BIO Protocol 2025 Update: Multichain Expansion, BioAgents Launch, and 13 BioDAOs

BIO Protocol in 2025: From Binance Launch to Multichain Ecosystem

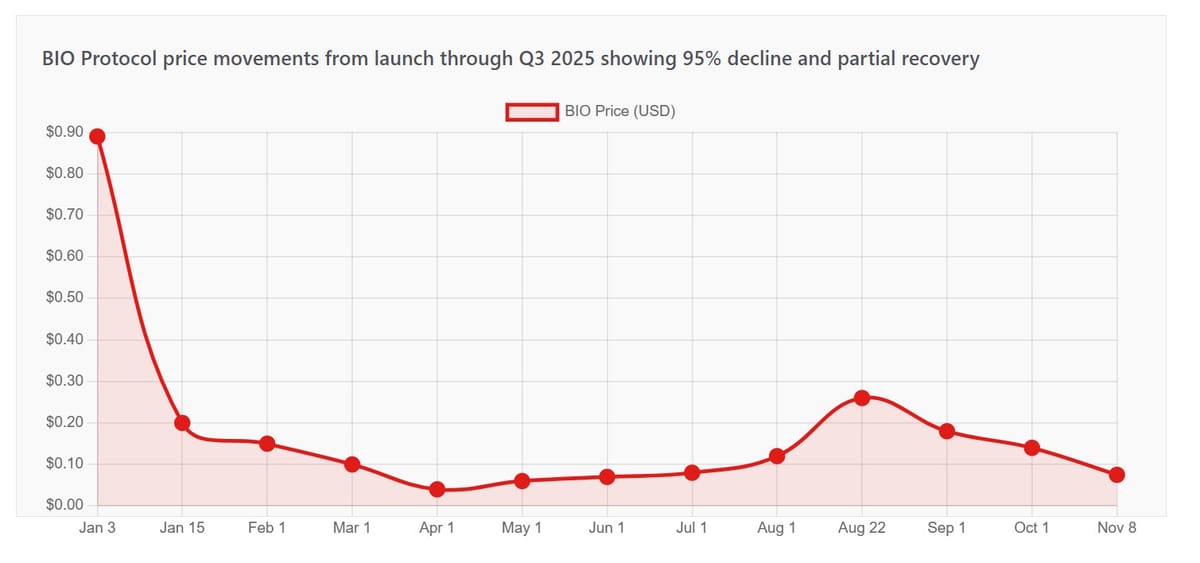

BIO Protocol launched on Binance as the first DeSci token on January 3, 2025, reaching $0.89 before dropping 95% to $0.04 by April. The protocol has since recovered but remains under pressure, currently trading around $0.075 with a market cap near $135-150 million. The ecosystem expanded from 8 initial BioDAOs to over 10 active organizations, managing research across longevity, women's health, and quantum biology.

Arthur Hayes invested $1 million in August 2025, calling BIO "revolutionary for DeSci." The protocol deployed BioAgents AI tools, expanded to Solana and Base networks, and secured 125.6 million BIO tokens in staking by September. Samsung partnered with BIO in September 2025 to integrate AI into ultrasound devices using anonymized data across 18+ French hospitals.

Unlike traditional academic funding where NIH allocates 98% of grants to researchers over 36, BIO Protocol enables permissionless funding through tokenized intellectual property. Quantum Biology DAO raised $6.8 million through BIO's launchpad, while VitaDAO received $4.1 million from Pfizer in 2023. Despite significant price decline, protocol development continues with real-world partnerships and product launches planned for Q4 2025.

Market Performance and Token Metrics

Note for readers: This section provides complete price history from launch through November 8, 2025. Investors should note that despite protocol development progress, token price remains 91% below ATH. This disconnect between price and product delivery is common in early-stage blockchain projects where monetization takes years.

BIO Token Price History in 2025

Data: CoinMarketCap, CoinGecko, Bitget (Updated November 8, 2025)

BIO Protocol entered 2025 with a splash. The token launched at $0.76 on Binance Launchpool and spiked to an all-time high of $0.89 within hours. Market cap hit $1.1 billion on day one. The initial circulating supply was 1.3 billion tokens, representing 39% of the total 3.32 billion supply.

The honeymoon ended fast. By late January 2025, BIO traded between $0.15-0.20. February and March brought further declines to $0.08-0.12, an 85% drop from peak. April 2025 marked the bottom at $0.04, a 95% crash from the all-time high.

Summer 2025 brought new life. The price climbed above $0.10 in August for the first time since launch. On August 22, BIO surged to $0.26, an 85% jump in three days. The rally came after V2 protocol upgrade and Hayes' $1 million investment announcement. As of November 8, 2025, BIO trades around $0.075 with a market cap of approximately $135-150 million, down from the August highs.

What This Means for Researchers, Patients, and Investors

The price decline does not necessarily reflect protocol failure. BIO Protocol continues executing its roadmap with V1 and V2 upgrades delivered, BioAgents deployed, and Samsung partnership secured. For researchers, the platform provides alternative funding channels regardless of token price. For patients, BioDAOs continue advancing research in underfunded areas like rare diseases and women's health.

For investors, current valuation at $135-150 million market cap represents either a buying opportunity if protocol adoption accelerates, or further downside risk if DeSci fails to gain mainstream traction. The disconnect between price and development suggests market skepticism about monetization timelines rather than technology viability.

Key Token Metrics November 2025

| Metric | Value | Details |

|---|---|---|

| Current Price | $0.075 | High volatility with 21% 30-day swings |

| Market Cap | $135-150M | Rank #249 across major exchanges |

| All-Time High | $0.89 | January 3, 2025 (launch day) |

| All-Time Low | $0.04 | April 16, 2025 (95% down from ATH) |

| Circulating Supply | 1.8B BIO | 54% of total supply |

| Total Supply | 3.32B BIO | Fixed maximum supply |

| Staked Tokens | 125.6M+ BIO | Across Ethereum, Solana, and Base (Sept 2025) |

| 24h Trading Volume | $40-65M | Represents 30-45% of market cap |

Data: CoinMarketCap, CryptoRank, Decrypt (November 8, 2025)

Protocol Evolution and New Features

V1 Launch: March 2025

BIO Protocol V1 launched in March 2025, transforming from a centralized accelerator to a permissionless financial layer. The upgrade introduced three components: a launchpad for onboarding BioDAOs, BioAgents AI tools, and milestone-based incentives.

The launchpad enables new BioDAOs to raise funds through auction contracts. BIO token holders vote on which DAOs join the ecosystem. Approved DAOs gain access to funding and liquidity support. The first DAO to use the launchpad was Quantum Biology DAO, which held its token auction in December 2024.

BioAgents reduce time and cost to generate monetizable IP. The first BioAgent, Aubrai, minted over 1,000 on-chain hypotheses and raised $250,000 in one month. Three BioAgents launched covering longevity, men's health, and microbiome research.

V2 Upgrade: August 2025

V2 arrived in August 2025 with Ethereum staking, Ignition Sales, and expanded BioAgent capabilities. The upgrade shifted from large fundraising rounds to smaller experimental sales for BioDAOs and tokenized IP.

The BioXP rewards system received an overhaul in September 2025. Points now expire after 14 days to combat bot farming. Staking multipliers reward long-term commitment. Staking $1,000 for 12 months earns 4x more BioXP than a 1-month stake.

Multichain expansion continued through 2025. BIO launched on Solana via Wormhole bridge and deployed on Base network. The protocol integrates with Uniswap, Jupiter, and CoW Swap for liquidity. Kraken listed BIO in February 2025 as the first DeSci token on a major US exchange. Upbit added BIO in October 2025.

BIO Protocol Revenue Streams in 2025

Data: Messari BIO Protocol V1 Upgrade Report (March 2025)

BioDAO Ecosystem Growth

The BIO Protocol network grew from 8 BioDAOs at launch to 10+ active organizations by mid-2025. Each DAO focuses on specific research areas, from extending human lifespan to developing quantum microscopes. The combined market cap of BioDAO tokens crossed $200 million in November 2023.

Active BioDAOs in the Network

| BioDAO | Focus Area | Key Metrics | Status |

|---|---|---|---|

| VitaDAO | Longevity research | $4.1M from Pfizer (2023), $150M+ market cap | Founded 2021, most established |

| AthenaDAO | Women's health | $500K translational research funding, 14 IP deals pending | Launched GIRLE and BABY tokens |

| ValleyDAO | Synthetic biology for climate | $2M+ raised, Imperial College partnership | Engineering carbon-capture microbes |

| HairDAO | Hair loss treatments | First DAO to file scientific patent (December 2023) | Patient-researcher collaboration |

| Quantum Biology DAO | Quantum microscopy | $6.8M raised through BIO launchpad | Partnership with Institute for Quantum Biology |

| CryoDAO | Cryopreservation | $3M+ raised, Oxford partnerships | Advancing cryobiology research |

| PsyDAO | Psychedelic medicine | Launched OPSY platform for trials data | Mental health focus |

| Long COVID Labs | Long COVID treatments | Targeting 100M+ patients globally | Founded by Stanford neuroscientist |

| Curetopia | Rare diseases | Uniting patient families | Founded by Harvard PhD Y-Combinator alumnus |

| CerebrumDAO | Brain health | Preventing neurodegeneration | Research coordination |

Data: BIO Protocol official site, Binance Square, BSCN (July-November 2025)

BioDAO Network Growth 2021-2025

Data: BIO Protocol announcements, CoinGecko, community reports (2021-2025)

VitaDAO remains the flagship DAO, with backing from Pfizer Ventures and Balaji Srinivasan. The DAO funded Matrix Biosciences creation and pumped $2.5 million into over 10 early-stage longevity projects by June 2022. VitaDAO's market cap exceeded $150 million by end of 2024.

HairDAO made history in December 2023 as the first DAO to file a scientific patent. AthenaDAO addresses a gap where traditional funding overlooks women's health research. The DAO provided $500,000 for translational research with 14 intellectual property transactions pending.

Quantum Biology DAO's $6.8 million raise through BIO's launchpad saw bidding prices exceed 10x the original price. The DAO collaborates with the Institute for Quantum Biology to develop quantum microscopes that could open new avenues in drug discovery.

Competitive Landscape in DeSci

The DeSci sector emerged as the top crypto performer in late 2024, averaging 11.55% returns according to LunarCrush analytics. BIO Protocol competes with established projects while leading as the first DeSci token on major exchanges.

DeSci Market Cap Comparison

| Project | Market Cap | Focus | Advantage vs BIO |

|---|---|---|---|

| BIO Protocol | $135-150M | Biotech funding layer | First major exchange listing, network of 10+ DAOs |

| OriginTrail (TRAC) | $350M+ | Secure data sharing | Established since earlier, broader Web3 focus |

| VitaDAO (VITA) | $150M+ | Longevity research | First mover (2021), Pfizer backing |

| ResearchHub (RSC) | $100M+ | Open-access publishing | Focus on academic incentives |

| AxonDAO (AXGT) | $65M | Neural research | Specialized neuroscience focus |

| GenomesDAO (GENOME) | Active | Genomic data security | Privacy-first genomics marketplace |

| LabDAO | Active | Lab tools marketplace | Global lab equipment sharing |

Data: CoinGecko, Bitget News, CoinEdition (December 2024-January 2025)

DeSci vs AI Agents Market Cap

Data: Bittime research, LunarCrush analytics (January 2025)

OriginTrail leads DeSci market caps at $350 million, up from $200 million in late 2023. The project focuses on secure data sharing across supply chains and research institutions. OriginTrail received 1,380 social media mentions in late 2024, reflecting a 293-mention increase.

AI Agents sector holds around $10 billion in total market cap compared to DeSci's sub-$1 billion valuation. However, DeSci growth relies on real-world scientific output rather than speculative token mechanics. Binance Labs' investment in BIO Protocol triggered renewed interest, with related tokens like VITA, GROW, and RSC posting double-digit gains.

BIO Protocol differentiates through its network effect. While VitaDAO and LabDAO operate independently, BIO coordinates multiple DAOs under one protocol. The treasury holds portions of each BioDAO token, creating meta-governance where BIO holders influence decisions across the entire ecosystem.

Tokenomics and Distribution

BIO Protocol set total supply at 3.32 billion tokens. The distribution prioritizes ecosystem growth, with 56% allocated to ecosystem and community, 25.4% to early contributors, and 18.6% to early supporters.

BIO Token Allocation

Data: Binance announcement, BSCN, ICO Drops (December 2024-July 2025)

| Category | Allocation | Tokens | Status (July 2025) |

|---|---|---|---|

| Ecosystem Incentives | 25% | 830,000,000 | Bio/acc rewards, staking incentives |

| Core Contributors | 21.2% | 703,840,000 | 0.87% unlocked, 20.3% locked |

| Community Auction | 20% | 664,000,000 | 15.4% unlocked, 4.62% locked |

| Investors | 13.6% | 451,520,000 | 3.97% unlocked, 9.63% locked |

| Community Airdrop | 6% | 199,200,000 | Distributed to early supporters |

| Molecule Ecosystem Fund | 5% | 166,000,000 | 1.87% unlocked, 3.12% locked |

| Advisors | 4% | 132,800,000 | Vesting schedule |

| Binance Launchpool | 3% | 99,600,000 | Farming period January 2025 |

| Public Sale | 2.2% | 73,040,000 | Genesis sale raised $33M+ |

Data: BSCN, Binance Launchpool announcement (December 2024-July 2025)

The Genesis sale raised over $33 million through public auction. Binance Launchpool allocated 3% for farming, with users staking BNB and FDUSD to earn BIO tokens before trading launch. Initial circulating supply at listing was 1.3 billion tokens, about 39% of total supply.

Bio/acc rewards total 132.8 million tokens (4% of supply) to incentivize BioDAO milestones. Rewards flow to DAOs that launch IP tokens, conduct decentralized clinical trials, or successfully commercialize research. Users participating in trials or reporting health data can also earn rewards.

The vesting schedule protects against dump pressure. Core contributors have only 0.87% unlocked as of July 2025, with 20.3% still locked. Investors similarly have 3.97% unlocked and 9.63% locked. The Molecule Ecosystem Fund, which seeds BioDAOs, has 1.87% unlocked and 3.12% locked.

Technology and Infrastructure

BIO Protocol operates on Ethereum as an ERC-20 token with multichain expansion to Solana and Base networks. The architecture uses Wormhole for cross-chain bridging, allowing BIO to move between networks while maintaining unified governance.

Smart contracts handle BioDAO curation, funding auctions, and treasury management. The protocol owns liquidity through BIO treasury pairs like VITA/BIO and HAIR/BIO with ETH or stablecoins. This eliminates the need for BioDAOs to manage secondary markets.

Integration with decentralized exchanges provides trading infrastructure. Uniswap handles Ethereum pairs, Jupiter manages Solana liquidity, and CoW Swap offers MEV-protected trading. The protocol added stablecoin swaps on Uniswap in July 2025.

BioAgents AI Infrastructure

BioAgents represent autonomous AI research assistants launched in 2025. These agents handle knowledge graph building, hypothesis generation, and experiment design. Aubrai, the first BioAgent, minted over 1,000 on-chain hypotheses and raised $250,000 within one month.

Three BioAgents deployed across longevity, men's health, and microbiome research. Additional agents are being developed by BioDAOs in partnership with researchers. The BioAgent plugin launched in April 2025 converts research papers into knowledge graphs.

BioAgents reduce IP generation time and costs. Traditional drug discovery takes 10-15 years and costs $2.6 billion on average. AI-powered agents accelerate hypothesis testing and data analysis, potentially cutting development timelines.

Multichain Expansion Timeline

| Date | Network | Feature | Impact |

|---|---|---|---|

| January 2025 | Ethereum | Token Generation Event | Primary network for governance and treasury |

| January 2025 | Solana | Wormhole bridge integration | Lower fees, faster transactions |

| Q1 2025 | Base | Layer 2 deployment | Reduced costs, Coinbase ecosystem access |

| August 2025 | Ethereum | Staking launch | 125.6M BIO staked across chains |

| Q4 2025 | Solana | Expanded staking | 25M BIO staked on Base within days |

Data: BIO Protocol weekly updates, BSCN, CoinMarketCap AI (January-September 2025)

Key Partnerships and Collaborations

BIO Protocol secured strategic partnerships throughout 2025, expanding beyond crypto into traditional biotech and healthcare.

Binance Labs Investment

Binance Labs made its first DeSci investment in November 2024 through BIO Protocol. The undisclosed amount supports new project development and platform infrastructure. Andy Chang, Binance Labs investment director, stated the investment aims to merge biotechnology with decentralized finance.

Samsung Healthcare Collaboration

Samsung partnered with BIO Protocol in September 2025 to integrate AI into ultrasound devices. The collaboration uses anonymized patient data from BIO's network to improve diagnostic accuracy. This marks one of the first major healthcare equipment manufacturers entering DeSci.

Academic and Research Partnerships

ValleyDAO collaborates with Imperial College London on synthetic biology solutions for climate change. The partnership raised over $2 million for engineering microbes that capture carbon dioxide or produce biodegradable materials.

VitaDAO works with the University of Copenhagen, Newcastle University, and multiple research institutions. The DAO funded the first on-chain science project in August 2021 with Copenhagen. The first IP token launched from Newcastle University in June 2023.

Quantum Biology DAO partners with the Institute for Quantum Biology to develop quantum microscopes. CryoDAO established projects with Oxford Cryogenics and Advanced Neurobiology, raising over $3 million.

Exchange Listings Timeline

| Date | Exchange | Milestone |

|---|---|---|

| January 3, 2025 | Binance | First listing via Launchpool, 63rd project |

| February 4, 2025 | Kraken | First DeSci token on major US exchange |

| October 20, 2025 | Upbit | Korean market expansion, KRW/BTC/USDT pairs |

Data: Exchange announcements, BSCN, 99Bitcoins (January-October 2025)

Security and Risk Considerations

BIO Protocol has not experienced any major security incidents through November 2025. No hacks, exploits, or smart contract vulnerabilities have been publicly reported. The protocol benefits from building on established infrastructure like Ethereum, Wormhole, and audited DeFi protocols.

Market Risks

The 95% price decline from January to April 2025, followed by partial recovery and subsequent decline, demonstrates extreme volatility. BIO exhibits 21% 30-day volatility according to market data. Daily price swings of 10-20% occur regularly. The token trades at $0.075 as of November 8, 2025, down 91% from launch and 71% from August 2025 highs.

Selling pressure from token unlocks poses ongoing risk. Initial circulating supply was only 39% of total. As contributor and investor tokens vest, supply increases without guaranteed demand growth. The next unlock event on August 3, 2025, released 32.45 million BIO tokens. The large community allocation exceeding 50% of supply creates potential for additional selling pressure.

Regulatory Uncertainty

DeSci operates in regulatory gray areas. Tokenizing intellectual property and conducting decentralized clinical trials face unclear legal frameworks. The SEC has not issued specific guidance on IP tokens or scientific DAOs.

Securities classification remains ambiguous. BIO tokens provide governance rights and access to funding rounds. Depending on jurisdiction, these features could trigger securities regulations. Binance and Kraken listings suggest exchanges view BIO as compliant, but regulatory landscapes evolve.

Execution Risks

BIO Protocol's success depends on BioDAO performance. If funded research fails to produce commercializable IP, token value could decline. Traditional drug development has a 90% failure rate. Decentralized models face similar or higher failure risks.

Competition threatens first-mover advantage. While BIO launched first on major exchanges, VitaDAO has deeper roots since 2021. New DeSci projects launching with improved tokenomics or stronger academic partnerships could capture market share.

The protocol requires sustained participation. BioDAOs need active communities of researchers, patients, and investors. Declining engagement would reduce funding for new projects and limit network effects that make BIO valuable.

Roadmap and Future Development

BIO Protocol outlined development plans through 2025 focusing on product launches, cross-chain integration, and health-tech adoption.

Q4 2025 Priorities

The dLAB health device launch targets Q4 2025. This will include a smart ring and mobile ECG device that tokenize personal health metrics. Users will be able to convert health data into assets, enabling monetization while contributing to research databases.

The dCLINIC platform is planned for Q4 2025 to coordinate decentralized clinical trials. Large holders appear to be accumulating ahead of this launch, with mobile ECG data tokenization generating interest. Samsung's partnership positions BIO to integrate with existing medical devices.

BioAgents AI expansion continues through Q4 2025. The protocol plans to scale AI tools for decentralized research coordination. Additional BioAgents will launch across new therapeutic areas beyond the initial three.

Development Timeline

Data: BIO Protocol official site, Bankless, MEXC (July 2021-Q4 2025 projected)

Long-Term Vision

BIO Protocol aims to become the financial layer for decentralized science. The vision extends beyond biotech to any scientific research that benefits from transparent funding and community governance. Physics, materials science, and climate research could adopt similar DAO structures.

The treasury growth strategy relies on owning portions of successful BioDAO tokens. As DAOs mature and commercialize IP, the value of treasury holdings increases. This creates a flywheel where successful projects fund new BioDAO launches.

IP token markets represent the next frontier. Currently, BIO facilitates auctions for new BioDAO tokens. The protocol plans secondary markets where researchers, patients, and investors trade IP tokens representing specific patents, datasets, or research outcomes.

How to Get Involved

BIO Protocol offers multiple participation paths for different stakeholders.

For Investors

BIO tokens trade on Binance, Kraken, and Upbit with BIO/USDT, BIO/BNB, and BIO/KRW pairs. Decentralized exchanges include Uniswap for Ethereum, Jupiter for Solana, and CoW Swap for MEV protection.

Staking BIO earns rewards and voting power. Stakers participate in BioDAO curation, selecting which projects join the network. Approved DAOs grant stakers priority access to funding rounds. Lock-up periods range from 1-12 months with multipliers up to 4x for longer commitments.

Ignition Sales provide early access to BioDAO tokens. These smaller fundraising rounds replaced large Genesis-style auctions in V2. Users stake vBIO (locked BIO) to participate in pre-seed auctions traditionally reserved for venture capital.

For Researchers

Scientists can propose new BioDAOs through the incubation program. The 16-week hybrid program provides funding, knowledge, and exposure to the BIO community. Successful applications receive grants in exchange for small equity stakes in their tokens.

Existing BioDAOs welcome research proposals. VitaDAO funds longevity research, AthenaDAO supports women's health, and Quantum Biology DAO backs quantum microscopy projects. Researchers submit proposals directly to relevant DAOs.

For Patients

Patients can join BioDAOs focused on their conditions. Long COVID Labs seeks input from over 100 million long COVID patients. HairDAO unites hair loss patients with researchers. Participation includes voting on research priorities and accessing experimental treatments.

Health data monetization launches in Q4 2025. Users with dLAB devices can tokenize personal metrics and earn from data sharing. Privacy protections ensure anonymization while enabling valuable research contributions.

Frequently Asked Questions

Related Resources

For more information on decentralized autonomous organizations and DeSci projects:

Dashboard of DAO tools - Comprehensive guide to DAO infrastructure and management tools.

List of DAOs - Directory of active DAOs across various sectors.

Sources

CoinMarketCap - BIO Protocol price data, market cap, trading volume (November 2025)

CoinGecko - Historical price data, exchange listings

Binance - Launchpool announcement, trading data

BSCN (BSC News) - "Bio Protocol Overview: Decentralized Science Platform and 2025 Updates" (July 2025)

Messari - "Bio Protocol V1 Upgrade: Scaling DeSci's Financial Layer" (March 2025)

Bankless - "Decoding BIO Protocol & DeSci's Big Dreams" (January 2025)

StealthEX - "Bio Protocol Price Prediction 2025-2030" (August 2025)

Bitget News - "2024's Decentralized Science Growth: Must-Know Projects for 2025" (January 2025)

CoinCodex - Price predictions and technical analysis (October 2025)

CryptoRank - Market data and rankings

BIO Protocol - Official website bio.xyz

ChainCatcher - "Detailed Explanation of How BIO Protocol and DeSci Projects Innovate" (January 2025)

NFT Evening - "Introducing Bio Protocol: The Future of On-Chain Science" (February 2025)

Bittime - "AI Agents and DeSci Narrative: Which is More Promising in 2025?" (January 2025)

ICO Drops - Token sale data and metrics