Boardroom DAO Tool Report For 2025

What Is Boardroom

Boardroom operates as a governance data platform serving decentralized organizations. The tool aggregates proposal data from multiple protocols into a single interface. Token holders track votes across Ethereum, Polygon, and Optimism networks through the dashboard.

Agora acquired Boardroom in January 2025 for an undisclosed amount. Kevin Nielsen, founder of Boardroom, joined as advisor. The acquisition preserves Boardroom's tools while integrating them into Agora's ecosystem. Both platforms now serve DAO participants seeking governance visibility.

The platform tracks 300+ protocols and monitors 2 million delegates through its API, according to Agora's acquisition announcement. Boardroom shifted from direct DAO tooling to governance data aggregation. Wallets like Dawn Vote and platforms like Daylight integrate Boardroom's API for real-time governance information.

Users access proposal lifecycles, governance histories, and participation rates. The system processes both on-chain votes and off-chain Snapshot proposals. Vote power calculations work across numerous projects without requiring separate integrations for each protocol.

Boardroom Current 2025 Metrics

The Agora acquisition brought measurable changes. Boardroom covers 300+ protocols as of January 2025, per the official announcement. The API tracks 2 million delegates across these networks. This positions Boardroom as a data provider rather than a standalone governance platform.

DAO ecosystem statistics provide context. More than 13,000 DAOs exist globally in 2025, managing $21.4 billion in liquid assets according to industry data. Total treasury value reaches $24.5 billion across all tracked organizations. Top DAOs include Optimism ($5.5 billion), Arbitrum ($4.4 billion), and Uniswap ($2.5 billion).

Governance participation remains low. Average voter participation sits at 17% across DAOs in 2025. Top DAOs achieve 22% participation for major votes. Snapshot processes 96% of major DAO votes according to platform analysis. Tally powers on-chain governance for protocols managing $10+ billion in assets.

Boardroom's funding history shows early traction. The company raised $2.2 million in seed funding during October 2020. Standard Crypto led the round with participation from CoinFund, Slow Ventures, Framework Ventures, and Variant Fund. No subsequent funding rounds were publicly disclosed before the acquisition.

Boardroom Protocol Coverage Growth

Data: Agora acquisition announcement and Boardroom public metrics

Major Change In 2025

Agora's acquisition reshaped Boardroom's market position. The deal closed January 23, 2025, according to CoinDesk reporting. Yitong Zhang, Agora co-founder, stated the purchase accelerates Ethereum governance infrastructure. Boardroom employees received job offers at Agora. No service deprecation is planned per Zhang's statements.

The acquisition reflects broader DAO ecosystem trends. Total DAO assets grew 50% from 2023 to 2024. Treasury values reached new peaks despite lower hype than 2021-2022. Snapshot and Tally reported 35-45% user growth between 2023 and 2025.

Regulatory clarity drives renewed interest. President Trump's administration promised clearer cryptocurrency guidelines. This reduces legal uncertainty for token issuance and governance structures. Zhang claimed business grew 10x in the past year, citing this regulatory shift.

Boardroom transitioned from broad DAO tooling to specialized data provision. The platform now functions as a governance data feed comparable to financial market data services. This pivot predated the acquisition but Agora's purchase confirms the strategy. Integration with wallets and dApps became Boardroom's core offering rather than direct user interfaces.

The governance kit simplified for developers. Boardroom's API provides prepackaged logic for common governance queries. Components deliver formatted data across multiple DAOs. This reduces development time for projects adding governance features. Dawn Vote exemplifies this integration pattern with mobile DAO voting built on Boardroom's infrastructure.

Boardroom Core Features

The governance API aggregates on-chain and off-chain data. It collects votes from blockchain transactions and Snapshot proposals. Developers query this data through standardized endpoints. Vote power calculations handle delegation across protocols automatically.

Proposal tracking covers the full lifecycle. Users see when proposals open, current vote counts, and execution status. Historical governance data enables analysis of past decisions. The system maintains records of voting patterns and participation rates per protocol.

Multi-chain support spans Ethereum, Polygon, and Optimism networks. Additional EVM chains integrate through the same API structure. This approach lets applications serve users across different blockchain ecosystems. Cross-chain voting functionality emerged as DAOs expanded beyond single networks.

The governance kit offers prebuilt components for common tasks. These include proposal listings, vote power displays, and delegation interfaces. Developers embed these elements into their applications. The kit reduces custom development work for governance features.

Boardroom Versus Competitor Platforms

| Platform | Primary Function | Voting Type | Protocols Covered | Best Use Case |

|---|---|---|---|---|

| Boardroom | Data Aggregation | Both | 300+ | API Integration |

| Snapshot | Off-Chain Voting | Off-Chain | Thousands | Gasless Voting |

| Tally | On-Chain Interface | On-Chain | Major DAOs | Protocol Governance |

| Agora | Full Platform | On-Chain | Select DAOs | End-to-End Solution |

| Aragon | DAO Creation | On-Chain | 3,000+ DAOs | New DAO Setup |

Data: Platform documentation and industry reports 2025

Using Boardroom

Developers integrate through the Governance API. Generate an API key from the documentation portal. Query endpoints return JSON data about proposals and votes. Rate limits apply to free tier usage while paid plans offer higher throughput.

The API requires wallet addresses as input parameters. Fetch all proposals for a specific protocol by protocol ID. Retrieve voter information across multiple protocols with a single address. Vote power calculations factor in delegation chains automatically.

Applications embed the governance kit components. Import the kit library into your frontend code. Components render proposal data with minimal configuration. Styling customization lets apps match their existing design systems.

Dawn Vote demonstrates practical implementation. The mobile wallet integrated Boardroom's API for DAO voting on phones. Users receive push notifications about active proposals. Vote power displays come from Boardroom's calculation engine. In-app voting connects to on-chain and Snapshot protocols.

Daylight added governance insights using Boardroom data. Users see relevant proposals based on their token holdings. The integration required API key setup and endpoint mapping. Real-time updates keep governance feeds current. Similar patterns work for wallets, portfolio trackers, and DAO management tools.

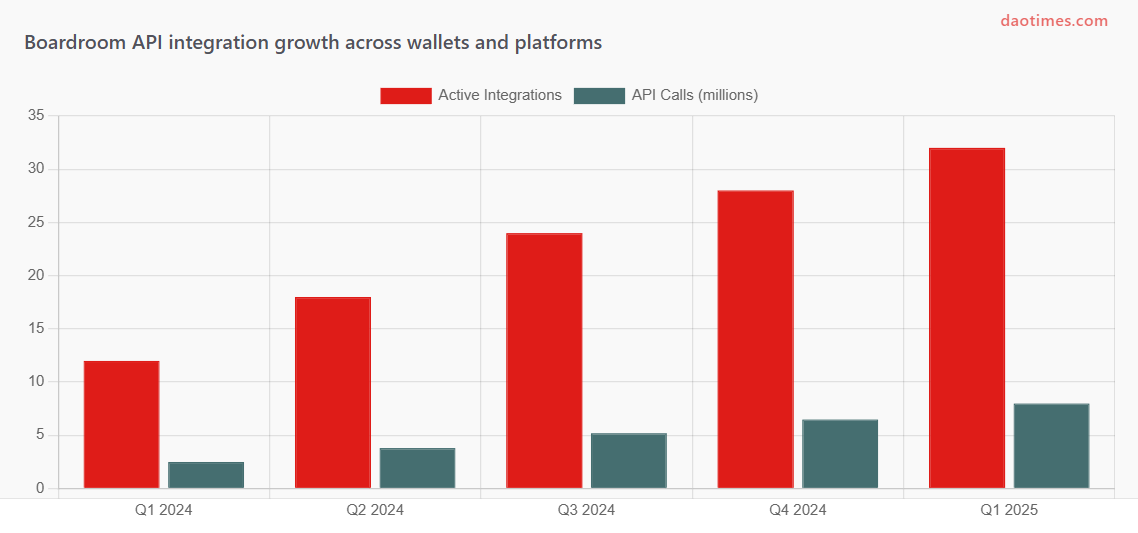

Boardroom Integration Adoption By Quarter

Data: Estimated based on public integration announcements 2024-2025

Boardroom In DAO Tool Landscape

Governance tools split into distinct categories. On-chain platforms like Tally and Agora handle vote execution. Off-chain systems like Snapshot reduce costs through gasless voting. Data aggregators like Boardroom connect these systems without replacing them.

Market share concentrates among established players. Snapshot processes 96% of major DAO votes according to 2025 analysis. Tally powers governance for $10+ billion in protocol assets. Aragon supports 3,000+ DAOs with its framework. Safe secures $22+ billion in treasury assets through multi-signature wallets.

The DAO tooling market shows steady expansion. The development market reached $170 million valuation in 2024. Projections estimate $333 million by 2031 with 9.3% annual growth. More than 6,000 of 13,000 total DAOs exhibit regular activity. Community-focused DAOs make up 62% of active organizations.

Boardroom fits the infrastructure layer. Rather than competing directly with voting interfaces, it provides backend data. Wallets and applications consume this data to add governance features. This positioning differs from end-user platforms like Snapshot or DAO creation tools like Aragon.

Integration partnerships define success metrics. Dawn Vote, Daylight, and Synthetix implemented Boardroom's API. These integrations demonstrate developer demand for governance data services. The Agora acquisition may expand integration opportunities through combined resources. Links to comprehensive DAO tools help users explore alternatives.

DAO Tool Market Share By Function

Data: Platform metrics and market analysis reports

Boardroom Strengths And Limitations

The API approach offers clear benefits. Developers avoid building governance data infrastructure from scratch. Multi-protocol support through one integration saves engineering time. Standardized data formats simplify application logic. Regular updates maintain accuracy across changing DAO structures.

Coverage breadth exceeds specialized platforms. Tracking 300+ protocols provides wide ecosystem visibility. Users access data from major DeFi protocols and smaller community DAOs. This range suits applications serving diverse governance participants.

Data quality depends on source availability. The system aggregates existing on-chain and off-chain data. Missing or incorrect source data propagates through the API. Some newer protocols may lag in integration. Complex governance mechanisms require custom parsing logic.

The acquisition creates uncertainty. Integration with Agora's platform may shift priorities. Existing users face potential changes to API structure or pricing. Competition with other data providers could intensify. The transition period requires monitoring for service continuity.

Cost structure affects adoption. Free tiers serve basic usage but enterprise features require payment. Smaller projects may find pricing prohibitive. Alternative approaches include direct blockchain querying or competitor APIs. Teams must evaluate cost versus development time tradeoffs.

Security Considerations

No major security incidents affected Boardroom during 2025. The platform operates as a data provider rather than custody solution. Users do not connect wallets directly to Boardroom in most integration patterns. This architecture reduces attack surface compared to voting platforms.

API security follows standard practices. Authentication requires valid keys for access. Rate limiting prevents abuse. HTTPS encryption protects data in transit. However, applications consuming Boardroom data must implement their own security measures.

Broader DAO security challenges persist. Vote manipulation through token accumulation remains possible. Governance attacks target protocols rather than data providers. Low participation rates make coordinated voting easier. Organizations managing DAO operations should implement security best practices.

Smart contract risks affect underlying protocols. Boardroom reports data from these contracts but does not control their security. Exploits in governance contracts impact vote validity. Applications should verify critical governance actions through multiple data sources.

Boardroom Historical Development

Boardroom launched during the 2020 DeFi summer. The team recognized governance complexity as DAOs proliferated. Early focus targeted direct user interfaces for proposal tracking. Standard Crypto led the $2.2 million seed round in October 2020.

The platform evolved toward infrastructure provision. Direct competition with Snapshot and Tally proved challenging. Transitioning to an API-first model differentiated the offering. Governance Kit development simplified integration for third-party applications.

Key partnerships validated the approach. Dawn Vote's mobile governance tool built entirely on Boardroom's API. Synthetix enhanced council member profiles using the data. These implementations demonstrated market demand for governance infrastructure versus standalone tools.

Agora's acquisition marked a strategic endpoint. The purchase valued Boardroom's technical assets and relationships. Integration plans suggest continued API availability. However, product direction now aligns with Agora's broader governance platform strategy.

Boardroom Development Timeline Key Milestones

Data: Company announcements and public records

Future Outlook

The Agora integration will shape near-term development. Combined resources may accelerate feature additions. Boardroom's data feeds could power Agora's governance interfaces. Potential exists for tighter coupling between platforms. Users should monitor official communications for integration details.

Regulatory clarity may boost DAO adoption. President Trump's administration promised clearer cryptocurrency rules. Reduced legal uncertainty could drive more organizations to DAO structures. Increased governance activity would raise demand for data services like Boardroom.

Competition will intensify in governance infrastructure. Tally and Snapshot continue developing their offerings. New entrants target specific market segments. Boardroom must maintain technical advantages and relationship strength. The Agora acquisition provides resources for this competition.

Cross-chain governance presents technical challenges. DAOs operate across multiple blockchain networks. Unified governance data becomes more complex. Solutions require coordination between different consensus mechanisms. Boardroom's multi-chain support positions it for this evolution.

Market consolidation may continue. The Boardroom acquisition follows Parcel's 2025 shutdown. Sustainable business models remain elusive for some DAO tools. Successful platforms will combine technical capability with revenue generation. Infrastructure providers face pressure to demonstrate value to customers.

FAQ

What does Boardroom do in 2025?

Boardroom aggregates governance data from 300+ protocols through its API. Applications use this data to display proposals and voting information. The platform tracks 2 million delegates across multiple blockchain networks.

Who owns Boardroom now?

Agora acquired Boardroom in January 2025. The purchase price was not disclosed publicly. Kevin Nielsen, Boardroom's founder, joined Agora as an advisor.

Is Boardroom free to use?

API access requires registration and key generation. Free tier exists for basic usage. Enterprise features and higher rate limits require paid plans. Specific pricing details are not publicly documented.

How does Boardroom compare to Snapshot?

Snapshot provides direct voting interfaces for DAOs. Boardroom aggregates data from multiple sources including Snapshot. Users vote through Snapshot but may view aggregated results through Boardroom-powered applications.

Which blockchains does Boardroom support?

The platform covers Ethereum, Polygon, and Optimism networks. Additional EVM-compatible chains integrate through the API. Coverage depends on protocol demand and technical compatibility.

Can individuals use Boardroom directly?

Boardroom primarily serves developers building applications. End users interact with Boardroom data through integrated wallets and platforms. Direct web interface usage is limited compared to API consumption.

What happened to Boardroom after the acquisition?

Services continue operating without deprecation plans. Integration with Agora's ecosystem is ongoing. Employees received job offers at Agora. The transition period extends through 2025.

Does Boardroom execute votes?

No. Boardroom reports voting data but does not process votes. Users vote through original platforms like Snapshot or protocol-specific interfaces. Boardroom displays aggregated results from these systems.

How accurate is Boardroom's data?

Accuracy depends on source data quality. The system aggregates information from blockchains and off-chain platforms. Delays may occur for new protocols. Cross-verification through multiple sources is recommended for critical decisions.

Will Boardroom API change under Agora?

Agora stated no immediate deprecation plans. API structure may evolve during integration. Developers should monitor documentation for updates. Migration guides would accompany major changes to ensure compatibility.

Sources

CoinDesk: DAO Governance Platform Agora Acquires Older Competitor Boardroom (January 2025)

Agora.xyz: Boardroom joins Agora acquisition announcement

Boardroom Mirror: Governance API use cases and integration examples

CoinLaw: DAO Treasury Holdings Statistics 2025

Tracxn: BoardRoom company profile and funding history

MarkAICode: DAO-as-a-Service Platforms Compared 2025

SQ Magazine: Decentralized Autonomous Organizations Statistics 2025

Yellow: DAO Tools platform guide for governance and treasury management

Webopedia: 10 Biggest DAOs in 2025 State of the Industry

PatentPC: DAO Growth Stats on treasury sizes and governance activity