Bulla Network DAO Tool Report For 2025

What Is Bulla Network

Bulla Network is an open-source decentralized accounting protocol for Web3 businesses, DAOs, and individuals. Founded in 2020 and launched in 2022 by CEO Mike Revy, the platform operates under ARKITOKEN INC. Headquarters are in Denver, Colorado and Zurich, Switzerland.

The protocol mints NFT-based invoice tokens for on-chain transactions. Users create, send, and manage invoices, payments, and payroll across 13 blockchains. No account setup is required. The system uses triple-entry accounting where each transaction is recorded once on the blockchain.

Bulla tracks finances across multiple chains in one dashboard. Web3 businesses can import past transactions, organize accounts, and export data for tax reporting. The platform supports any ERC-20 token including USDC, ETH, and wBTC.

How Bulla Network Works

Users connect a non-custodial wallet such as MetaMask, Liquality, or any WalletConnect-compatible wallet. Web3Auth integration provides seamless access. No registration or KYC is needed.

When creating an invoice, Bulla mints a Claim Token. This token contains creditor, debtor, and amount information. The token appears in both parties' dashboards automatically. Creditors see receivables while debtors see payables.

The protocol supports batch payments for payroll processing. Users can pay multiple invoices in one transaction. The Transaction Importer tool scans 13 chains to find and import all wallet activity into one view.

Bulla offers three invoice types: on-chain invoices fully recorded on blockchain, off-chain invoices stored privately, and hybrid invoices that balance transparency with privacy. The hybrid option launched in May 2025.

What Changed In 2025

Hybrid Invoice Feature

Bulla launched hybrid invoices in May 2025. This feature lets users customize which transaction details appear on-chain. Sensitive information like employee IDs or addresses can remain private while maintaining blockchain benefits.

RMA Certification

In March 2025, Bulla earned Risk Management Assessment certification from VaaSBlock. The company exceeded expectations in Team Proficiency and Corporate Governance categories. This certification validates operational integrity and security standards.

TCS Lending Pool Expansion

Bulla partnered with TCS blockchain for freight invoice financing. Small trucking companies can access liquidity in 1-2 business days instead of waiting 30-180 days. This saves up to 90% compared to traditional factoring fees.

The TCS Pool has 350+ operators on the waitlist. Bulla plans to process $10M in freight invoices during Q2 2025. The total pipeline reached $100M as of mid-2025.

Wyoming Stablecoin Integration

Fundora selected Bulla to showcase peer-to-peer lending at the Wyoming Stabletoken Commission meeting in July 2025. The Wyoming Stablecoin (WYST) launched August 20, 2025. Bulla enables WYST-holders to access working capital through the platform.

Supported Blockchains

Bulla Network Multi-Chain Coverage For 2025

Data: Bulla Network official documentation

Bulla supports 13 blockchain networks as of 2025. This includes Ethereum Mainnet, Polygon, Arbitrum, Optimism, Base, Gnosis Chain, Fuse, Rootstock, Celo, Avalanche, BNB Chain, Fantom, and Aurora. The platform is EVM-compatible and chain-agnostic.

Bulla Network Versus Competitors

Bulla Network Feature Comparison With Web3 Invoicing Tools

| Platform | Chains Supported | Invoice Types | Decentralization | Invoice Factoring | Account Required |

|---|---|---|---|---|---|

| Bulla Network | 13 chains | On-chain, Off-chain, Hybrid | Fully decentralized | Yes (TCS Pool) | No |

| Request Finance | 25+ chains | On-chain only | Hybrid (uses IPFS) | Yes (via Huma) | No |

| Utopia Labs | 6 chains | On-chain | Hybrid | No | Yes |

| Transfer | Multiple EVMs | On-chain | Partially decentralized | No | No |

| Coinshift | 8 chains | On-chain | Hybrid | No | Yes |

| OneSafe | Limited | Mixed | Centralized | No | Yes |

Data: Platform documentation and DAO Times tooling guide

Bulla stands out with its fully decentralized architecture. Request Finance processes more chains but relies on IPFS storage. Both platforms offer invoice factoring through partnerships. Bulla requires no account creation while most competitors need registration.

Freight Invoice Financing Performance

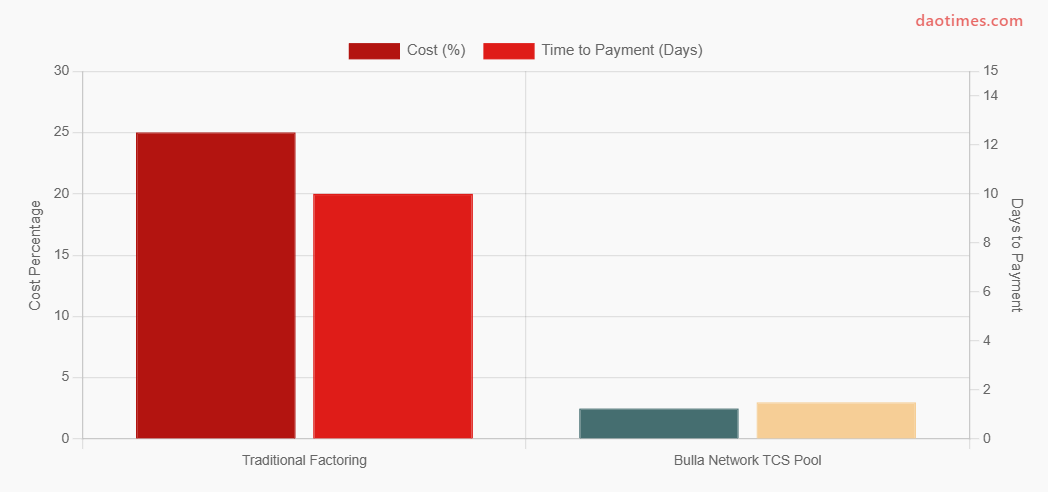

Bulla Network Cost Savings For Freight Operators In 2025

Data: Bulla Network press releases June 2025

Traditional factoring costs freight companies 20-30% of invoice value. Payment takes 10 days on average. Bulla and TCS provide liquidity in 1-2 business days at 2-3% cost. Small operators who haul 75% of US freight previously surrendered up to 30% of revenue.

The TCS Pool targets $10M in settlements for 2025. CEO Mike Revy presented this solution at Yield Day in New York City on June 23, 2025. The model tokenizes 30-60 day freight invoices as AA/AAA commercial paper credits.

Platform Adoption And Usage

Bulla Network Growth Indicators For 2024-2025

Data: Company announcements and blockchain analytics

Bulla launched in 2022 with basic invoicing. By 2023, the Transaction Importer added multi-chain tracking. The platform expanded from 11 to 13 supported chains through 2024. LinkedIn shows 259 followers as of late 2025.

The freight financing vertical attracted 350+ transportation operators to the waitlist. Pipeline value reached $100M. RWA tokenization for recurring receivables represents a major use case expansion beyond simple invoicing.

Bulla Network Key Metrics For 2025

Bulla Network Operational Statistics

| Metric | Value | Status | Date |

|---|---|---|---|

| Supported Blockchains | 13 | Active | 2025 |

| Invoice Pipeline (Freight) | $100M | Growing | Mid-2025 |

| Q2 Target Settlement | $10M | In Progress | Q2 2025 |

| TCS Pool Waitlist | 350+ operators | Active | 2025 |

| Cost Savings vs Factoring | Up to 90% | Verified | 2025 |

| Liquidity Speed | 1-2 business days | Active | 2025 |

| Founded Year | 2020 | Operational | Launch 2022 |

| RMA Certification | Achieved | Certified | March 2025 |

Data: Bulla Network press releases and VaaSBlock certification

Security And Audits

Bulla Network received RMA certification from VaaSBlock in March 2025. The assessment covered six categories including Team Proficiency and Corporate Governance. No security incidents or breaches have been reported for Bulla Network as of December 2025.

The protocol uses audited smart contracts with multi-signature authorization. All transactions are recorded immutably on-chain. Users maintain control of their private keys through non-custodial wallet connections. Bulla stores no data on centralized servers.

The platform is open-source. Developers can review and audit the code on GitHub. The codebase includes V1 and V2 contracts with active development through July 2025.

Strengths And Limitations

What Works Well

Fully decentralized architecture with no intermediaries. No account creation or KYC required. Supports 13 major blockchains for maximum flexibility. NFT-based invoice tokens provide immutable transaction records.

Hybrid invoices balance transparency with privacy needs. Transaction Importer aggregates multi-chain activity in one view. Batch payment feature streamlines payroll. Invoice factoring through TCS Pool unlocks working capital.

Cost savings reach 90% versus traditional factoring. Liquidity arrives in 1-2 days instead of 30-180 days. Open-source protocol allows developer integration. RMA certification validates security and governance.

What Needs Improvement

Limited mainstream adoption compared to Request Network which processes 13,000+ transactions monthly. Freight financing still in pilot phase with $10M target for Q2 2025. No published transaction volume statistics available.

Smaller blockchain support than Request Finance which covers 25+ chains. Learning curve for users unfamiliar with Web3 wallets. Dependent on gas fees for on-chain transactions. Limited documentation for developers compared to larger competitors.

Freight factoring requires TCS blockchain partnership. Platform primarily targets crypto-native users. Traditional businesses may find pure on-chain accounting challenging. Integration with legacy accounting software not advertised.

Primary Use Cases

DAOs use Bulla for transparent payroll and contributor payments. Organizations working with various DAO structures can track all treasury movements on-chain. No central authority controls the records.

Web3 freelancers invoice clients directly wallet-to-wallet. No PayPal or Stripe fees apply. Payment proof lives on blockchain. Clients in different countries pay in any supported token.

Small freight operators factor invoices through the TCS Pool. Companies avoid predatory 20-30% factoring rates. Liquidity arrives 15-90 times faster than traditional methods. The solution serves operators who haul 75% of US freight.

Crypto businesses manage accounts receivable and payable in one dashboard. Multi-chain activity consolidates automatically. Tax season exports simplify compliance. Batch payments reduce time spent on recurring obligations.

Technical Architecture

Bulla Network Technology Components In 2025

Data: Bulla Network technical documentation

Bulla runs on EVM-compatible blockchains using Solidity smart contracts. The protocol is composable and can integrate into other tech stacks. Web3Auth and WalletConnect provide authentication. All data stores on-chain with no centralized servers.

The Transaction Importer acts as a multi-chain block explorer. It queries blockchain data across 13 networks simultaneously. Users can tag transactions and add notes for categorization. Export functionality produces reports for accounting software.

Development Roadmap

Q1-Q2 2025 focused on capital investment rounds and TCS Pool expansion. The freight financing vertical targets additional supply chains and industries. Bulla plans to scale operations and improve the dApp interface.

Future pools will extend beyond transportation. Manufacturing and retail sectors with recurring receivables could benefit from invoice tokenization. The model proves that RWA tokenization works for high-volume, lower-value assets rather than only luxury items.

Long-term vision includes building a global capital market on-chain. Bulla aims to create a blockchain for future crypto claims and payments. Invoice factoring represents a step toward peer-to-peer credit without geographic restrictions.

Frequently Asked Questions

Do I need to create an account to use Bulla Network?

No account creation is required. Users simply connect a non-custodial wallet like MetaMask. The platform is permissionless and requires no KYC.

Which blockchains does Bulla Network support?

Bulla supports 13 chains including Ethereum, Polygon, Arbitrum, Optimism, Base, Gnosis, Fuse, Rootstock, Celo, Avalanche, BNB Chain, Fantom, and Aurora.

What tokens can I use for invoicing?

Any ERC-20 token works on supported chains. Common options include USDC, ETH, wBTC, and xUSD. DAOs can add custom native tokens.

How much does Bulla Network charge?

The protocol itself charges no fees. Users pay blockchain gas fees for on-chain transactions. Freight factoring through TCS Pool charges 2-3% versus traditional 20-30%.

Is Bulla Network safe to use?

Bulla earned RMA certification from VaaSBlock in March 2025. The protocol uses audited smart contracts. No security breaches have been reported. Users control their own keys.

What are hybrid invoices?

Hybrid invoices launched May 2025. Users choose which details appear on-chain versus off-chain. This balances transparency with privacy for sensitive business information.

Can I import past transactions?

Yes. The Transaction Importer tool scans all 13 supported chains. It finds and imports historical wallet activity into your dashboard automatically.

Does Bulla work for traditional businesses?

The platform targets crypto-native users and Web3 businesses. Traditional companies need crypto wallets and blockchain familiarity. Legacy accounting software integration is not advertised.

What is invoice factoring on Bulla?

The TCS Pool lets freight operators sell invoices for immediate cash. Payment arrives in 1-2 business days at 2-3% cost. This beats traditional factoring which takes 10 days and costs 20-30%.

How does Bulla compare to Request Network?

Both offer on-chain invoicing and factoring. Request covers 25+ chains versus Bulla's 13. Bulla is fully decentralized while Request uses IPFS. Bulla offers hybrid invoices for privacy.

Sources

Official Sources:

Bulla Network website and documentation

Bulla Network LinkedIn company page

Bulla Network GitHub repositories

News And Press Releases:

VaaSBlock RMA Certification announcement April 2025

Fundora uses Bulla Network press release July 2025

Bulla Network tokenizes private credit press release June 2025

Bulla offers hybrid invoices blog post May 2025

Industry Resources:

Request Network Foundation blog posts and documentation

Alchemy DAO accounting tools guide

Ethereum Ecosystem directory

CB Insights company profile

DAO Times comprehensive tooling guide