Coinshift DAO Tool Report For 2025

Executive Summary

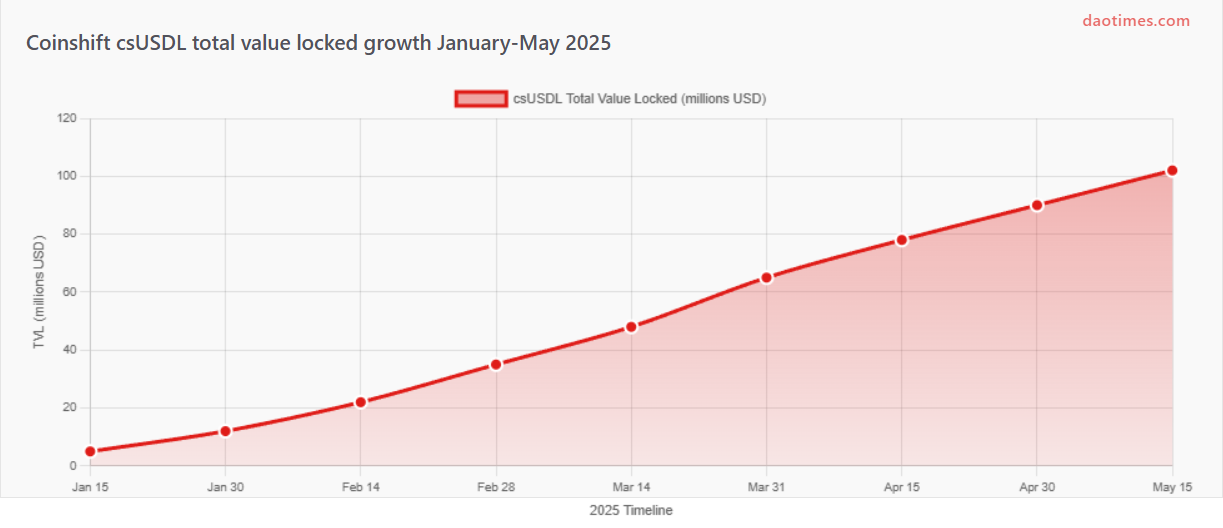

Bottom line: Coinshift manages $1.3 billion across 300+ organizations in 2025. The platform launched csUSDL stablecoin reaching $100 million TVL in four months. No security breaches reported.

Coinshift is an onchain treasury management platform for DAOs and businesses. Founded in 2021, the company helps organizations manage crypto assets through Safe wallet integration. Clients include Aave, Starknet, and Gitcoin.

The platform offers payments, accounting, and asset management. Users can batch transactions, save up to 90% on gas fees, and access DeFi protocols. Coinshift raised $17.5 million total from Tiger Global and Sequoia.

In 2025, Coinshift expanded into yield-bearing stablecoins. The csUSDL token combines U.S. Treasury bills with onchain lending. This positioned Coinshift to compete in the $5.5 billion yield stablecoin market.

What Is Coinshift

Coinshift provides treasury management for organizations operating onchain. The platform integrates with Safe (formerly Gnosis Safe) to offer enhanced functionality beyond basic multi-signature wallets.

Organizations use Coinshift to handle crypto payments, track spending, and generate financial reports. The platform supports multiple blockchain networks including Ethereum, Polygon, Arbitrum, Optimism, and Base.

Key capabilities include mass payouts to 150 addresses in one transaction. Role-based access controls let teams assign permissions without requiring Safe signer status. The interface provides human-readable transaction data instead of raw blockchain code.

Coinshift extends Safe functionality with budget tracking and proposal systems. Non-signers can create transaction proposals. The platform syncs with Safe's infrastructure while offering alternative offline capabilities.

The company serves DAOs, crypto funds, and Web3 businesses. Clients manage treasury operations from a unified dashboard. Integration with accounting tools like QuickBooks and Xero automates bookkeeping.

Coinshift Growth From 2021 to 2025

Data: Coinshift company reports, The Block, CoinDesk

Coinshift processed $1 billion in total payments since launch. Assets under management grew from zero at founding to $1.3 billion by mid-2025.

The platform started with basic Safe enhancements in 2021. By 2022, Coinshift added multi-chain support and advanced reporting. The $15 million Series A enabled product expansion.

Client count increased from early adopters to 300+ organizations by 2025. Growth accelerated after V2 launch with improved treasury features. The platform now handles operations for major DeFi protocols.

Revenue comes from premium features and enterprise services. The base platform remains free for DAOs and businesses. This freemium model drove user acquisition in competitive treasury management space.

How to Use Coinshift Platform

Initial Setup

Connect your Safe wallet to Coinshift dashboard. The platform imports existing Safe configurations automatically. Add team members and assign roles based on operational needs.

Configure transaction thresholds and approval requirements. Set up spending categories for budget tracking. Import contact addresses to streamline future payments.

Making Payments

Create single or batch transactions from the dashboard. Upload CSV files for mass payouts to contractors or contributors. The platform batches up to 150 payments in one transaction.

Non-signers can create proposals that signers review and approve. This separates operational work from custody control. All transactions display decoded, readable data before signing.

Treasury Management

View portfolio across multiple chains in unified interface. Track assets, transaction history, and cash flow. Generate reports for accounting and compliance.

Access DeFi protocols directly through Coinshift Apps. Connect to lending platforms, DEXs, and yield strategies. Stream payments using Superfluid integration for payroll automation.

Accounting Integration

Export transaction data in accounting-friendly formats. Connect QuickBooks or Xero for automated bookkeeping. Tag transactions with categories and labels for financial tracking.

Generate custom reports filtered by date, token, or category. The platform maintains complete audit trails. All financial data remains transparent and verifiable onchain.

Coinshift vs Competitors Treasury Management Comparison

| Platform | Assets Managed | Client Count | Free Tier | Key Differentiator |

|---|---|---|---|---|

| Coinshift | $1.3B | 300+ | Yes | Safe integration, accounting tools |

| Safe | $22B+ | Thousands | Yes | Core custody infrastructure |

| Aragon | Not disclosed | Hundreds | Yes | Full DAO framework |

| Bitwave | Not disclosed | 100+ | No | Enterprise accounting focus |

| Loop Crypto | Not disclosed | Not disclosed | Yes | Automated recurring payments |

| Magna | Not disclosed | Not disclosed | Limited | Token vesting |

Data: Company websites, CB Insights, Tracxn reports 2025

Safe dominates with $22 billion in assets but offers basic functionality. Coinshift positions as operational layer on top of Safe infrastructure. This strategy captures users needing treasury management beyond custody.

Aragon provides complete governance frameworks including voting and proposals. Coinshift focuses specifically on financial operations. Different target markets with some overlap in DAO clients.

Enterprise platforms like Bitwave charge fees but offer advanced compliance features. Coinshift's free tier attracts smaller DAOs and startups. Premium features serve larger organizations with complex needs.

New 2025 Features and Updates

csUSDL Stablecoin Launch

Coinshift launched csUSDL in January 2025. This yield-bearing stablecoin reached $100 million TVL by May. The token combines U.S. Treasury bill exposure with DeFi lending yields.

csUSDL is built on USDL from Paxos International. Regulation comes from Abu Dhabi's Financial Services Regulatory Authority. Morpho protocol handles the lending infrastructure.

Steakhouse Financial curates the vault strategy. Assets allocate to blue-chip collateral like wstETH and cbBTC. The Credora rating service assigned A+ risk score to the Morpho vault.

Users earn yields around 10% APY according to Coinshift projections. Additional rewards come from SHIFT and MORPHO token distributions. Pendle saw $16 million in csUSDL trading volume within 30 days.

Paxos Gold Integration

Coinshift added Paxos Gold (PAXG) as csUSDL collateral. This allows gold-backed leverage while earning yield. The move bridges traditional assets into DeFi infrastructure.

Gold exposure provides diversification beyond crypto assets. Each PAXG token represents one troy ounce of gold. The integration targets treasuries seeking real-world asset exposure.

Platform Enhancements

Coinshift Business platform offers free payments and accounting for DAOs. The unified interface manages operations across ten blockchain networks. Support expanded for Celo and Base networks.

Dashboard improvements show consolidated views of multi-chain assets. Users access 15+ DeFi protocol integrations on launch. Enhanced reporting tools automate monthly financial statements.

Coinshift csUSDL Performance and Market Position

Data: DeFiLlama, The Block, Coinshift announcements

csUSDL captured market share quickly after launch. The $100 million milestone came faster than many competing yield stablecoins. Institutional adoption drove growth alongside retail demand.

Market participants include GSR, Dialectic, and Amber Group. SCB Limited and Edge Capita provided liquidity. These firms brought credibility to the new stablecoin product.

The yield stablecoin sector totals $5.5 billion in market cap. Sky's sUSDS leads with largest share. Ethena's USDe and Ondo's USDY round out top competitors.

csUSDL ranked in top three assets on Pendle by trading activity. The 30-day volume showed strong secondary market interest. Liquidity depth increased as TVL grew.

DAO Treasury Management Market Context

Data: DataIntelo market research report, PatentPC industry analysis

The DAO treasury management market reached $1.25 billion in 2024. Projections show growth to $5.38 billion by 2033 at 19.7% CAGR. This expansion reflects increasing DAO adoption and DeFi maturation.

Over 13,000 active DAOs manage collective treasuries exceeding $30 billion. Regulation drives demand for compliant management tools. Treasury operations now require institutional-grade infrastructure.

Asset allocation tools represent the largest application segment. Risk management and compliance follow closely. Liquidity management grows as DAOs diversify beyond native tokens.

Small and medium organizations dominate user counts. Large enterprises bring majority of assets under management. Both segments need scalable treasury solutions as crypto operations expand.

Coinshift Funding and Valuation History

| Round | Date | Amount | Lead Investors | Post-Money Valuation |

|---|---|---|---|---|

| Seed | Sep 2021 | $2.5M | Multiple investors | Not disclosed |

| Series A | May 2022 | $15M | Tiger Global, Sequoia Capital | $100M |

| Total Raised | - | $17.5M | 43 investors total | $100M current |

Data: Tracxn, PitchBook, Crunchbase company profiles

Other Series A participants included ConsenSys, Polygon, and Spartan Group. FinTech Collective and BR Capital also invested. The funding supported V2 platform development and team expansion.

Coinshift's $100 million valuation reflects position in growing market. The company monetizes through premium features rather than transaction fees. This model aligns with DAO community values.

Investor backing provides credibility for enterprise clients. Tiger Global and Sequoia bring traditional finance expertise. Crypto-native investors offer industry connections and strategic guidance.

Coinshift User Base and Client Portfolio

Data: Coinshift company information, LinkedIn profiles, public DAO reports

DeFi protocols form the largest client segment. Aave uses Coinshift for multi-chain treasury operations. Uniswap leveraged the platform for grants program disbursements.

Infrastructure projects like Starknet manage development budgets through Coinshift. Layer-2 protocols handle validator payments and ecosystem funding. The platform supports complex organizational structures.

DAOs use Coinshift for contributor compensation and operational expenses. GitcoinDAO runs grant distributions through the platform. UMA DAO manages protocol revenue allocations.

Web3 companies including Zapper handle business operations via Coinshift. These firms need traditional business functions with crypto-native tools. The platform bridges familiar workflows with onchain execution.

Coinshift's positioning attracts organizations beyond pure DeFi. NFT projects, gaming DAOs, and social tokens use treasury features. The diverse client base validates the platform's adaptability.

Security Analysis and Risk Assessment

Bottom line: Coinshift has no reported security breaches since 2021 founding. The platform builds on Safe's battle-tested smart contracts.

Safe (Gnosis Safe) undergoes regular audits by leading security firms. Over $22 billion in assets secure through these contracts. Coinshift extends this infrastructure rather than replacing it.

The platform uses multi-signature requirements for transaction execution. Multiple parties must approve before funds move. This reduces single points of failure in treasury operations.

Coinshift maintains separation between transaction creation and approval. Non-custodial architecture means the platform never controls user funds. Organizations retain full custody through Safe wallets.

Risks exist in DeFi protocol integrations accessed through Coinshift. Users bear smart contract risks when interacting with lending or DEX platforms. The platform provides access but doesn't eliminate protocol vulnerabilities.

csUSDL introduces additional considerations. The stablecoin depends on Morpho protocol security. Paxos handles USDL custody with regulatory oversight. Steakhouse Financial manages strategy execution.

No major incidents affected Coinshift clients during 2024-2025. The crypto industry saw $2.3 billion stolen in H1 2025 across exchanges and protocols. Treasury management platforms like Coinshift avoided major breaches.

Best practices include regular permission audits and transaction limit reviews. Organizations should verify addresses before approving payments. The platform's proposal system adds verification layer before execution.

Pros and Cons of Coinshift Platform

Advantages

Proven infrastructure: Built on Safe with $22 billion secured. The foundation provides reliability for treasury operations.

Cost efficiency: Free tier includes full payment and accounting features. Gas savings reach 90% through transaction batching.

Multi-chain support: Ten networks accessible from single interface. Cross-chain treasury management simplifies operations.

Enterprise clients: 300+ organizations trust the platform including Aave and Gitcoin. Track record demonstrates capability.

Integrated accounting: QuickBooks and Xero connections automate bookkeeping. This reduces manual reconciliation work.

DeFi access: Direct connections to lending, DEXs, and yield protocols. Users don't need separate interfaces.

Limitations

Safe dependency: Platform requires Safe wallet for core functionality. Organizations must use this specific custody solution.

Technical complexity: Teams need crypto proficiency to operate effectively. Learning curve exists for traditional finance users.

Limited fiat integration: Platform focuses on crypto-native operations. Converting between fiat and crypto requires additional services.

Competition from Safe: Safe continues developing treasury features directly. This could reduce Coinshift's value proposition over time.

csUSDL risks: New stablecoin lacks long-term track record. Dependence on multiple protocols creates layered risk exposure.

Comparison With Alternative DAO Treasury Tools

| Tool | Primary Focus | Pricing Model | Best For | Integration Difficulty |

|---|---|---|---|---|

| Coinshift | Treasury operations | Freemium | DAOs needing full financial stack | Moderate |

| Safe | Multi-sig custody | Free | Basic secure storage | Low |

| Parcel | Automated payments | Discontinued 2025 | Not available | - |

| Coordinape | Contributor rewards | Free | Community compensation | Low |

| Request Finance | Invoicing | Transaction fees | B2B payments | Low |

| Fireblocks | Institutional custody | Enterprise pricing | Large funds | High |

Data: Company websites, Alchemy Dapp Store, Web3 tool directories

Safe provides foundation but lacks treasury management features. Coinshift fills this gap with enhanced capabilities. Integration between the two creates comprehensive solution.

Parcel's shutdown in 2025 despite $250 million processed highlights monetization challenges. The treasury tools market struggles with sustainable business models. Coinshift's freemium approach may face similar pressures.

Coordinape serves different use case focused on compensation distribution. Request Finance handles invoicing specifically. Coinshift offers broader feature set covering multiple treasury needs.

Enterprise platforms charge higher fees for compliance and custody features. Fireblocks targets institutional clients with different requirements. The market segments by organization size and regulatory needs.

For more information on comprehensive DAO tooling options, organizations should evaluate needs across governance, treasury, and operations. Explore various DAO implementations to understand how different organizations structure treasury management.

Frequently Asked Questions About Coinshift

What is Coinshift and who should use it?

Coinshift is a treasury management platform for DAOs and crypto businesses. Organizations managing onchain assets use it for payments, accounting, and financial operations. Best suited for teams handling frequent crypto transactions.

How much does Coinshift cost?

The platform offers free tier for DAOs and businesses. Core features include payments, accounting, and Safe integration at no charge. Premium enterprise features available for larger organizations with complex needs.

Does Coinshift custody my funds?

No. Coinshift is non-custodial and built on Safe wallet infrastructure. Your organization maintains full control of funds. The platform provides interface and tools without holding assets.

What is csUSDL and how does it work?

csUSDL is Coinshift's yield-bearing stablecoin launched January 2025. It combines U.S. Treasury bill exposure with DeFi lending yields. Built on Paxos USDL and Morpho protocol for institutional-grade returns.

Which blockchain networks does Coinshift support?

The platform supports Ethereum, Polygon, Arbitrum, Optimism, Base, Avalanche, BSC, Gnosis Chain, Celo, and Polygon zkEVM. Multi-chain treasury management from unified dashboard.

Can Coinshift integrate with traditional accounting software?

Yes. Coinshift connects with QuickBooks and Xero for automated bookkeeping. Export transaction data in accounting-friendly formats. Tag and categorize transactions for financial reporting.

Has Coinshift experienced any security breaches?

No security breaches reported since 2021 founding. Platform builds on Safe's audited smart contracts. Over 300 organizations trust Coinshift with treasury operations managing $1.3 billion in assets.

How does Coinshift compare to using Safe directly?

Coinshift adds treasury management features to Safe's custody infrastructure. Enhanced reporting, accounting automation, batch payments, and DeFi integrations. Safe provides secure storage while Coinshift handles operations.

What are the main competitors to Coinshift?

Direct competitors include Parcel (discontinued 2025), Loop Crypto, and Magna. Broader alternatives include Aragon for full DAO framework and enterprise platforms like Bitwave. Safe itself continues developing treasury features.

What is Coinshift's business model and funding?

Freemium model with free core features and premium enterprise options. Raised $17.5 million total from Tiger Global, Sequoia, and others. Current valuation $100 million. Revenue from premium services and csUSDL ecosystem.

Future Outlook and Roadmap

Coinshift plans expanding csUSDL integrations across DeFi protocols. The stablecoin targets inclusion in treasury strategies for additional DAOs and businesses. Partnerships with family offices show institutional interest growing.

Platform development focuses on cross-chain capabilities and automation. AI-driven treasury optimization features may launch based on industry trends. Predictive analytics could help organizations forecast cash flow needs.

The SHIFT token launch scheduled for July 15, 2025. Token economics and governance details remain under development. Community participation in platform direction likely increases with token distribution.

Regulatory environment affects product roadmap especially for csUSDL. Compliance requirements shape feature development and market expansion. Abu Dhabi regulation provides framework but other jurisdictions vary.

Competition intensifies as Safe develops native treasury features. Coinshift must maintain differentiation through superior UX and integrations. The platform's value proposition depends on offering capabilities beyond basic Safe functionality.

Market growth projections support continued investment in DAO tooling. The 19.7% CAGR treasury management market creates expansion opportunities. Success depends on user acquisition and retention against free alternatives.

Conclusion

Coinshift established itself as leading treasury management layer for Safe wallets. The platform serves 300+ organizations managing $1.3 billion in assets. Free tier and focus on operational features drove adoption.

The 2025 csUSDL launch diversified Coinshift beyond treasury management. Reaching $100 million TVL in four months demonstrates market demand for yield-bearing stablecoins. This positioned the company in growing real-world asset sector.

Challenges include Safe's continued feature development and sustainable monetization. The freemium model must balance growth with profitability. Competition from both free tools and enterprise platforms pressures market positioning.

Organizations seeking comprehensive treasury operations find value in Coinshift. The platform bridges custody infrastructure with business needs. Integration complexity remains consideration for traditional finance teams.

Success metrics include user growth, assets under management, and csUSDL adoption. Platform reliability and security track record support continued trust. The DAO tooling market expansion provides favorable environment for specialized solutions.

Sources

Company Information:

Coinshift company website and documentation

Tracxn company profile June 2025

PitchBook company analysis 2025

CB Insights database

Crunchbase company data

Industry Reports and Analysis:

The Block: Coinshift's csUSDL stablecoin tops $100 million in TVL (May 16, 2025)

The Defiant: Coinshift's csUSDL Reaches $100M in TVL (May 16, 2025)

Decrypt: Yield-Bearing Stablecoins Will Underpin New Financial Architecture (March 17, 2025)

CoinDesk: Cash Management Firm Coinshift Closes $15M Series A

DataIntelo: DAO Treasury Management Market Research Report 2033

Quant Matter: Top 12 Crypto Treasury Management Firms to Watch in 2025

Yellow: What Are DAO Tools & How to Choose? 2025 Platform Guide

PatentPC: DAO Growth Stats Treasury Sizes Governance Votes Activity (September 2025)

Markaicode: Automating DAO Treasury Management AI-Driven Tools (April 26, 2025)

Technical Resources:

DeFiLlama protocol data

Morpho protocol documentation

Paxos International reports

Safe wallet documentation