Axelar DAO Tool Report For 2025

What Is Axelar Network

Axelar Network is a decentralized blockchain interoperability platform connecting 80+ blockchains in 2025. Founded in 2020 by Sergey Gorbunov and Georgios Vlachos, former Algorand team members, the platform addresses blockchain fragmentation. Users and developers can transfer assets and execute functions across any chain with one click.

Axelar operates as a Layer 1 blockchain built on Cosmos SDK. It uses Delegated Proof-of-Stake consensus with 75+ validators. The network enables communication between EVM chains like Ethereum and non-EVM chains including XRP Ledger, Solana, and Sui. This differs from simple token bridges.

The platform processes cross-chain messages through gateway smart contracts. Validators observe events on connected blockchains, verify transactions, and execute corresponding actions. AXL token holders can stake tokens to validators, earn rewards, and participate in governance decisions.

Axelar supports three core technologies. General Message Passing (GMP) allows smart contracts to call functions across different chains. Interchain Token Service (ITS) enables canonical token representations without wrapped assets. The Axelar Virtual Machine (AVM) provides permissionless chain connections through Interchain Amplifier.

2025 Market Performance Metrics

Axelar Network performance data shows mixed results in 2025. The AXL token trades at $0.11-0.12 with market capitalization of $124 million, ranking #238 on CoinMarketCap. The price decreased 54% year-to-date, reflecting broader altcoin market pressures.

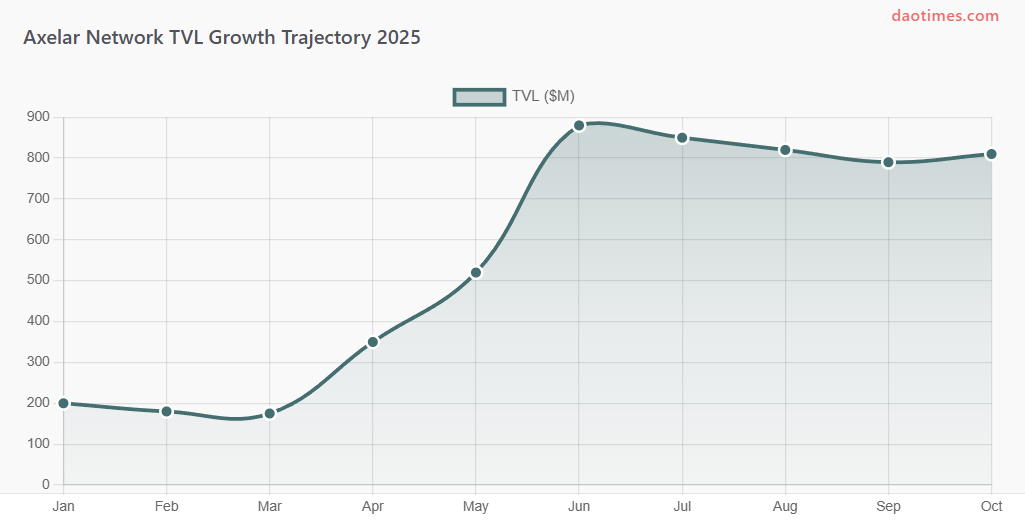

Total Value Locked (TVL) reached $880 million in June 2025, up from $175 million in March. This represents 400% growth in three months, driven by institutional partnerships and expanding ecosystem adoption. Monthly transaction fees hit $1.5 million in April, rising from $302,000 in March.

The network processed 141,800+ transactions in the last 30 days worth $163 million. Total GMP volume across all time reached $5.2 billion through 3.1 million transactions. Weekly GMP activity ranges from $25-70 million. The platform gained 125,500 new wallet addresses since January 2025.

Circulating supply stands at 1.08 billion AXL tokens out of 1.22 billion total supply. Token distribution includes 29.5% for backers, 17% for team, 12.5% for operations, and 5% for community sale. In March 2025, strategic investors including Arrington Capital and Electric Capital invested $30 million in AXL tokens.

Data: Axelar Network transaction data January-October 2025

What Changed In Axelar Network In 2025

Cobalt Upgrade And Fee Burning Mechanism

The Cobalt network upgrade launched in February 2025 after tokenholder approval. This version 1.2.1 upgrade implements fee burning where 98% of network gas fees paid in AXL go to a burn address. Only 2% flows to community proposal grant pools. This mechanism makes AXL potentially deflationary as network activity increases.

The upgrade fundamentally changed tokenomics. Previous models relied on perpetual inflation through block rewards and incentive rewards. The new system reduces inflation while burning transaction fees. This scales better as Axelar connects hundreds of new chains without expanding token supply.

Interchain Amplifier Mainnet Launch

The Interchain Amplifier enables permissionless chain connections via smart contracts. Developers can integrate new blockchains without centralized governance approval. Validators vote on new connections through the Axelar Virtual Machine framework.

Sui and Flow became first adopters, locking 300,000 AXL monthly in Verifier reward pools as of March 2025. This reward pool mechanism replaces inflation-based incentives. Future integrations including Monad, Solana, Stellar, TON, and XRP Ledger will use this system.

Strategic Partnerships And Integrations

Deutsche Bank partnered with Axelar in 2025 for the DAMA 2 tokenized-asset platform. The project builds compliant rails for tokenized finance on Ethereum Layer-2. JPMorgan's Onyx Digital Assets used Axelar for cross-chain tokenized fund transfers in late 2023, continuing in 2025.

Sui integrated with Axelar mainnet in May 2025, adding high-throughput DeFi capabilities. XRPL EVM Sidechain connected in June 2025, bringing XRP liquidity to 80+ chains. The integration processed 9,400 transactions worth $376,000 in the first week.

Hyperliquid announced integration in July 2025, connecting HyperCore and HyperEVM to Axelar's 80+ blockchain ecosystems. Midas launched mXRP in September 2025, a liquid staking token powered by Axelar that reached $30 million in deposits by October.

Data: Axelar Network public announcements and Axelarscan data

How To Use Axelar Network

For Developers

Developers access Axelar through the Mobius Development Stack. The platform provides APIs and SDKs for cross-chain application development. No need to learn new programming languages. If code can be written in Solidity or Rust, it works on Axelar.

General Message Passing (GMP) enables smart contracts to communicate across chains. A DeFi app on Ethereum can execute lending transactions on Cosmos or fetch price data from Avalanche. The SDK handles cross-chain complexity automatically. Developers implement two functions: send and receive.

Interchain Token Service (ITS) allows tokens to maintain fungibility across chains. Instead of creating multiple wrapped versions, ITS routes tokens through a hub design. This preserves custom functionality and security. Canonical USDC and USDT already use ITS.

For Users

Users interact with Axelar through integrated applications. Squid Router provides cross-chain swaps. Satellite demonstrates asset transfer capabilities. Users pay gas once in the source-chain token. Smart contract logic handles AXL conversions automatically.

Token holders can stake AXL with validators to earn rewards. Minimum hardware requirements for running a validator node: 32 cores, 32 GB RAM, 2 TB drive. Validators must stake AXL and attach external EVM-compatible blockchains.

Staking returns vary based on validator commission and network activity. The network uses quadratic voting to ensure fair validator distribution. Token holders participate in governance by voting on protocol upgrades, parameter changes, and new chain integrations.

Axelar Network Transaction Metrics For 2025

| Metric | Value | Time Period | Growth Rate |

|---|---|---|---|

| GMP Total Volume | $5.2B | All-time | +19% YoY |

| GMP Transactions | 3.1M | All-time | +55% YoY |

| Connected Blockchains | 80+ | December 2025 | +25% YoY |

| Unique Addresses | 800K | All-time | +18% YoY |

| Monthly Fees | $1.5M | April 2025 | +396% MoM |

| New Weekly Users | 3,000-7,000 | Q3 2025 | Stable |

| TVL | $880M | June 2025 | +400% Since March |

| Active Validators | 75+ | 2025 | Stable |

Data: Axelarscan, Token Terminal, DefiLlama - October 2025

Axelar Compared To Competitors

LayerZero

LayerZero operates as an omnichain messaging protocol. It uses an oracle-relayer model for cross-chain communication. This architecture provides speed with minimal on-chain overhead. LayerZero relies on Ultra-Light Nodes that verify messages without storing full headers.

In August 2025, LayerZero acquired Stargate protocol for $110 million. The acquisition dissolved Stargate DAO with 95% voter approval. LayerZero expanded PayPal's PYUSD stablecoin to multiple blockchains in September 2025. However, Lido DAO rejected LayerZero in favor of Axelar-Wormhole in 2024.

LayerZero offers flexibility through customizable security configurations. Applications choose their own oracle and relayer sets. This differs from Axelar's validator-secured model. Transaction volume data shows competitive positioning, though Axelar's volume was twice that of Wormhole in early 2025.

Wormhole

Wormhole uses a Guardian network of 19 independent validators. The protocol focuses on decentralization through distributed verification. This makes it more resilient but slightly slower than LayerZero. Wormhole started as a bridge between Ethereum and Solana.

The network processed billions in cross-chain transfers by 2025. Wormhole partners with Axelar on specific integrations. Lido selected both Axelar and Wormhole for official stETH bridging to BNB Chain. The partnership combines security properties of both networks.

Wormhole Gateway adopted Cosmos SDK and IBC light clients in 2025, similar to Axelar's approach. This validates Axelar's architectural choices. Wormhole remains a primary competitor for institutional cross-chain solutions.

Chainlink CCIP

Chainlink Cross-Chain Interoperability Protocol (CCIP) leverages Chainlink's established oracle network. The platform provides enterprise-grade security for token transfers and data messaging. CCIP integrates with existing Chainlink infrastructure used by hundreds of DeFi protocols.

Axelar's transaction volume in 2025 exceeded Chainlink CCIP by 8x according to Binance Research Institute data from February. This growth comes from GMP feature implementation supporting complex cross-chain function calls and state synchronization.

Data: Binance Research, Messari, industry reports - 2025

Axelar Network Security Analysis

Axelar employs multiple security layers. The network uses Delegated Proof-of-Stake consensus with 75+ validators. This provides stronger decentralization than federated multisig bridges. Validators stake AXL tokens to participate in consensus and multi-party cryptography protocols.

Slashing penalties enforce proper validator behavior. Downtime results in 0.01% stake slash per missed block, maximum 1.75%. Double-signing causes 2% stake loss and permanent removal from the active set. These economic incentives ensure validator reliability.

All Axelar code and contracts are open-source. Security audits come from Trail of Bits and Halborn. An active bug bounty program incentivizes white-hat hacker submissions. The network has experienced zero major security breaches in 2025.

Application developers can implement custom security policies using Turing-complete GMP. DeFi applications add limits on transfer volumes, repeat transactions, or require co-authoring for large transfers. These features work alongside network requirements for enhanced security.

Cross-chain bridge hacks totaled $2.5 billion in 2022, with Nomad ($200M) and Harmony ($100M) among major incidents. Axelar's validator-secured architecture and threshold cryptography provide stronger security than traditional bridge designs. The platform positions itself as institutional-grade infrastructure.

Pros And Cons Of Axelar Network

Advantages

The platform connects 80+ blockchains including EVM and non-EVM chains. This comprehensive coverage exceeds most competitors. Developers access any asset on any chain through one integration. The hub-and-spoke model reduces complexity compared to point-to-point connections.

Strong institutional backing includes Binance Ventures, Coinbase Ventures, Dragonfly Capital, Galaxy Ventures, and Polychain Capital. The March 2025 funding round brought $30 million from Arrington Capital and Electric Capital. Enterprise partnerships with Deutsche Bank, JPMorgan, and Microsoft validate the technology.

The Cobalt upgrade introduces deflationary tokenomics. Burning 98% of transaction fees reduces circulating supply as activity grows. This mechanism scales better than inflation-based models. The Interchain Amplifier enables permissionless chain connections without governance bottlenecks.

Axelar's security model uses Proof-of-Stake with economic penalties for misbehavior. This provides stronger decentralization than oracle-relayer models. Open-source code, security audits, and bug bounties increase transparency. Zero major breaches in 2025 demonstrate security effectiveness.

Disadvantages

AXL token price dropped 54% year-to-date despite strong fundamentals. Market capitalization of $124 million ranks only #238 among cryptocurrencies. The price trades at $0.11, down 95% from all-time high of $2.64 in March 2024. This creates uncertainty for investors.

Competition from LayerZero, Wormhole, and Chainlink CCIP intensifies. LayerZero's $110 million Stargate acquisition and PayPal partnership demonstrate aggressive expansion. Ethereum's Fusaka upgrade in December 2025 could reduce reliance on cross-chain bridges short-term.

Technical complexity remains high. Running a validator requires 32-core processors, 32 GB RAM, and 2 TB storage. Setting up cross-chain infrastructure demands expertise in multiple blockchain environments. This limits validator participation compared to simpler networks.

Axelar's TVL of $880 million remains small compared to major DeFi protocols. Aave holds $20 billion TVL, Uniswap $15 billion. While TVL grew 400% from March to June 2025, scaling to compete with established platforms requires sustained growth.

Data: DefiLlama, BanklessTimes - March-October 2025

Roadmap And Future Development

The Interchain Amplifier mainnet launches in Q4 2025. This enables permissionless chain connections through standardized validation. Developers can integrate new blockchains via smart contracts without centralized approval. The AVM framework supports scaling to thousands of chains.

Gas-burning mechanism governance proposal targets Q1 2026. This would formalize the deflationary tokenomics introduced in Cobalt upgrade. Rising transaction volume combined with fee burning could make AXL deflationary long-term. Token holders will vote on the final implementation.

Solana and Stellar integrations are planned for 2026. These expand Axelar's reach into high-speed consumer finance and institutional blockchain networks. The integrations will support GMP and ITS capabilities for complex cross-chain applications.

sBTC multichain support launches in Q4 2025 through Stacks partnership. This bridges Bitcoin-backed assets to Ethereum and Solana ecosystems. The integration positions Axelar for Bitcoin's growing DeFi narrative. Bitcoin's $170+ billion idle liquidity represents opportunity.

The platform aims to become the universal interoperability layer for Web3. As blockchain networks grow from hundreds to thousands, Axelar's permissionless connection model scales efficiently. The combination of technical infrastructure, institutional partnerships, and deflationary tokenomics supports long-term growth.

For more context on DAO tools and ecosystems, see the comprehensive DAO tooling guide. Explore additional decentralized organizations at the list of DAOs.

Frequently Asked Questions

What is Axelar Network used for?

Axelar Network enables cross-chain communication between 80+ blockchains. Developers build applications that transfer assets, execute smart contracts, and share data across different chains. Users can swap tokens between Ethereum, Solana, Cosmos, and other networks through one interface.

How does Axelar differ from traditional bridges?

Traditional bridges only transfer tokens between two specific chains. Axelar provides General Message Passing that allows smart contracts to call functions across any connected chain. This enables complex applications like cross-chain lending, multichain games, and universal wallets.

Is Axelar Network secure?

Axelar uses Delegated Proof-of-Stake with 75+ validators and economic slashing penalties. Security audits from Trail of Bits and Halborn verify the infrastructure. The network experienced zero major breaches in 2025. Open-source code and bug bounties increase transparency.

What is the AXL token used for?

AXL token serves four functions: paying transaction fees, staking with validators for rewards, participating in governance votes, and funding ecosystem growth. The Cobalt upgrade burns 98% of fees, making AXL potentially deflationary as network activity increases.

How much can I earn staking AXL?

Staking returns vary based on validator commission rates and network activity. Token holders delegate AXL to validators and receive proportional rewards minus commission. Validators with high uptime and low fees typically provide better returns. Check current APY rates on Axelarscan.

Which blockchains connect to Axelar?

Axelar connects 80+ blockchains including Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Cosmos, XRP Ledger, Sui, Flow, and Hyperliquid. Solana, Stellar, and TON integrations are planned for 2026. The Interchain Amplifier enables permissionless additions.

Can Axelar reach $1?

AXL trades at $0.11 in December 2025, requiring 809% growth to reach $1. Price predictions vary. Institutional partnerships, deflationary tokenomics, and expanding integrations support growth potential. However, competition and market conditions create uncertainty. Never invest more than you can lose.

Who are Axelar's main competitors?

Primary competitors include LayerZero, Wormhole, and Chainlink CCIP. LayerZero offers speed through oracle-relayer architecture. Wormhole provides Guardian-based security. Chainlink CCIP leverages established oracle infrastructure. Axelar differentiates through validator-secured consensus and comprehensive chain coverage.

What was the Cobalt upgrade?

The Cobalt upgrade (v1.2.1) launched in February 2025 after tokenholder approval. It implements fee burning where 98% of network gas fees are permanently destroyed. This replaces inflation-based tokenomics with deflationary mechanics. The upgrade enables scaling to thousands of chains.

How do I start using Axelar?

Developers access Axelar through the Mobius Development Stack with APIs and SDKs. Users interact through applications like Squid Router and Satellite. Connect a Web3 wallet, select source and destination chains, and execute transfers. The platform handles cross-chain complexity automatically.

Sources

Axelar Network Official: Axelar Network homepage, Axelar Blog articles, Axelar documentation, Axelarscan blockchain explorer

Market Data: CoinMarketCap Axelar page, CoinGecko price data, CryptoRank market metrics, Token Terminal analytics

DeFi Analytics: DefiLlama TVL data, Dune Analytics dashboards, Artemis fee metrics

Research Reports: Binance Research Institute cross-chain interoperability analysis, Messari LayerZero vs Axelar comparison, Genfinity Axelar deep dive

News Coverage: The Block partnership announcements, CoinDesk technology analysis, Disruption Banking industry report, BanklessTimes price predictions

Technical Documentation: Axelar GitHub repositories, security audit reports from Trail of Bits and Halborn, CertiK security monitoring

Industry Analysis: LI.FI arbitrary messaging bridge comparison, Yellow Network cross-chain research, Flashift protocol evaluation