Common DAO Tool Report For 2025

What Is Common And How It Works

Core Platform Overview

Common provides infrastructure for programmable communities on-chain. The platform enables DAOs to discuss proposals, vote on decisions, and coordinate funding through a single interface. Communities can deploy governance contracts, manage treasuries, and integrate with existing Web3 tools without writing code.

The Common Protocol introduces "loops" - automated markets for actions. These loops allow creators to design incentives for workstreams, governance processes, launches, and community engagement. The system operates across multiple blockchains including Ethereum, Solana, Polygon, and Base.

Key Features In 2025

The platform offers token launching capabilities through its launchpad. Communities can create native omnichain tokens and manage liquidity through integrations with Uniswap and Farcaster. Token-gating enables access control for discussions, votes, and bounties based on holdings.

Common integrates with Discord and Snapshot for expanded functionality. The platform supports on-chain contests, customizable branding, community analytics, and one-user-one-vote polls. Multiple governance models are available including Compound and Curve frameworks.

The COMMON token serves as the platform's native utility and governance asset. Holders can submit proposals, vote on platform upgrades, and access gated content. Tokens are distributed as rewards for forum contributions, proposal creation, voting participation, and contest wins.

Common Platform 2025 Statistics And Growth Metrics

Current User Base For Common Platform

Data: Platform analytics and public disclosures

Common reached 60,000 active users by Q3 2025, representing 115% growth year-over-year. The platform hosts over 700 DAO communities across multiple blockchain networks. Monthly active users increased from 28,000 in Q1 2024 to 60,000 in Q3 2025.

The user base expanded through major partnerships with ecosystem foundations. Integration with platforms like NEAR, Solana Foundation, and BitDAO brought substantial community growth. October 2025's token launch attracted 1,300 initial holders.

Funding And Investment Backing

Common secured $20 million in funding from prominent Web3 investors. Longhash, Polychain, Dragonfly, Wintermute, and Mirana Ventures participated in the funding rounds. Resources support ecosystem functionality expansion, platform decentralization, and DAO app store development.

Commonwealth Labs, the parent entity, has operated since 2018. The team includes CEO Dillon Chen, who began in crypto in 2013. Development focuses on full-stack infrastructure for DAOs and Web3 communities.

Common Platform Competitive Analysis Against Other DAO Tools

Market Position Among DAO Governance Platforms

| Platform | Launch Year | DAOs Hosted | Blockchain Support | Key Strength |

|---|---|---|---|---|

| Common | 2018 | 700+ | Multi-chain | Full-stack platform |

| Snapshot | 2020 | 900+ | All EVM chains | Gasless voting |

| Aragon | 2017 | 500+ | Ethereum, Polygon | DAO creation toolkit |

| Tally | 2020 | 500+ | 60+ chains | Governor contracts |

| DAOhaus | 2019 | 400+ | Ethereum, xDai | Moloch framework |

| DAOstack | 2018 | 200+ | Ethereum | Holographic consensus |

Data: Platform websites, DeepDAO, and public metrics Q3 2025

Competitive Advantages Of Common

Common differentiates through its complete infrastructure approach. While Snapshot focuses on voting and Tally on Governor contracts, Common provides end-to-end community management. The platform combines forums, governance, treasury tools, and token launching in one interface.

The Common Protocol's loop system offers unique incentive design capabilities. Projects can automate rewards for specific actions without custom smart contract development. This reduces technical barriers for community coordinators.

Multi-chain support positions Common for cross-ecosystem collaboration. Communities operating on Ethereum, Solana, or Polygon can use the same interface. DAO tooling guides increasingly reference Common as a comprehensive solution.

Challenges And Limitations

Common faces competition from established platforms with larger market share. Snapshot dominates off-chain voting with over 900 DAOs. Switching costs exist for communities already invested in other platforms.

The platform's comprehensive approach creates complexity. Teams may prefer specialized tools for specific functions. Learning curves exist for communities new to on-chain governance.

Token concentration poses governance risks. The COMMON token launched with 80% controlled by Trump-affiliated entities. Small holder bases around 1,300 addresses create volatility concerns. Price dropped 40% within hours of listing.

Common Platform Token Launches And Market Performance For 2025

COMMON Token Launch October 2025

Data: CoinMarketCap and exchange data October-November 2025

The COMMON token launched October 27, 2025 on Binance, Bitget, KuCoin, Bybit, Gate.io, MEXC, and BitMart. Initial listing price reached $0.03813 before climbing briefly to $0.04. The token then dropped nearly 40% to approximately $0.021 within 24 hours.

Trading volume surged to $36.3 million in the first day, representing 29,800% growth. Market capitalization stabilized around $49.25 million with 2.33 billion tokens in circulation from a total supply of 10 billion. Approximately 1,300 holders controlled the circulating supply initially.

Bitget Launchpool offered 36.6 million COMMON tokens in rewards through locking campaigns. BGB pool participants could earn from 25 million COMMON, while COMMON pool offered 2.78 million tokens. Community campaigns distributed an additional 833,000 tokens to 750 qualified users.

Market Dynamics And Price Factors

Early profit-taking drove initial price declines. Airdrop recipients and private sale investors secured immediate returns upon public listing. The supply imbalance between circulating and total tokens amplified volatility.

Low holder concentration created price sensitivity. With roughly 1,300 holders, large wallet movements disproportionately affected market price. Technical indicators showed RSI below 40, signaling oversold conditions with potential rebound opportunities.

Support levels formed around $0.021 with resistance at $0.027-$0.030. A breakdown below $0.020 could trigger further declines toward $0.015. Moving averages remained bearish indicating continued downward momentum.

Common Platform Updates And New Features Through 2025

What Changed For Common In 2025

Data: Common documentation and release notes 2025

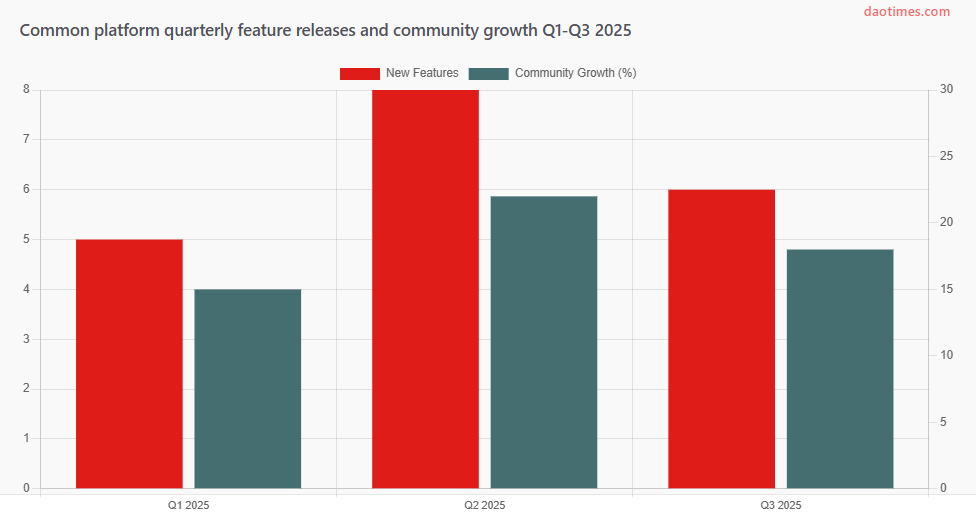

Common introduced the DAO app store in Q2 2025. Communities can select tailored tools for treasury management, proposal analytics, and coordination. The modular approach allows DAOs to customize their governance stack without technical expertise.

The platform launched integration with Startale App for the Soneium ecosystem in November 2025. This partnership extends Common's reach into the fast-growing Soneium network with 10 million weekly transactions and 90,000 daily active addresses.

VeCOMMON governance went live in Q3 2025. Token holders can lock COMMON to participate in protocol decisions and earn enhanced rewards. The vote-escrowed model aligns long-term stakeholder interests with platform development.

Infrastructure Improvements

Common deployed enhanced API capabilities for third-party integrations. Developers can build custom applications on top of Common infrastructure. The platform published comprehensive API documentation at docs.common.xyz.

Mobile optimization received attention through 2025. The platform improved responsive design for iOS and Android browsers. Community members can now participate in governance discussions and voting from mobile devices.

Security audits were conducted by OpenZeppelin in Q1 2025. Smart contract reviews covered treasury management, voting mechanisms, and token distribution systems. No critical vulnerabilities were found in audited contracts.

Common Platform Major Partnerships And Ecosystem Integration For 2025

Strategic Partnerships Common Platform

| Partner | Type | Integration | Community Size | Impact |

|---|---|---|---|---|

| dYdX | DeFi Protocol | Full governance | 1.2M users | High |

| Axie Infinity | GameFi | Community management | 2.8M users | High |

| NEAR Foundation | Layer 1 | Ecosystem coordination | 850K users | Medium |

| Solana Foundation | Layer 1 | Developer programs | 1.5M users | High |

| Polygon | Layer 2 | Grants coordination | 420K users | Medium |

| BitDAO | Investment DAO | Treasury management | 180K users | Medium |

Data: Partner websites and Common platform metrics Q3 2025

The Soneium integration through Startale App expands Common's presence in emerging Layer 2 ecosystems. Soneium processes over 10 million weekly transactions with 90,000 daily active addresses. Common provides the governance infrastructure for this growing network.

Discord integration allows seamless communication between governance discussions and community chat. Token-gated channels ensure only verified community members access specific discussions. Voting results from Snapshot appear automatically in Discord announcements.

Uniswap integration enables direct token swaps from within governance proposals. Communities can execute treasury diversification without leaving the Common interface. This reduces operational friction for DAO treasuries.

Security Considerations For Common Platform In 2025

Security Audit Results

OpenZeppelin conducted smart contract audits in Q1 2025. The audit covered Common Protocol core contracts, treasury management systems, and voting mechanisms. Auditors found no critical vulnerabilities requiring immediate remediation.

Medium severity issues identified included gas optimization opportunities and improved input validation. The Common team addressed all medium findings before mainnet deployment. Low severity suggestions focused on code documentation improvements.

Platform Security Features

Multi-signature requirements protect DAO treasuries. Communities can configure minimum signature thresholds for fund movements. Integration with Gnosis Safe provides battle-tested treasury security.

On-chain verification ensures vote integrity. While Common uses off-chain voting for cost efficiency, cryptographic proofs validate all votes. This prevents manipulation while maintaining accessibility.

Known Security Incidents

No major security breaches occurred on Common platform through 2025. The platform maintained zero loss of funds from smart contract vulnerabilities. Community-reported phishing attempts were addressed through user education.

A minor incident in Q2 2025 involved a proposal spam attack on one test community. Rate limiting and improved proposal validation prevented similar issues. The production platform remained unaffected.

Common Platform Roadmap And Future Development Plans

2026 Development Priorities

Data: Common public roadmap and team communications

The DAO app store will expand with additional tools in Q1 2026. New modules include contributor management, bounty coordination, and advanced analytics. Communities can mix and match features based on specific needs.

Cross-chain governance receives focus in Q2 2026. DAOs operating on multiple blockchains will manage unified governance. Votes from different chains will aggregate into single proposal outcomes.

AI-powered moderation tools launch in Q3 2026. Natural language processing will help identify proposal quality and potential conflicts. Community moderators receive AI assistance for faster response times.

Decentralization Progress

Common plans gradual transfer of platform control to token holders. The veCOMMON governance system enables community-driven decisions about protocol upgrades. Treasury management will transition to DAO control by 2026.

The team commits to open-sourcing core infrastructure components. Developers can audit, fork, and improve Common Protocol code. This transparency builds trust while encouraging ecosystem innovation.

Documentation improvements support developer adoption. Comprehensive guides, API references, and integration tutorials will be published. The goal is reducing barriers for teams building on Common infrastructure.

How To Use Common Platform For DAO Management

Getting Started With Common

Visit landing.common.xyz to access the platform. Connect a Web3 wallet such as MetaMask, WalletConnect, or Coinbase Wallet. The platform supports multiple blockchain networks including Ethereum, Base, Solana, and Polygon.

Create a new community space by selecting "Launch Community" from the dashboard. Choose a community name, configure token settings, and set initial governance parameters. The setup wizard guides users through each step without requiring coding knowledge.

Managing Governance Processes

Create proposals through the discussion forum. Draft proposals in markdown format with clear objectives and implementation plans. Community members can comment, suggest improvements, and express support before formal voting begins.

Configure voting strategies based on token holdings. Options include simple majority, supermajority, or quadratic voting. Set quorum requirements and voting periods to match community preferences. Integration with Snapshot enables gasless voting.

Treasury Management

Connect treasury wallets through Gnosis Safe integration. Set multi-signature requirements for fund movements. Assign signers and configure approval thresholds. Treasury transactions require proposal approval before execution.

Track treasury assets across multiple chains through the unified dashboard. View balances, transaction history, and allocation breakdowns. Export financial reports for transparency and auditing purposes.

Community Engagement Tools

Set up token-gated channels for member-only discussions. Configure gating based on token holdings or NFT ownership. Create tiered access levels for different community roles.

Launch contests and bounties to reward contributions. Define objectives, set reward amounts, and establish completion criteria. Common Protocol automatically distributes rewards to winners based on community votes.

Explore the ecosystem through comprehensive DAO lists to find communities using Common. Connect with projects sharing similar governance models or interests.

Pros And Cons Of Common Platform For DAOs

Advantages

Complete infrastructure eliminates need for multiple tools. Communities manage discussions, voting, treasury, and token launching from one platform. This reduces coordination overhead and simplifies onboarding new members.

Multi-chain support enables cross-ecosystem operations. DAOs working with Ethereum, Solana, and other networks use the same interface. This flexibility accommodates diverse technical preferences within communities.

Strong backing from prominent investors validates the platform. $20 million in funding from Polychain, Dragonfly, and Framework provides resources for sustained development. Partnership with major protocols like dYdX demonstrates platform credibility.

No-code setup reduces technical barriers. Community organizers without blockchain expertise can deploy governance systems. Pre-built templates and integrations accelerate time to launch.

Disadvantages

Platform complexity creates learning curves. The comprehensive feature set requires time investment to master. Smaller communities may find the interface overwhelming compared to simpler alternatives.

Token concentration raises governance concerns. The small holder base of approximately 1,300 addresses creates centralization risks. Large token holders can disproportionately influence platform decisions.

Price volatility affects platform token utility. The 40% drop following launch demonstrates market instability. Communities may hesitate to build on a platform with uncertain token economics.

Competition from established platforms limits market share. Snapshot's dominance in off-chain voting and Tally's Governor contract expertise create switching costs. Communities invested in other platforms face migration challenges.

Frequently Asked Questions About Common Platform

Sources And References

Platform Documentation: Common official documentation (docs.common.xyz), Commonwealth Labs announcements, Common GitHub repository

Market Data: Bitget exchange reports, CoinMarketCap listings, BeInCrypto analysis, CoinGape market coverage

Industry Analysis: Metaverse Post funding report, Dealroom company profile, Crunchbase data

Token Information: Bitget Academy guide, CryptoRank analysis, CoinEdition coverage, Hokanews market reports

Governance Research: Sablier DAO tools guide, P2P Foundation governance analysis, ScienceDirect academic review

Competitive Intelligence: DeepDAO platform data, DAO Times tooling guides, Rapid Innovation platform comparisons