified management rather than separate entities per jurisdiction.

Real-world asset integration expands DAO scope beyond purely digital operations. Tokenized real estate, intellectual property and physical goods enter DAO treasuries. This convergence between on-chain governance and off-chain assets requires legal innovations but unlocks broader use cases beyond current crypto-native applications.

DAO Development History and Evolution

Frequently Asked Questions About DAO Operations

Comprehensive DAO Discovery Resources

Understanding the full DAO landscape requires examining hundreds of organizations across diverse categories. The Comprehensive DAO Tooling Guide and List of DAO Tools provides detailed analysis of governance platforms, treasury management solutions and operational infrastructure enabling decentralized organizations.

For exploring specific DAO implementations across protocols, investors and communities, the Comprehensive List of DAOs to Explore tracks active organizations by category and sector. These resources help participants discover DAOs aligned with their interests, expertise and values. Understanding available options enables informed participation rather than joining first-discovered organization.

Data Sources and Methodology

This report analyzes DAO ecosystem status as of November 2025 using publicly available blockchain data, governance platform statistics and industry research. Metrics represent best available estimates from DeepDAO, Dune Analytics, CoinLaw and protocol-specific dashboards. Treasury values reflect token market prices subject to volatility. Participation rates vary by proposal type and organizational maturity. Security incident descriptions based on public disclosures and security firm reports. For current real-time statistics, consult DeepDAO, DAOlytics and individual protocol governance interfaces.