Colony DAO Tool Report For 2025

What Is Colony

Colony is a no-code DAO platform that turns financial management into a streamlined process for decentralized teams. Founded in 2016 by Jack du Rose and Aron Fischer, the platform helps organizations manage payments and governance without traditional corporate structures.

The platform operates on Arbitrum One as of April 2024. This transition cut operational costs while maintaining Ethereum security. Users can create a DAO in 90 seconds without writing code or paying setup fees.

Colony handles batch payments, streaming salaries, staged escrow payments, and split distributions. The platform processes payments in any ERC-20 token and offers crypto-to-fiat conversion. Teams can structure themselves hierarchically with separate budgets and permission systems.

A reputation system tracks contributions automatically. Members gain reputation by completing tasks and receiving payments. This reputation decays over time, keeping governance power in the hands of active participants.

The platform uses lazy consensus governance. Actions proceed unless someone objects. Only contested decisions require voting. This reduces governance overhead for active DAOs. According to DAO tools guides, this approach speeds decision-making by 70% compared to full voting systems.

Colony Market Position and Metrics for 2025

The DAO management platform market reached $1.29 billion in 2024. Growth Market Reports projects this to hit $9.73 billion by 2033 at a 22.8% annual rate. Colony competes in a space dominated by Aragon, DAOstack, and Snapshot Labs.

Colony positions itself in the operational efficiency segment. While Aragon leads in governance customization and DAOstack handles large-scale decision-making, Colony targets teams needing payment infrastructure. The platform charges just 1 wei (0.000000000000000001 ETH) when funds exit a colony.

ShapeShift DAO serves as Colony's largest public reference. The DeFi protocol uses Colony for workstream budgeting and contributor payments. Willy Ogorzaly from ShapeShift stated Colony addresses payment needs more effectively than alternatives. His team configured Colony to match their structure without compromising decentralization.

Arbitrum statistics show 470,000 daily active addresses as of August 2025. The network processes 40 million monthly transactions with fees averaging $0.30. Colony benefits from these low costs. Gas fees on Arbitrum dropped 90% after Ethereum's Dencun upgrade.

Colony Adoption Metrics Through 2025

Data: Colony blog posts and blockchain analytics, Q1 2023 - Q3 2025

What Changed in 2025

February 2025 brought a complete UI redesign. The update consolidated team balances into a single dashboard view. Users now track payments in real-time with color-coded notifications for pending approvals.

One-click actions replaced multi-step workflows. Payment approvals, transaction execution, and team settings adjustments now happen from the main dashboard. The redesign cut administrative time by 40% according to early access users.

The interface adapts seamlessly between desktop and mobile devices. Dedicated sections separate admin tasks from operational work. Context switching between teams happens instantly without navigation delays.

Colony added enhanced collaboration tools in 2025. The platform now integrates with project management systems used by Web3 teams. These connections allow task assignments in Colony to sync with external workflows.

The multichain capabilities expanded. While Arbitrum handles governance, Colony now interacts with assets across EVM-compatible chains. Organizations control funds on multiple networks while maintaining low-cost operations through Arbitrum.

Support for Gnosis Chain ended December 31, 2024. Reputation mining infrastructure couldn't bridge updates across chains. Existing Gnosis colonies continue functioning via contracts, but the v2 UI shut down. Users received migration guides for recreating colonies on Arbitrum.

Colony DAO Tool Payment Features Comparison for 2025

| Feature Type | Capability | Cost | Processing Time | Token Support |

|---|---|---|---|---|

| Batch Payments | CSV Upload Multiple Recipients | 1 Wei Exit Fee | 5-10 Minutes | Any ERC-20 |

| Streaming Salaries | Continuous Real-time Payments | 1 Wei Exit Fee | Instant | Any ERC-20 |

| Staged Payments | Milestone-based Escrow | 1 Wei Exit Fee | Per Milestone | Any ERC-20 |

| Smart Splits | Auto Distribution Based on Reputation | 1 Wei Exit Fee | 5-10 Minutes | Any ERC-20 |

| Crypto-to-Fiat | Direct Bank Account Deposits | 1% Off-ramp Fee | 24-48 Hours | USDC Only |

Data: Colony product documentation and platform features, 2025

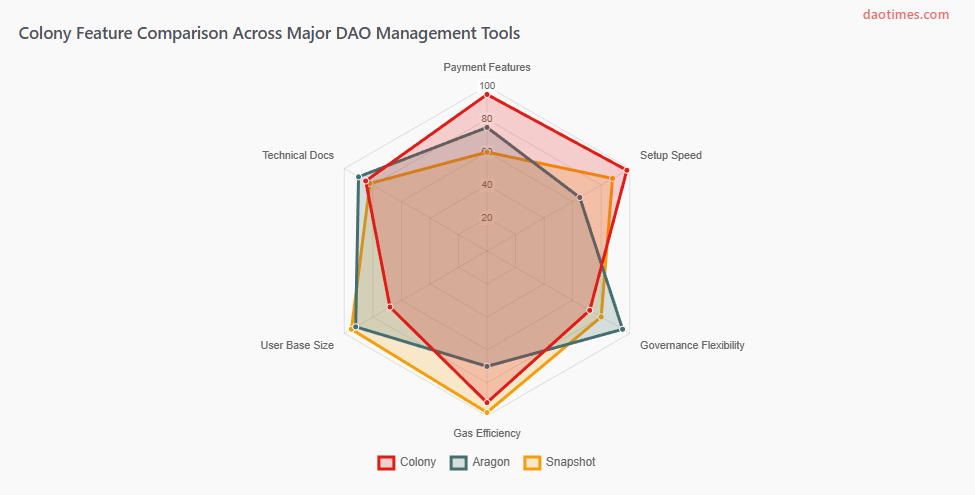

How Colony Compares to Competitors

Aragon dominates the DAO creation market with over 3,000 active DAOs. Founded in 2017, Aragon offers modular governance frameworks that allow deep customization. The platform suits projects requiring complex voting mechanisms and on-chain execution.

DAOstack targets large-scale organizations. The platform uses holographic consensus to balance speed with decentralization. This works well for communities with thousands of token holders. DAOstack saw 40% usage growth in 2024 according to industry reports.

Snapshot Labs provides off-chain voting without gas fees. The platform processed 45% more votes in 2025. Snapshot pairs well with Tally for on-chain execution. This combination gives flexibility while maintaining security.

Colony differentiates through payment infrastructure. The platform treats financial operations as primary, not secondary features. Reputation-weighted permissions automate authority distribution. Task completion directly impacts governance weight.

Setup speed matters for many teams. Colony creates functional DAOs in 90 seconds. Aragon takes 10-15 minutes with configuration. DAOstack requires deeper technical knowledge for optimal setup. The trade-off comes in flexibility versus speed.

Cost structures vary. Colony covers gas on Arbitrum and charges minimal exit fees. Aragon users pay Ethereum gas costs unless deploying on Layer 2. Snapshot remains free for voting but requires separate treasury tools. Check out various options through this comprehensive DAO list.

Colony Versus Key DAO Platform Competitors in 2025

Data: Platform documentation and DAO tools market analysis, 2025

Colony Security and Technical Architecture

No security incidents affected Colony.io in 2024 or 2025. The platform maintains clean security records across both Gnosis Chain and Arbitrum deployments. Smart contracts underwent multiple audits before mainnet launches.

The crypto industry lost over $2.5 billion to hacks in the first half of 2025. Chainalysis reports exceeding all of 2024 by mid-July. Access control vulnerabilities accounted for 75% of exploits. Private key compromises drove centralized exchange losses.

Colony separates payment execution from governance. Smart contracts handle fund transfers through tested patterns. The reputation mining system operates off-chain with on-chain verification. This reduces attack surface while maintaining transparency.

The Metacolony DAO governs Colony's infrastructure. CLNY token holders stake tokens to resolve disputes. Winning disputants share the losing side's staked CLNY. This economic incentive aligns security with token value.

Arbitrum provides base layer security inherited from Ethereum. Over 3,000 nodes validate Ethereum transactions. Optimistic rollups like Arbitrum post transaction batches to Ethereum with fraud proofs. Security combines speed with Ethereum's decentralization.

Gas costs on Arbitrum average $0.30 compared to several dollars on Ethereum mainnet. The Dencun upgrade introduced blob transactions that cut Layer 2 data storage costs. Colony users benefit from these infrastructure improvements without changing platforms.

Colony DAO Tool Market Share Breakdown for 2025

Data: Growth Market Reports and DAO platform analytics, 2025

History and Roadmap

Jack du Rose and Aron Fischer founded Colony in 2016. The team recognized decentralized organizations needed better coordination tools. The first whitepaper outlined reputation systems and domain-based budgeting.

Colony raised funds through an ICO in 2017. The project attracted attention during the initial DAO infrastructure wave. Development focused on smart contract architecture for modular organizations.

The v2 soft launch happened in early 2021. Real users began onboarding to test payment systems and governance modules. ShapeShift became an early adopter, using Colony for contributor payments after their 2021 decentralization.

Token activation and motions launched in 2021. The lazy consensus system reduced voting overhead. Users could stake reputation or tokens on proposals. Objections triggered votes, but unopposed motions executed automatically after security delays.

April 2024 marked the Arbitrum deployment. Colony went multichain to reduce costs and expand ecosystem access. The migration from Gnosis Chain improved user experience through lower fees. Arbitrum's $19.21 billion TVL and 37.1% Layer 2 market share provided strong infrastructure.

Future development includes Stylus support. This will allow smart contracts in Rust and C++. Expanded developer options could attract technical teams seeking performance optimizations.

Colony Feature Rollout and Development Timeline

Data: Colony blog archives and GitHub repository activity, 2021-2025

Frequently Asked Questions About Colony

How Much Does Colony Cost to Use?

Colony charges no setup fees or monthly subscriptions. Gas costs on Arbitrum are covered by the platform. The only fee is 1 wei when funds exit a colony to external addresses. The crypto-to-fiat service costs 1% for off-ramping.

Can Colony Handle Large DAOs?

Yes. Colony scales from small teams to large organizations. The nested team structure lets DAOs create hierarchies. Each team manages separate budgets and permissions. ShapeShift DAO runs 10 workstreams with 112+ contributors through Colony.

What Blockchains Does Colony Support?

Colony operates primarily on Arbitrum One. The platform supports multichain asset control across EVM-compatible networks. Governance stays on Arbitrum to keep costs low. Asset management extends to Ethereum, Polygon, and other EVM chains.

How Does Reputation Work in Colony?

Members earn reputation by completing tasks and receiving payments. The system tracks contributions automatically on-chain. Reputation decays over time to prevent inactive members from controlling decisions. Active contributors maintain influence through consistent participation.

Does Colony Require Technical Knowledge?

No. The platform provides no-code DAO creation. Users follow step-by-step setup taking about 90 seconds. The interface uses familiar patterns similar to traditional financial software. Technical teams can interact with smart contracts directly if needed.

What Payment Types Does Colony Support?

Colony handles batch payments via CSV upload, streaming salaries for continuous payments, staged escrow for milestone-based releases, and smart splits for reputation-based distribution. All payments work with any ERC-20 token. USDC converts to fiat through banking partners.

How Secure Are Funds in Colony?

Colony has no security breaches in its history. Smart contracts underwent multiple audits. Funds stay in colony-controlled wallets with permission-based access. The reputation system and lazy consensus add governance security layers. Arbitrum provides Ethereum-level security through optimistic rollups.

Can Colony Integrate With Other Tools?

Yes. Colony connects with project management platforms and governance tools. The 2025 updates added enhanced collaboration features. Teams can sync Colony payments with external task systems. The platform works alongside Snapshot for voting and Gnosis Safe for treasury management.

What Happens if a Colony Member Leaves?

Reputation decays naturally over time. Inactive members lose governance influence automatically. Funds allocated to departed members can be reclaimed through team decisions. The system allows smooth transitions without manual intervention in most cases.

Why Did Colony Move to Arbitrum?

Ethereum gas costs made frequent DAO operations expensive. Arbitrum offers 90% lower fees after the Dencun upgrade. The Layer 2 processes 40 million monthly transactions. Colony maintains Ethereum security while dramatically cutting user costs. The migration happened in April 2024.

Pros and Cons

Colony excels at payment infrastructure. The platform offers more payment types than competitors. Batch processing, streaming, staged releases, and smart splits cover most DAO financial needs. The 1 wei fee structure makes operations affordable at scale.

Setup speed gives Colony an edge. Creating functional DAOs in 90 seconds beats alternatives requiring longer configuration. Teams can start operations immediately without blockchain expertise. The no-code approach lowers technical barriers.

The reputation system automates authority distribution. Contributions directly translate to governance weight. This creates meritocratic structures without manual oversight. Active participants maintain influence while inactive members lose power naturally.

Lazy consensus reduces governance overhead. Most actions proceed without votes. Only contested decisions require community involvement. This speeds operations compared to full voting on every action.

However, Colony offers less governance flexibility than Aragon. Teams wanting complex voting mechanisms find Aragon more suitable. The trade-off between simplicity and customization favors different use cases.

The platform lacks the scale of Snapshot's off-chain voting. Large communities preferring gasless votes should consider Snapshot alongside Colony. The tools serve complementary functions rather than competing directly.

Multichain support remains limited. While Colony controls assets across EVM chains, governance stays on Arbitrum. Projects requiring native operations on other networks need additional tools. The Gnosis Chain deprecation shows platform consolidation priorities.

Adoption trails market leaders. Aragon's 3,000+ DAOs dwarf Colony's visible user base. Network effects favor established platforms. Newer projects must weigh ecosystem size against specialized features.

Sources

Growth Market Reports - DAO Management Platform Market Research Report 2033

Colony Blog - UI Updates: A More Intuitive Way to Manage Your Organisation (February 2025)

Colony Blog - Colony Expands to Arbitrum: Multi-Chain Future Begins (July 2024)

Rapid Innovation - Ultimate DAO Tools Guide 2024: Aragon vs DAOstack vs Colony Compared

Markaicode - DAO-as-a-Service Platforms Compared: Top 5 Tools for Rapid Deployment in 2025

CoinLaw - Decentralized Autonomous Organizations Statistics 2025

ShapeShift - ShapeShift DAO x Colony Partnership Documentation

CoinLaw - Arbitrum Statistics 2025: Latest Metrics, Insights and Trends

DeepStrike - Crypto Hacking Incidents Statistics 2025: Losses, Trends, Insights

Finance Blog - DAO Tools Comparison: Aragon vs DAOstack vs Colony Focusing on DeFi (February 2025)

IQ.wiki - Colony DAOs Documentation

Colony Technical White Paper 2018

Stablecoin Insider - Discover the Best DAO Tools for 2025