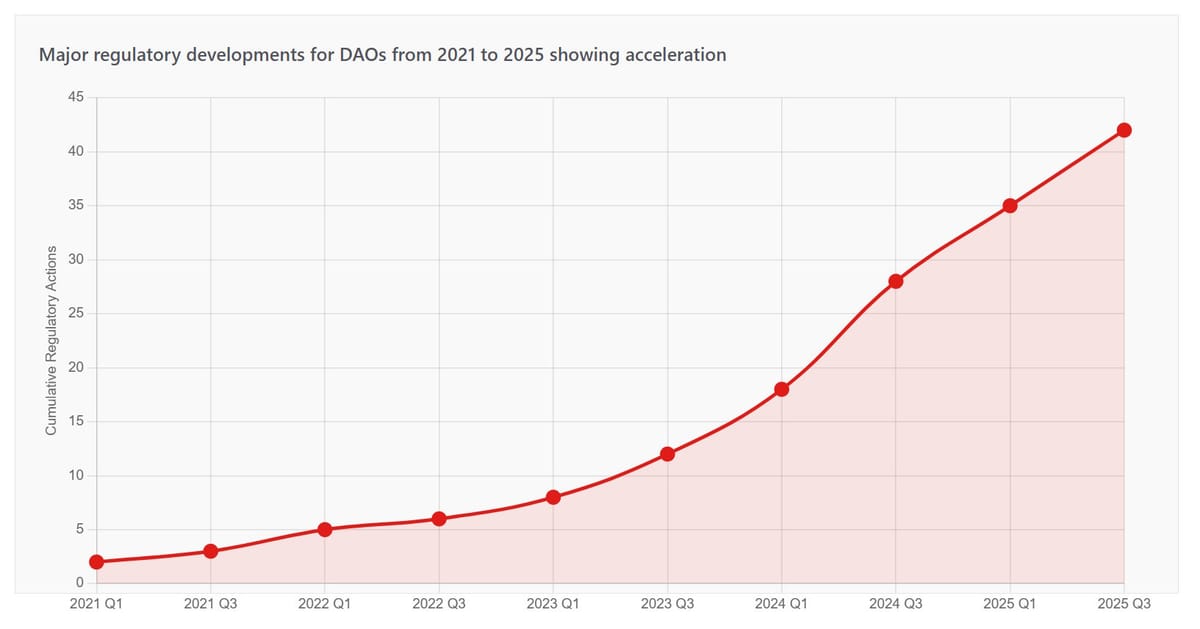

DAO Regulation News 2025, Wyoming DUNA, EU MiCA, FATF Requirements and Court Rulings

DAO Regulation 2025 Overview

Regulatory frameworks for Decentralized Autonomous Organizations transformed from theoretical discussions to enforceable laws in 2024-2025. Courts ruled that unwrapped DAOs expose participants to unlimited personal liability. Multiple jurisdictions enacted specific DAO legislation. International bodies extended existing financial regulations to cover decentralized organizations.

Wyoming passed the Decentralized Unincorporated Nonprofit Association Act in March 2024, effective July 1, 2024. The European Union implemented Markets in Crypto-Assets regulation on December 30, 2024. The Financial Action Task Force classified most DAOs as Virtual Asset Service Providers triggering anti-money laundering requirements.

Courts determined that DAOs without legal structures operate as general partnerships under state law. Members with governance participation face joint liability for organizational obligations. The regulatory shift ended the "entityless DAO" concept where organizations could avoid legal classification.

Samuels v. Lido DAO Court Ruling

Judge Vince Chhabria of the US District Court for the Northern District of California ruled in November 2024 that Lido DAO functions as a general partnership under California law. This establishes personal liability for all members actively participating in governance.

Andrew Samuels purchased LDO tokens and incurred losses. He sued claiming Lido failed to register tokens as securities with the SEC. Lido argued it was autonomous software without legal personality. The court rejected this defense.

The court found that Paradigm Operations, Andreessen Horowitz, and Dragonfly Digital Management actively participated in governance. This made them general partners subject to liability. Robot Ventures was dismissed due to insufficient participation evidence.

The ruling confirmed that 64% of LDO tokens held by founders and early investors demonstrated centralized control despite public decentralization claims. Any participation in DAO forums or governance could establish partnership status under California law.

This case followed CFTC v. Ooki DAO in 2023 where the court issued default judgment. Courts served documents through posts on DAO discussion forums. The regulatory message became clear: decentralization does not immunize organizations from legal responsibility.

Global Regulatory Frameworks November 2025

| Jurisdiction | Regulation | Effective Date | Primary Requirement |

|---|---|---|---|

| Wyoming, USA | DUNA Act (SF50) | July 1, 2024 | 100+ members, legal entity status, limited liability protection |

| European Union | MiCA Regulation | December 30, 2024 | CASP licensing, excludes truly decentralized protocols |

| California, USA | Partnership Law Application | November 2024 | Unwrapped DAOs classified as general partnerships |

| Global | FATF VASP Classification | 2025 | AML/KYC requirements, $3,000 reporting threshold |

| International | Harmony Framework | February 2025 | Jurisdiction-neutral modular legal structure |

Data: Wyoming Legislature, European Commission, California Courts, FATF, Aurum Law (2024-2025)

Wyoming DUNA Legislation

Governor Mark Gordon signed Senate File 0038 in March 2024 creating the Decentralized Unincorporated Nonprofit Association framework. This provides the first US legal structure purpose-built for blockchain organizations.

DUNAs require minimum 100 members joining through mutual consent for nonprofit purposes. Members hold voting power proportional to their interests. The organization gains legal entity status enabling contracts, bank accounts, court appearances, and tax obligations.

The framework permits profit-making activities despite nonprofit classification. Organizations can pay reasonable compensation for ecosystem services. This allows decentralized protocols to operate while compensating contributors.

Members receive limited liability protection for organizational debts and judgments. This addresses the primary risk that discouraged DAO participation before 2024. The structure removes centralized management requirements potentially affecting securities law application under the Howey Test.

Miles Jennings from a16z Crypto called DUNA a breakthrough enabling blockchain projects to operate within laws without compromising decentralization. Wyoming previously allowed DAO LLCs in 2021 but DUNAs offer simpler nonprofit structure better suited for governance protocols.

EU Markets in Crypto-Assets Regulation

MiCA became fully applicable across 27 EU member states on December 30, 2024. This creates the first comprehensive continental framework for digital asset regulation.

The regulation excludes protocols operating in fully decentralized manner without identifiable responsible parties. However, most DAOs fail this threshold due to founders, core teams, or token concentration creating de facto control.

Crypto-Asset Service Providers must obtain authorization in one EU country for operations across all member states. This replaces fragmented national licensing requirements. Netherlands and Germany issued first licenses on December 30, 2024 and mid-January 2025.

Over 40 CASP licenses were granted in first six months. The European Securities and Markets Authority maintains public register tracking authorized providers. Non-compliant entities face prohibition from EU operations and financial penalties.

MiCA introduced mandatory market abuse controls, insider trading prevention, and disclosure requirements. Organizations must implement KYC procedures, transaction monitoring, and suspicious activity reporting. The regulation applies to custody providers, trading platforms, and token issuers.

Regulatory Requirements by Jurisdiction

Data: Wyoming DUNA Act, EU MiCA, FATF Guidelines, State Partnership Laws (2025)

FATF Anti-Money Laundering Requirements

The Financial Action Task Force updated standards in June 2025 classifying most DAOs as Virtual Asset Service Providers. This triggers comprehensive AML obligations regardless of decentralization level.

DAOs must implement continuous transaction monitoring for all treasury funds. Enhanced due diligence applies to members with voting rights. Organizations must verify participant identities through KYC procedures and maintain records.

The Travel Rule requires collecting participant information for cross-border transfers above $1,000. Standardized data must accompany payment messages including name, address, and date of birth. Financial institutions must verify recipient banking details.

Reporting thresholds decreased from $10,000 to $3,000 for suspicious transactions. DAOs must file suspicious activity reports with relevant authorities when unusual patterns emerge. Failure to comply results in penalties and potential criminal charges for responsible parties.

FATF published sixth targeted update in August 2025 on global implementation of AML measures for virtual assets. The update highlights where stronger action is needed to safeguard financial system integrity.

Harmony Framework Introduction

The Harmony Framework launched in February 2025 as jurisdiction-neutral legal architecture for DAOs. This modular system enables operation across multiple countries while protecting members from personal liability.

The framework balances decentralization with legal recognition through separable components. DAOs can maintain on-chain governance while establishing legal entities in strategic jurisdictions for specific functions.

Harmony addresses the problem of DAOs operating globally but needing legal presence in multiple countries. Traditional approaches require separate entities in each jurisdiction with duplicated compliance costs. The framework allows coordinated structure with reduced overhead.

The system separates economic rights from governance tokens addressing regulatory concerns about token classification. This separation helps argue against securities characterization under various national frameworks.

Legal Structure Options for DAOs

| Structure | Jurisdiction | Liability Protection | Regulatory Burden | Setup Timeline |

|---|---|---|---|---|

| Unwrapped DAO | None | None - unlimited liability | Low | Immediate |

| Wyoming DUNA | USA | Limited liability for members | Moderate | 2-4 weeks |

| DAO LLC (Wyoming) | USA | Limited liability | High | 4-6 weeks |

| Cayman Foundation | Cayman Islands | Full protection | High | 8-12 weeks |

| Swiss Association | Switzerland | Full protection | High | 6-10 weeks |

| MiCA-Compliant Entity | EU | Full protection | Very High | 12-18 weeks |

Data: Legal structuring firms, regulatory filings (2025)

Smart Contract Governance Requirements

Regulators introduced specific expectations for smart contract governance in 2025. DAOs must implement regular third-party security audits from certified providers. Audit reports must be made available to members and submitted to regulatory authorities where applicable.

Smart contracts require documented upgrade mechanisms showing how modifications occur and who authorizes changes. Emergency pause functions must exist with clear activation criteria and responsible parties identified.

Dispute resolution mechanisms must be defined before conflicts arise. This includes procedures for challenging governance decisions, resolving token holder disputes, and addressing smart contract failures.

These requirements apply differently based on DAO classification. Organizations operating as CASPs under MiCA face strictest standards. Those qualifying for decentralization exemptions have reduced but still present obligations.

DAO Regulation Adoption Timeline

Data: Regulatory announcements, court rulings, legislative acts (2021-2025)

What Changed in 2025

Courts established that decentralization claims do not prevent legal liability. The Samuels v. Lido DAO ruling created precedent that active governance participation creates partnership liability in jurisdictions without specific DAO laws.

Federal and international bodies extended existing financial regulations to DAOs. FATF classification as VASPs triggered AML requirements. EU MiCA enforcement demonstrated serious consequences for non-compliance.

Legal wrapper adoption became standard for new DAOs. The cost of remaining unwrapped exceeded compliance costs after liability risks materialized through actual lawsuits.

The Trump administration formed Presidential working group on digital assets in January 2025. This signals potential federal legislation addressing DAO legal status and token classification in the United States.

Upcoming Regulatory Developments

European Commission plans interim MiCA report by June 30, 2025 assessing initial implementation. A separate report will address areas not covered including DeFi protocols and NFTs. Lawmakers discuss MiCA 2.0 for next iteration.

The Organisation for Economic Cooperation and Development may develop international standards for DAO taxation and regulation. OECD produced cryptocurrency reporting frameworks in 2024 that could extend to decentralized organizations.

Utah implemented innovation-friendly DAO legislation in 2024. New Hampshire prepared similar regulations. Delaware and Nevada updated Unincorporated Nonprofit Association statutes to accommodate blockchain governance.

Switzerland and Singapore develop regulatory sandboxes for DAO experimentation. These frameworks allow testing new governance models while providing temporary regulatory relief.

The regulatory trend favors explicit legal recognition over ambiguity. Jurisdictions compete to attract DAO formation through favorable frameworks balancing innovation with consumer protection.

Compliance Burden by Structure

Data: Legal firms, compliance consultants (2025)

Frequently Asked Questions

Key Regulatory Resources

Wyoming State Legislature - Decentralized Unincorporated Nonprofit Association Act (Senate File 0038, 2024)

European Commission - Markets in Crypto-Assets Regulation (EU) 2023/1114

Financial Action Task Force - Updated Virtual Asset Standards and Recommendation 16 (June 2025)

US District Court, Northern District of California - Samuels v. Lido DAO Case No. 23-cv-06492 (November 2024)

Aurum Law - "DAO 3.0: Ultimate Legal Structuring for DAOs in 2025 and Beyond"

a16z Crypto - "The DUNA: An Oasis For DAOs" (March 2024)

Falcon Rappaport & Berkman - "The Wyoming DUNA and Future of DAO Legal Frameworks" (June 2025)

Fenwick & West - "Legal Landscape for DAOs: Key Lessons from Lido DAO and Ooki DAO" (May 2025)

Davis Wright Tremaine - "Samuels v. Lido DAO: Potential New Frontier for Liability" (January 2025)

Markaicode - "2025 Legal Trends for DAOs" (April 2025)

Global Law Experts - "MiCA Regulation New Rules for 2024 and Predictions for 2025" (April 2025)

European Securities and Markets Authority - CASP Public Register

Additional resources: DAO Tools Guide | List of DAOs