Cheapest Crypto Exchanges by Country: UAE, UK, Pakistan & Beyond

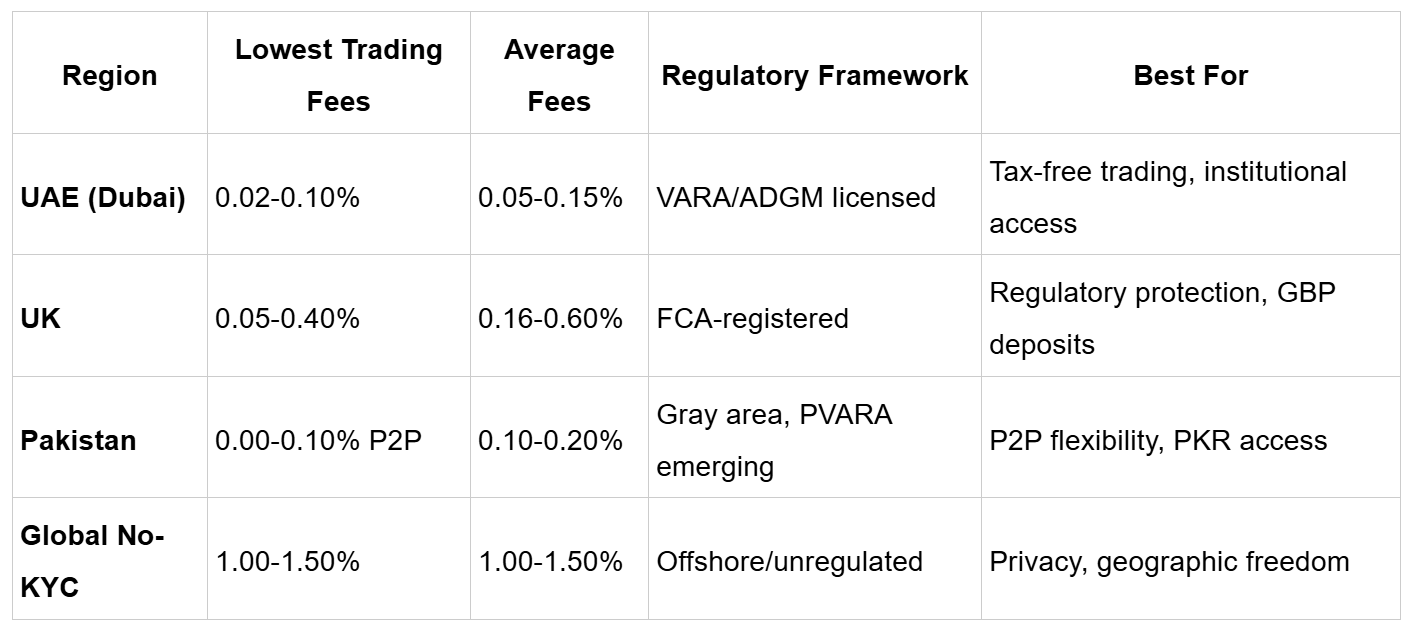

In cryptocurrency trading, your location determines far more than just which exchanges accept your registration - it fundamentally shapes the fees you pay, the payment methods available, and the regulatory frameworks governing your transactions. A trader in Dubai benefits from zero-tax crypto environments and competitive exchange fees averaging 0.02-0.1%, while a UK trader navigates FCA-registered platforms charging 0.16-0.60% with mandatory consumer protections, and Pakistani users rely predominantly on P2P markets with entirely different cost structures.

This comprehensive analysis examines how geographic factors create massive fee disparities across regions, comparing the cheapest crypto exchange options available in UAE, UK, Pakistan, and exploring alternatives that transcend borders entirely..

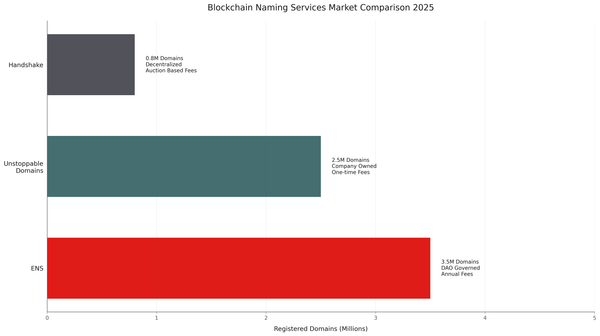

Quick Regional Fee Comparison: What Geography Costs You

Geographic location shapes not just fees but trading viability itself. Dubai's regulatory clarity enables institutional-grade platforms with rock-bottom fees. London's FCA oversight creates safety but adds compliance costs passed to users. Islamabad's banking restrictions force creative P2P solutions with unique fee dynamics. Understanding these geographic realities transforms how you approach exchange selection.

1. Godex: Geographic Freedom Through Privacy-First Architecture

Alt text: Godex no-KYC crypto exchange platform supporting 923 cryptocurrencies with instant anonymous swaps, fixed exchange rates, unlimited transaction volumes

Beyond borders: 923+ cryptocurrencies accessible anywhere without registration, verification, or geographic restrictions

Godex represents a fundamentally different paradigm from region-specific exchanges - operating since 2018 from Seychelles, it facilitates wallet-to-wallet cryptocurrency swaps without ever requiring users to create accounts, verify identities, or comply with geographic restrictions. While UAE exchanges optimize for institutional traders, UK platforms prioritize regulatory compliance, and Pakistani services navigate banking obstacles, Godex eliminates these geographic constraints entirely through privacy-first architecture.

The platform delivers constant access to cryptocurrency markets with 24/7 operational infrastructure, positioned as one of the most accessible instant crypto swap services in the industry with seamless trading functionality across all devices. Whether you're in Dubai, London, Islamabad, Lagos, or anywhere else, Godex offers identical pricing, access, and processing - geographic location becomes irrelevant.

Key Advantages:

- 923+ cryptocurrencies including privacy coins frequently delisted elsewhere

- Zero registration, verification, or geographic restrictions enabling true accessibility

- Unlimited transaction volumes from $10 to millions without tiered limits

- Fixed-rate protection against market volatility during swap execution

- 5-30 minute automated processing 24/7 with 99.9% uptime

- Privacy-first design with zero data storage protecting financial anonymity

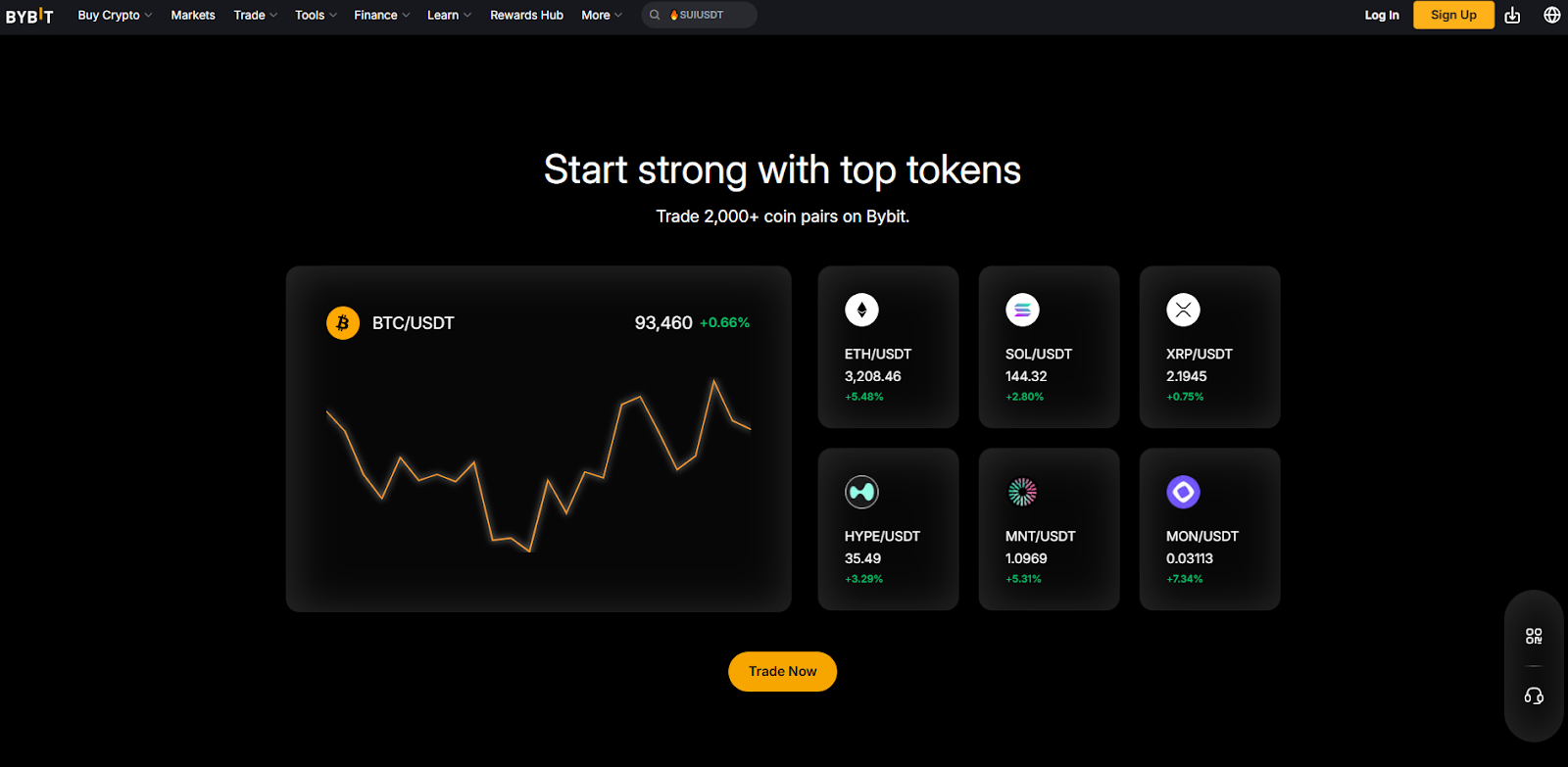

2. UAE & Dubai: The Zero-Tax Institutional Hub

Alt text: Bybit cryptocurrency exchange UAE platform featuring 700 tokens, 0.02-0.06% trading fees, strategic partnership with Dubai VARA licensing

Why Dubai traders pay less: Zero crypto taxes combined with regulatory clarity creates aggressive fee competition

The UAE represents one of the most crypto-friendly jurisdictions globally, with individuals facing zero capital gains tax on cryptocurrency profits. Dubai's VARA and Abu Dhabi's ADGM provide sophisticated regulatory frameworks creating an environment where major exchanges compete aggressively on fees while maintaining institutional-grade compliance.

Bybit secured the "Best Crypto Exchange UAE 2025" award with spot trading fees ranging from 0.02-0.1% for makers and takers. The platform supports 1,699 cryptocurrencies with derivatives fees dropping to 0.01-0.055% for makers. Binance received full VARA licensing operating its Binance FZE entity with fees starting at 0.10%, dropping significantly for high-volume traders. Rain offers zero trading fees with 0.2% spread, eliminating traditional trading commissions entirely.

UAE Fee Breakdown:

- Bybit: 0.02-0.1% spot, 0.01-0.055% derivatives

- Binance FZE: 0.10% base, discounts to 0.012% maker

- Rain: 0% + 0.2% spread embedded

- OKX: 0.08-0.10% with VIP discounts

Key Advantages:

- Lowest trading fees globally (0.02-0.15%)

- Zero capital gains tax on cryptocurrency profits

- Full regulatory clarity under VARA/ADGM frameworks

- Direct AED deposit support across major platforms

3. United Kingdom: Premium Fees for FCA Protection

Alt text: Coinbase Advanced UK crypto exchange platform with zero maker fees, 0.05-0.60% taker rates, FCA registration, and 250 cryptocurrencies

Regulatory protection costs money: FCA oversight adds 0.2-0.4% to typical trading fees compared to offshore platforms

For UK traders in 2025, Coinbase Advanced leads with 0% maker fees and taker fees from 0.05-0.60%. Kraken charges maker fees from 0.20% to 0.00% and taker fees from 0.26% to 0.001%, making it the cheapest FCA-registered cryptocurrency exchange in the UK. However, these platforms require comprehensive KYC verification, impose withdrawal restrictions, and maintain detailed transaction records subject to regulatory reporting.

UK Fee Landscape:

- Coinbase Advanced: 0% maker, 0.05-0.60% taker

- Kraken Pro: 0.16-0.26% base, near-zero for high volume

- Gemini ActiveTrader: 0.20% maker, 0.40% taker

- eToro: 1% spread-based pricing

UK regulations constrain exchange operations through bans on retail crypto derivatives, mandatory FCA registration, travel rule enforcement, and appropriateness assessments. Each requirement adds operational costs passed to users through higher fee structures.

Key Advantages:

- Strong regulatory oversight and consumer protection

- Direct GBP deposit support via Faster Payments

- Clear legal recourse through FCA framework

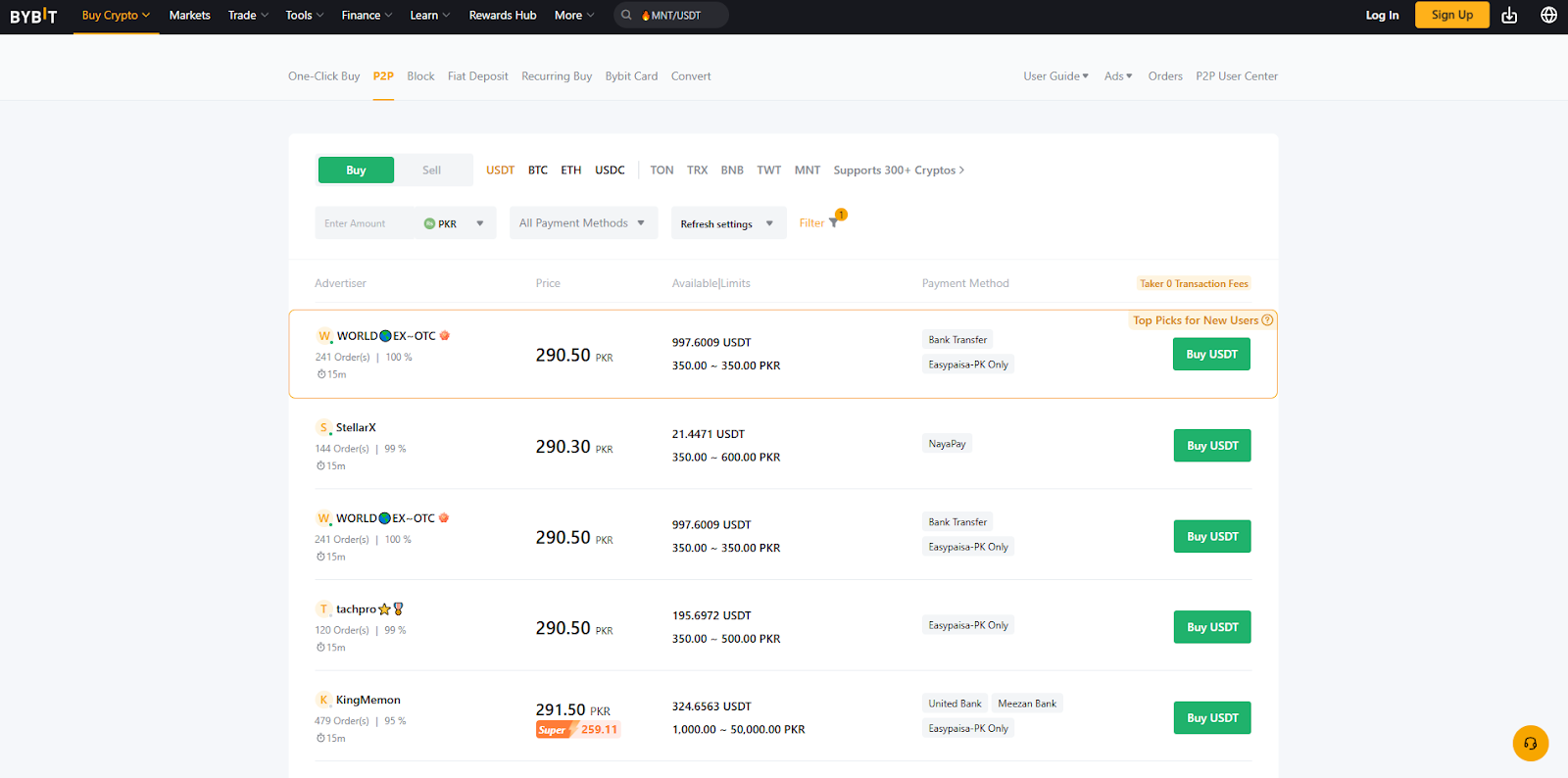

4. Pakistan: P2P Innovation Creates Unique Fee Dynamics

Alt text: Bybit Pakistan P2P crypto exchange marketplace featuring PKR deposits through Easypaisa, JazzCash, bank transfers with competitive trading fees

Banking restrictions force innovation: P2P markets bypass traditional fees entirely through peer-to-peer trading

Pakistan's crypto market operates within a legal gray area where individuals can own and trade crypto, but financial institutions are prohibited from processing transactions. This creates unique dynamics where P2P trading dominates, with platforms like Bybit, MEXC, and Binance offering zero-fee P2P marketplaces.

Bybit secured a VASP license and supports PKR deposits via P2P with 700+ tokens. MEXC offers zero maker fees on 2,000+ tokens with P2P marketplace functionality. The platforms enable Pakistani users to trade directly using Easypaisa, JazzCash, and bank transfers, completely bypassing traditional banking restrictions.

Pakistan Fee Structure:

- Bybit P2P: 0% on P2P marketplace, 0.1% centralized

- MEXC P2P: 0% P2P, 0% maker/0.02% taker spot

- Binance P2P: 0% P2P fees, 0.10% centralized

P2P trading dominates because bank accounts can be locked when buying crypto, forcing users toward peer-to-peer marketplaces where they trade directly with counterparties using local payment systems. User adoption is accelerating, with crypto users projected to reach 28.9 million by 2026.

Key Advantages:

- Zero fees on P2P marketplace trading

- Bypass banking restrictions entirely

- Local payment method support (Easypaisa, JazzCash)

- Competitive centralized exchange fees (0.02-0.1%)

Comparing #1 (Godex) to Regional Alternatives

vs. UAE Exchanges (0.02-0.15% fees):

- UAE Advantage: Lower fees (0.02-0.15%), deeper liquidity, direct AED fiat on-ramps, institutional-grade execution

- Godex Advantage: Zero KYC eliminating identity exposure, privacy coins fully supported, no geographic restrictions, no account freezes or compliance delays, 923+ cryptocurrencies vs 400-700 on licensed platforms

vs. UK Exchanges (0.16-0.60% fees):

- UK Advantage: FCA protection providing legal recourse, direct GBP deposits via Faster Payments, consumer safeguards, insurance coverage on deposits

- Godex Advantage: No registration or verification requirements, true anonymity protecting financial privacy, 1.5% fee remains competitive vs 0.6% + spreads + withdrawal fees + KYC compliance burden

vs. Pakistan P2P Markets (0% P2P, 0.1% centralized):

- Pakistan Advantage: Zero P2P fees eliminating transaction costs, local payment methods (Easypaisa, JazzCash) bypassing banking restrictions

- Godex Advantage: No counterparty risk from P2P fraud, instant automated processing vs escrow waiting periods, privacy coins access unavailable on P2P platforms, fixed-rate protection during swap execution

vs. Traditional Centralized Exchanges (0.02-0.60%):

- Centralized Advantage: Lower advertised fees, maximum liquidity depth, advanced trading features (derivatives, margin, lending), fiat integration

- Godex Advantage: Complete anonymity, zero data collection, no verification procedures creating delay or denial risk, no geographic restrictions or compliance-based account closures, unlimited volumes without tiered limits

Real-World Cost Analysis: When Godex Saves Money

Hidden Centralized Exchange Costs: Advertised trading fees represent only one component of total trading costs. Consider a UK trader using Coinbase:

- Trading fee: 0.40% taker

- GBP deposit via card: 3.99%

- GBP withdrawal: £0.15 + 1.49%

- Spread markup: ~0.5% embedded

- Total first-trade cost: ~6% on small transactions

Godex's transparent 1.5% + network fees often proves cheaper than the aggregated hidden costs on "low-fee" platforms when accounting for deposit methods, withdrawal charges, and spread markups.

Opportunity Cost of Verification: A trader spots a arbitrage opportunity with 3% profit potential. Traditional exchange verification takes 6 hours. By approval time, the opportunity vanished. Godex's immediate access preserves that 3% opportunity, making the 1.5% fee economically rational compared to 0.5% fees + 100% opportunity loss.

Volume Optimization: A trader executing $50,000 monthly volume at 1.5% pays $750 in fees. The same trader using a 0.1% exchange might pay $50 in trading fees but must:

- Complete invasive KYC creating permanent records

- Accept transaction limits requiring multiple accounts

- Risk account freezes from compliance algorithms

- Submit to potential tax reporting or regulatory scrutiny

For traders valuing privacy and operational freedom, $700 monthly represents reasonable insurance against compliance risks, surveillance exposure, and operational restrictions.

Geographic Fee Disparities: The Real Numbers

Hidden Costs Beyond Trading Fees:

- Deposit fees: 0-3.99% depending on payment method

- Withdrawal fees: £1-£5 fiat, 0.0001-0.001 BTC

- Spread costs: 0.2-1% embedded in prices

- Currency conversion: 1-3% non-local currency

- Compliance delays: Opportunity cost from verification

A seemingly cheap 0.1% trading fee platform becomes expensive when card deposits cost 3%, withdrawals charge £3 per transaction, and mandatory KYC creates 24-hour delays during volatile markets.

Tax Implications Dwarf Trading Fees

UAE: Zero capital gains tax makes even higher fees worthwhile UK: Capital Gains Tax at 10-20% above £3,000 completely overwhelms 0.3% fee savings Pakistan: Uncertain tax framework creates reporting complexity

Individual crypto investors face no crypto taxes in the UAE. This single factor justifies accepting higher trading fees-a 0.1% trading fee becomes irrelevant when UK traders lose 10-20% to CGT while Dubai traders keep 100% of gains.

Conclusion: Geographic Strategy Meets Privacy Freedom

The cheapest crypto exchange varies dramatically by region and individual priorities. Dubai traders access institutional-grade platforms with rock-bottom fees (0.02-0.15%) and zero taxation. London users accept higher costs (0.16-0.60%) for FCA protection and clear legal frameworks. Pakistani traders navigate P2P markets offering zero fees but requiring escrow management.

Godex transcends geographic constraints entirely, charging a transparent 1.5% flat fee while delivering complete anonymity, zero registration requirements, 923+ cryptocurrencies including frequently-delisted privacy coins, unlimited transaction volumes, fixed-rate protection against volatility, and 5-30 minute processing-making it the premier choice for traders prioritizing sovereignty, privacy, and operational freedom over pure fee optimization.

For traders executing significant monthly volumes, geographic location determines far more than trading fees-it shapes taxation (0-20%), asset access (350-4,100 cryptocurrencies), and regulatory certainty (gray area to institutional licensing). The sophisticated approach combines regional platforms for best-execution on large volume with privacy-focused alternatives like Godex for sensitive transactions, optimizing total cost of trading rather than narrowly pursuing lowest advertised fees.

Whether minimizing costs within Dubai's zero-tax framework, accepting UK's regulatory premium, navigating Pakistan's P2P innovation, or choosing Godex's privacy-first global access, understanding how location shapes fees represents the critical first step toward profitable cryptocurrency trading in 2025's fragmented regulatory landscape.