Lido DAO Ruling Exposes Token Holders to Partnership Liability, California Federal Court Decides

Bottom Line: California court ruled November 18, 2024 that DAO members who vote or participate in governance face personal liability as general partners. The case against Lido DAO and three major venture capital firms proceeds to trial. Simply owning governance tokens may create partnership liability under California law. The decision affects anyone participating in profit-driven DAOs with California operations or members.

What the Court Decided

Judge Vince Chhabria rejected Lido DAO's claim that it operates as autonomous software. The court wrote: "Lido's alleged actions are not those of an autonomous software program—they are the actions of an entity run by people."

The ruling applies California Corporations Code: "The association of two or more persons to carry on as coowners a business for profit forms a partnership, whether or not the persons intend to form a partnership."

Lido makes decisions through votes. It has a treasury worth over $30 billion. It hired over 70 employees. These facts convinced the court that humans run Lido, not software alone.

Who Was Named as General Partners

Paradigm Operations, Andreessen Horowitz, and Dragonfly Digital Management were identified as general partners. The court examined their token holdings and public statements about governance participation.

Robot Ventures was dismissed. Evidence of its participation was "much sparser" according to Judge Chhabria.

The court found that these firms "took an active role in Lido's management or intended to do so." Token ownership plus governance activity equals partnership liability.

The Facts Behind the Lawsuit

Andrew Samuels bought 132 LDO tokens through Gemini exchange in April and May 2023. He sold them at a loss in June 2023. In December 2023, he filed a class action lawsuit.

Samuels claims LDO tokens are unregistered securities. He argues that 64% of tokens are held by founders and early investors, giving them control over governance.

The lawsuit states Lido DAO deliberately structured itself to avoid legal liability while selling tokens to the public through centralized exchanges.

What Lido DAO Does

Lido is a liquid staking protocol for Ethereum. Users deposit ETH and receive stETH tokens. Lido pools the ETH and stakes it with validators. Stakers earn approximately 3% annual yield.

Lido takes a percentage of staking rewards. These funds go into a treasury managed by LDO token holders through governance votes. The protocol manages over $30 billion in assets.

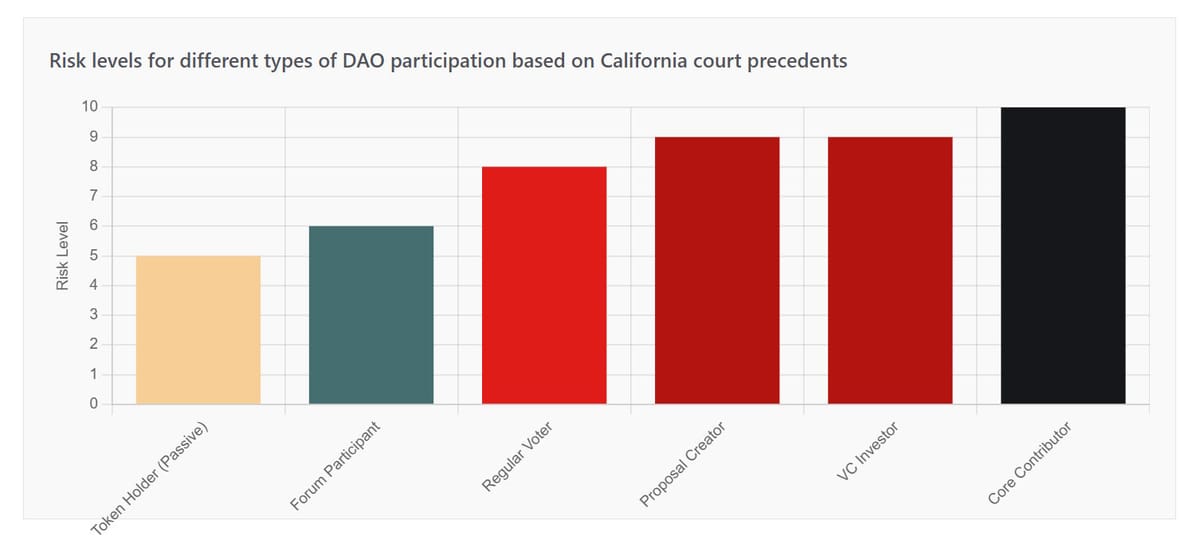

Who Faces Liability Risk Under This Ruling

| Participant Type | Activity | Risk Level | Court's Reasoning |

|---|---|---|---|

| Venture Capital Investors | Large token holdings plus public statements about governance roles | High | Active management or intent to manage creates general partner status |

| Active Governance Voters | Regular voting on proposals, forum participation | High | Participation in management decisions constitutes partnership activity |

| Proposal Creators | Submitting governance proposals | High | Direct involvement in managing DAO operations |

| Forum Participants | Posting in governance forums | Medium-High | Miles Jennings warned even forum posts may create liability |

| Token Holders (Passive) | Holding tokens without voting | Medium | bZx DAO case suggests mere ownership might create partnership |

| Core Contributors | Paid work for DAO | Very High | Employment relationship establishes management role |

Analysis based on Samuels v. Lido DAO ruling and related California DAO cases

Current Case Status November 2025

The case continues through discovery. On January 10, 2025, a case management conference established key deadlines:

Key Dates

Document production must be substantially complete by July 1, 2025. Parties exchange evidence about who participated in governance and how decisions were made.

Hearing on dispositive motions is scheduled for mid-November 2026. This determines if the case goes to trial or settles.

In December 2024, Samuels requested a default judgment against Lido DAO for failing to appear in court. This request remains pending.

What Happens Next

February 3, 2025, the court denied defendants' motion for interlocutory appeal. This means the case cannot go to appellate court until trial concludes.

Defendants must now produce documents showing their involvement in Lido governance. Email, Telegram messages, voting records, and public statements will be examined.

Settlement discussions likely occur during discovery. The case may resolve before trial if parties reach agreement on damages.

Lido DAO Case Timeline

Data: Court filings from Samuels v. Lido DAO, Case No. 3:23-cv-06492

What Makes This Different from Previous DAO Cases

Earlier cases like CFTC v. Ooki DAO ended in default judgment. Ooki DAO never defended itself in court. No one knows what would happen if Ooki had fought the case.

Sarcuni v. bZx DAO involved a hack that caused $55 million in losses. Token holders sued over security failures. That case also denied motions to dismiss.

Lido DAO is different. Major venture capital firms are defending the case. They have significant resources to fight. The outcome will establish precedent that applies to future cases.

Why This Case Matters More

Paradigm, Andreessen Horowitz, and Dragonfly are well-known investors. Their involvement attracts attention from other VCs who invest in DAOs.

Lido manages over $30 billion. It is one of the largest DeFi protocols. If liability attaches to Lido members, no large DAO is safe.

The case addresses secondary market purchases. Samuels did not buy tokens directly from Lido. The court still found that Lido "solicited" purchases through marketing and exchange listings.

Comparison of California DAO Liability Cases

| Case Name | Court | Status | Key Finding | Result |

|---|---|---|---|---|

| Samuels v. Lido DAO | N.D. California | Active, discovery phase | DAO is general partnership, VCs are general partners | Motion to dismiss denied Nov 2024, trial set for late 2026 |

| CFTC v. Ooki DAO | N.D. California | Closed, default judgment | DAO is unincorporated association, can be served via forum | $643,542 penalty, permanent bans, shutdown ordered June 2023 |

| Sarcuni v. bZx DAO | S.D. California | Active | All token holders may be general partners | Motion to dismiss denied March 2023, ongoing |

Data: Federal court records from California Northern and Southern Districts

What the Ruling Means for Secondary Market Token Sales

The court expanded Section 12(a)(1) liability beyond direct sales. DAOs face liability for tokens sold on exchanges if they "solicit" purchases.

Solicitation includes marketing campaigns, social media promotion, and facilitating exchange listings. Lido promoted token purchases and staking rewards through these channels.

This interpretation creates risk for any DAO that promotes its tokens. Even if you never sold tokens directly, you may be liable for exchange sales.

What Counts as Solicitation

The court examined Lido's website, which stated that holding LDO "gives DAO members a vote in the future of Lido" and "allows each DAO member to have a personal say in the community."

Lido encouraged participation in governance. This encouragement constitutes solicitation even though Lido did not operate the exchange where Samuels bought tokens.

DAO Participation Activities and Liability Exposure

Analysis based on Lido DAO, Ooki DAO, and bZx DAO court rulings

Industry Response

Miles Jennings, General Counsel at Andreessen Horowitz crypto, stated the ruling "dealt a huge blow to decentralized governance." He warned that "any DAO participation (even posting in a forum) could be sufficient to hold DAO members liable."

Jennings advocated for Wyoming's DUNA (Decentralized Unincorporated Nonprofit Association) as a solution. The DUNA law provides limited liability protection for DAO members.

How Wyoming DUNA Protects Members

Wyoming passed the DUNA law in March 2024. It took effect July 1, 2024. The law recognizes DAOs as legal entities with limited liability protection.

Requirements: minimum 100 members, nonprofit purpose, Wyoming registered agent, and governance documentation. Cost approximately $23,000 for setup plus annual fees.

Protection: individual members are not personally liable for DAO actions. Only the DUNA entity faces liability.

Limitation: DUNAs must operate as nonprofits. Profit distributions to members are prohibited. This structure does not work for investment DAOs or profit-sharing tokens.

Token Ownership Concentration in Lido DAO

Data: Samuels v. Lido DAO complaint allegations

Practical Steps for Current DAO Participants

If you hold governance tokens in a profit-driven DAO with California operations or members, evaluate your risk exposure now.

Immediate Actions

Document your participation level. Save records showing whether you voted, posted in forums, or submitted proposals. This evidence matters if liability claims arise.

Review the DAO's legal structure. Does it have a legal wrapper? Is it registered as a business entity? Unregistered DAOs create maximum risk.

Consider reducing governance participation. Passive token holding carries less risk than active voting. Some holders transfer tokens to avoid partnership status.

For DAO Organizers

Implement a legal wrapper immediately. Wyoming DUNA works for nonprofit DAOs. For-profit projects need offshore structures like Cayman foundations or Marshall Islands LLCs.

Obtain Directors and Officers insurance. Coverage protects governance participants from personal liability. Annual premiums range from $50,000 to $500,000 depending on treasury size.

Document that the DAO follows legal advice. Establish formal governance procedures. Show that decisions result from collective votes, not individual control.

Legal Wrapper Options Post-Ruling

| Structure | Jurisdiction | Protection Level | Cost | Best For |

|---|---|---|---|---|

| DUNA | Wyoming, USA | Limited liability for members | $23,000 | Nonprofit DAOs with 100+ members |

| Non-profit LLC | Marshall Islands | Limited liability for members | $15,000 | Smaller DAOs, faster setup |

| Foundation Company | Cayman Islands | Limited liability, asset protection | $40,000+ | For-profit DAOs, privacy needs |

| Association | Switzerland | Legal entity status | $30,000+ | European operations, regulatory clarity |

Data: Legal service providers and formation cost estimates as of 2025

What Changes if New SEC Leadership is More Crypto-Friendly

Paul Atkins, nominated to replace Gary Gensler as SEC Chair, is known for supportive views on cryptocurrency. The Trump administration signals a more favorable regulatory environment.

However, the California court ruling does not depend on SEC policy. Partnership liability arises from state law, not federal securities regulation.

A crypto-friendly SEC might reduce enforcement actions against DAOs. But private lawsuits like Samuels v. Lido DAO continue regardless of SEC position.

State Law vs Federal Regulation

California Corporations Code governs partnership formation. The SEC does not control state partnership law.

Even if the SEC stops calling DAO tokens securities, California courts can still find DAOs are general partnerships.

Partnership liability is separate from securities registration. Both issues can apply to the same DAO simultaneously.

FAQ

Sources

Court Documents:

Samuels v. Lido DAO, Case No. 3:23-cv-06492 (N.D. Cal.), Order re: Motion to Dismiss (November 18, 2024)

Case Management Conference Minutes (January 10, 2025), U.S. District Court Northern District of California

CourtListener.com: Complete case docket and filings for Samuels v. Lido DAO

CFTC v. Ooki DAO, No. 3:22-cv-05416 (N.D. Cal. June 8, 2023)

Sarcuni v. bZx DAO, 664 F. Supp. 3d 1100 (S.D. Cal. 2023)

Legal Analysis:

Davis Wright Tremaine LLP: "Samuels v. Lido DAO: A Potential New Frontier for Liability in the Cryptocurrency Space" (January 2025)

Fenwick & West LLP: "The Legal Landscape for DAOs: Key Lessons from Lido DAO and Ooki DAO" (May 2025)

Winston & Strawn LLP: "DAOs Watch Out: Federal Court in California Decides a DAO Can Be a General Partnership" (November 2024)

Dynamis LLP: "Lido DAO: Legal Impact on Crypto Industry" (April 2025)

Industry Reporting:

Bankless: "New Court Ruling Finds Lido DAO Members Liable as Partners" (November 2024)

Decrypt: "California Court Rules Lido DAO Members Can Be Held Liable Under Partnership Laws" (November 2024)

DL News: "Crypto's court docket in 2025 is packed with big cases" (January 2025)

CoinGeek: "Lido DAO ruling, significant or not?" (January 2025)

Additional Resources:

DAO Tools Database: https://daotimes.com/comprehensive-dao-tooling-guide-list-of-dao-tools/

List of Active DAOs: https://daotimes.com/a-comprehensive-list-of-daos-to-explore/