Chainlink CCIP DAO Tool Report For 2025

What Is Chainlink CCIP

Chainlink Cross-Chain Interoperability Protocol (CCIP) connects 70+ blockchains for secure asset and data transfers. Launched in July 2023, CCIP processes billions in value monthly using defense-in-depth security.

The protocol enables arbitrary messaging, token transfers, and programmable token transfers. Major DeFi protocols like Aave and Synthetix rely on CCIP for cross-chain operations.

As of December 2025, CCIP integrates with Base, Solana, TON, World Chain, and dozens more networks. Financial institutions including Swift, J.P. Morgan, UBS, and ANZ Bank use the protocol for tokenized asset management.

CCIP solves three core problems: transferring data between chains, moving tokens securely, and executing programmable logic across networks. Token issuers control their contracts while avoiding vendor lock-in.

Chainlink has enabled over $22 trillion in transaction value since launch. The network secures $93+ billion in on-chain assets across multiple ecosystems.

Chainlink CCIP Key Metrics For 2025

Chainlink CCIP Volume Growth Across 2024-2025

Data: Chainlink Ecosystem metrics dashboard, October 2025

CCIP reached $7.77 billion in cumulative transfer volume by October 2025. The protocol processed $375 million in the same period during 2024, representing 1,972% year-over-year growth.

Cross-Chain Token value hit $33.61 billion by February 2025. Total fees paid by users reached $1.15 million. The network handles transactions across 70+ blockchain ecosystems.

November 2025 saw temporary declines with weekly transfer volume dropping 39.4% to $292.75 million. Transaction volume fell 11.6% to 6,653 messages. Network fees decreased 43.8% to $4,930 during this period.

Daily volume averages $293 million across 132 blockchains as of September 2025 according to market data. CCIP maintains dominant position in cross-chain infrastructure despite periodic fluctuations.

Network Expansion And Blockchain Support

Chainlink CCIP Supported Blockchains 2025 Comparison

| Period | Blockchains Supported | New Additions | Key Integrations |

|---|---|---|---|

| Q4 2024 | 50+ | - | Ethereum, Polygon, Base, Avalanche |

| Q1 2025 | 57+ | 37 new chains | Bitlayer, BOB, World Chain |

| May 2025 | 60+ | Solana (v1.6) | First non-EVM chain support |

| October 2025 | 65+ | TON Network | Telegram ecosystem access |

| December 2025 | 70+ | Base-Solana Bridge | Aptos, Monad testnet |

Data: Chainlink official announcements and integration reports 2025

The network expanded from 50 to 70+ blockchains during 2025. Q1 alone saw 37 new blockchain integrations, the fastest expansion period in CCIP history.

Solana integration in May 2025 marked the first non-EVM chain support. The v1.6 upgrade cut gas costs by 50-90% while enabling seamless EVM-to-SVM transfers.

Base-Solana bridge launched December 4, 2025. The connection enables SOL and SPL token trading inside Base applications using dual verification from Coinbase and Chainlink node operators.

TON Network integration in October 2025 provides access to 1 billion+ Telegram users. Toncoin now moves securely between TON and 60+ blockchain networks using the Cross-Chain Token standard.

What Changed In 2025

Version 1.5 Launch

CCIP v1.5 launched on mainnet January 2025. The update introduced Cross-Chain Token standard for self-serve token deployment. Token Manager provides no-code guided deployment tools.

The new CCIP SDK builds on Wagmi framework for improved developer experience. CCIP Explorer received upgrades for better transaction tracking and monitoring capabilities.

Aave's GHO stablecoin and Solv Protocol's SolvBTC adopted CCT standard immediately. Both protocols benefit from zero-slippage transfers and enhanced programmability features.

Version 1.6 And Non-EVM Support

v1.6 rolled out May 2025 with Solana as first non-EVM chain. The architecture supports streamlined design for rapid scaling to hundreds of blockchains.

Transaction costs dropped between 50-90% compared to v1.5. The update enables cost-effective multi-chain deployment for projects requiring broad network coverage.

Institutional Partnerships

UBS Asset Management completed pilot for automated fund administration using CCIP. The project demonstrated tokenized fund workflows in Hong Kong's regulatory framework.

ANZ Bank joined Project Guardian using CCIP private transactions. The bank executed privacy-enabled cross-chain, cross-border connectivity for tokenized commercial paper.

J.P. Morgan's Kinexys ran cross-chain delivery-vs-payment tests with Ondo Finance. Both asset and payment legs settled automatically using CCIP infrastructure.

Swift demonstrated secure tokenized asset transfers using CCIP at Sibos 2025. The global messaging standard now bridges digital assets with established financial systems.

Chainlink Runtime Environment

Chainlink Runtime Environment (CRE) reached internal MVP status in Q1 2025. CRE orchestrates blockchain technologies, oracle networks, and smart contracts into unified applications.

The platform enables institutions to access blockchain infrastructure using existing tools. CRE processes subscriptions and redemptions for tokenized funds without disrupting core systems.

How Chainlink CCIP Compares To Competitors

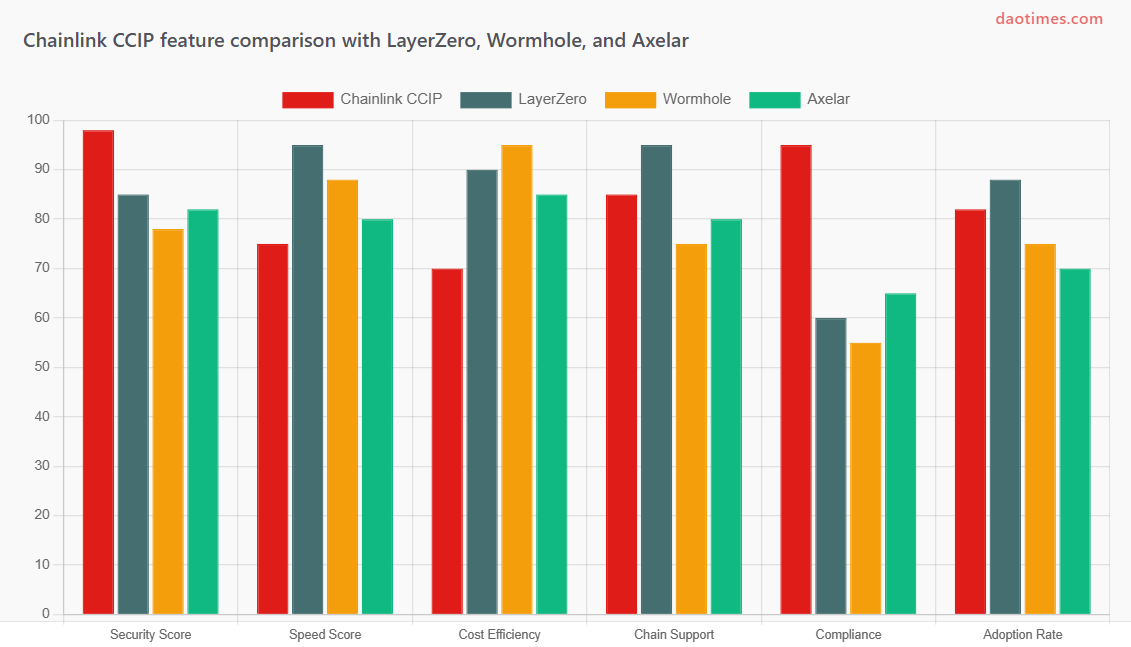

Chainlink CCIP Versus Other Cross-Chain Protocols 2025

Data: Cross-chain protocol analysis reports, September 2025

LayerZero Comparison

LayerZero processes 75% of cross-chain bridge volume as of September 2025. The protocol handles $293 million daily across 132 blockchains with flexible DVN selection.

CCIP prioritizes security with defense-in-depth architecture. LayerZero emphasizes speed with Ultra Light Nodes reducing verification overhead.

LayerZero offers customizable oracle and relayer combinations. CCIP provides unified security through Chainlink's decentralized oracle networks without configuration choices.

Cost structures differ between protocols. LayerZero enables variable fee structures based on DVN selection. CCIP maintains predictable fees ranging $0.01-0.10 per message.

Wormhole And Axelar

Wormhole uses fixed guardian validators with 19 nodes. Transaction costs stay lower than CCIP for high-frequency applications and gaming platforms.

Axelar operates proof-of-stake blockchain with 75+ validators. Users pay fees in AXL tokens. Axelar transaction volume reached twice that of Wormhole in early 2025.

CCIP remains permissionless without native token requirements for basic usage. The protocol supports compliance features and privacy capabilities competitors lack.

Protocol Integration And Adoption Metrics

Chainlink CCIP Cross-Chain Protocol Market Position

| Protocol | Blockchains | Daily Volume | Security Model | Notable Users |

|---|---|---|---|---|

| Chainlink CCIP | 70+ | $293M | Decentralized Oracle Networks + Risk Management | Aave, Synthetix, Swift, UBS |

| LayerZero | 132 | $293M | Customizable DVN selection | Stargate Finance, PancakeSwap |

| Wormhole | 50+ | $146M | 19 Guardian validators | Gaming platforms, Social apps |

| Axelar | 65+ | ~$250M | Proof-of-stake L1 | Cosmos ecosystem, EVM chains |

Data: DeFi protocol metrics and cross-chain volume reports, Q3 2025

How DAOs And Projects Use Chainlink CCIP

Cross-Chain Governance

Aave leverages CCIP for multi-chain governance operations. The protocol implements approved proposals across different blockchains using CCIP's secure messaging.

Olympus DAO integrated CCIP in June 2025 after 100% governance approval. OHM tokens transfer across Solana, Ethereum, Arbitrum, Base, and Optimism using CCT standard.

DAOs facilitate on-chain voting across high-speed, low-cost networks. Results transmit to higher-cost blockchains hosting core governance contracts, reducing member transaction costs.

DeFi Applications

Synthetix uses CCIP for Synths Teleporter with burn-and-mint model. Users transfer synthetic assets across chains without liquidity pools or slippage concerns.

Lido implemented CCIP Programmable Token Transfers for Direct Staking. The integration improves wstETH liquidity across Layer 2 networks with enhanced interoperability.

Radiant Capital manages over $100 million in cross-chain positions using OFT technology. The lending protocol unifies collateral across chains for better capital efficiency.

Tokenized Assets And RWAs

Spiko enables $380+ million in regulated money market funds to move across blockchains. French Financial Markets Authority approves the funds held by major depositary banks.

Lombard Finance uses CCIP for BTCFi scaling. The protocol rebuilds decentralized finance atop Bitcoin with Proof of Reserve and Price Feeds integration.

Maple Finance extends syrupUSD to Solana using Cross-Chain Token standard. The on-chain asset manager depends on secure infrastructure for product expansion.

Stablecoins And Payments

Major stablecoins adopted OFT standard for native transfers. Ethena's USDe synthetic dollar operates across 50+ chains without wrapped versions or liquidity fragmentation.

CCIP enables CBDCs to connect with domestic and international digital currency systems. Hong Kong's e-HKD pilot demonstrated atomic settlement with Australian dollar-backed stablecoins.

Institutional And DeFi Protocol Adoption

Chainlink CCIP Major Protocol Integrations Timeline 2025

Data: Chainlink integration announcements and press releases 2025

Security Architecture And Incidents

Defense-In-Depth Security

CCIP employs aerospace-inspired redundancy principles for cross-chain security. The protocol uses multiple decentralized networks to validate single cross-chain transactions.

Three separate decentralized networks execute and verify each transaction. Node operators remain independent across Committing DON, Executing DON, and Risk Management Network.

Risk Management Network monitors transactions for suspicious activity independently. The system can pause operations or shut down affected services when detecting threats.

Rate limiting mitigates potential exploit impact. Timelocked upgrades pass through Role-based Access Control contracts providing review periods before implementation.

2025 Security Record

No major security incidents occurred on CCIP mainnet during 2025. The protocol maintains clean security record since July 2023 launch.

Traditional cross-chain bridges lost $2.87 billion to exploits according to DeFiLlama data. High-profile incidents include $600 million Ronin Bridge hack and $81 million Orbit Chain breach.

CCIP addresses vulnerabilities through multi-layered verification. Token Developer Attestation allows issuers to add external verifiers for enhanced security.

The protocol earned SOC 2 Type 1 and ISO 27001 certifications. Globally recognized standards validate security controls and information management practices.

Privacy Features

CCIP Private Transactions launched October 2024. The feature enables institutions to conduct private chain-to-chain transfers while meeting regulatory requirements.

ANZ Bank demonstrated privacy-preserving capabilities in Project Guardian. The bank executed confidential cross-jurisdictional transfers for tokenized assets.

Blockchain Privacy Manager ensures only necessary data reveals during transactions. Financial institutions maintain strict compliance with data privacy standards.

Technical Capabilities And Features

Cross-Chain Token Standard

CCT standard enables self-serve token deployment within minutes. Developers retain full ownership over token contracts and cross-chain pools.

Zero-slippage transfers guarantee exact amounts received on destination chains. Pre-audited token pool contracts eliminate liquidity pool requirements.

Programmable Token Transfers execute complex workflows as single atomic instructions. Applications combine token movements with embedded logic for destination chain actions.

Arbitrary Messaging

CCIP supports transfer of any encoded data between smart contracts. Developers send messages to any contract on supported chains without architecture constraints.

The protocol handles cross-chain function calls and state synchronization. General Messaging feature supports complex application logic across network boundaries.

Compliance And Controls

Automated Compliance Engine defines and enforces custom onchain policies. Token issuers implement identity verification, jurisdictional restrictions, and asset-specific constraints.

Transactions finalize only when recipients meet approval requirements. Failed compliance checks trigger asset rerouting to recovery wallets for manual review.

Protocol Capability Assessment

Chainlink CCIP Multi-Dimensional Performance Analysis

Data: Protocol documentation and performance benchmarks 2025

CCIP scores highest in security and compliance categories. The protocol provides institutional-grade infrastructure with proven track record.

Speed and cost metrics place CCIP in middle range. LayerZero offers faster message delivery for applications prioritizing transaction speed.

Scalability benefits from v1.6 architecture supporting hundreds of blockchains. The modular design enables rapid network expansion without core protocol changes.

Roadmap And Future Development

Short-Term Plans

CCIP General Availability targets Q1 2026. The release provides production-ready cross-chain interoperability for institutions and DeFi protocols.

Additional blockchain integrations continue throughout 2026. The protocol aims to support hundreds of networks using streamlined v1.6 architecture.

Chainlink Runtime Environment expands to become default orchestration layer. The system enables institutions to build workflows across blockchains and legacy systems.

Long-Term Vision

Chainlink positions CCIP as universal standard for cross-chain communication. The protocol seeks adoption by major financial institutions and governments worldwide.

Tokenization market could reach $500 trillion according to institutional estimates. CCIP provides infrastructure connecting tokenized assets across global markets.

The network enables "always-on" capital markets with 24/7 settlement capabilities. Cross-border transactions process without traditional banking hours limitations.

Challenges Ahead

Gas costs remain concern for high-frequency applications. The protocol works to reduce fees while maintaining security standards.

Rate limits require configuration for high-volume use cases. Developers must balance throughput needs with security considerations.

Cross-chain complexity creates integration challenges for projects. Technical understanding of multi-network dependencies presents adoption barrier.

Strengths And Limitations

Strengths

- Battle-tested security infrastructure with $22+ trillion transaction value enabled

- Defense-in-depth architecture prevents single points of failure

- Support for 70+ blockchains including both EVM and non-EVM chains

- Institutional partnerships with Swift, UBS, ANZ, J.P. Morgan

- Privacy-preserving capabilities for compliant cross-chain transfers

- Zero-slippage token transfers without liquidity pool requirements

- Self-serve token deployment through CCT standard

- Programmable token transfers for complex workflows

- SOC 2 Type 1 and ISO 27001 certifications

- No vendor lock-in for token issuers

Limitations

- Higher costs compared to LayerZero for frequent transactions

- Less flexible than competitors offering customizable security models

- Slower message delivery than specialized speed-focused protocols

- Limited routing logic without built-in retry mechanisms

- Single executor per message reduces redundancy options

- Complex integration requirements for advanced use cases

- Periodic volume fluctuations during market downturns

- Network dependency on Chainlink oracle infrastructure

Frequently Asked Questions

What blockchains does CCIP support?

CCIP connects 70+ blockchains including Ethereum, Solana, Base, Polygon, Avalanche, Arbitrum, Optimism, BNB Chain, TON, Aptos, and World Chain. The network expanded from 50 to 70+ chains during 2025.

How much does CCIP charge per transaction?

Fees range from $0.01 to $0.10 per message depending on network conditions. Total fees collected reached $1.15 million by early 2025. Costs remain predictable compared to variable fee structures of competing protocols.

Is Chainlink CCIP secure for high-value transfers?

CCIP maintains clean security record since July 2023 launch with no major incidents. The protocol uses defense-in-depth architecture with three independent verification networks. Chainlink infrastructure has secured $93+ billion in assets.

Can DAOs use CCIP for governance?

DAOs leverage CCIP for cross-chain voting and proposal execution. Aave and Olympus DAO successfully integrated the protocol for multi-chain governance. Voting occurs on low-cost chains while results execute on networks hosting core contracts.

What is Cross-Chain Token standard?

CCT enables self-serve token deployment across multiple chains in minutes. Developers retain full contract ownership without vendor lock-in. The standard provides zero-slippage transfers and programmable capabilities.

How does CCIP compare to LayerZero?

CCIP prioritizes security with institutional-grade infrastructure and compliance features. LayerZero offers more flexibility with customizable security and faster message delivery. CCIP costs more but provides predictable fees.

Does CCIP work with non-EVM chains?

v1.6 introduced Solana support in May 2025 as first non-EVM chain. TON Network integration followed in October 2025. The architecture supports both EVM and non-EVM ecosystems.

What institutions use Chainlink CCIP?

Swift, UBS Asset Management, ANZ Bank, J.P. Morgan's Kinexys, and SBI Digital Markets integrated CCIP for tokenized asset operations. Over 100 financial institutions explore the protocol for cross-chain solutions.

Can CCIP handle private transactions?

CCIP Private Transactions feature enables confidential cross-chain transfers. ANZ Bank demonstrated privacy-preserving capabilities in Project Guardian. The system reveals only necessary data while maintaining regulatory compliance.

What is Chainlink Runtime Environment?

CRE orchestrates blockchains, oracles, and smart contracts into unified workflows. The platform enables institutions to access blockchain infrastructure using existing tools. Internal MVP launched Q1 2025 with broader rollout planned.

Sources And Resources

Official Documentation:

- Chainlink Official Website and CCIP Documentation

- Chainlink Blog and Press Releases

- Chainlink Quarterly Reports Q1-Q3 2025

Market Data:

- Chainlink Ecosystem CCIP Metrics Dashboard

- DeFiLlama Cross-Chain Protocol Analytics

- CoinMarketCap Chainlink Statistics

- SQ Magazine Chainlink Statistics 2025

Research Reports:

- Grayscale Research - The LINK Between Worlds

- Llama Risk Aave Explainer Series

- Binance Research Institute Cross-Chain Interoperability Report

- Yellow.com Cross-Chain Messaging Protocol Comparison

News Sources:

- PRNewswire CCIP Integration Announcements

- CoinDesk Web3 Coverage

- BeInCrypto Protocol Updates

- Chainlink Today Community News

Project Announcements:

- World Chain Official Blog

- Olympus DAO Medium

- Spiko Official Website

- Metis Network Blog

Additional Resources: